AS-21 - Safe eCollege

advertisement

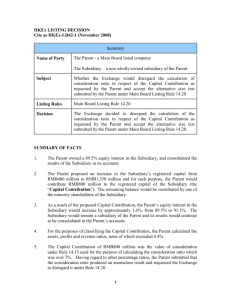

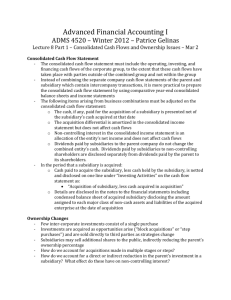

Consolidation of Accounts AS 21 1. This AS is mandatory in nature. Exemptions not available. This is mandatory for applying principles and procedures of consolidation. Note: AS 21 does not require consolidation but is to be followed if entity is preparing Consolidated Financial Statement. 2. Parent means entity having Subsidiary. Subsidiary is entity under control of Parent. Control means any of following qualification : Where One Entity, Directly or Indirectly through subsidiary, own more than 50 % voting Power. OR Where one Entity has power to compose governing body of another entity. 3. Subsidiary are of two types: Temporary Subsy 4. Permanent Subsy Temporary Subsidiary are not Consolidated. Temporary Subsy are any of the following two : i) Whose parent hold shares in Subsidiary for disposal in near future. ii) Where there are Long Term Restrictions on fund transfer from subsidiary to parent Company. Note: Near Future means within 12 months Note: If any entity hold investment as Stock in trade, than such shares are for temporary purpose, No consolidation is required. ( India Bulls holds certain shares as investment) 5. Consolidation Procedure Procedure are applied for consolidation of : 1. 2. 3. 4. Consolidated Balance Sheet Consolidated Profit & Loss A/c Consolidated Cash Flow Consolidated Notes of Account a) Investment in Subsidiary held by parent will be cancelled against Net Asset of Subsidiary on the date of acquisition. Any excess paid is called Goodwill. Excess Net Asset received is called Capital Reserve. b) All Asset, Liability, Income, Expence and Cash Flow will be consolidated on line by line basis. c) Excess Net Asset Consolidated which are not owned by parent is called Minority Interest. It is Shown in CB/S after Unsecured Loans. If Minority interest is Negative or Debit Balance, than such negative balance will not be shown in asset side. It will be written off against CPL in CB/S. d) Unrealized Profit / Loss on Assets will be cancelled from Consolidated Statement. As per “Frequently Asked Questions” on AS 21 issued by ICAI, unrealised profit / loss can be on two tyoes of transactions: Upstream Transaction Downstream Transaction Unrealised Profit will be eliminated where profit has been recognised. e) Any receivable or payable within group will be cancelled. f) Before Consolidation, Financial Statements of Subsidiary will be updated to date of Parents Financial Statement. Still if such updation is not possible Consolidation can be done provided gap between financial statement should not exceed 6 months. g) Before Consolidation Accounting Policy of subsidiary should be made compliant, with that of parent. f) Whenever multiple acquisition is made by parent in Subsidiary, Calculation of Goodwill or Capital Reserve will be on Step by Step Basis. g) Whenever Subsidiary have outstanding Cumulative Preference Share, whose dividend is in arrear, parent share in Profit / Loss on subsidiary will be calculated after providing Preference Dividend. 6. Disclosures i) Name of Subsidiary with address ii) Whenever Investment in subsidiary has been sold during the year, fact will be disclosed. iii) If the date of Financial Statement of Subsidiary is not updated, fact will be mentioned.