Advanced Business Law - Santa Monica College

advertisement

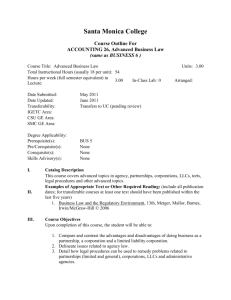

Santa Monica College Course Outline For BUSINESS 6, Advanced Business Law (same as ACCOUNTING 26 ) Course Title: Advanced Business Law Total Instructional Hours (usually 18 per unit): 54 Hours per week (full semester equivalent) in 3.00 Lecture: Date Submitted: Date Updated: Transferability: IGETC Area: CSU GE Area: SMC GE Area: Degree Applicability: Prerequisite(s): Pre/Corequisite(s): Corequisite(s): Skills Advisory(s): I. II. III. Units: 3.00 In-Class Lab: 0 Arranged: May 2011 June 2011 Transfers to UC (pending review) BUS 5 None None None Catalog Description This course covers advanced topics in agency, partnerships, corporations, LLCs, torts, legal procedures, and other advanced topics. *Maximum UC credit for Bus 5 and 6 is one course (three units). Examples of Appropriate Text or Other Required Reading: (include all publication dates; for transferable courses at least one text should have been published within the last five years) 1. Business Law and the Regulatory Environment, 13, Metger, Mallor, Barnes, Irwin/McGraw-Hill © 2006 Course Objectives Upon completion of this course, the student will be able to: 1. Compare and contrast the advantages and disadvantages of doing business as a partnership, a corporation and a limited liability corporation. 2. Delineate issues related to agency law. 3. Detail how legal procedures can be used to remedy problems related to partnerships (limited and general), corporations, LLCs and administrative agencies. 4. Articulate the legal process for forming, operating, and dissolving partnerships, corporations and LLCs. 5. Compare and contrast limited and general partnerships. 6. Delineate management?s and owners? legal responsibilities and liability for the various types of businesses. 7. Research and report on business cases and evaluate legal judgments by determining relevant issues and by incorporating legislation and prior case law. 8. Break down and apply the laws that regulate business. IV. V. Methods of Presentation: Lecture and Discussion , Discussion , Other (Specify) Other Methods: Case studies, videos, slideshows Course Content % of course VI. Topic 15% Agency law 20% Third-party relations of the principal and the agent 20% Partnerships 20% Corporations and LLCS 25% Regulation of business 100% Total Methods of Evaluation: (Actual point distribution will vary from instructor to instructor but approximate values are shown.) Percentage Evaluation Method 20 % Exams/Tests 5% Class Participation - Participation in discussions 20 % Midterm exams 30 % Final exam 25 % Other - Case Studies 100 % Total Additional Assessment Information: 90 – 100% = A 80 – 89% = B 70 – 79% = C 60 – 69% = D 50 – 59% = F VII. Sample Assignments: - VIII. Student Learning Outcomes 1. Demonstrate a level of engagement in the subject matter that reveals their understanding of the value of the course content beyond the task itself, specifically as it relates to linking the relevance of course content to careers in business and accounting and their personal lives.