Managing Fixed-Income Positions with OTC Derivatives 1

advertisement

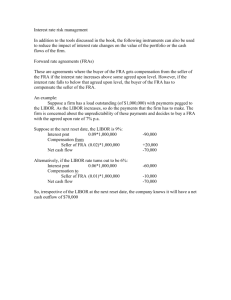

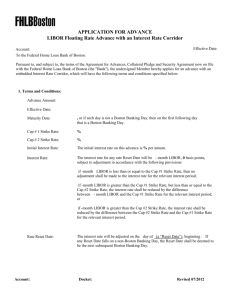

Managing Fixed-Income Positions with OTC Derivatives 1 1. Hedging with OTC Derivatives 2. Hedging a Series of Cash Flows—OTC Caps and Floors 3. Financing Caps and Floors: Collars and Corridors 4. Other Interest Rate Derivatives 5. Hedging Currency Positions with Currency Options 2 Hedging with OTC Derivatives 3 Forward Rate Agreements (FRA) A forward rate agreement, FRA, requires a cash payment or provides a cash receipt based on the difference between a realized spot rate such as the LIBOR and a pre-specified rate. For example, the contract could be based on a specified rate of Rk = 6% (annual) and the 3-month LIBOR (annual) in 5 months and a notional principal, NP (principal used only for calculation purposes) of $10,000,000. 4 Forward Contracts and Forward Rate Agreements (FRA) In five months the payoff would be Payoff ($10,000,000) LIBOR .06(91 / 365) 1 LIBOR (91 / 365) If the LIBOR at the end of five months exceeds the specified rate of 6%, the buyer of the FRA (or long position holder) receives the payoff from the seller. If the LIBOR is less than 6%, the seller (or short position holder) receives the payoff from the buyer. 5 Forward Contracts and Forward Rate Agreements (FRA) Payoff ($10,000,000) LIBOR .06(91 / 365) 1 LIBOR (91 / 365) If the LIBOR were at 6.5%, the buyer would be entitled to a payoff of $12,267 from the seller; If the LIBOR were at 5.5%, the buyer would be required to pay the seller $12,297. 6 Forward Contracts and Forward Rate Agreements (FRA) In general, a FRA that matures in T months and is written on a M-month LIBOR rate is referred to as a T x (T+M) agreement. Thus, in this example the FRA is a 5 x 8 agreement. At the maturity of the contract (T), the value of the contract, VT is VT LIBOR R k (M / 365) NP 1 LIBOR (M / 365) 7 Forward Contracts and Forward Rate Agreements (FRA) FRAs originated in 1981 amongst large London Eurodollar banks that used these forward agreements to hedge their interest rate exposure. Today, FRAs are offered by banks and financial institutions in major financial centers and are often written for the bank’s corporate customers. They are customized contracts designed to meet the needs of the corporation or financial institution. 8 Forward Contracts and Forward Rate Agreements (FRA) FRAs are used by corporations and financial institutions to manage interest rate risk in the same way as financial futures are used. Different from financial futures, FRAs are contracts between two parties and therefore are subject to the credit risk of either party defaulting. The customized FRAs are also less liquid than standardized futures contracts. The banks that write FRAs often takes a position in the futures market to hedge their position or a long and short position in spot money market securities to lock in a forward rate. As a result, in writing the FRA, the specified rate Rk is often set equal to the rate implied on a futures contract. 9 Forward Contracts and Forward Rate Agreements (FRA) Example: Suppose Kendall Manufacturing forecast a cash inflow of $10,000,000 in 2 months that it is considering investing in a Sun National Bank CD for 90 days. Sun National Bank’s jumbo CD pays a rate equal to the LIBOR. Currently such rates are yielding 5.5%. Kendall is concerned that short-term interest rates could decrease in the next 2 months and would like to lock in a rate now. 10 Forward Contracts and Forward Rate Agreements (FRA) Example: As an alternative to hedging its investment with Eurodollar futures, Sun National suggests that Kendall hedge with a Forward Rate Agreement with the following terms: 1. FRA would mature in 2 months (T) and would be written on a 90-day (3-month) LIBOR (T x (T+M) = 2 x 5 agreement 2. NP = $10,000,000 3. Contract rate = Rk = 5.5% 4. Day count convention = 90/365 5. Cagle would take the short position on the FRA, receiving the payoff from Sun National if the LIBOR were less than Rk = 5.5% 6. Sun National would take the long position on the FRA, receiving the payoff from Cagle if the LIBOR were greater than Rk = 5.5% 11 Forward Contracts and Forward Rate Agreements (FRA) The exhibit slide shows Kendall’s FRA receipts or payments and cash flows from investing the $10,000,000 cash inflow plus or minus the FRA receipts or payments at possible LIBORs of 5%, 5.25%, 5%, 5.75%, and 6%. As shown, Kendall is able to earn a hedged rate of return of 5.5% from its $10,000,000 investment. 12 Forward Contracts and Forward Rate Agreements (FRA) LIBOR 0.0500 0.0525 0.0550 0.0575 0.0600 Sun National Payoff -$12,178.62 -$6,085.60 $0.00 $6,078.21 $12,149.03 Payoff ($10,000,000) Kendall Payoff $12,178.62 $6,085.60 $0.00 -$6,078.21 -$12,149.03 Cagle CD Investment $10m + FRA Payoff $10,012,178.62 $10,006,085.60 $10,000,000.00 $9,993,921.79 $9,987,850.97 CF at CD Maturity Hedged Rate $10,135,616 $10,135,616 $10,135,616 $10,135,616 $10,135,616 0.0550 0.0550 0.0550 0.0550 0.0550 LIBOR .055(90 / 365) 1 LIBOR (90 / 365) 13 Interest Rate Call An interest rate call, also called a caplet, gives the buyer a payoff on a specified payoff date if a designated interest rate, R, such as the LIBOR, rises above a certain exercise rate, Rx. On the payoff date: If the designated rate is less than Rx, the interest rate call expires worthless. If the rate exceeds Rx, the call pays off the difference between the actual rate and Rx, times a notional principal, NP, times the fraction of the year specified in the contract, θ. Payoff Max[R R x ,0]()( NP) 14 Interest Rate Call Example: Given an interest rate call with a designated rate of LIBOR, Rx = 6%, NP = $1,000,000, time period of 180 days, and day-count convention of actual/360, the buyer would receive a $5,000 payoff on the payoff date if the LIBOR were 7%: Payoff = Max[.07−.06, 0](180/360)($1,000,000) Payoff = $5,000 15 Interest Rate Call Hedging Use Interest rate call options are often written by commercial banks in conjunction with futures loans they plan to provide to their customers. The exercise rate on the option usually is set near the current spot rate, with that rate often being tied to the LIBOR. 16 Hedging a Future Loan Rate with an OTC Interest Rate Call Example: Suppose a construction company plans to finance one of its project with a $10,000,000 90-day loan from Sun Bank, with the loan rate to be set equal to the LIBOR + 100 BP when the project commences 60 day from now. Furthermore, suppose that the company expects rates to decrease in the future, but is concerned that they could increase. 17 Hedging a Future Loan Rate with an OTC Interest Rate Call Example: To obtain protection against higher rates, suppose the company buys an interest rate call option from Sun Bank for $20,000 with the following terms: 1. Exercise rate = 7% 2. Reference rate = LIBOR 3. Time period applied to the payoff = 90/360 4. Notional principal = $10,000,000 5. Payoff made at the maturity date on the loan (90 days after the option’s expiration) 6. Interest rate call’s expiration = T = 60 days (time of the loan) 7. Interest rate call premium of $20,000 to be paid at the option’s expiration with a 7% interest: Cost = $20,000(1 + (.07)(60/360)) = $20,233 18 Hedging a Future Loan Rate with an OTC Interest Rate Call Example: The exhibit slide shows the company's cash flows from the call, interest paid on the loan, and effective interest costs that would result given different LIBORs at the starting date on the loan and the expiration date on the option. As shown in Column 6 of the slide, the company is able to lock in a maximum interest cost of 8.016% if the LIBOR is 7% or greater at expiration, and still benefit with lower rates if the LIBOR is less than 7%. 19 Hedging a Future Loan Rate with an OTC Interest Rate Call Company's Loan: $10m at LIBOR+100BP for 90 days (.25 per year) Interest Rate Call Option: Exercise Rate = 7%, Reference Rate = LIBOR, NP = $10m, Time Period = .25, Option Expiration = T= 60 days Cost of Option = $20,000, payable at T plus 7% interest 1 2 3 4 5 6 LIBOR Interest Rate Call Cost of the Option at T Interest Paid on Cost at Maturity Annualized Hedged Rate Payoff: $10M[Max[LIBOR-.07,0]](.25) $20,000(1+.07(60/360)) Loan at its Maturity Col (4) - Col (2) 4[Col (5)/($10m-Col (3))] (LIBOR+100bp)(.25)($10,000,000) 0.0550 $0 $20,233 $162,500 $162,500 0.06513 0.0575 $0 $20,233 $168,750 $168,750 0.06764 0.0600 $0 $20,233 $175,000 $175,000 0.07014 0.0625 $0 $20,233 $181,250 $181,250 0.07265 0.0650 $0 $20,233 $187,500 $187,500 0.07515 0.0675 $0 $20,233 $193,750 $193,750 0.07766 0.0700 $0 $20,233 $200,000 $200,000 0.08016 0.0725 $6,250 $20,233 $206,250 $200,000 0.08016 0.0750 $12,500 $20,233 $212,500 $200,000 0.08016 0.0775 $18,750 $20,233 $218,750 $200,000 0.08016 0.0800 $25,000 $20,233 $225,000 $200,000 0.08016 0.0825 $31,250 $20,233 $231,250 $200,000 0.08016 0.0850 $37,500 $20,233 $237,500 $200,000 0.08016 20 Interest Rate Put An interest rate put, also called a floorlet, gives the buyer a payoff on a specified payoff date if a designated interest rate, R, is below the exercise rate, Rx. On the payoff date: If the designated rate (or reference rate) is more than Rx, the interest rate put expires worthless. If the reference rate is less than Rx, the put pays the difference between Rx and the actual rate times a notional principal, NP, times the fraction of the year, θ, specified in the contract. Payoff Max[R x R,0]()( NP) 21 Interest Rate Put Hedging Use A financial or non-financial corporation that is planning to make an investment at some future date could hedge that investment against interest rate decreases by purchasing an interest rate put from a commercial bank, investment banking firm, or dealer. 22 Hedging a CD Rate with an OTC Interest Rate Put Example: Suppose the ABC manufacturing company was expecting a net cash inflow of $10,000,000 in 60 days from its operations and was planning to invest the excess funds in a 90-day CD from Sun Bank paying the LIBOR. To hedge against interest rate decreases occurring 60 days from the now, suppose the company purchases an interest rate put (corresponding to the bank's CD it plans to buy) from Sun Bank for $10,000. 23 Hedging a CD Rate with an OTC Interest Rate Put Example: Suppose the put has the following terms: 1. 2. 3. 4. 5. 6. 7. 8. Exercise rate = 7% Reference rate = LIBOR Time period applied to the payoff = θ = 90/360 Day Count Convention = 30/360 Notional principal = $10 million Payoff made at the maturity date on the CD (90 days from the option’s expiration) Interest rate put’s expiration = T = 60 days (time of CD purchase) Interest rate put premium of $10,000 to be paid at the option’s expiration with a 7% interest: Cost = $10,000(1 + (.07)(60/360)) = $10,117 24 Hedging a CD Rate with an OTC Interest Rate Put Example: As shown in the exhibit slide, the purchase of the interest rate put makes it possible for the ABC company to earn higher rates if the LIBOR is greater than 7% and to lock in a minimum rate of 6.993% if the LIBOR is 7% or less. 25 Hedging a CD Rate with an OTC Interest Rate Put Company's Investment: $10m at LIBOR for 90 days (.25 per year) Interest Rate Put Option: Exercise Rate = 7%, Reference Rate = LIBOR, NP = $10m, time period = .25, option expiration = T = 60 days Cost of Option = $10,000, payable at T plus 7% interest 1 LIBOR 2 3 4 5 6 Interest Rate Put Cost of the Option at T Interest Received on Revenues at Maturity Annualized Hedged Rate Payoff: $10M[Max[.07−LIBOR,0](.25) $10,000(1+.07(60/360)) CD at its Maturity Col (2) + Col 4 4[Col (5)/($10m+Col (3))] 0.0550 $37,500 $10,117 $137,500 $175,000 0.06993 0.0575 $31,250 $10,117 $143,750 $175,000 0.06993 0.0600 $25,000 $10,117 $150,000 $175,000 0.06993 0.0625 $18,750 $10,117 $156,250 $175,000 0.06993 0.0650 $12,500 $10,117 $162,500 $175,000 0.06993 0.0675 $6,250 $10,117 $168,750 $175,000 0.06993 0.0700 $0 $10,117 $175,000 $175,000 0.06993 0.0725 $0 $10,117 $181,250 $181,250 0.07243 0.0750 $0 $10,117 $187,500 $187,500 0.07492 0.0775 $0 $10,117 $193,750 $193,750 0.07742 0.0800 $0 $10,117 $200,000 $200,000 0.07992 0.0825 $0 $10,117 $206,250 $206,250 0.08242 0.0850 $0 $10,117 $212,500 $212,500 0.08491 (LIBOR)(.25)($10,000,000) 26 Hedging a CD Rate with an OTC Interest Rate Put Example: If 60 days later the LIBOR is at 6.5%, then the company would receive a payoff (90 day later at the maturity of its CD) on the interest rate put of $12,500: $12,500 = ($10,000,000)[.07 − .065](90/360) The $12,500 payoff would offset the lower (than 7%) interest paid on the company’s CD of $162,500: $162,500 = ($10,000,000)(.065)(90/360) At the maturity of the CD, the company would therefore receive CD interest and an interest rate put payoff equal to $175,000: $175,000 = $162,500 + $12,500 27 Hedging a CD Rate with an OTC Interest Rate Put Example: With the interest-rate put’s payoffs increasing the lower the LIBOR, the company would be able to hedge any lower CD interest and lock in a hedged dollar return of $175,000. Based on an investment of $10,000,000 plus the $10,117 costs of the put, the hedged return equates to an effective annualized yield of 6.993%: 6.993% = [(4)($175,000)]/[$10,000,000 + $10,117] On the other hand, if the LIBOR exceeds 7%, the company benefits from the higher CD rates. 28 Cap A popular option offered by financial institutions in the OTC market is the cap. A plain-vanilla cap is a series of European interest rate call options—a portfolio of caplets. 29 Cap Example: A 7%, 2-year cap on a 3-month LIBOR, with a NP of $100,000,000, provides, for the next 2 years, a payoff every 3 months of (LIBOR − .07)(.25)($100M) if the LIBOR on the reset date exceeds 7% and nothing if the LIBOR equals or is less than 7%. Note: Typically, the payoff does not occur on the reset date, but rather on the next reset date. 30 Cap Uses Caps are often written by financial institutions in conjunction with a floatingrate loan and are used by buyers as a hedge against interest rate risk. 31 Cap A company with a floating-rate loan tied to the LIBOR could lock in a maximum rate on the loan by buying a cap corresponding to its loan. At each reset date, the company would receive a payoff from the caplet if the LIBOR exceeded the cap rate, offsetting the higher interest paid on the floating-rate loan; on the other hand, if rates decrease, the company would pay a lower rate on its loan whereas its losses on the caplet would be limited to the cost of the option. Thus, with a cap, the company is able to lock in a maximum rate each quarter, and yet still benefit with lower interest costs if rates decrease. 32 Floor A plain-vanilla floor is a series of European interest rate put options—a portfolio of floorlets. 33 Floor Example: A 7%, 2-year floor on a 3-month LIBOR, with a NP of $100,000,000, provides for the next 2 years a payoff every 3 months of (.07 − LIBOR)(.25)($100M) if the LIBOR on the reset date is less than 7% and nothing if the LIBOR equals or exceeds 7%. 34 Floor Uses Floors are often purchased by investors as a tool to hedge their floating-rate investment against interest rate declines. Thus, with a floor, an investor with a floating-rate security is able to lock in a minimum rate each period, and yet still benefit with higher yields if rates increase. 35 Hedging a Series of Cash Flows: OTC Caps and Floors 36 Hedging a Series of Cash Flows: OTC Caps and Floors We have examined how a strip of Eurodollar futures puts can be used to cap the rate paid on a floating-rate loan, and how a strip of Eurodollar futures calls can be used to set a floor on a floating-rate investment. Using such exchange-traded options to establish interest rate floors and ceiling on floating rate assets and liabilities, though, is subject to hedging risk. As a result, many financial and non-financial companies looking for such interest rate insurance prefer to buy OTC caps or floors that can be customized to meet their specific needs. 37 Hedging a Series of Cash Flows: OTC Caps and Floors Financial institutions typically provide caps and floors with: 1. 2. 3. 4. 5. Terms that range from 1 to 5 years Monthly, quarterly, or semiannual reset dates LIBOR as the reference rate Notional principal and the reset dates that often match the specific investment or loan Settlement dates that usually come after the reset dates 38 Hedging a Series of Cash Flows: OTC Caps and Floors In cases where a floating-rate loan (or investment) and cap (or floor) come from the same financial institution, the loan and cap (or investment and floor) are usually treated as a single instrument so that when there is a payoff, it occurs at an interest payment (receipt) date, lowering (increasing) the payment (receipt). The exercise rate is often set so that the cap or floor is initially out of the money, and the payments for these interest rate products are usually made up front, although some are amortized. 39 Floating Rate Loan Hedged with an OTC Cap Example: Suppose the Diamond Development Company borrows $50 million from Commerce Bank to finance a 2-year construction project. Suppose: The loan is for 2 years The loan starts on March 1 at a known rate of 8% The loan rate resets every three months—6/1, 9/1, 12/1, and 3/1—at the prevailing LIBOR plus 150 bp. 40 Floating Rate Loan Hedged with an OTC Cap In entering this loan agreement, suppose the company is uncertain of future interest rates and therefore would like to lock in a maximum rate, but still benefit from lower rates if the LIBOR decreases. 41 Floating Rate Loan Hedged with an OTC Cap To achieve this, suppose the company buys a cap corresponding to its loan from Commerce Bank for $150,000, with the following terms: 1. 2. 3. 4. 5. 6. 7. The cap consist of seven caplets with the first expiring on 6/1/Y1 and the others coinciding with the loan’s reset dates. Exercise rate on each caplet = 8% NP on each caplet = $50,000,000 Reference Rate = LIBOR Time period to apply to payoff on each caplet = 90/360. (Typically the day count convention is defined by the actual number of days between reset date.) Payment date on each caplet is at the loan’s interest payment date, 90 days after the reset date. The cost of the cap = $150,000; it is paid at beginning of the loan, 3/1/Y1. 42 Floating Rate Loan Hedged with an OTC Cap On each reset date, the payoff on the corresponding caplet would be Payoff = ($50,000,000) (Max[LIBOR − .08, 0])(90/360) With the 8% exercise rate (sometimes called the cap rate), the Diamond Company would be able to lock in a maximum rate each quarter equal to the cap rate plus the basis points on the loan, 9.5%, but still benefit with lower interest costs if rates decrease. This can be seen in the exhibit slide, where the quarterly interests on the loan, the cap payoffs, and the hedged and unhedged rates are shown for different assumed LIBORs at each reset date on the loan. 43 Floating Rate Loan Hedged with an OTC Cap Loan: Floating Rate Loan; Term = 2 years; Reset dates: 3/1, 6/1, 9/1, 12/1; Time frequency = .25; Rate = LIBOR + 150bp; Payment Date = 90 days after reset date Cap: Cost of cap =$150,000; Cap Rate = 8%; Reference Rate = LIBOR; Time frequency = .25; Caplets' Expiration: On loan reset dates, starting at 6/1/Y1; Payoff made 90 days after reset date. 1 2 3 4 5 6 7 Reset Date Assumed LIBOR Loan Interest on Payment Date Cap Payoff on Payment Date Hedged Interest Payment Hedged Rate Unhedged Rate (LIBOR + 150bp)(.25)($50m) (Max[LIBOR−.08,0])(.25)($50m) Col. (3) − Col. (4) 4[Col (5)/$50m] LIBOR + 150bp 3/1/Y1n 0.065 6/1/Y1 0.070 $1,000,000 $0 $1,000,000 0.080 0.080 9/1/Y1 0.075 $1,062,500 $0 $1,062,500 0.085 0.085 12/1/Y1 0.080 $1,125,000 $0 $1,125,000 0.090 0.090 3/1/Y2 0.085 $1,187,500 $0 $1,187,500 0.095 0.095 6/1/Y2 0.090 $1,250,000 $62,500 $1,187,500 0.095 0.100 9/1/Y2 0.095 $1,312,500 $125,000 $1,187,500 0.095 0.105 12/1/Y2 0.100 $1,375,000 $187,500 $1,187,500 0.095 0.110 $1,437,500 $250,000 $1,187,500 0.095 0.115 3/1/Y3 n There is no caplet for this date 44 Floating Rate Loan Hedged with an OTC Cap For the 5 reset dates from 12/1/Y1 to the end of the loan, the LIBOR is at 8% or higher. In each of these cases, the higher interest on the loan is offset by the payoff on the cap, yielding a hedged rate on the loan of 9.5% (the 9.5% rate excludes the $150,000 cost of the cap; the rate is 9.53% with the cost included). For the first 2 reset dates on the loan, 6/1/Y1 and 9/1/Y1, the LIBOR is less than the cap rate. At these rates, there is no payoff on the cap, but the rates on the loan are lower with the lower LIBORs. 45 Floating Rate Asset Hedged with an OTC Floor Example: As noted, floors are purchased to create a minimum rate on a floating-rate asset. As an example, suppose the Commerce Bank in the preceding example wanted to establish a minimum rate or floor on the rates it was to receive on the 2year floating-rate loan it made to the Diamond Company. 46 Floating Rate Asset Hedged with an OTC Floor Suppose the bank purchased from another financial institution a floor for $100,000 with the following terms corresponding to its floating-rate asset: 1. 2. 3. 4. 5. 6. The floor consist of 7 floorlets with the first expiring on 6/1/Y1 and the others coinciding with the reset dates on the bank’s floating-rate loan to the Diamond Company Exercise rate on each floorlet = 8% NP on each floorlet = $50,000,000 Reference Rate = LIBOR Time period to apply to payoff on each floorlet = 90/360 Payment date on each floorlet is at the loan’s interest payment date, 90 days after the reset date The cost of the floor = $100,000; it is paid at beginning of the loan, 3/1/Y1 47 Floating Rate Asset Hedged with an OTC Floor On each reset date, the payoff on the corresponding floorlet would be Payoff = ($50,000,000) (Max[.08 − LIBOR, 0])(90/360) With the 8% exercise rate, Commerce Bank would be able to lock in a minimum rate each quarter equal to the floor rate plus the basis points on the floating-rate asset, 9.5%, but still benefit with higher returns if rates increase. 48 Floating Rate Asset Hedged with an OTC Floor In the exhibit slide, Commerce Bank’s quarterly interests received on its loan to Diamond, its floor payoffs, and its hedged and unhedged yields on its loan are shown for different assumed LIBORs at each reset date. 49 Floating Rate Asset Hedged with an OTC Floor Asset: Floating-rate loan made by bank; Term = 2 years; Reset dates: 3/1, 6/1, 9/1, 12/1; Time frequency = .25; Rate = LIBOR + 150bp; Payment Date = 90 days after reset date Floor: Cost of floor =$100,000; Floor Rate = 8%; Reference Rate = LIBOR; Time frequency = .25; Floorlets' expirations: On loan reset dates, starting at 6/1/Y1; Payoff made 90 days after reset date. 1 2 Reset Date 3 4 5 6 7 Hedged Interest Income Hedged Rate Unhedged Rate (Max[.08−LIBOR,0})(.25)($50m) Col. (3) + Col. (4) 4[Col (5)/$50m] LIBOR + 150BP Assumed LIBOR Interest Received on Payment Date Floor Payoff on Payment Date (LIBOR + 150bp)(.25)($50m) 3/1/Y1n 0.065 6/1/Y1 0.070 $1,000,000 $0 $1,000,000 0.080 0.080 9/1/Y1 0.075 $1,062,500 $125,000 $1,187,500 0.095 0.085 12/1/Y1 0.080 $1,125,000 $62,500 $1,187,500 0.095 0.090 3/1/Y2 0.085 $1,187,500 $0 $1,187,500 0.095 0.095 6/1/Y2 0.090 $1,250,000 $0 $1,250,000 0.100 0.100 9/1/Y2 0.095 $1,312,500 $0 $1,312,500 0.105 0.105 12/1/Y2 0.100 $1,375,000 $0 $1,375,000 0.110 0.110 $1,437,500 $0 $1,437,500 0.115 0.115 3/1/Y3 n There is no floorlet for this date 50 Floating Rate Asset Hedged with an OTC Floor For the first two reset dates on the loan, 6/1/Y1 and 9/1/Y1, the LIBOR is less than the floor rate of 8%. At theses rates, there is a payoff on the floor that compensates for the lower interest Commerce receives on the loan; this results in a hedged rate of return on the bank’s loan asset of 9.5% (the rate is 9.52% with the $100,000 cost of the floor included). For the five reset dates from 12/1/Y1 to the end of the loan, the LIBOR equals or exceeds the floor rate. At these rates, there is no payoff on the floor, but the rates the bank earns on its loan are greater, given the greater LIBORs. 51 Financing Caps and Floors: Collars and Corridors 52 Collars A collar is combination of a long position in a cap and a short position in a floor with different exercise rates. The sale of the floor is used to defray the cost of the cap. For example, the Diamond Company in the preceding case could reduce the cost of the cap it purchased to hedge its floating rate loan by selling a floor. By forming a collar to hedge its floating-rate debt, the Diamond Company, for a lower net hedging cost, would still have protection against a rate movement against the cap rate, but it would have to give up potential interest savings from rate decreases below the floor rate. 53 Collars Example: Suppose the Diamond Company decided to defray the $150,000 cost of its 8% cap by selling a 7% floor for $70,000, with the floor having similar terms to the cap: 1. Effective dates on floorlet = reset date on loan 2. Reference rate = LIBOR 3. NP on floorlets = $50,000,000 4. Time period for rates = .25 54 Collars By using the collar instead of the cap, the company reduces its hedging cost from $150,000 to $80,000, and as shown in the exhibit slide, it still locked in a maximum rate on its loan of 9.5%. However, when the LIBOR is less than 7%, the company has to pay on the 7% floor, offsetting the lower interest costs it would pay on its loan. For example: When the LIBOR is at 6% on 6/1/Y1, Diamond has to pay $125,000 ninety days later on its short floor position. When the LIBOR is at 6.5% on 9/1/Y1, the company has to pay $62,500. These payments, in turn, offset the benefits of the respective lower interest of 7.5% and 8% (LIBOR + 150 bp) it pays on its floating rate loan. 55 Collars Loan: Floating Rate Loan; Term = 2 years; Reset dates: 3/1, 6/1, 9/1, 12/1; Time frequency = .25; Rate = LIBOR + 150BP; Payment Date = 90 days after reset date Cap Purchase: Cost of cap =$150,000; Cap Rate = 8%; Reference Rate = LIBOR; Time frequency = .25; Caplets' Expiration: On loan reset dates, starting at 6/1/Y1; Payoff made 90 days after reset date. Floor Sale: Sale of floor = $70,000; Floor rate = 7%; Reference rate = LIBOR; Time frequency = .25; Floorlets' expiration: On loan reset dates, starting at 61/Y1; Payoff date = 90 days after reset date. 1 2 3 4 5 6 7 8 Reset Date Assumed LIBOR Loan Interest Cap Payoff Floor Payment Hedged Interest Payment Hedged Rate Unhedged Rate (LIBOR + 150bp)(.25)($50m) Max[LIBOR-.08,0](.25)($50m) Max[.07-LIBOR,0](.25)($50m) Col. (3) - Col. (4) + Col (5) 4[Col (6)/$50m] LIBOR + 150BP 3/1/Y1 0.050 6/1/Y1 0.060 $812,500 $0 $0 $812,500 0.065 0.065 9/1/Y1 0.065 $937,500 $0 $125,000 $1,062,500 0.085 0.075 12/1/Y1 0.070 $1,000,000 $0 $62,500 $1,062,500 0.085 0.080 3/1/Y2 0.075 $1,062,500 $0 $0 $1,062,500 0.085 0.085 6/1/Y2 0.080 $1,125,000 $0 $0 $1,125,000 0.090 0.090 9/1/Y2 0.085 $1,187,500 $0 $0 $1,187,500 0.095 0.095 12/1/Y2 0.090 $1,250,000 $62,500 $0 $1,187,500 0.095 0.100 $1,312,500 $125,000 $0 $1,187,500 0.095 0.105 3/1/Y3 Loan interest, cap payoff, and floor payment made on payment date 56 Collars Thus, for LIBORs less than 7%, Diamond has a floor in which it pays an effective rate of 8.5% (losing the benefits of lower interest payments on its loan) and for rates above 8% it has a cap in which it pays an effective 9.5% on its loan. 57 Corridor An alternative financial structure to a collar is a corridor. A corridor is a long position in a cap and a short position in a similar cap with a higher exercise rate. The sale of the higher exercise-rate cap is used to partially offset the cost of purchasing the cap with the lower strike rate. 58 Corridor For example, instead of selling a 7% floor for $70,000 to partially finance the $150,000 cost of its 8% cap, the Diamond company could sell a 9% cap for say $70,000. If cap purchasers believe there was a greater chance of rates increasing than decreasing, they would prefer the collar to the corridor as a tool for financing the cap. 59 Reverse Collar A reverse collar is combination of a long position in a floor and a short position in a cap with different exercise rates. The sale of the cap is used to defray the cost of the floor. For example, the Commerce Bank in the floor example could reduce the $100,000 cost of the 8% floor it purchased to hedge the floating-rate loan it made to the Diamond company by selling a cap. By forming a reverse collar to hedge its floating-rate asset, the bank would still have protection against rates decreasing against the floor rate, but it would have to give up potential higher interest returns if rates increase above the cap rate. 60 Reverse Collar Example: Suppose Commerce sold a 9% cap for $70,000, with the cap having similar terms to the floor. By using the reverse collar instead of the floor, the company would reduce its hedging cost from $100,000 to $30,000, As shown in the exhibit slide, Commerce would lock in an effective minimum rate on its a asset of 9.5% and an effective maximum rate of 10.5%. 61 Reverse Collar Asset: Floating rate loan made by bank; Term = 2 years; Reset dates: 3/1, 6/1, 9/1, 12/1; Time frequency = .25; Rate = LIBOR + 150bp; Payment Date = 90 days after reset date Floor Purchase: Cost of floor =$100,000; Floor Rate = 8%; Reference Rate = LIBOR; Time frequency = .25; Floorlets' expirations: On loan reset dates, starting at 6/1/Y1; Payoff made 90 days after reset date. Cap Sale: revenue from cap =$70,000; Cap Rate = 9%; Reference Rate = LIBOR; Time frequency = .25; Caplets' Expiration: On loan reset dates, starting at 6/1/Y1; Payoff made 90 days after reset date. 1 2 3 4 5 6 7 8 Reset Date Assumed LIBOR Interest Received Floor Payoff Cap Payment Hedged Interest Income Hedged Rate Unhedged Rate (LIBOR + 150bp)(.25)($50m) Max[.08-LIBOR,0](.25)($50m) Max[LIBOR-.09,0](.25)($50m) Col. (3) + Col. (4) - Col (5) 4[Col (6)/$50m] LIBOR + 150BP 3/1/Y1 0.065 6/1/Y1 0.070 $1,000,000 $0 $1,000,000 0.080 0.080 9/1/Y1 0.075 $1,062,500 $125,000 $0 $1,187,500 0.095 0.085 12/1/Y1 0.080 $1,125,000 $62,500 $0 $1,187,500 0.095 0.090 3/1/Y2 0.085 $1,187,500 $0 $0 $1,187,500 0.095 0.095 6/1/Y2 0.090 $1,250,000 $0 $0 $1,250,000 0.100 0.100 9/1/Y2 0.095 $1,312,500 $0 $0 $1,312,500 0.105 0.105 12/1/Y2 0.100 $1,375,000 $0 $62,500 $1,312,500 0.105 0.110 $1,437,500 $0 $125,000 $1,312,500 0.105 0.115 3/1/Y3 Interest Received, floor payoff, and cap payment made on payment date 62 Reverse Corridor Instead of financing a floor with a cap, an investor could form a reverse corridor by selling another floor with a lower exercise rate. 63 Other Interest Rate Products 64 Other Interest Rate Products Caps and floors are one of the more popular interest rate products offered by the OTC derivative market. In addition to these derivatives, a number of other interest rate products have been created over the last decade to meet the many different interest rate hedging needs. Many of these products are variations of the generic OTC caps and floors—exotic options; two of these to note are barrier options and path-dependent options. 65 Barrier Options Barrier options are options in which the payoff depends on whether an underlying security price or reference rate reaches a certain level. They can be classified as either knock-out or knock-in options: 1. Knock-out option is one that ceases to exist once the specified barrier rate or price is reached. 2. Knock-in option is one that comes into existence when the reference rate or price hits the barrier level. 66 Barrier Options Knock-out and knock-in options can be formed with either a call or put and the barrier level can be either above or below the current reference rate or price when the contract is established Down-and-out or up-and-out knock out options Up-and-in or down-and-in knock in options 67 Barrier Options Barrier caps and floors with termination or creation features are offered in the OTC market at a premium above comparable caps and floors without such features. 68 Barrier Options Down-and-out caps and floors are options that ceases to exist once rates hit a certain level. Example: A 2-year, 8% cap that ceases when the LIBOR hits 6.5% A 2-year, 8% floor that ceases once the LIBOR hits 9% 69 Barrier Options Up-and-in cap and florr is one that becomes effective once rates hit a certain level. Examples: A 2-year, 8% cap that that becomes effective when the LIBOR hits 9% A 2-year, 8% floor that become effective when rates hit 6.5% 70 Path-Dependent Options In the generic cap or floor, the underlying payoff on the caplet or floorlet depends only on the reference rate on the effective date. The payoff does not depend on previous rates; that is, it is independent of the path the LIBOR has taken. Some caps and floors, though, are structured so that their payoff is dependent on the path of the reference rate. 71 Path-Dependent Options: Average Cap An average cap is one in which the payoff depends on the average reference rate for each caplet. If the average is above the exercise rate, then all the caplets will provide a payoff. If the average is equal or below, the whole cap expires out of the money. 72 Path-Dependent Options: Average Cap Example: Consider a one-year average cap with an exercise rate of 7% with four caplets. If the LIBOR settings turned out to be 7.5%, 7.75%, 7%, and 7.5%, for an average of 7.4375%, then the average cap would be in the money: (.074375 − .07)(.25)(NP). If the rates, though, turned out to be 7%, 7.5%, 6.5, and 6%, for an average of 6.75%, then the cap would be out of the money. 73 Path-Dependent Options: Q-Cap In a cumulative cap (Q-cap), the cap seller pays the holder when the periodic interest on the accompanying floating-rate loan hits or exceeds a specified level. 74 Path-Dependent Options: Q-Cap Example: Suppose the Diamond Company in the earlier cap example decided to hedge its 2-year floating rate loan (paying LIBOR + 150bp) by buying a Q-Cap from Commerce Bank with the following terms (next 2 slides): 75 Path-Dependent Options: Average Cap Q-Cap Terms: 1. The cap consist of seven caplets with the first expiring on 6/1/Y1 and the others coinciding with the loan’s reset dates 2. Exercise rates on each caplet = 8% 3. NP on each caplet = $50,000,000 4. Reference Rate = LIBOR 5. Time period to apply to payoff on each caplet = 90/360 76 Path-Dependent Options: Average Cap Q-Cap Terms: 6. For the period 3/1/Y1 to 12/1/Y1, the caplet will payoff when the cumulative interest starting from loan date 3/1/Y1 on the company’s loan hits $3 million. 7. For the period 3/1/Y2 to 12/1/Y2, the caplet will payoff when the cumulative interest starting from date 3/1/Y2 on the company’s loan hits $3 million. 8. Payment date on each caplet is at the loan’s interest payment date, 90 days after the reset date. 9. The cost of the cap = $125,000; it is paid at beginning of the loan, 3/1/Y1. 77 Path-Dependent Options: Q-Cap The exhibit slide shows the quarterly interest, cumulative interests, Q-cap payments, and effective interests for assumed LIBORs. In the Q-caps first protection period, 3/1/Y1 to 12/1/Y1, Commerce Bank will pay the Diamond Company on its 8% caplet when the cumulative interest hits $3 million. The cumulative interest hits the $3 million limit on reset date 9/1/Y1, but on that date the 9/1/Y1 caplet is not in the money. On the following reset date, though, the caplet is in the money at the LIBOR of 8.5%. Commerce would, in turn, have to pay Diamond $62,500 (90 days later) on the caplet, locking in a hedged rate of 9.5% on Diamond’s loan. 78 Path-Dependent Options: Q-Cap In the second protection period, 3/1/Y2 to 12/1/Y2, the assumed LIBOR rates are higher. The cumulative interest hits the $3 million limit on reset date 9/1/Y1. The caplet on that date and the caplet on the next reset date (12/1/Y1) are in the money. As a result, with the caplet payoffs, Diamond is able to obtained a hedged rate of 9.5% for the last 2 payment periods on its loan. 79 Path-Dependent Options: Q-Cap Loan: Floating Rate Loan; Term = 2 years; Reset dates: 3/1, 6/1, 9/1, 12/1; Time frequency = .25; Rate = LIBOR + 150bp; Payment Date = 90 days after reset date Q-Cap: Cost of Q-cap =$125,000; Cap Rate = 8%; Reference Rate = LIBOR; Time frequency = .25; Caplets' Expiration: On loan reset dates, starting at 6/1/Y1; Payoff made 90 days after reset date; Cap become effective once cumulative interest reaches $3M; protection periods: Y1 and Y2. 1 2 3 4 5 6 7 Reset Date Assumed LIBOR Interest to be paid at next reset date Cumulative Interest Q-Cap Payment Hedged Interest Payment Hedged Rate to be paid at next reset date at payment date: Col (3) −Col (5) 4[Col (6)/$50m] (LIBOR + 150bp)(.25)($50m) 3/1/Y1 0.070 $1,062,500 $1,062,500 $0 6/1/Y1 0.075 $1,125,000 $2,187,500 $0 $1,062,500 0.085 9/1/Y1 0.080 $1,187,500 $3,375,000 $0 $1,125,000 0.090 12/1/Y1 0.085 $1,250,000 $4,625,000 $62,500 $1,187,500 0.095 3/1/Y2 0.085 $1,250,000 $1,250,000 $0 $1,187,500 0.095 6/1/Y2 0.090 $1,312,500 $2,562,500 $0 $1,250,000 0.100 9/1/Y2 0.095 $1,375,000 $3,937,500 $187,500 $1,312,500 0.105 12/1/Y2 0.100 $1,437,500 $5,375,000 $250,000 $1,187,500 0.095 $1,187,500 0.095 3/1/Y3 80 Path-Dependent Options: Q-Cap When compared to a standard cap, the Q-cap provides protection for the 1-year protection periods, whereas the standard cap provides protection for each period (quarter). As shown in the next exhibit slide, a standard 8% cap provides more protection than the Q-cap, capping the loan at 9.5% from date 12/1/Y1 to the end of the loan and providing a payoff on 5 of the 7 caplets for a total payoff of $687,500. In contrast, the Q-cap pays on only 3 of the 7 caplets for a total payoff of only $500,000. Because of its lower protection limits, a Q-cap cost less than a standard cap. 81 Path-Dependent Options: Q-Cap Loan: Floating Rate Loan; Term = 2 years; Reset dates: 3/1, 6/1, 9/1, 12/1; Time frequency = .25; Rate = LIBOR + 150bp; Payment Date = 90 days after reset date Cap: Cost of cap =$150,000; Cap Rate = 8%; Reference Rate = LIBOR; Time frequency = .25; Cap: Caplets' Expiration: On loan reset dates, starting at 6/1/Y1; Payoff made 90 days after reset date. Q-Cap: Cost of Q-cap =$125,000; Cap Rate = 8%; Reference Rate = LIBOR; Time frequency = .25; Caplets' Expiration: On loan reset dates, starting at 6/1/Y1; Payoff made 90 days after reset date; Cap become effective once cumulative interest reaches $3M; protection periods: Y1 and Y2. 1 2 3 4 5 6 Reset Date Assumed LIBOR Loan Interest Unhedged Interest Cumulative Interest Unhedged Loan Rate 3/1/Y1 0.070 $1,062,500 6/1/Y1 0.075 $1,125,000 0.085 1062500 2187500 0.085 9/1/Y1 0.080 $1,187,500 0.090 3375000 0.090 12/1/Y1 0.085 $1,250,000 0.095 4625000 0.095 3/1/Y2 0.085 $1,250,000 0.100 1250000 0.100 6/1/Y2 0.090 $1,312,500 0.100 2562500 0.100 9/1/Y2 0.095 $1,375,000 0.105 3937500 0.105 12/1/Y2 0.100 $1,437,500 0.110 5375000 0.110 3/1/Y3 0.115 0.115 1 7 8 9 10 11 Reset Date Q-Cap Payment Hedged Interest Payment Q-Cap Hedged Rate Cap-Payments Cap-Hedged Rate 3/1/Y1 $0 6/1/Y1 $0 1062500 0.085 $0 0.085 at payment date: Col (3)- Col (5) 9/1/Y1 $0 1125000 0.090 $0 0.090 12/1/Y1 $62,500 1187500 0.095 $62,500 0.095 3/1/Y2 $0 1187500 0.095 $62,500 0.095 6/1/Y2 $0 1250000 0.100 $125,000 0.095 9/1/Y2 $187,500 1312500 0.105 $187,500 0.095 12/1/Y2 $250,000 1187500 0.095 $250,000 0.095 1187500 0.095 3/1/Y3 0.095 82 Exotic Options Q-caps, average caps, knock-in options, and knock-out options are sometimes referred to as exotic options. Exotic option products are nongeneric products that are created by financial engineers to meet specific hedging needs and return-risk profiles. 83 Exotic Options Chooser Option: Option that gives the holder the right to choose whether the option is a call or a put after a specified period of time. Bermudan Option: An option in which early exercise is restricted to certain dates. Forward Start Option: An option that will start at some time in the future. Trigger Option: An option that depends on another index; that is, whether the option is in the money depends on value of another index. 84 Exotic Options Asian Option: An option in which the payoff depends on the average price of the underlying asset during some part of the option’s life: Call: IV = Max[Sav – X,0]; put: IV = Max[X - Sav,0]. Lookback Option: An option in which the payoff depends on the minimum or maximum price reached during the life of the option. Binary Option: An option with a discontinuous payoff such as a payoff or nothing. For example: If the price is equal or less than X, the option pays nothing; if the price exceeds X, the option pays a fixed amount. Compound Option is an option on an option: Call on a call, call on put, put on put, and put on call. 85 Exotic Options Caption: An option on a cap. Floortion: An option on a floor. Yield Curve Option: An option between two points on a yield curve. For example, a yield curve with a exercise equal to 200 basis point on the difference between the yields on two-year and 10-year notes: Payoff = Max[(YTM10 – YTM2) – .02, 0]NP. 86