Chapter Three

Consolidations

– Subsequent

to the Date of

Acquisition

McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

3-2

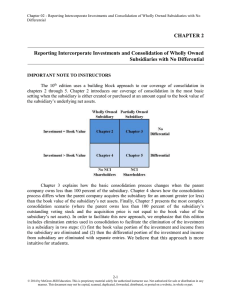

Investment Accounting

Method

Investment Account

Income Account

Equity

Continually

adjusted to reflect

ownership of

acquired company.

Income accrued as

earned;

amortization and

other adjustments

are recognized.

Initial Value

Remains at InitiallyRecorded cost

Cash received is

recorded as

Dividend Income

Partial Equity

Adjusted only for

accrued income and

dividends received

from acquired

company.

Income accrued as

earned; no other

adjustments

recognized.

3-3

Subsequent Consolidation Equity Method

During the year, the Parent will adjust its

investment account for the Subsidiary

under application of the equity method.

The original investment, recorded at the

date of acquisition, is adjusted for:

1. FMV adjustments and other

intangible assets,

2. The parent’s share of the sub’s

income (loss), and

3. The receipt of dividends from the

sub.

Subsequent Consolidation Worksheet Entries

3-4

S)

A)

A)

I)

I)

D)

E)

E)

F)

The Sub’s equity accounts are eliminated.

Other intangible assets are recorded and

the Sub’s assets are adjusted to FV.

The Equity in Sub Income account is

eliminated.

The Sub’s dividends are eliminated.

Amortization Expense is recorded for the

FMV adjustments and other intangible

assets that were recorded in consolidation.

3-5

Subsequent Consolidation –

Equity Method – Example Entry S

Common Stock (Sun Company). . . . 200,000

APIC (Sun Company) . . . . . . . . . . . . 20,000

R/E, 1/1/10 (Sun Company) . . . . . . . 380,000

Investment in Sun Company . . . . . . . . . . 600,000

Note: If this is the first year of

the investment, and the

investment was made at a

time other than the beginning

of the fiscal year, then preacquisition income of the sub

must be accounted for in the

retained earnings balance.

3-6

Subsequent Consolidation –

Equity Method – Example Entry A

Trademarks . . . . . . . . . . . . . . .20,000

Patented technology . . . . . . .130,000

Goodwill . . . . . . . . . . . . . . . . .80,000

Equipment . . . . . . . . . . . . . . . . . . 30,000

Investment in Sun Company . . . 200,000

Note: In the first year, the FV

adjustments for this entry are

calculated in the allocation

computation. In subsequent years, the

FV adjustments must be reduced by

any depreciation taken in prior

consolidations.

3-7

Subsequent Consolidation –

Equity Method–Example Entry I&D

Equity in Subsidiary Earnings . . .93,000

Investment in Sun Company. . . . . . . 93,000

Investment in Sun Company . . . . 40,000

Dividends Paid . . . . . . . . . . . . . . . . 40,000

3-8

Subsequent Consolidation –

Equity Method – Example Entry E

Amortization Expense . . . . . . . . . 13,000

Equipment . . . . . . . . . . . . . . . . . . . 6,000

Patented Technology . . . . . . . . . . . . . . . . . . . 13,000

Depreciation Expense . . . . . . . . . . . . . . . . . . . 6,000

Remember: Never

amortize land or

goodwill!

3-9

Applying the Initial Value Method

If the Initial Value Method is used by the parent

company to account for the investment, then the

consolidation entries will change only slightly.

Remember . . . The PARENT will record the sub’s

activity differently under this method, so the Parent’s

accounts will differ from the Equity Method.

1. No adjustments are recorded in the

Investment account for current year

operations, dividends paid by the subsidiary,

or amortization of purchase price allocations.

2. Dividends received from the subsidiary are

recorded as Dividend Revenue.

3-10

Consolidation Entries –

Partial Equity Method

If the Parent uses the Partial Equity

Method, what will change from the

previous two methods?

Remember, the Parent’s record-keeping is

limited to two periodic journal entries:

1) the annual accrual of subsidiary income and

2) the receipt of dividends.

So, the Investment and Income

account balances will differ from

the other methods, and so will

worksheet Entries I and D.

3-11

Other Consolidation Entries

In addition to the Entries S, A, I, D, & E,

we will also eliminate intercompany

payables or receivables.

AND, if control acquired is

less than 100%, an

additional adjustment must

be made (see Chapter 4).

3-12

Consolidation Entries –

ALL METHODS

Now, check out the consolidated results!

No matter which method the Parent

chooses to record the Sub’s activity,

the consolidated totals end up

the SAME!

This is because we are eliminating all the

entries that we made during the year,

regardless of the method used,

and regardless of the amount!

3-13

Goodwill and Other Intangible

Assets (ASC Topic 350)

Generally, once goodwill has been recorded, the

value will remain unchanged.

We will adjust goodwill on the

consolidated balance sheet if:

1. We sell all or part of the related

subsidiary, or

2. We determine that there has been a

permanent decline in value (in which

case we record the impairment as an

extraordinary item).

3-14

Acquisition Method – Accounting

for Contingent Consideration

What if part of the consideration to be

transferred is contingent on a future

event?

Then the acquiring firm must estimate

the fair value of the contingent portion

and record a liability in consolidation.

The amount of the payment, times

The likelihood it will be paid, times,

A factor for the time value of money

(represented as [1 / (1+%)]