How does the budget deficit and national debt influence our economy?

advertisement

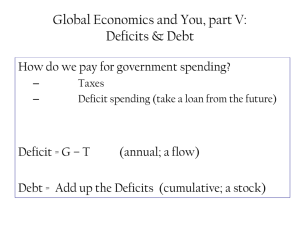

Do Now: What is a budget? Budget President Congress Revenues (taxes) Expenditures (spending/appropriations) Categories of spending (Big 3) Budget deficit Define Budget Surplus? National Debt Define – 18 trillion dollars Interest Payments on the Debt part of the budget Grows as the debt grows 7% of budget due to low interest rates Effects of National Debt Crowding out (?) Increase total demand ofr goods/services (inflation) Interest payments on debt Foreign owned portion 1. 2. 3. 4. Define Budget. What is our federal government’s major source of revenue? What is meant by expenditure? What are the 3 biggest categories of federal spending? When government expenditures exceed revenue a ________ has occurred. When government revenues exceed expenditures a _________has occurred. The accumulated borrowing the federal government engages to finance its budget deficits is the ________________. What is the current level of the U.S. national debt? What are some negative effects of a large national debt? Do Now: What is a budget deficit? What is the national debt? Cut Spending? Which areas? Negative effects? Politicians? Raise Taxes For whom? How much? Negative effects Balanced Budget Amendment Define difficulties? Good for the economy? Demand-Side Theory Keynesian Economics Deficit spending to stimulate the economy during a recession/contraction Democrats favor this theory Supply-Side theory Across the board tax cuts Individuals and corporations “trickle down” economics Stimulate the economy Reaganomics Favored by Republicans Other concerns Can we afford our debt? Debt as a percentage of GDP Foreign owned portion of the debt Does the problem of budget deficits and national debt need to be solved for? Explain.