Break-Even Analysis

advertisement

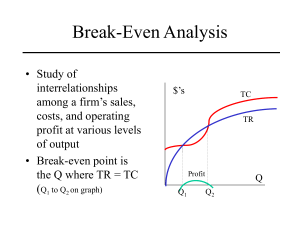

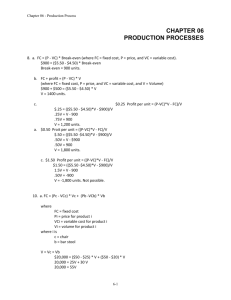

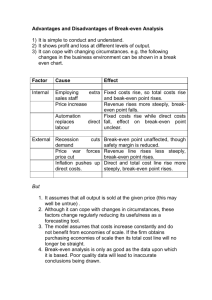

Break-Even Analysis • Study of interrelationships among a firm’s sales, costs, and operating profit at various levels of output • Break-even point is the Q where TR = TC (Q1 to Q2 on graph) $’s TC TR Profit Q1 Q Q2 Linear Break-Even Analysis • Over small enough range of output levels TR and TC may be linear, assuming – Constant selling price (MR) – Constant marginal cost (MC) – Firm produces only one product – No time lags between investment and resulting revenue stream Graphic Solution Method • Draw a line through origin with a slope of P (product price) to represent TR function • Draw a line that intersects vertical axis at level of fixed cost and has a slope of MC • Intersection of TC and TR is break-even point TR $’s TC MC 1 unit Q FC P 1 unit Q Break-even point Q Algebraic Solution • Equate total revenue and total cost functions and solve for Q TR = P x Q TC = FC + (VC x Q) TR = TC P x QB = FC + VC x QB (P x QB) – (VC x QB) = FC QB (P – VC) = FC QB = FC/(P – VC), or in terms of total dollar sales, PQ = (FxP)/(P-VC) = ((FxP)/P)/((P-VC)/P) = F/((P/P) – (VC/P)) = F/(1-VC/P) Related Concepts • Profit contribution = P – VC – The amount per unit of sale contributed to fixed costs and profit • Target volume = (FC + Profit)/(P – VC) – Output at which a targeted total profit would be achieved Example 1 – how many Christmas trees need to be sold • • • • Wholesale price per tree is $8.00 Fixed cost is $30,000 Variable cost per tree is $5.00 Solution Q(break-even) = F/(P – VC) = $30,000/($8 - $5) = $30,000/$3 = 10,000 trees Example 2 – two production methods to accomplish same task • Method I : TC1 = FC1 + VC1 x Q • Method II : TC2 = FC2 + VC2 x Q • At break-even point: FC1 + (VC1 x Q) = FC2 + (VC2 x Q) (VC1 x Q) – (VC2 x Q) = FC2 – FC1 Q x (VC1 – VC2) = FC2 – FC1 Q = (FC2 – FC1)/(VC1 – VC2) Example 2 continued: bowsaw or chainsaw to cut Christmas trees • Bowsaw – Fixed cost is $5.00 – Variable cost is $0.40 per • Chainsaw • Fixed cost is $305 • Variable cost is $0.10 per tree • Solution Q(break-even) = ($305 - $5)/($0.40 - $0.10) = 300/.30 = 1,000 trees Revenue and Cost as Function of a Single Input • Marginal Revenue Product – Increase in revenue per unit increase in one input – = MR / (Xt+1 – X t ) • Marginal Factor Cost – Increase in cost per unit increase in one input – =MC / (Xt+1 – X t ) • Go to Spreadsheet Example 3: Optimal planting density No. Trees per A @ 5 years 300 Yield in cords @ rotation 21.3 Total Revenue @$24/cord 511 400 23.4 562 500 25.2 605 600 26.7 641 700 28.0 672 800 29.1 698 900 30.1 722 Example 3: Continued • Fixed costs per acre: – – – – – Land . . . . . . . $300 Site prep . . . . 100 Annual . . . . 60 Set-up . . . . . 5 Total . . . . 465 • Variable costs per 100 seedlings – Seedlings . . . . $ 5 – Planting . . . . 20 – Total . . . . 25 TC = 465 + 25 x (# trees per A/100) Go to Spreadsheet