CP Economics Course Outline: Money & Banking

advertisement

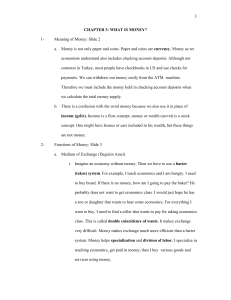

COURSE OUTLINE Unit 1: Fundamentals of Economics Economics and Choice Chapter 1:The Economic Way of Thinking Chapter 2: Economic Systems Chapter 3: The American Free Enterprise Unit 2: Microeconomics Market Economies at Work Chapter 4: Demand Chapter 5: Supply Chapter 6: Demand, Supply, and Prices Chapter 7: Market Structures Unit 3: Types of Business Organizations Chapter 8: Types of Business Organizations Unit 4: Macroeconomics Money and Banking Chapter 10: Money Unit 5: Measuring and Monitoring Economic Performance Chapter 12: Economic Indicators and Measurements Chapter 13: Facing Economic Challenges Unit 6: The Role of Government in the Economy Chapter 14: Government Revenue and Spending Chapter 15: Using Fiscal Policy Unit 7: The Global Economy CP Economics Organizer Chapter 10: Money: Its Functions and Properties The Big Picture: The Role of Money. Money can be anything that people accept as payment for goods and services. It has three functions. 1. It is a medium of exchange. Buying and selling with money, as opposed to bartering for goods, is convenient and allows for flexible and precise pricing. 2. It is a standard of value. Money allows people to measure the relative worth of goods and services and to compare prices. In the United States the value of goods and services is expressed in terms of the dollar, the country’s basic monetary unit. 3. It is a store of value. Money holds its value over time so people don’t have to spend it all at once but can save some for the future. Inflation erodes the purchasing power of money. The narrowest measure of the U.S. money supply is M1. It includes currency (paper money and coins), checking accounts, and other demand deposits. M2 consists of M1 plus savings accounts and time deposits. Unit Pacing: ____ – Money: Its Functions and Properties Homework ____– Read p. 288-289 ____—Read p. 290-294 ____ – Money: Its functions and Properties Cont’d RETEACHING ACTIVITIES: Section 1 ____—Chapter 10 Vocabulary Quiz & TEST ____-- Unit Benchmark #4 TEST Key Terms and Phrases: (Reading Assignments) ____ – Study Ch. 10 Vocabulary Quiz & TEST 1. 2. 3. 4. 5. 6. 7. 8. Money Medium of exchange Barter Standard of value Store of value Stability in value Durability Portability 9. 10. 11. 12. 13. 14. 15. 16. Acceptability Commodity money Representative money Fiat money Currency Demand deposits Near money Divisibility Essentials Question: GPS 1. Describe how money help the market economy work more efficiently. 1. SSEMI1b Chapter 16: The Federal Reserve and Monetary Policy Chapter 17: International Trade Unit 8: Personal Finance Chapter 11: Personal Finance & Financial Markets Course Website: http://www.gocats.org