to view the attachment

advertisement

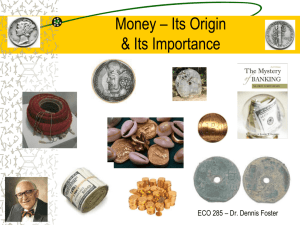

MONETARY ECONOMICS CONCEPTS OF MONEY Content History and Evolution of Money Monetary Systems/Payment Standards Definition/Functions of Money Measurement of Money Supply Discussion: Concepts of Money in Islam From Barter to Money Barter is the exchange of a good or service for another good or service. Barter requires a “double coincidence of wants” for a transaction to take place. A barter economy has fewer exchanges, exchanges that are made are more time consuming, and less specialization is possible. The frustrations associated with barter led people to create MONEY Over time may different items have served as money. To serve as money an item must be SCARCE and: Portable Durable Divisible Familiar (Uniform) Acceptable Stable in Value Various Forms of Money The use of cattle in exchange can be traced back as far as 90006000 BC Cowrie shells being used as money can be traced to China in 1200 BC. An Okpoho manilla (or bracelet) was an early form of money in Nigeria. The Katanga Cross was an archaic form of money from West Africa. Bronze and copper replicas of shells were manufactured in China by the end of the Stone Age and the Lydians (modern Turkey) coined gold and silver around 560 BC. Other Forms of Money: - Whale’s teeth - Bread - Spices On the Micronesian Island of Yap, huge limestone rocks were formed into coins. Some of these coins were 9-12 feet in diameter and weighed several tons. Monetary Payment Systems Commodity Money: item which is useful in its intrinsic value as well as its monetary properties Began with banks issuing paper receipts to depositors indicating that the receipt is redeemable for the precious goods being stored Representative to Gold-backed money Commodity Money Barter Economy Representative money made the practice of fractional reserve banking possible. Paper Currency This money is not backed by reserves of another commodity Fiat Money and the Future The money is given value by government fiat (Latin for “let it be done”) or decree Functions of Money Medium of Exchange – acts as a go-between to make it easier to buy and sell goods and services or pay debts. Allows buyers and sellers to avoid the difficulties associated with barter exchanges. Store of Value – allows people to transfer the purchasing power of their present money income or wealth into the future, ideally without a loss of value. Unit of Account – serves as a way to measure and compare the value of goods and services in relation to one another. It also allows people to keep accurate financial records. Measurement of Money Supply Money supply (or Money Stock): – The amount of money in an economy that is easily available for use in payments. It is not just coins and notes in circulation Measurement of Money Supply-Malaysia M2 = M1 + M1:currency and demand deposits held by the private sector. savings deposits + fixed deposits of all maturities + net issues of NCD + repo transactions effected [of/to the private sector] [by the commercial banks]. M3 = M2 + savings deposits + fixed deposits of all maturities + net issues of NCD + repo transactions effected [of/to the private sector] [by other banks] First Discussion: Do the official measures of Money Stock (M1, M2 and M3) accurately reflect the quantity of money in the economy? When we state: M2 = Currency + Demand Deposits + Savings Deposits + Fixed Deposits + NCD + REPO, what does this mean? Second Discussion: What is the concept of Money in Islam? Must money in an Islamic economy be in the form of gold? Is fiat money incompatible with Islamic principles?