ACC 401

advertisement

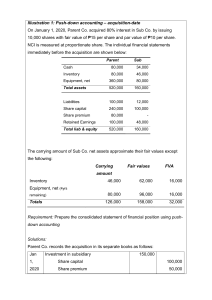

Page Title ACC 401 Module 3 Alternatives • Initial value method • Equity method • Partial equity method Required Procedures • Acquisition was made during the current fiscal period. - Parent adjusts its own Investment account to reflect the subsidiary’s income and dividend payments as well as any amortization expense. - Worksheet entries used to establish consolidated figures. • Acquisition was made during a previous fiscal period. - Most consolidation remains the same. - Amount of the subsidiary’s stockholders’ equity to be removed. - Allocations established will also change in each subsequent consolidation. Other Than the Equity Method • Initial value method applied by the parent company • Partial equity method is in use • Periods after the year of acquisition - The initial value method recognizes neither income in excess of dividend payments nor excess amortization expense - The partial equity method does not recognize excess amortization expenses Bargain Purchases • Occurs when the parent company transfers consideration less than net fair values of the subsidiary’s assets acquired and liabilities assumed • Parent recognizes an excess of net asset fair value over the consideration transferred Push-Down Accounting • A subsidiary may record any acquisition-date fair value allocations directly in its own financial records rather than through the use of a worksheet. • Push-down accounting reports the assets and liabilities of the subsidiary at the amount the new owner paid. • Push-down accounting can also make the consolidation process easier.