Interest Rate Futures

advertisement

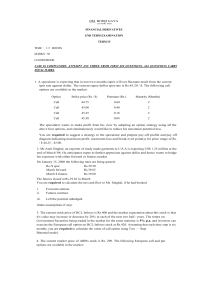

Interest Rate Futures Mark Fielding-Pritchard of mefielding.com ACCA p4 , also CFA, ICAS, ICAEW mefielding.com 1 The question is based on ACCA P4, Phobos from 12/08 Please download the question, it is on our website Key information Now is 1 January, loan will be taken out 1 March, the loan is for £30m for a period of 4 months Assumption: when the loan is taken out it is fixed rate mefielding.com 2 3 Questions 1) Do I buy (calls) or sell (futures)? The theoretical value of a future is 100 – LIBOR Therefore if interest rates are 5%, value is 95 If interest rates rise to 6%, value falls to 94 If we are hedging rising interest rates we sell. Sell at 95 Buy at 94 Gain mefielding.com 1 3 What does gain or loss mean? A contract has a standard value of £500,000 for 3 months A gain of 1 = 1%x 500000 x 3/12 = £1250 In the question they give you tick value, 1 tick = 0.01% = 12.50. 100 ticks = 1% = £1250 mefielding.com 4 3 Questions Question 1, do we buy or sell. We sell because the company has a rsik of rising interest rates Question 2, how many? 1 contract will hedge £500000 for 3 months. If your loan will be 1 million for 3 months you need 2 contracts because your interest is twice as much Similarly if your loan is £500000 for 6 months you will need 2 contracts because your interest will be twice as much. Remember the loan is fixed interest when taken out so don’t think about changing rates or anything, just simple maths. mefielding.com 5 Question 2- How many contracts Easy Formula Number of contracts = In our example = = 80 mefielding.com 4 𝑥 3 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑚𝑜𝑛𝑡ℎ𝑠 𝑜𝑓 𝑟𝑖𝑠𝑘 𝑠𝑢𝑚 𝑜𝑓 𝑙𝑜𝑎𝑛 𝑥 3 500000 30𝑚 500000 6 Question 3 Which Month Assume in these questions that securities close at the end of the month Futures price will not = 100- LIBOR The difference is called basis risk. This arises for a lot of reasons, expectations, volatility, changes in interest rates etc. The longer the futures ha to go until closure the greater will be that basis risk Therefore we choose the future that closes first after our risk ends, our risk ends when we take out a fixed rate loan (1 March) therefore we chose March futures If we look at our March future he price is 93.88 which implies a Libor of 6.12%. Libor is actually 6% so basis risk is 0.12% or 12 ticks and the market is expecting a rise in interest rates mefielding.com 7 Our Hedging Strategy Therefore bring together the elements of the 3 questions. On 1 January we will sell 80 March futures On 1 March we will close our position by buying 80 March futures mefielding.com 8 Illustration of effect The examiner wants you to show what happens if interest rates rise and fall So lets take 5 & 7% (Currently 6%) Interest on the loan 30m x 4/12 x 7%= 700000 30m x 4/12 x 5%= 500000 Benchmark 30m x 4/12 x 6%= 600000 mefielding.com 9 Effect of the future 1 7% 5% Sold 93.88 93.88 Buy 92.96 94.96 Difference 0.92 Where does 92.96 come from? Basis risk on 1 January was 94-93.88= 12 basis points Basis risk declines evenly so on 1 March 2/3 will have disappeared, therefore 1/3 or 4 basis points remains. And it is above LIBOR so LIBOR of 7% gives an implicit rate in the future of 7.04% mefielding.com (1.08) 10 Effect of the future 2 So at 7% interest rate we had again of 0.92 % or 92 ticks 0.92%x 500000x 3/12x 80 = 92000, or 92x 12.5x 80 = 92000 So at 7% our additional interest was 100000 minus our future gain of 92000 gives us a loss of 8000 and hedge efficiency of 92% If rates fall to 5% We save 100000 on interest but we lose 108000 (108x12.5x80) Net loss is 8000 as before, hedge efficiency is 100/108 (92.6%) Loss has arisen because of 8 ticks of basis risk (8x12.5x80) disappearing mefielding.com 11 Problems with futures Cost Deposits Margin calls Market sentiment Open mefielding.com positions 12