1. Why money??

advertisement

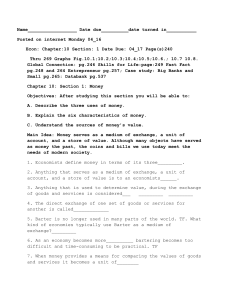

Unit 3.1: Money Why do we need money? To exchange for those goods and services we each need and want but are unable to produce for ourselves, because: • we are not self-sufficient (individually we cannot produce everything we need and want) • we specialize in those tasks and productive activities we are best able to do and therefore need to trade with producers of other products What did we do before money? Barter involves exchanging goods and services, i.e. ‘payment’ for one product is made with another. Problems with barter are: Finding someone to swap with (there must be a double coincidence of wants- what does this mean???) How to agree values (how many apples to one cow, and how much cheese for one apple?) The functions of money To overcome the problems of barter money must be: a medium of exchange: this means that when buyers and sellers get together to exchange, money is an acceptable method of payment a good store of value: this means that when a seller sells something for money, the money will keeps its value until it can be spent at a later date. a measure of value: money is used to put a value on good or services. How much satisfaction do you get from drinking a hot chocolate- 10RMB? 15RMB? 20RMB? We tend to think of how much something is worth in money termsits price a means of deferred payment: Many people and businesses buy on credit (i.e. they buy now and pay later). The business selling the good on credit will happily accept money at a later date. Characteristics of good money Good money must be: • • acceptable to others in payment for goods and services. The paper notes that we use are worthless pieces of paper but everyone will accept notes at the value printed on them- this is called token money. durable so that it is not worn down or damaged easily though frequent use portable so that it is easy to carry around divisible into smaller units and values- the lack of divisibility was a key problem for old types of money- like cowrie shells & dog’s teeth scarce, otherwise if it is freely available it will be of little or no value to others. • • • TASK: In the table below are the various characteristics of money - that is the qualities money needs to fulfil its functions well. Across the top of the table are various possible types of money. For each type of money, give a score between 1 and 10 to say how well you think it meets each characteristic. 10 = meets the attribute perfectly 1 = hardly meets the characteristic at all Characteristic of money Gold coins Playing cards Sea shells Tobacco Leaves Bank notes Acceptability Divisibility Portability Difficult to counterfeit Durability Uniformity Limited in supply Total Score Now add up the totals for each type of money and list them in order below, starting with the best form of money (the one with the highest score): a. b. c. d. e. f. ___________________________________ ___________________________________ ___________________________________ ___________________________________ ___________________________________ ___________________________________ 3. Write a short paragraph justifying why the type of money at the top of your 'money chart' is likely to fulfil the functions of money best. What is Near Money and what is not? CASH in the form of notes and coins is widely _________________ in many countries as money. However, cash can lose its __________________ over time due to rising prices (_________________) Financial assets (things that people own) that can store value over time and can be turned quickly into cash are a good form of money. Money that his held in bank accounts (deposit or current accounts), that can quickly be converted into cash (by withdrawing it at an __________, for example) is the closest form of money to actual cash and is often called NEAR MONEY. On the other-hand, even though money held in savings accounts may store its value over time (because you receive _____________ on your savings), it is often difficult to convert it quickly into cash as the bank might require that you tell them a month in advance that you need the money. Some of you might have savings account set up by your parents- they will hold their value but you can’t turn the money in it quickly into cash- why not??___________________) In addition, assets like gold jewelry or watches could also be sold for cash but this could take some time. As a result they are not considered NEAR MONEY. NEAR MONEY is often called the MONEY SUPPLY and it consists of notes and coins in circulation and money held in deposit accounts.