File - Daniella Comito

advertisement

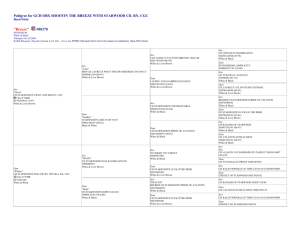

Financial Analyst Report Zara Ali, Cory Carlson, Daniella Comito, Emma Hebblethwaite December 5, 2013 Table of Contents Executive Summary 2 I. Company Overview 3 SWOT Analysis 3 II. Industry 4 Competitors 5 Value Drivers 6 III. Risk Analysis 6 IV. Financial Analysis 8 Liquidity 8 Asset Management 9 Debt Management 10 Profitability 10 Market Value 11 V. Beta 12 VI. Capital Asset Pricing Model 12 VII. Dividend Discount Model 13 VIII. Free Cash Flow Model 16 IX. Weighted Average Cost of Capital 17 Free Cash Flow Stock Valuation 18 X. Valuation Using Multiples 19 XI. Conclusions and Recommendations 19 XII. Exhibits 21 XIII. Work Cited 27 1|Page Executive Summary Starwood Hotels is a high-end hotel company that operates in over 100 different countries. Starwood has nine distinct brands each with their own unique touch. The majority of the hotels are located in the North Americas, followed by Europe, Africa and the Middle East; making their global portfolio unmatched. They aim to increase their worldwide presence by 20% within the next five years. They are in the upper upscale and luxury hotel category and have dipped into the limited service segment as well. Starwood Hotels has a market capitalization of $14.26 billion and enjoys a healthy competitive place in the market. Starwood has three direct competitors, Hilton, Hyatt and the Marriot. Starwood is currently trading at a higher price than all three of these competitors. When benchmarking ratios Starwood does well compared to the industry, discussed late in this paper. Although Starwood has a global presence, they face the threat of weak foreign economies affecting their business. An increased amount of economies are not doing well, however, all global hotel firms face the same risk. Starwood is an industry leader that consistently pays dividends and has strong brand recognition, especially in the U.S. Starwood has a noticeably higher stock price than its competitors. Starwood is trading at $74.02 while competitors are trading in the high $40 range. At a glance it would appear that perhaps Starwood is a properly valued stock. However, after analyzing the company using the dividend discount model, valuation using multiples and free cash flow model, we found out that it is actually undervalued. Overall, we recommend investing in Starwood, especially as part of a diverse stock portfolio. Our company valuation analysis includes an in depth description of Starwood, its competitors and industry, as well as firm riskiness and market riskiness. We also completed many different analyses’ including: beta regression, capital asset pricing model, financial ratios, valuation using multiples and free cash flow model. We believe that our report provides ample evidence for our conclusion that Starwood’s company is undervalued based on our assessment of the company’s intrinsic value. 2|Page I. Company Overview Starwood Hotels & Resorts Worldwide, Inc. was founded in 1969 and is now a leading hotel and leisure company within the lodging industry. The Corporation owns, manages and franchises 1,162 properties in approximately 100 different countries world-wide. With many properties, comes the addition of employees and Starwood Hotels has about 171,000 of them. Their headquarters is located in Stamford, Connecticut in the United States. The Corporation encompasses nine different brand names: St. Regis, The Luxury Collection, W Hotels, Westin, Le Meridien, Sheraton, Four Points, Aloft and Element by Weston. These brands include: resorts, hotels, residences, retreats, select-service hotels and extended stay hotels; where a majority are considered luxury and upscale full-service hotels. Starwood Hotels’ biggest competitive advantage is its industry leading loyalty program, Starwood Preferred Guests (SPG). This loyalty program allows customers to earn points that they can then redeem for room stays, room upgrades, as well as flights (offered with no blackout dates). Figure 1 below displays the strengths and weaknesses of Starwood. SWOT Analysis • • • Strengths Nine unique brands Brand loyalty World’s most award-winning loyalty program • • Weaknesses Not a strong global presence Economy has customers reducing their spending • • • Opportunities Digitalized media as a new source of revenue Economy has customers looking for packages Vacation ownership is a growing market • • Threats Highly competitive industry Is affected by many different economies Figure 1. This table identifies Starwood Hotels & Resorts Worldwide, Inc.’s strengths, weaknesses, opportunities and threats1. 1 "MBA Skool-Study.Learn.Share.." <i>Starwood Hotels and Resorts</i>. N.p., n.d. Web. 6 Nov. 2013. &lt;http://www.mbaskool.com/brandguide/tourism-and-hospitality/4276starwood-hotels-and-resorts.html&gt;. 3|Page II. Industry Starwood Hotel & Resorts competes in the services sector within the lodging industry. This is a mature industry which focuses on delivering specialized services to their customers. Hotels across America are categorized into eight specific hotel classifications. These classifications are: Commercial Hotels, Airport Hotels, Conference Centers, Economy Hotels, All-Suite Hotels, Residential Hotels, Casino Hotels and Resort Hotels. “Commercial Hotels” has a target market of business people. It is common for these types of hotels to offer room service, laundry and valet access, and a dining area. “Airport Hotels” encompasses hotels that are conveniently located near airports and provides quick access to and from air lines for travelers. “Conference Centers” are specifically geared towards providing a gathering space for groups of people. They are furnished with the services and equipment necessary for conferences and other large scale events. “Economy Hotels” are small hotels which meet the basic needs of travelers. They are affordable and offer limited services. “All-Suite Hotels” are often upscale, providing the customer with ample amount of space to complete their work while having a separate area to lounge and relax. “Residential Hotels” are not as common as they were twenty years ago, but offer long-term accommodations and stays to their customers. “Casino Hotels”, known for their five-star restaurants, lavish living, unforgettable entertainment, and are an ideal location for gambling customers. “Resort Hotels”, whose main guests are vacationers and families, are often located near beaches, mountains, or amusement parks. The resort hotels are known for their entertainment and a “fun” atmosphere, where the rooms are often booked ahead of time and are a destination for customers2. Throughout the years, the hotel and lodging industry has experienced several trends which have helped shape it to be the successful, yet competitive business it is today. Some of the more recent trends include transforming its process of booking rooms. Only recently did hotels create a system where their 2 "Hotel Industry Overview - Complete Version." <i>Hotel Industry Overview - Complete Version</i>. N.p., n.d. Web. 6 Nov. 2013. &lt;http://www.irs.gov/Businesses/Hotel-IndustryOverview---Complete-Version&gt;. 4|Page rooms could be booked through the internet. Another recent trend in the industry is the addition of luxury mattresses, complimentary breakfast, high speed internet and WIFI access. Because many across the industry have remodeled their rooms and dining areas, making them more extravagant and customer oriented, many have also become “smoke-free facilities”. Others have also begun to recreate their lobby, decorating them to look like a place of destination. By adhering to these trends, hotels have been able to abide by their mission of allowing guests to feel comfortable and in control3. Even though the lodging industry is highly profitable, executives and managers face significant areas of concern for their business. When surveyed, respondents reported that human resources management was the most troubling area in their company. These concerns included attraction, retention, training, and morale. Managers also reported other problems which included economic and environmental matters, understanding customer needs, and thinking strategically in a competitive market4. Refer to Figure 1 above for opportunities and threats regarding the lodging industry. Competitors Starwood’s primary competitors in the services sector are Marriott International, Inc. and Hyatt Hotels Corporation. Marriot is the largest of Starwood’s competitors and as of last year the company recorded a net income of $571,000 million. They operate nearly 3,800 properties in 74 countries around the world. Some of the hotels and resorts which Marriot controls and franchises include Marriott Hotels & Resorts, JW Marriott, Renaissance Hotels, Gaylord Hotels, Autograph Collection Hotels, Courtyard, and Fairfield Inn & Suites. Similarly, Hyatt Hotels, another major competitor, recorded a net income of $88 million last year and consists of 524 properties across 46 countries5. The company operates Park Hyatt, 3 "The Center for Hospitality Research." CHR Reports RSS. N.p., n.d. Web. 6 Nov. 2013. <http:// www.hotelschool.cornell.edu/research/chr/pubs/reports/abstract-15005.html>. 4 "Starwood Hotel & Resorts Overview." Yahoo! Finance. N.p., n.d. Web. 6 Nov. 2013. <http:// finance.yahoo.com/q/pr?s=HOT+Profile>. 5 "Marriott International Profile Overview." Yahoo! Finance. N.p., n.d. Web. 6 Nov. 2013. <http:// finance.yahoo.com/p/pr?s=MAR+Profile>. 5|Page Andaz, Grand Hyatt, Hyatt Place, and Hyatt House6. They have also developed and control Hyatt Residences and Hyatt Residence Club. Due to the strength and success of its current competitors, Starwood must always keep up with current trends and innovate in order to maintain a competitive advantage. Value Drivers Starwood Hotels has several value drivers that give it a competitive advantage. Its main value driver is its award-winning loyalty program7. This program increases brand loyalty by encouraging customers to always use Starwood Hotels brands in order to earn points and then redeem them for a rewards. This also increases a customer’s overall experience and perception of the brand. Another value driver for the firm is the fact that they have over 1,000 properties in almost 100 different countries. This large geographical diversification allows the company to reach a wide customer base and also expands the company’s brand awareness8. Lastly, an additional value driver is their Element9 by Weston brand because it is the first LEED-certified hotel brand. This means that the Element Hotels are high performance green buildings. This satisfies guests that have a concern for the environment, which is a growing trend10. III. Risk Analysis Starwood Hotels is a large and established company that has overall stabilized possible risks. These risks include: industry risk, data breach risk, staff risk, tax and law/regulation risk. The first risk is “Hyatt Hotels Corporation Profile Overview." Yahoo! Finance. N.p., n.d. Web. 6 Nov. 2013. <http:// finance.yahoo.com/q/pr?s=H+Profile>. 7 "Starwood Hotels and Resorts." Starwood Preferred Guest. N.p., n.d. Web. 6 Nov. 2013. <http:// www.starwoodhotels.com/corporate/about/values/index.html>. 8 "Starwood | Innovation Drivers." Starwood | Innovation Drivers. N.p., n.d. Web. 6 Nov. 2013. <http:// innovationleaders.org/star_drivers.html>. 9 "Starwood Hotels and Resorts." Starwood Preferred Guest. N.p., n.d. Web. 6 Nov. 2013. <http:// www.starwoodhotels.com/element/experience/green_leed.html>. 10 "MBA Skool-Study.Learn.Share.." <Starwood Hotels and Resorts>. N.p., n.d. Web. 6 Nov. 2013. &lt;http:/www.mbaskool.com/brandguide/tourism-and-hospitality/4276-starwood-hotels-andresorts.html&gt;. 6 6|Page industry risk. The lodging industry is highly competitive and this is seen through the many different hotel brands and competing loyalty programs. Currently this risk is under control by the corporation due to its large geographical diversification, brand diversification, and its loyalty program. Starwood Hotels dominates the industry as one of the top ten leaders, increasing the value of the firm. Data Breach is another possible risk for the corporation. Hotels are trusted with large amounts of private information where possibilities of data and identity theft are huge. This is currently not a risk because Starwood is taking proactive steps in identifying areas of exposure and developing adequate risk management programs that address the security of data11. If there was a data breach the value of the company would decrease because it would lose credibility and it is very costly to find and fix the root cause of the breach as well as recover lost data. There is also a potential of staff risk. Currently the economy has been at a lull, helping to keep turnover rates low since people want to secure jobs. If the economy picks up, then staff is more apt to get poached by competitors or look for better careers. This would lessen the value of the corporation because a high turnover incurs training costs. This is currently not a risk because the economy is still in recovery. There is a tax and law regulation risk because the lodging industry could potentially be subject to higher tax rates or more lawful regulation12. Currently this is not a risk to the corporation because there has been no government talk about doing either of these things, but it could be a possible risk in the future13. If this happened, it would increase Starwood’s costs, which would in turn reduce profits and lessen the value of the firm. "Marriott 2010 Annual Report — Financial Form 10-K Section." Marriott 2010 Annual Report — Financial Form 10-K Section. N.p., n.d. Web. 6 Nov. 2013. <http://investor.shareholder.com/ MAR/marriottAR10/financials/risk_factors/index.html>. 12 "Top Risks Facing the Hospitality Industry." Top Risks Facing the Hospitality Industry. N.p., n.d. Web. 6 Nov. 2013. <http://www.resolvergrc.com/blog/top-risks-facing-the-hospitalityindustry/>. 13 "Parker, Smith & Feek." <i>Hospitality Industry Risks: Data Privacy and Security</i>. N.p., n.d. Web. 6 Nov. 2013. &lt;http://www.psfinc.com/press/hospitality-industry-risks-data-privacyand-security&gt;. 11 7|Page IV. Financial Analysis Overview The overall analysis of Starwood Hotels and Resorts is based on a variety of data, beginning with an analysis of the company’s financial ratios. Figures 2-6, below represent trends in Starwood over the last three years. They also show a benchmark analysis where Starwood is compared to the ratios of the lodging industry. Liquidity Liquidity 2012 2011 2010 Industry Current Ratio 0.95 1.27 1.21 1.16 Quick Ratio 0.27 0.26 0.25 1.05 Figure 2. This figure shows Starwood’s liquidity over time and compared to the industry. Liquidity is Starwood’s ability to convert their assets quickly to cash without the loss of value. The moderate decrease in the current ratio means Starwood has reduced their ability to cover their current liabilities with their current assets. Even though year 2012 has a current ratio of .95, this is still less than 1.0 and less than the industry average of 1.16. Therefore, compared to the industry values and Starwood’s values overtime, the company is not as effective at paying their current debt as it comes due. In regards to their quick ratio, Starwood has only slightly improved over the last three years and they are doing much worse than the industry average. Because they have a quick ratio that is much less than 1.0, this implies that Starwood is highly dependent on their inventory to liquidate their short-term debt14. 14 "Balance Sheet." Yahoo! Finance. N.p., n.d. Web. 6 Nov. 2013. <http://finance.yahoo.com/q/bs?s=HOT +Balance+Sheet&annual>. 8|Page Asset Management Industry Asset Management 2012 2011 2010 Inventory Turnover 6.52 2.42 2.24 14.78 Days sale outstanding 55.98 150.82 162.95 24.7 Total Asset Turnover 0.71 .59 0.52 0.24 Figure 3. This figure shows Starwood’s asset management over time and compared to the industry. Asset management ratios determine whether or not a company has adequate levels of various types of assets. Over the course of the last three years, Starwood’s ability to sell out and restock their inventory has greatly improved, from 2.24 times in 2010 to 6.52 times in 2012. Larger inventory turnover ratios indicate that a company has a high volume of sales and that they are purchasing just the right amount of inventory for their business. However, even though they have improved over the last three years, Starwood is doing far worse than the industry average of 14.78 times. Similarly, during the last three years, Starwood has greatly improved on the length of time it takes for them to collect cash after a sale is made. Their days sales outstanding ratio has decreased from 162.95 days in 2010 to only 55.98 days in 2012. However, the industry days sales outstanding ratio is much less than Starwood’s, meaning that the industry is able to collect unit sales more quickly than Starwood. Finally, the total asset turnover ratio evaluates how effectively a company uses all of their assets. Over time, Starwood has increased its ability to use their assets efficiently and has overall performed better than the industry15. 15 "Income Statement." Yahoo! Finance. N.p., n.d. Web. 6 Nov. 2013. <http://finance.yahoo.com/q/is? s=HOT +Income+Statement&annual>. 9|Page Debt Management Debt Management 2012 2011 2010 Industry Total Debt Ratio 65% 69% 75% 46.6% Times Interest Earned 5.24 3.15 2.39 11.79 Figure 4. This figure shows Starwood’s debt management over time and compared to the industry. The total debt ratio measures the percentage of funds which are provided by creditors. Therefore, the amount of funds Starwood has borrowed from creditors has decreased over the last three years. This means that Starwood is becoming more dependent on themselves and their assets instead of those provided by creditors. However, compared to the industry, Starwood is more reliant on lenders. The times interest earned ratio measures a company’s ability to pay interest. Starwood’s ability to pay interest has greatly increased over the years, from only 2.39 in 2010 to 5.24 in 2012. Therefore, they are more easily and able to pay their interest expense. However, this is not as impressive as the industry average of 11.7916. Profitability Profitability Ratios 2012 2011 Profit Margin 8.89% 8.69% 9.41% 6.6% Return on Total Assets 6.34% 5.12% 4.88% 1.08% 17.92% 16.55% 19.30% 2.53% Return on Equity 2010 Industry Figure 5. This figure shows Starwood’s profitability ratios over time and compared to the industry. The profit margin ratio measures net income generated per dollar of sales. This ratio shows how much money the company makes on its sales after accounting for all of their expenses. Even though their profit margin has decreased over the last three years, Starwood is still able to effectively generate 8.89% 16 "Financials: Starwood Hotels & Resorts ." Reuters. N.p., n.d. Web. 6 Nov. 2013. <http:// www.reuters.com/finance/stocks/financialHighlights?symbol=HOT>. 10 | P a g e on its sales after accounting for their expenses, which is better than the industry average of 6.6%. Return on total assets measure net income generated per dollar of total assets. Again, Starwood has improved over the three years and in 2012 generated 6.34% of net income per every dollar of total assets. They have also managed to perform better than the industry average, which only generates 1.08% net income on every dollar of assets. Finally, return on equity estimates the rate of return on shareholder’s investments. Even though Starwood has slightly decreased overtime, their return on equity is still remarkable and dominates compared to the industry17. Market Value Market Value Ratios 2012 2011 2010 Industry Price/Earnings ratio 19.70 17.71 19.30 33.18 Market/Book Ratio 3.75 2.94 3.29 2.23 Figure 6. This figure shows Starwood’s market value over time and compared to the industry. The price per earnings ratio shows how much an investor would be willing to pay per dollar of reported profits. Despite a minor decrease from 2010 to 2011, Starwood has slightly improved their price per earnings ratio. This means that in 2012, investors were willing to pay $19.70 per dollar of reported profits. However, the industry with a price per earnings ratio of $33.18, is performing much better than Starwood. The market to book ratio shows how much investors are willing to pay per book value of shares18. Again, Starwood has managed to slightly increase their market to book ratio, from 3.29 to 3.75. However, they are also performing better than the industry average of 2.2319. 17 "Financials: Starwood Hotels & Resorts ." Reuters. N.p., n.d. Web. 6 Nov. 2013. <http:// www.reuters.com/finance/stocks/financialHighlights?symbol=HOT>. 18 "Shares Outstanding." Y Charts. N.p., n.d. Web. 6 Nov. 2013. <http://ycharts.com/companies/HOT/ shares_outstanding>. 19 "Financials: Starwood Hotels & Resorts ." Reuters. N.p., n.d. Web. 6 Nov. 2013. <http:// www.reuters.com/finance/stocks/financialHighlights?symbol=HOT>. 11 | P a g e V. Beta In order to find Starwood’s firm riskiness, or their beta, we first had to gather historical past stock returns to run a regression. We found the past five years of stock returns for our chosen firm and also the past five years of market returns, for which we used S&P500. Therefore, our start date was September 18, 2008 and our end date was October 18, 2013. For each of these we found the historical prices on Yahoo! Finance. We made sure the data gave us monthly information so we could then download the data into an excel spreadsheet. From the Adjustment Close variable we were able to compute returns from prices using the formula R= (P1-P0) / P0. Once we followed these steps for both Starwood’s data and S&P500’s data, we were then able to run the regression; refer exhibit 1 for the regression’s calculation of beta. We used Starwood’s Returns as our y-variable and the market portfolio’s returns as the x-variable. When we ran the regression and found that our beta was 2.33601704. Since this beta is greater than the market beta of 1.0, this means that Starwood is riskier than the average firm in the market. The beta we have recorded is similar to those provided from various sources. For example, Yahoo! Finance estimated Starwood’s beta as 1.91, Google Finance estimated the beta to be 2.33, and MSN Money recorded a 2.13 beta. We are choosing our beta of 2.33 because it was also supported from data estimated with other online sources. Thus, we can conclude that Starwood Hotels is about twice as risky as the market since it’s beta is greater than 1. VI. Capital Asset Pricing Model In order to value Starwood’s stock we first have to determine their cost of equity capital or ri, using the CAPM model. To do this we used the formula ri = rf + (rm – rf) Bi. We decided our risk free rate was going to be 3.65%. To find this number we used a 30-year Treasury bond rate20. We used this Treasury bond because we are valuing a firm that may have an unlimited life. We chose a market risk 20 "United States Government Bonds." Bloomberg.com. Bloomberg, n.d. Web. 6 Nov. 2013. <http:// www.bloomberg.com/markets/rates-bonds/government-bonds/us/>. 12 | P a g e premium of 2%. We used this percentage because we were given a suggested spread between 2% and 8%. We chose a low percentage because we feel the market is not very risky due to its maturity. From here, we substituted the values into the CAPM equation. When we did this is what we got: ri = 3.65% + (2%) x (2.33). As a result we found that our cost of capital for Starwood was is 8.31%. VII. Dividend Discount Model There are three methods used in order to predict future company growth. These are estimating the company’s past growth in dividends, evaluating an analyst’s prediction of future dividend growth rate, and finally utilizing the plowback formula21. According to Bloomberg’s analyst estimates, Starwood’s previous growth in dividends is 6.79%. Analyst predictions of future dividend growth rates, according to Yahoo! Finance, is 8.69%22. Finally, to calculate growth using the plowback ratio the equation (1-payout) x ROE was used. Yahoo! Finance recorded Starwood’s payout ratio to be 38% and the company’s ROE was previously calculated as 17.92%. The formula to find plowback is: (1-.38) x 17.92% = 11.11% growth rate. We projected the cost of equity to be 8.31%, as estimated in the Capital Asset Pricing model. The fifth year was selected as the horizon year. This is because the lodging industry is mature and we do not anticipate a trend of exceptional growth after five more years. Starwood’s 2013 forecasted dividend of $1.35 was used for our starting dividend (D0)23. Cash flows were discounted by the cost of equity estimated through the Capital Pricing Model. Non-constant growth of 11.11% was used during the first five years. We chose to use 11.11% as the non-constant growth because that is the growth we calculated using the plowback ratio. We feel this growth rate is more accurate than those of the analyst predictions because they are directly from the ratios and financial 21 "HOT:New York Stock Quote." Bloomberg.com. Bloomberg, n.d. Web. 26 Nov. 2013. <http:// www.bloomberg.com/quote/HOT:US>. 22 "Analyst Estimates." Yahoo! Finance. N.p., n.d. Web. 6 Nov. 2013. <http://finance.yahoo.com/q/ae? s=HOT+Analyst+Estimates>. 23 "Equities." Starwood Hotels & Resorts Worldwide Inc, HOT:NYQ forecasts. N.p., n.d. Web. 26 Nov. 2013. <http://markets.ft.com/research/Markets/Tearsheets/Forecasts?s=HOT:NYQ>. 13 | P a g e statements from Starwood. After the horizon year, growth became constant at 2.2%, which is the expected long term growth of the economy24. After using these values in the DDM Model we calculated Starwood’s stock price to be $33.12. Refer to figure 7 to see the DDM with 11.11% growth rate. However, when we used Bloomberg’s estimates of previous dividend growth of 6.79% instead of our calculation of 11.11% we received a different stock price. The stock price was $27.43. This change in growth rate caused a $5.69 change in stock price, making Starwood’s stock price very sensitive to changes in growth estimates. We decided to use Starwood’s previous growth in dividends over analysts future estimated growth rate because we feel Starwood’s past growth is a more significant indication of how they will perform in the future, especially in an economy that is only expected to grow at 2.2%. We feel that our stock price of $33.12 is a more accurate price to use because it was calculated through the company financials and also because it more closely relates to the stock price recorded on Yahoo! Finance. Refer to figure 8 to see the DDM with 6.79% growth rate. 24 "United States Home." World Bank. N.p., n.d. Web. 26 Nov. 2013. <http://www.worldbank.org/en/ country/unitedstates>. 14 | P a g e DDM Non-Constant Growth - Using 11.11% Horizon Year r = 8.31% 0 1 2 3 4 5 6 g= 11.11% g=11.11% g=11.11% g=11.11% g=11.11% g=11.11% g= 2.2% D0 = $1.35 D1 = D0 (1+g) = $1.35 (1.1111) = $1.50 D2 = D1 (1+ g) = $1.50 (1.1111) = $1.67 D3 = D2 (1+g) = $1.67 (1.1111) = $1.86 D4 = D3 (1+g) = $1.86 (1.1111) = $2.07 D5 = D4 (1+g) = $2.07 (1.1111) = $2.30 D6 = D5 (1 + g) = $2.30 (1.022) = $2.35 P5 = D6 r-g P5 = 2.35/ 8.31% -2.2% P5 = $38.46 CF0 = 0 CF1 = 1.50 CF2 = 1.67 CF3 = 1.86 CF4 = 2.07 CF5 = (2.30 + 38.46) = 40.76 NPV = $33.12 Figure 7. This figure shows Starwood’s Dividend Discount Model with non-constant growth, using the growth percentage from the plowback equation. 15 | P a g e DDM Non-Constant Growth - Using 6.79% Horizon Year r = 8.31% 0 1 2 3 4 5 6 g= 6.79% g= 6.79% g= 6.79% g= 6.79% g= 6.79% g=11.11% g= 2.2% D0 = $1.35 D1 = D0 (1+g) = $1.35 (1.0679) = $1.44 D2 = D1 (1+ g) = $1.44 (1.0679) = $1.54 D3 = D2 (1+g) = $1.54 (1.0679) = $1.64 D4 = D3 (1+g) = $1.64 (1.0679) = $1.75 D5 = D4 (1+g) = $1.75 (1.0679) = $1.87 D6 = D5 (1 + g) = $1.87 (1.022) = $1.91 P5 = D6 r-g P5 = 1.91/ 8.31% -2.2% P5 = $31.26 CF0 = 0 CF1 = 1.44 CF2 = 1.54 CF3 = 1.64 CF4 = 1.75 CF5 = (1.87 + 31.26) = 33.13 NPV = $27.43 Figure 8. This figure shows Starwood’s Dividend Discount Model with non-constant growth, using estimates of previous dividend growth. IX. Free Cash Flow Model In order to evaluate stock price using the free cash flow model we first had to create pro-forma financial statements, see exhibit 2. From here we projected many different growths: revenue growth, expenses as a percent of revenue, depreciation as a percent of revenue, non-cash adjustments as a percent of revenue, capital expenditures as a percent of operating activities, and investing activities as a percent of investing activities, shown in exhibit 3. Next we created a projected pro forma income statement for the 16 | P a g e next five years. From here we created a pro forma free cash flow in order to calculate five years of projected unlevered free cash flow, refer to exhibit 4.It is with the unlevered free cash flows that we then valued the firm. The following steps are discussed more in depth in the proceeding sections. X. Weighted Average Cost of Capital (WACC) We calculated Starwood’s beta to be 2.33 through regression analysis. We found the cost of equity capital to be 8.31% through using the CAPM formula. On Reuters we found the company’s credit rating to be BBB. According to this credit rating yield25 the company has a spread of 0.80%. According to Morning Star, Starwood has a 1.70% yield to maturity26. We used the 10-year yield on U.S. Treasury at 3.65%, found on Bloomberg’s U.S. government bond chart of market rates. We used a market risk premium of 2% from the given 2%-8% spread. We found the cost of debt to be 4.45% by adding the 10Year Treasury Yield (3.65%) to the 0.80% credit rating spread. We chose equity to value percentage of 49.85%; this was found from dividing their market value of equity ($14,146,843,700) by their total value of debt and equity ($28,376,843,700). This makes sense because the firm has almost an even amount of debt to equity financing. These calculations are shown in figure 9, see exhibit 5 for in depth calculation process. Cost of Equity Cost of Debt Debt to Value Equity to Value WACC Terminal WACC 8.31% 4.45% 50.15% 49.85% 5.59% 4.27% Figure 9. This figure shows the components of Starwood’s weighted average cost of capital. Starwood is a well established company with brand loyalty that has been operating for 44 years. With this information we have concluded that the company will stabilize in year 5; hitting a constant growth rate of 2.20%. This gives us the horizon year in year 5. To calculate the terminal value we took 25 "S&P raises rtg on starwood hotels & resorts to 'BBB'." Reuters. N.p., n.d. Web. 26 Nov. 2013. <http:// www.reuters.com/article/2012/06/08/idUSWNB163020120608>. 26 "Starwood Hotels & Resorts Worldwide Inc." HOT XNYS:HOT Stock Quote Price News. N.p., n.d. Web. 26 Nov. 2013. <http://quotes.morningstar.com/stock/s?t=HOT>. 17 | P a g e the unlevered free cash flow from forecasted year 6 and divided it by our constant growth rate (2.2%) subtracted from the terminal weight average cost of capital (4.27%). Figure 10 below shows the forecast of unlevered free cash flow, but exhibit 6 shows more in depth calculations for these numbers. Years Unlevered Free Cash Flow 1 2 3 4,554,771 4,808,552 5,379,865 4 5 6,017,736 Terminal Value 6 6,729,919 7,525,071 363,530,000 Figure 10. This figure shows Starwood’s forecasted terminal value over 6 years. See attached exhibits for detailed calculations of unlevered free cash flows. Free Cash Flow Stock Valuation In order to value the stock price of Starwood using the Free Cash Flow model, we first needed to value the firm. We found the firm value to be $319,034,417. We found this by using the cash flow function on our calculators: CF0=0: CF1=4,554,771: CF2=4,808,551: CF3=5,379,865: CF4=6,017,736: CF5=6,729,919+363,530,000; also shown in exhibit 7. We also used our terminal weighted average cost of capital as our discount rate (4.27%). Next we used the firm value to calculate the firm’s value of equity. We calculated value of equity by adding cash and marketable securities to firm value and then subtracting long term debt. From here we took the value of equity and divided it by the number of diluted outstanding shares (194,000,000)27 to get the stock price of $184.55, as shown in figure 11. Firm Value (+) Cash & Marketable Securities (-) Long Term Debt Equity Value Stock Price $319,034,417 $463,000 $3,695,000 $35,802,417 $184.55 Figure 11. This figure shows how we calculated Starwood’s value of equity to get stock price. 27 “Starwood Shares Outstanding” Guru Focus N.p., n.d. Web. 26 Nov. <http://www.gurufocus.com/term/Shares%20Outstanding/HOT/Total%2BShares%2BOutstandin g/Starwood%2BHotels%2B%2526%2BResorts%2BWorldwide%2BInc> 18 | P a g e XI. Valuation Using Multiples (P/E) To valuate Starwood using multiples we had to find the company’s earnings per share ratio and the industry’s P/E ratio. Starwood’s most recent earning per share is 3.3. To find the lodging industry’s P/E ratio we averaged the P/E of twelve competitors; from doing this we found the lodging industry’s P/E ratio to be 25.98. Starwood’s most direct competitor, Marriott, has a P/E ratio of 22.0, which matches up closely to the industry’s P/E ratio28. By multiplying Starwood’s EPS and the industry’s P/E, we found the stock price to be $85.73. Starwood’s stock is currently trading at the price of $73.8729. According to this model that means that Starwood’s stock price is undervalued by $11.86. XII. Conclusion and Recommendation Starwood’s stock is currently trading at a price of $73.87. To find the intrinsic stock value of $104.21 we used a weighted average of the three valuation methods. We weighted P/E ratio as 20% because we believe that the P/E method is less accurate because of its simplicity. We weighted the dividend discount method as 40% because we believe this is a more accurate and credible method as it is more in depth and takes into account discount rate. We also weighted the free cash flow method as 40% because we believe its forecasting of growth is just as accurate and analytical as that of the DDM. Overall we can conclude that Starwood’s company is undervalued by $30.34. Therefore, we believe Starwood is a good potential investment and recommend buying their stock. Refer to figure 12 for valuations methods and their corresponding stock price. 28 "Lodging Industry." Market Cap and PE Ratio (TTM). N.p., n.d. Web. 26 Nov. 2013. <http:// ycharts.com/industries/Lodging/market_cap,pe_ratio>. 29 "HOT: Summary for Starwood Hotels & Resorts World- Yahoo! Finance." Yahoo! Finance. N.p., n.d. Web. 26 Nov. 2013. <http://finance.yahoo.com/q?s=HOT>. 19 | P a g e Valuation Method Stock Price P/E Ratio $85.73 DDM $33.12 FCF $184.55 Weighted Average $104.21 Figure 12. This figure shows Starwood’s estimated stock prices using different valuation methods. 20 | P a g e XII. Exhibits Exhibit I. Beta Regression SUMMARY OUTPUT Regression Statistics Multiple R 0.794108 R Square 0.630608 Adjusted R Square 0.624239 Standard Error 0.08485 Observation s 60 ANOVA df Regression Residual Total SS MS 0.71286 1 0.0072 F 99.0148 4 P-value 0.70203 9 3.73E14 1 58 59 0.712861 0.417573 1.130434 Coefficien ts Standard Error Intercept 0.004328 0.011258 t Stat 0.38446 6 X Variable 1 2.336017 0.234761 9.95062 Significan ce F 3.73E-14 Lower 95% -0.01821 1.866092 Upper 95% 0.02686 3 2.80594 2 Lower 95.0% 0.01821 1.86609 2 Upper 95.0% 0.02686 3 2.80594 2 21 | P a g e Exhibit II. Pro Forma Income Statement Fiscal Year 2012 Total Revenues 6,321,000 2013 2014 2015 2016 2017 7,057,396.50 7,879,583.19 8,797,554.63 9,822,469.75 10,966,787.47 5,658,862.34 Total Expenses Depreciation and Ammortization 3,057,000 3,641,617 4,065,864.93 4,539,538.19 5,068,394.39 170,000 242,774.44 271,057.66 302,635.88 337,892.96 EBIT 3,094,000 3,173,005.47 3,542,660.60 3,955,380.56 4,416,182.40 Interest Expense 170,000 EBT 2,924,000 3,003,005.47 3,372,660.60 3,785,380.56 4,246,182.40 4,760,667.65 Provision for Income Taxes 629,537.20 646,547.08 726,133.83 814,992.44 914,203.07 1,024,971.74 Net Earnings 2,294,462.80 2,356,458.39 2,646,526.78 2,970,388.13 3,331,979.33 3,735,695.90 170000 170000 170000 377,257.49 4,930,667.65 170000 170000 Exhibit III. Projected Growth Rates Projecting Revenue 2012 2011 Total Revenues Revenue Growth Rate 2 Year Average 6,321,000 12.39% 11.65% 5,624,000 10.91% Projecting Expenses Fiscal Year 2012 2011 Fiscal Year 2010 5,071,000 2010 Total Revenues 6,321,000 5,624,000 5,071,000 Total Expenses Expenses as a percent of Revenue 3,057,000 48.36% 3,024,000 53.77% 2,671,000 52.67% 3 Year Average 51.60% 22 | P a g e Projecting Depreciation and Ammortization Fiscal Year Total Revenues Total Depreciation and Ammortization Depreciation as a percent of Revenue 3 Year Average 2012 2011 2010 6,321,000 170,000 2.69% 3.44% 5,624,000 189,000 3.36% 5,071,000 217,000 4.28% 2012 2011 2010 6,321,000 72,000 1.14% 1.79% 5,624,000 175,000 3.11% 5,071,000 57,000 1.12% 2012 2011 2010 1,184,000 362,000 -30.57% -40.12% 641,000 385,000 -60.06% 764,000 227,000 -29.71% 2012 2011 2010 1,184,000 488,000 641,000 209,000 764,000 156,000 41.22% 31.41% 32.61% 20.42% Interest Expense 170,000 Tax Rate 20.53% Projecting Non-Cash Adjustments From Operations Fiscal Year Total revenues Total Non-Cash Adjustments to CF from Operations Non-Cash Adjustments as a percent of Revenues 3 Year Average Projecting Capital Expenditures Fiscal Year Total CF from Operating Activities Total Capital Expenditures Capital Expenditures as a percent of Operating Activities 3 Year Average Projecting Other Investing Activities Fiscal Year Total CF from Operating Activities Total Other Investing Activities Other Investing Activites as a percent of Operating Activities 3 Year Average 23 | P a g e Exhibit IV. Projected Free Cash Flow Fiscal Year 2012 2013 2014 2015 2016 2017 Net Income 2,294,46 2.80 2,356,45 8.39 2,646,52 6.78 2,970,38 8.13 3,331,97 9.33 3,735,69 5.90 Depreciation & Amortization 170,000 242,774. 44 271,057. 66 302,635. 88 337,892. 96 377,257. 49 Total Other NonCash Adjustments 113,145. 90 126,327. 40 141,044. 54 157,476. 23 175,822. 21 196,305. 50 Net Operating Cash Flow 2,577,60 8.70 2,725,56 0.23 3,058,62 8.98 3,430,50 0.24 3,845,69 4.50 4,309,25 8.89 $(1,093, 494.76) $ (856,098 .47) $(1,227, 121.95) $ (960,715 .36) $(1,376, 316.69) $(1,542, 892.63) $(1,728, 874.67) Other Investments $(1,034, 136.61) $ (809,626 .89) $(1,077, 520.12) $(1,207, 932.64) $(1,353, 538.22) Net Cash Flow from Operating Activities Interest Expense $(1,843, 763.50) 170,000 $(1,949, 593.23) 170,000 $(2,187, 837.31) 170,000 $(2,453, 836.82) 170,000 $(2,750, 825.27) 170,000 $(3,082, 412.88) 170,000 Levered Free Cash Flow 4,591,37 2.20 4,845,15 3.46 5,416,46 6.28 6,054,33 7.05 6,766,51 9.77 7,561,67 1.77 Tax Shield 36,601 36,601 36,601 36,601 36,601 36,601 Unlevered Free Cash Flow 4,554,77 1.20 4,808,55 2.46 5,379,86 5.28 6,017,73 6.05 6,729,91 8.77 7,525,07 0.77 Capital Expenditures 24 | P a g e Exhibit V. WACC Computation WACC Beta Market risk Premium 10 year yield on U.S Treasury cost of equity capital 2.33 2% 3.7% 8.31% Cost of debt 4.450% 10 year yield on U.S Treasury 3.7% Credit Rating BBB Spread 0.80% Debt to Value 50.15% Equity to Value 49.85% Market value of equity # of shares (diluted) outstanding Market price per share Market value of debt Book value of debt 14,146,843,700.00 191,510,000.00 73.87 14,230,000,000 5,724,000 Value 28,376,843,700.00 WACC 5.59% Terminal WACC Terminal cost of equity Terminal growth rate Calculated through Regression Assumed Bloomberg Reuters Spread based on the credit rating and yield This makes sense because their debt/equity ratio is 47% From yahoo finance From Yahoo Finance From Yahoo Finance 4.2672% 5.65000% 2.20% WACC cost of equity capital 8.31% 25 | P a g e Cost of debt 4.450% Debt to Value 50.15% Equity to Value 49.85% WACC 5.59% Terminal WACC Terminal cost of equity Terminal growth rate 4.2672% 5.65000% 2.20% Exhibit VI. Unlevered Free Cash Flow Year 2012 1. Find Unlevered Free Cash Flow from Most Recent Year 2012 Net Income 562,000 Depreciation & Amortization Total other Non-cash Adjustments 170,000 Net Operating Cash Flow Capital Expenditures Other Investments Net Cash Flow from Investing Activities Interest Expense Levered Free Cash Flow Tax Shield Unlevered Free Cash Flow -72000 804000 -362000 -488000 -850000 170,000 124000 34896 89104 Exhibit VII. Firm Value CF0=0 CF1=4,554,771 CF2=4,808,552 CF3=5,379,865 CF4=6,017,736 CF5=6,729,919+363,530,000 Terminal WACC=4.27 NPV=319,034,417 26 | P a g e XIII. Work Cited "Analyst Estimates." Yahoo! Finance. N.p., n.d. Web. 6 Nov. 2013. <http://finance.yahoo.com/q/ae? s=HOT+Analyst+Estimates>. "Balance Sheet." Yahoo! Finance. N.p., n.d. Web. 6 Nov. 2013. <http://finance.yahoo.com/q/bs?s=HOT +Balance+Sheet&annual>. "Cost of Capital by Sector." Cost of Capital by Sector. N.p., n.d. Web. 6 Nov. 2013. <http:// pages.stern.nyu.edu/~%20adamodar/New_Home_Page/datafile/wacc.htm>. "Equities." Starwood Hotels & Resorts Worldwide Inc, HOT:NYQ forecasts. N.p., n.d. Web. 26 Nov. 2013. <http://markets.ft.com/research/Markets/Tearsheets/Forecasts?s=HOT:NYQ>. "Financials: Starwood Hotels & Resorts ." Reuters. N.p., n.d. Web. 6 Nov. 2013. <http:// www.reuters.com/finance/stocks/financialHighlights?symbol=HOT>. "HOT Earnings Date." <i>NASDAQ.com</i>. N.p., n.d. Web. 6 Nov. 2013. <http://www.nasdaq.com/ earnings/report/hot> "HOT:New York Stock Quote." Bloomberg.com. Bloomberg, n.d. Web. 26 Nov. 2013. <http:// www.bloomberg.com/quote/HOT:US>. "HOT: Summary for Starwood Hotels & Resorts World- Yahoo! Finance." Yahoo! Finance. N.p., n.d. Web. 26 Nov. 2013. <http://finance.yahoo.com/q?s=HOT>. "Hotel Industry Overview - Complete Version." <i>Hotel Industry Overview - Complete Version</i>. N.p., n.d. Web. 6 Nov. 2013. &lt;http://www.irs.gov/Businesses/Hotel-IndustryOverview---Complete-Version&gt;. “Hyatt Hotels Corporation Profile Overview." Yahoo! Finance. N.p., n.d. Web. 6 Nov. 2013. <http:// finance.yahoo.com/q/pr?s=H+Profile>. "Income Statement." Yahoo! Finance. N.p., n.d. Web. 6 Nov. 2013. <http://finance.yahoo.com/q/is? s=HOT +Income+Statement&annual>. "Lodging Industry." Market Cap and PE Ratio (TTM). N.p., n.d. Web. 26 Nov. 2013. <http://ycharts.com/ industries/Lodging/market_cap,pe_ratio>. "Marriott 2010 Annual Report — Financial Form 10-K Section." Marriott 2010 Annual Report — Financial Form 10-K Section. N.p., n.d. Web. 6 Nov. 2013. <http://investor.shareholder.com/ MAR/marriottAR10/financials/risk_factors/index.html>. "Marriott International Profile Overview." Yahoo! Finance. N.p., n.d. Web. 6 Nov. 2013. <http:// finance.yahoo.com/p/pr?s=MAR+Profile>. "MBA Skool-Study.Learn.Share.." <i>Starwood Hotels and Resorts</i>. N.p., n.d. Web. 6 Nov. 2013. &lt;http://www.mbaskool.com/brandguide/tourism-and-hospitality/4276starwood-hotels-and-resorts.html&gt;. "Parker, Smith & Feek." <i>Hospitality Industry Risks: Data Privacy and Security</i>. N.p., n.d. Web. 6 Nov. 2013. &lt;http://www.psfinc.com/press/hospitality-industry-risks-data-privacyand-security>. 27 | P a g e "S&P raises rtg on starwood hotels & resorts to 'BBB'." Reuters. N.p., n.d. Web. 26 Nov. 2013. <http:// www.reuters.com/article/2012/06/08/idUSWNB163020120608>. "Shares Outstanding." Y Charts. N.p., n.d. Web. 6 Nov. 2013. <http://ycharts.com/companies/HOT/ shares_outstanding>. "Starwood Hotel & Resorts Charts." <i>Y Charts</i>. N.p., n.d. Web. 6 Nov. 2013. <http://ycharts.com/ companies/HOT/chart/# series=type:company,id Hot, cal:eps_ttm,, &zoom=5&startDate= &endDate =&format=real&recessions=false&chartView=>. "Starwood Hotels and Resorts." <i>Starwood Preferred Guest</i>. N.p., n.d. Web. 6 Nov. 2013. &lt;http://www.starwoodhotels.com/corporate/about/index.html&gt;. "Starwood Hotels and Resorts." Starwood Preferred Guest. N.p., n.d. Web. 6 Nov. 2013. <http:// www.starwoodhotels.com/element/experience/green_leed.html>. "Starwood Hotel & Resorts Overview." Yahoo! Finance. N.p., n.d. Web. 6 Nov. 2013. <http:// finance.yahoo.com/q/pr?s=HOT+Profile>. "Starwood Hotels & Resorts Worldwide Inc." HOT XNYS:HOT Stock Quote Price News. N.p., n.d. Web. 26 Nov. 2013. <http://quotes.morningstar.com/stock/s?t=HOT>. "Starwood Hotels & Resorts Worldwide, Inc. Revenue & Earnings Per Share (EPS)." NASDAQ.com. N.p., n.d. Web. 6 Nov. 2013. <http://www.nasdaq.com/symbol/hot/revenue-eps>. "Starwood | Innovation Drivers." Starwood | Innovation Drivers. N.p., n.d. Web. 6 Nov. 2013. <http:// innovationleaders.org/star_drivers.html>. “Starwood Shares Outstanding” Guru Focus N.p., n.d. Web. 26 Nov. <http://www.gurufocus.com/term/Shares%20Outstanding/HOT/Total%2BShares%2BOutstandin g/Starwood%2BHotels%2B%2526%2BResorts%2BWorldwide%2BInc> "The Center for Hospitality Research." CHR Reports RSS. N.p., n.d. Web. 6 Nov. 2013. <http:// www.hotelschool.cornell.edu/research/chr/pubs/reports/abstract-15005.html>. "Top Risks Facing the Hospitality Industry." Top Risks Facing the Hospitality Industry. N.p., n.d. Web. 6 Nov. 2013. <http://www.resolvergrc.com/blog/top-risks-facing-the-hospitality-industry/>. "United States Government Bonds." Bloomberg.com. Bloomberg, n.d. Web. 6 Nov. 2013. <http:// www.bloomberg.com/markets/rates-bonds/government-bonds/us/>. "United States Home." World Bank. N.p., n.d. Web. 26 Nov. 2013. <http://www.worldbank.org/en/ country/unitedstates>. 28 | P a g e