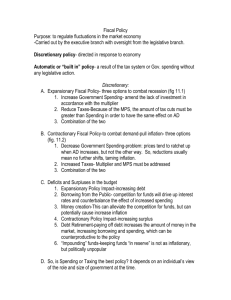

fiscal policy

advertisement

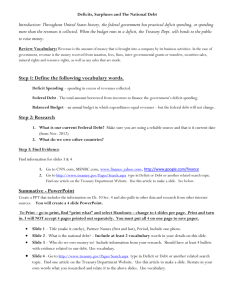

FISCAL POLICY What government can do for the economy Fiscal Policy and the Economy How does the President and Congress affect the economy? Control of tax rate. Proportional taxes (flat tax) – say 5% of everyone’s income whether you or Bill Gates. Progressive taxes – Richer should pay more. Luxury taxes. Regressive taxes – Taxes the poor tend to pay more. Lottery tickets, cigarette taxes. Taxes Majority of revenue for the US is through income tax. 45.2% Second is Social security taxes and contributions. 35% Third is corporate taxes. 11% Recession People have the money but don’t spend it. Unemployment goes up. GDP slows. Fiscal Cures for Recession Change the tax rates. Puts more money in the economy for Consumption and Investment. Government Spending. Unemployment benefits, money for projects like roads, building improvements. Fiscal Cures for Recession Change the tax rates. Puts more money in the economy for Consumption and Investment. Government Spending. Unemployment benefits, money for projects like roads, building improvements. Problem of Fiscal Policy in 2006: The Deficit When government SPENDS (outlays) more than they TAKE IN (receipts) in taxes for the year – DEFICIT. Projected 2006 deficit is “around” $300billion. When a government increases spending and cuts taxes DEFICIT! More outlays than receipts of money More going out than coming in. DEBT v. DEFICIT Deficit = yearly budget problem Debt = YEARS of deficit Current Debt???? http://www.brillig.com/debt_clock/ OR Google: “debt clock” Projected Deficits According to the Congressional Budget Office What is causing the deficit? Higher government expenditures Social Security / Medicare War in Iraq War on terrorism Government needs Lack of taxes being collected due to Too many tax cuts? How do we pay for the debt? US Savings Bonds IOUs for the government. Two Terms for Fiscal Policy Expansionary Policies Government policy actions that lead to increases in output Contractionary Policies Actions that government does that leads to a decrease in output Expansionary Policies Government lowers taxes and spends more to get people jobs and provide services. Increases debt Keeps voters happy More working means more we can tax Contractionary Policy To reduce the debt government either/or Raises taxes Reduces government spending. People lose jobs – Govt. employees – Govt. purchases People lose services – Notice schools? What is Government to do? IF nothing is done, by 2020, 45% of taxes will be used to pay the interest off the debt. Where will money come from for medical research? Roads? Police? Etc? Nebraska’s Situation?