Free - 2010 Macro FRQ Click Here

advertisement

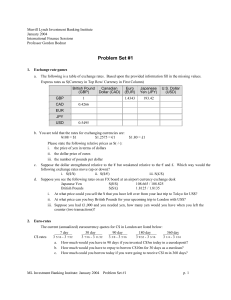

Norman 1. [10 total points] Assume that the U.S. economy is currently in long-run equilibrium. (a) [2 pts] Draw a correctly labeled graph of aggregate demand and aggregate supply and show each of the following. (i) The long-run aggregate supply curve (ii) The current equilibrium output & PL, labeled as YE and PLE, respectively. PL PL2 PLE LRAS SRAS AD1 E2 E1 AD2 Answer 1(a)(i): 1 pt for correctly labeled graph with downward-sloping AD, upward-sloping SRAS, PLE and YE. (ii) 1 pt for showing a vertical LRAS at YE. YE YI Real GDP (b) [2 pts] Assume that the government increases spending on national defense without raising taxes. (i) On your graph in part (a), show how the government action affects AD. (ii) How will this government action affect the unemployment rate in the short run? Explain. Answer: 1. (b) (i) As can be seen on the graph, the increase in G would increase AD to AD2, increasing PL and Y. 1. (b) (II) The increase in AD to AD2 would decrease unemployment in the short run, as the increase in AD would lead to an increase in output & profits, resulting in more workers being hired and therefore the decrease in unemployment. 1. (c) [2 pts] Assume that the economy adjusts to a new long-run equilibrium after the increase in government spending. (i) How will the short-run aggregate supply curve in the new long-run equilibrium compare with that in the initial long-run equilibrium in part (a) ? Explain. (ii) On your graph in part (a), label the new long-run equilibrium price level as PL2. LRAS PL PL2 PLE SRAS2 SRAS1 E2 E1 AD YE YI Real GDP Answer 1.(c)(i): 1 pt for stating that the SRAS will shift to the left because the Increase in AD would result in more inflation so workers will demand higher wages AND showing PL2 correctly in part (a)’s graph. 1.(c)(ii) 1 pt for explaining that the actual PL is higher than the expected PL, or wages and commodity prices adjust to higher PL[flexible wages], causing the SRAS curve to shift to the left. Real Interest Rate, (%) 1. (d) [2 pts] In order to finance the increase in government spending on national defense from part (b), the government borrows funds from the public. Using a correctly labeled graph of the loanable funds market, show the effect of the government’s borrowing on the real interest rate. (e) [2 pts] Given the change in the real interest rate in part (d), what is the impact on each of the following? Answer to 1. (d) 1 pt for correctly labeled graph (i) Investment of the LFM. (ii) Economic growth rate. Explain. 1 pt for showing a rightward shift of the demand D2 LFM D1 r2 r1 S curve resulting in a higher interest rate OR a leftward shift of the supply curve resulting in a higher RIR. E2 E1 F1 F2 Quantity of Loanable Funds Answer to 1. (e) (i) [1 pt] The higher RIR will result in less investment in tools and machinery. 1. (e) (ii) [1 pt] The decrease in tools and machinery will decrease overall productivity and economic growth [capital stock]. Nominal Interest Rate 2. [6 total points] A drop in credit card fees causes people to use credit cards more often for transactions and demand less money. (a) [2 pts] Using a correctly labeled graph of the money market, show how the nominal interest rate will be affected. (b) [1 pt] Given the interest rate change in part (a), what will happen to bond prices in the short run? Dm 1 MS Answer to 2. (a) The decrease in Dt for money would decrease the Dm curve resulting in a lower NIR and RIR. 2. (b) Bond prices are inverse to the interest rate so bond prices would increase n1 Answer to 2. (c) The lower IR will increase AD due to more investment and interest n2 sensitive consumption [the lower IR would Dm2 also depreciate the dollar and increase Xn]. All 3 cause an increase in AD & PL in the SR. Quantity of Money 2. (d) Selling bonds would be the OMO as [Money Market] it would decr MS, incr NIR and decr AD & PL. (c) [2 pt] Given the interest rate change in part (a), what will happen to the price level in the short run? Explain. (d) [1 pt] Identify an open-market operation the Fed could use to keep the nominal interest rate constant at the level that existed before the drop in credit card fees. Explain. 3. [6 total points] A U.S. firm sells $10 million worth of goods to a firm in Argentina, where the currency is the peso. (a) [1 pt] How will the transaction above affect Argentina’s aggregate demand? Explain. (b) [1 pt] Assume that the U.S. current account balance with Argentina is initially zero. How will the transaction above affect the United States current account balance? Explain. Answer to 3. (a) The selling of $10 M of U.S. goods to Argentina would decrease Argentina’s net exports which would decrease their AD. AD = C+I+G+X-M, when M gets larger, GDP gets smaller. 3. (b) The $10 million increase in net exports would cause a flow of $10 million worth of pesos into the U.S. [recorded as a +$10 million] and would cause a current account balance of ZERO to become a +$10 million surplus account balance. Price D1$ Peso Price of Dollar P looking for $’s P100 P50 S2$ S1$ Answer to 3. (c) (i): If the U.S. decrease financial investment $’s looking for P in Argentina, the U.S. would decrease their supply of E2 D dollars to Argentina, resulting in a decrease in demand for the peso. (c) (ii) As shown on the graph, Peso depreciates E1 the dollar would appreciate. Quantity of Dollars A (d) The cheaper prices in the U.S. will result in more demand for U.S. goods and therefore the dollar, appreciating the dollar and depreciating the peso. 3. (c) [2pt] Using a correctly labeled graph of the foreign exchange market for the U.S. dollar, show how a decrease in the U.S. financial investment in Argentina affects each. (i) The supply of United States dollars (ii) The value of the United States dollar relative to the peso (d) [2 pt] Suppose that the inflation rate is 3% in the U.S. and 5% in Argentina. What will happen to the value of the peso relative to the United States dollar as a result of the difference in inflation rates? Explain. FRQs for Dummies 2010 FRQ Animationeconomics.com