C7 - 7 Corporations, Partnerships, Estates & Trusts

advertisement

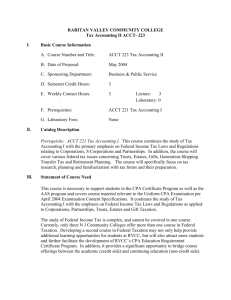

Chapter 7 Corporations: Reorganizations Corporations, Partnerships, Estates & Trusts Copyright ©2008 South-Western/Thomson Learning Reorganizations—In General • Refers to any corporate restructuring that may be tax-free under §368 – To qualify, must meet certain general requirements: • Must be a plan of reorganization • Must meet continuity of interest and continuity of business enterprise tests • Must have a sound business purpose • Tax-free status can be denied under step transaction doctrine Corporations, Partnerships, Estates & Trusts C7 - 2 Summary of Different Types of Reorganizations • The term reorganization includes: – – – – – – – Statutory merger or consolidation Stock for stock exchange Stock for assets exchange Divisive exchange Recapitalization Change in identity, form, or place of organization Transfers in bankruptcy or receivership Corporations, Partnerships, Estates & Trusts C7 - 3 Tax Free Reorganization Consequences, in General (slide 1 of 3) • Consequences to Acquiring Corporation – No gain or loss recognized unless it transfers property to the Target corporation as part of the transaction • Then gain, but not loss, may be recognized – Basis of property received retains basis it had in hands of Target corp plus any gain recognized by the target Corporations, Partnerships, Estates & Trusts C7 - 4 Tax Free Reorganization Consequences, in General (slide 2 of 3) • Consequences to Target Corporation – No gain or loss unless it retains “other property” received in the exchange or it distributes its own property to shareholders • Other property is defined as anything received other than stock or securities – Treated as boot • Gain, but not loss, may be recognized Corporations, Partnerships, Estates & Trusts C7 - 5 Tax Free Reorganization Consequences, in General (slide 3 of 3) • Consequences to Target or Acquiring Co. Shareholders – No gain or loss unless shareholders receive cash or other property in addition to stock • Cash or other property is considered boot – Gain recognized by the stockholder is the lesser of the boot received or the realized gain – Basis of shares received is same as basis of those surrendered, decreased by boot received, increased by gain and dividend income, if any, recognized in the transaction Corporations, Partnerships, Estates & Trusts C7 - 6 Type A Reorganization • Includes mergers and consolidations – Merger is union of two or more corporations • One corporation retains it existence and absorbs the others – Consolidation occurs when a new corporation is created to take the place of two or more corporations Corporations, Partnerships, Estates & Trusts C7 - 7 Type A Reorganization (slide 1 of 2) Corporations, Partnerships, Estates & Trusts C7 - 8 Type A Reorganization (slide 2 of 2) Corporations, Partnerships, Estates & Trusts C7 - 9 Type A Reorganization Issues (slide 1 of 2) • Advantages: – Type A reorganization is flexible – Consideration need not be voting stock – Money or other property can be transferred without disqualifying the transaction, as long as “continuity of interest” is met (at least 50% of consideration used in reorganization must be stock) Corporations, Partnerships, Estates & Trusts C7 - 10 Type A Reorganization Issues (slide 2 of 2) • Disadvantages: – Money or other property transferred is “boot” so some gain may be required to be recognized – Shareholders of either entity may dissent; in most states their shares must be redeemed – Acquiring entity must assume all liabilities of Target Corporations, Partnerships, Estates & Trusts C7 - 11 Type B Reorganization (Stock-for-Stock Reorganization) Corporations, Partnerships, Estates & Trusts C7 - 12 Type B Reorganization Requirements (slide 1 of 4) • Corporation acquires stock of Target solely in exchange for its own voting stock (stock for stock) – Acquiring corporation must acquire “control” of Target • Control is ownership of at least 80% of all classes of stock of target • Acquirer may add shares owned previously with shares acquired in reorganization Corporations, Partnerships, Estates & Trusts C7 - 13 Type B Reorganization Requirements (slide 2 of 4) • Acquiring corporation may acquire shares from either: (1) Shareholders of Target, or (2) Directly from Target • Exception to the “solely for voting stock” requirement when shareholders must receive fractional shares – May receive cash rather than fractional shares in the acquiring corporation Corporations, Partnerships, Estates & Trusts C7 - 14 Type B Reorganization Requirements (slide 3 of 4) • Example: Assume Target has 100 shares outstanding: – Acquirer may obtain 80 shares from current Target shareholders in exchange for Acquirer’s voting stock – Target may also issue 400 new shares to Acquirer in exchange for Acquirer’s voting stock (500 shares would be outstanding) Corporations, Partnerships, Estates & Trusts C7 - 15 Type B Reorganization Requirements (slide 4 of 4) • Consideration paid by Acquirer can only include Acquirer’s voting stock or transaction does not qualify Corporations, Partnerships, Estates & Trusts C7 - 16 Type C Reorganization (Stock-for-Assets Reorganization) Corporations, Partnerships, Estates & Trusts C7 - 17 Type C Reorganization Requirements (slide 1 of 3) • A ‘‘Type C’’ reorganization is essentially an exchange of voting stock for assets followed by liquidation of the target corporation – Called a “Stock-for-Assets” reorganization – Transfer is generally between the entities, not the shareholders Corporations, Partnerships, Estates & Trusts C7 - 18 Type C Reorganization Requirements (slide 2 of 3) • Consideration paid by Acquirer normally consists only of voting stock – However, if at least 80% of FMV of Target is acquired with voting stock, cash or other property can be used for remainder – Limitation: liabilities assumed by Acquirer are considered “other property” if any additional “other property” is used Corporations, Partnerships, Estates & Trusts C7 - 19 Type C Reorganization Requirements (slide 3 of 3) • “Substantially all” of Target’s assets must be transferred to Acquirer • There is no statutory definition of ‘‘substantially all’’ – To receive a favorable ruling from the IRS, the target must transfer at least 90% of net asset value or 70% of the gross asset value to the acquiring corporation Corporations, Partnerships, Estates & Trusts C7 - 20 Type D Reorganization (slide 1 of 4) • Generally a mechanism for corporate division – Called a “divisive reorganization” but can be used to carry out a corporate combination – In a Type D acquisitive reorganization • Entity transferring assets is considered the acquiring corporation • Corporation receiving the property is the target Corporations, Partnerships, Estates & Trusts C7 - 21 Type D Reorganization (slide 2 of 4) • In an acquisitive Type D reorganization – Substantially all of acquiring corp’s property must be transferred to target corporation – The acquiring corp must be in control (at least 50%) of the target – Target stock received by the acquiring corp and any remaining assets of acquiring corp must be distributed to its shareholders – Acquiring corporation must liquidate Corporations, Partnerships, Estates & Trusts C7 - 22 Type D Reorganization (slide 3 of 4) • In a divisive Type D reorganization – A corporation is divided – One or more new corps are formed to receive assets of original corp – Original corp must receive stock representing control (80%) of new corps – Stock of new corps is then distributed to shareholders of original corp Corporations, Partnerships, Estates & Trusts C7 - 23 Type D Reorganization (slide 4 of 4) • Three types of divisive “Type D” reorganizations – Spin-Off and Split-Off • A new corporation is formed to receive some of the assets of the original corporation in exchange for the new corporation's stock – Split-Up • Two or more corporations are formed to receive substantially all of the assets of the original corporation Corporations, Partnerships, Estates & Trusts C7 - 24 Type D Reorganization Spin-Off (slide 1 of 2) Corporations, Partnerships, Estates & Trusts C7 - 25 Type D Reorganization Spin-Off (slide 2 of 2) Corporations, Partnerships, Estates & Trusts C7 - 26 Type D Reorganization Split-Off (slide 1 of 2) Corporations, Partnerships, Estates & Trusts C7 - 27 Type D Reorganization Split-Off (slide 2 of 2) Corporations, Partnerships, Estates & Trusts C7 - 28 Type D Reorganization Split-Up (slide 1 of 2) Corporations, Partnerships, Estates & Trusts C7 - 29 Type D Reorganization Split-Up (slide 2 of 2) Corporations, Partnerships, Estates & Trusts C7 - 30 Type E Reorganization (slide 1 of 2) • Type E reorganization is a recapitalization – Involves a major change in character and amount of outstanding stock, securities, or paidin-capital • The following exchanges qualify: – Bonds for stock – Stock for stock – Bonds for bonds Corporations, Partnerships, Estates & Trusts C7 - 31 Type E Reorganization (slide 2 of 2) • Corporation can exchange its common stock for preferred stock or its preferred stock for common stock tax-free – The exchange of bonds for other bonds is taxfree when the debt received has a principal amount that is not more than the surrendered debt’s principal amount Corporations, Partnerships, Estates & Trusts C7 - 32 Type F Reorganization • A mere change in identity, form, or place of organization, however effected – Restricted to a single operating corporation – Tax characteristics of predecessor corp carry over to successor corp – Does not jeopardize status of §1244 stock or terminate a valid S corp election Corporations, Partnerships, Estates & Trusts C7 - 33 Type G Reorganization • All or part of assets of debtor corp are transferred to an acquiring corp in bankruptcy – Debtor corp’s creditors must receive voting stock of the acquiring corp in exchange for debt representing 80% or more of total FMV of debt of debtor corp Corporations, Partnerships, Estates & Trusts C7 - 34 Judicial Doctrines (slide 1 of 2) • Besides meeting specific requirements of reorganization, several judicially created doctrines must be met – Reorganization must exhibit a sound business purpose • Not a well defined test – Continuity of interest test • IRS deems this test met if shareholders of Target receive stock in Acquirer equal to at least 50% of their prior stock ownership in Target stock Corporations, Partnerships, Estates & Trusts C7 - 35 Judicial Doctrines (slide 2 of 2) – Continuity of business enterprise test • Requires the acquiring corp to either: – Continue the Target’s historic business, or – Use a significant portion of Target’s assets in business – Step transaction doctrine • Ensures that a series of transactions are not used to obtain tax benefits that would be unavailable if the transaction were accomplished in a single step • IRS generally views any transactions occurring within one year of reorganization as part of the restructuring Corporations, Partnerships, Estates & Trusts C7 - 36 Carryover of Corporate Tax Attributes (slide 1 of 4) • Assumption of liabilities – Acquiring corp either assumes liabilities of Target or takes property subject to liabilities • Allowance of Carryovers – In Type A, C, acquisitive D, and G reorganizations, the Target’s tax attributes are acquired – In Type B reorganizations, Target retains its assets and tax attributes Corporations, Partnerships, Estates & Trusts C7 - 37 Carryover of Corporate Tax Attributes (slide 2 of 4) • NOL Carryovers – Amount of NOL that can be used in year ownership change occurs is limited to a percentage representing the remaining days in the tax year over the total number of days in the year Corporations, Partnerships, Estates & Trusts C7 - 38 Carryover of Corporate Tax Attributes (slide 3 of 4) • NOL Carryovers (cont’d) – NOL can be further limited in first and succeeding years when there is a more than 50-percentage-point ownership change • An ownership change takes place on the day (change date) that either an equity structure shift or an owner shift occurs – An equity structure shift occurs when a tax-free reorganization causes an owner shift – An owner shift is any change in the common stock ownership of shareholders owning at least 5% – NOL can be used to the extent of the value of the loss corp’s stock on the date of the ownership change multiplied by the long-term tax-exempt rate Corporations, Partnerships, Estates & Trusts C7 - 39 Carryover of Corporate Tax Attributes (slide 4 of 4) • Earnings and Profits – Positive E & P of acquired corp carries over – E & P of a deficit corp are deemed received by acquiring corp as of change date • Deficit may only be used to offset E & P accumulated by successor corporation after the change date Corporations, Partnerships, Estates & Trusts C7 - 40 Comparison of Reorganization Types (slide 1 of 5) Type Advantages A. Merger/ Consolidation Consideration need not be voting stock Disadvantages State law may give dissenters rights or require s/holder mtgs. Up to 50% of All liabilities of consideration can Target are be in cash assumed by Acquirer Corporations, Partnerships, Estates & Trusts C7 - 41 Comparison of Reorganization Types (slide 2 of 5) Type Advantages Disadvantages B. Stock-for- Stock can be acq’d Stock from shareholders Only voting stock of Acquirer can be used Procedures are not complex Must have 80% control of Target -May have minority after reorg. Corporations, Partnerships, Estates & Trusts C7 - 42 Comparison of Reorganization Types (slide 3 of 5) Type Advantages C. Stock-for- Less complex as to Assets state law than “A” Cash or property are OK consideration if 20% or less of FMV of property transferred Corporations, Partnerships, Estates & Trusts Disadvantages “Substantially all” assets of Target must be transferred Liabilities count as “other property” for 20% test if any other consideration used. Target must distribute assets rec’d to s/holders C7 - 43 Comparison of Reorganization Types (slide 4 of 5) Type Advantages D. Division (generally) Permits corporate division without tax consequences if no boot is involved E. Recapitalization Allows for major change in makeup of shareholders’ equity without gain recognition requirement Corporations, Partnerships, Estates & Trusts C7 - 44 Comparison of Reorganization Types (slide 5 of 5) Type Advantages F. Change in form, Survivor is treated as same entity identity, or place as predecessor; tax attributes of of organization predecessor can be carried back or forward G. Court approved Creditors can exchange notes for reorganization stock tax-free and state merger laws need not be followed Corporations, Partnerships, Estates & Trusts C7 - 45