Government Debt and Budget Deficits

advertisement

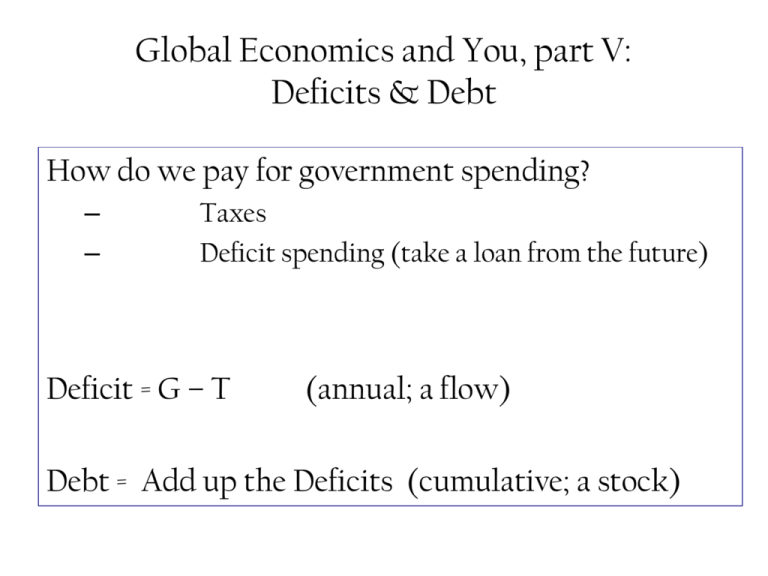

Global Economics and You, part V:

Deficits & Debt

How do we pay for government spending?

–

–

Taxes

Deficit spending (take a loan from the future)

Deficit = G – T

(annual; a flow)

Debt = Add up the Deficits (cumulative; a stock)

Indebtedness of the world’s governments

Country

Gov Debt

(% of GDP)

Country

Gov Debt

(% of GDP)

Japan

173

U.K.

59

Italy

113

Netherlands

55

Greece

101

Norway

46

Belgium

92

Sweden

45

U.S.A.

73

Spain

44

France

73

Finland

40

Portugal

71

Ireland

33

Germany

65

Korea

33

Canada

63

Denmark

28

Austria

63

Australia

14

Ratio of U.S. govt debt to GDP

1.2

1.0

WW2

0.8

0.6

Revolutionary

War

Civil War

Iraq

War

WW1

0.4

0.2

0.0

1790 1810 1830 1850 1870 1890 1910 1930 1950 1970 1990 2010

The U.S. experience with Debt

1980s - 1990s

– debt-GDP ratio: 25.5% in 1980, 48.9% in 1993

– due to Reagan tax cuts, increases in defense

spending & entitlements

1990s - 2000

– $290b deficit in 1992, $236b surplus in 2000

– debt-GDP ratio fell to 32.5% in 2000

– due to rapid growth, stock market boom, tax hikes

The U.S. experience in recent years

Early 2000s

– the return of huge deficits, due to Bush tax cuts,

2001 recession, Medicare expansion, Iraq war

The 2008-2009 recession

– fall in tax revenues

– huge spending increases (bailouts of financial

institutions and auto industry, stimulus package)

Federal Debt and Deficit

•Surplus in 4 of last 25 years.

Fiscal Year

2004

2002

2000

1998

GWBush

1996

1994

Clinton

1992

1988

Bush

1986

1984

Reagan

1990

$500

$400

$300

$200

$100

$$(100)

$(200)

$(300)

$(400)

$(500)

1982

$ in billions

Surplus or Deficit

Troubling long-term fiscal outlook

• The U.S. population is aging.

• Health care costs are rising.

• Spending on entitlements like Social Security and

Medicare is growing.

• Deficits and the debt are projected to significantly

increase…

Percent of U.S. population age 65+

Percent of 23

pop.

actual

projected

20

17

14

11

8

2050

2040

2030

2020

2010

2000

1990

1980

1970

1960

1950

5

U.S. government spending on Medicare and Social

Security

Percent of 8

GDP

6

4

2

2005

2000

1995

1990

1985

1980

1975

1970

1965

1960

1955

1950

0

CBO projected U.S. federal govt debt in two scenarios

300

Percent of GDP

250

200

pessimistic

scenario

150

100

50

0

2005

optimistic scenario

2010

2015

2020

2025

2030

2035

2040

2045

2050

Is the govt debt really a problem?

Consider a tax cut with corresponding

increase in the government debt.

Two viewpoints:

1. Traditional view

2. Ricardian view

The traditional view

• Yes, the Debt matters – in the long run

• Short run: Consumption, Unemployment

• Long run:

– Consumption and Unemployment back at their

natural rates

– But Real interest rates, Investment

Crowding out private investment

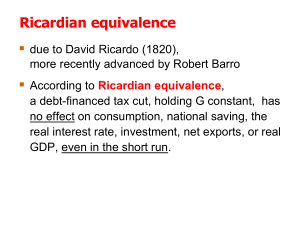

The Ricardian view

• No, debt is not a problem

• As argued by David Ricardo (1820)

and Robert Barro (2010)

• According to Ricardian equivalence,

a debt-financed tax cut has no effect on

consumption, national saving, the real interest

rate, investment, net exports, or real GDP,

even in the short run.

The logic of Ricardian Equivalence

• Consumers are forward-looking—a debt-financed tax

cut today has to be paid for with a future tax increase.

• The tax cut does not make us better off, so we do not

increase consumption.

Instead, we save the full tax cut to repay the future tax

liability.

• Result: Private saving rises by the amount public

saving falls, leaving national saving unchanged.

•People increase saving in anticipation of future tax

increases.

•This causes a reduction in private sector spending that

is exactly equal to the increase in government

spending.

•Deficit spending is not stimulative. It has no effect

whatsoever.

•This implies fiscal policy is useless at best.

•Activist policy cannot work!

Problems with Ricardian Equivalence

• Myopia: Not all consumers think so far ahead,

some see the tax cut as a windfall.

• Borrowing constraints: Some consumers cannot

borrow enough to achieve their optimal consumption,

so they spend a tax cut.

• Future generations: If consumers expect that the

burden of repaying a tax cut will fall on future

generations, then a tax cut now makes them feel better

off, so they increase spending.

Evidence against Ricardian Equivalence?

1980s:

Reagan tax cuts increased deficit.

National saving fell, real interest rate rose

1992:

Income tax withholding reduced to stimulate economy.

– This delayed taxes but didn’t make consumers better off.

– Almost half of consumers increased consumption.

The Laffer Curve

Evidence against Ricardian Equivalence?

• Proponents of R.E. argue the Reagan tax cuts did not

provide a fair test of R.E.

– Consumers may have expected the debt to be

repaid with future spending cuts instead of future

tax hikes.

– Private saving may have fallen for reasons other

than the tax cut, such as optimism about the

economy.

• Because the data is subject to different

interpretations, both views of govt debt survive.

OTHER PERSPECTIVES:

Balanced budgets vs. optimal fiscal policy

• A balanced federal budget every year?

• Economists reject this proposal, arguing deficit

should be used to:

– stabilize output & employment

– smooth taxes in the face of fluctuating income

– redistribute income across generations when

appropriate

OTHER PERSPECTIVES:

Debt and politics

“Fiscal policy is not made by angels…”

– Greg Mankiw, p.487

• Trust policymakers with deficit spending?

• They argue :

– policymakers neglect true costs of their spending since

burden falls on future taxpayers

– since future taxpayers cannot vote, their interests are

ignored

OTHER PERSPECTIVES:

Fiscal effects on monetary policy

– Printing money?

– Inflation

– Not too popular in most countries

Taxes: the price to live in a civilized society

"I like paying taxes. With them I buy civilization."

Justice Oliver Wendell Holmes

Dueling tax plans

From the 2008

campaign

Current Law

McCain’s

Plan

Obama’s

Plan

Highest Income

Tax Rate

35%

35%

41%

Capital Gains

15

15

20

Dividends

15

15

20

Income &

Payroll Tax

combined

35

35

43-45

Estate tax

45

15

45

Corporate Tax

35

25

35

"Let me try to put each tax plan into a single number.

Suppose you earn a dollar today and decide to invest it for your kids.

How much, as a result, will he leave his kids in T years?

The answer depends on four tax rates.

First, combined income and payroll tax on the dollar earned.

Second, the corporate tax rate while the money is invested in a firm.

Third, the dividend and capital gains rate as you receive that return.

Fourth, the estate tax when you leave what has accumulated to my kids.

Let

t1 be the combined income and payroll tax rate,

t2 be the corporate tax rate,

t3 be the dividend and capital gains tax rate, and

t4 be the estate tax rate.

And let r be the before-tax rate of return on corporate capital.

Then one dollar you earn today will yield yourkids:

(1-t1){[1+r(1-t2)(1-t3)]^T}(1-t4).

Assume

r to be 10 percent and

remaining life expectancy T to be 35 years.

If there were no taxes, so t1=t2=t3=t4=0, then $1 earned today would yield my kids $28.

That is simply the miracle of compounding.

Under the McCain plan, t1=.35, t2=.25, t3=.15, and t4=.15.

• In this case, a dollar earned today yields my kids $4.81.

• Even under the low-tax McCain plan, the incentive to work is cut by 83 percent

compared to the situation without taxes.

Under the Obama plan, t1=.43, t2=.35, t3=.2, and t4=.45.

• In this case, a dollar earned today yields my kids $1.85.

• Obama's proposed tax hikes reduce my incentive to work by 62 percent compared

to the McCain plan and by 93 percent compared to the no-tax scenario.

• In a sense, putting the various pieces of the tax system together, I would be facing a

marginal tax rate of 93 percent.

The bottom line:

• If you are trying to induce me to do some work for you, there is a good chance I

will turn you down.

The Economics of Taxation

Taxes on Economic “Flows”

• Most taxes are levied

on measurable

economic flows.

• For example, a profits,

or net income, tax is

levied on the annual

profits earned by

corporations.

27 of 52

Proportional, Progressive,

and Regressive Taxes

• A proportional tax is a tax

whose burden is the same

proportion of income for all

households.

28 of 52

Proportional, Progressive,

and Regressive Taxes

• A progressive tax is a tax whose

burden, expressed as a percentage

of income, increases as income

increases.

29 of 52

Proportional, Progressive,

and Regressive Taxes

• A regressive tax is a tax whose burden,

expressed as a percentage of income, falls as

income increases.

– Excise taxes (taxes on goods) are regressive.

– The retail sales tax is also regressive.

30 of 52

Proportional, Progressive,

and Regressive Taxes

The Burden of a Hypothetical 5% Sales Tax Imposed on Three Households with

Different Incomes

HOUSEHOLD

INCOME

SAVING

RATE, %

SAVING

CONSUMPTION

5% TAX ON

CONSUMPTION

TAX

AS A %

OF INCOME

A

$ 10,000

20

$ 2,000

$ 8,000

$ 400

4.0

B

20,000

40

8,000

12,000

600

3.0

C

50,000

50

25,000

25,000

1,250

2.5

31 of 52

Marginal versus Average Tax Rates

• The average tax rate is the total amount of

tax you pay divided by your total income.

• The marginal tax rate is the tax rate you pay

on any additional income you earn.

32 of 52

Marginal versus Average Tax Rates

• Marginal tax rates influence

behavior. Decisions about

how much to work and how

much to invest depends in

part on the after-tax return.

33 of 52

Tax Equity

• One theory of fairness is called the

benefits-received principle, which

holds that taxpayers should

contribute to government (in the

form of taxes) in proportion to the

benefits that they receive from

public expenditures.

34 of 52

Tax Equity

• Another theory of fairness is called

the ability-to-pay principle, which

holds that citizens should bear tax

burdens in line with their ability to

pay taxes.

35 of 52

What is the “Best” Tax Base?

• The three leading candidates

for best tax base are:

– Consumption

– Income

– Wealth

36 of 52

Consumption as the Best Tax Base

• If we want to redistribute

well-being, the tax base

should be consumption

because consumption is the

best measure of well-being.

37 of 52

Income as the Best Tax Base

• Supporters of the use of income as the tax

base argue that your ability to pay is your

ability to command resources.

• It is your income that enables you to save or

consume, and it is income that should be

taxed regardless of its sources and uses.

38 of 52

Wealth as the Best Tax Base

• Supporters of the use of

wealth as the tax base argue

that the real power to

command resources comes

not from income but from

accumulated wealth.

39 of 52

Tax Incidence: Who Pays?

• Tax incidence refers to the ultimate

distribution of a tax’s burden.

• Tax shifting occurs when households can alter

their behavior and do something to avoid

paying the tax.

40 of 52

Measuring Excess Burdens

• A tax that alters economic

decisions imposes a burden

that exceeds the amount of

taxes collected.

•

An excise tax that raises the price of

a good above marginal cost drives

some consumers to buy lessdesirable substitutes, reducing

consumer surplus.

41 of 52