2 - OECD

advertisement

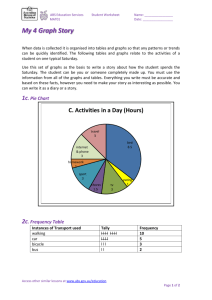

INFORMATION AND DISCLOSURE ISSUES IN THE ASSET-BASED SECURITIES MARKETS José Antonio Trujillo InterMoney Titulización SGFT, SA WPFS WORKSHOP ON SECURITIZATION Madrid, 27 and 28 May 2010 1 OVERVIEW 1. 2. 3. 4. 5. 6. 7. The importance of information Information and ABS market collapse What information do ABS markets require The ECB triple-A rating requirement for ABS The Spanish ABS information framework Securitisation versus covered bonds The future of securitisation 2 1. The importance of information • Asset information management demands enhancement across the banking industry – – – – Dynamic data on debtors and guaranties is not always updated Information may be disperse in non-related data-bases Data may not be readily and easily exportable Data responsibilities are disperse not well defined, and rank low in management scale the • Problems to generate information and make it easily available to third parties (supervisors, rating agencies, markets), is an indication poor risk control • If loan information had been better across the banking system, alarms would have turned on at an earlier stage of the bubble • Enhancing information standards at originator level for internal control and external supervision is a much more important objective than disclosure for ABS markets 3 2. Information and ABS market collapse • ABS opacity may have contributed to the collapse of markets but it was not its main cause. • The nature of ABS makes it difficult for them not to be relatively illiquid, which has resulted in unbearable levels of market risk for most investors. • Their apparent liquidity before the crisis was a mirage, produced by a market in continuous expansion, fed by SIVs, Conduits, and other low capitalised term-transformation vehicles. • Too high expectations have been placed on information enhancement as a means of restoring ABS markets. • Investors in (triple-A) ABS are concerned mainly with market risk not with credit risk. 4 3. What information do ABS markets require (1/2) • Two different issues – – • Enhancing the quality of information A balance between disclosure and efficiency The ECB proposal a) b) • A complete data template, to homogenise content and terminology across EU jurisdictions. Required disclosure (for ABS ECB discount) at loan by loan level during the life of the ABS to all investors. How to implement this disclosure remains open. Is it a good proposal to restore ABS markets? – – – – The template is a very positive initiative Broad loan-level disclosure of granular portfolios is irrelevant for credit risk analysis A unified portal open to all investor to access loan-level data is costly and unnecessary As a requirement for ECB discount, it is irrelevant to asses credit risk (ABS are required to exhibit 2 triple-A ratings) and penalises relatively securitisation versus covered bonds, which is not neutral across jurisdictions 5 3. What information do ABS markets require (2/2) • Same benefits could be attained simply by – – – • Requiring better information at the originator’s and cash-flow servicer’s levels, which is the objective of the template, Standardising and enhancing reporting obligations with some level of aggregation, and Facilitating access to information on a decentralised basis. Market risk – – – – Some investors demand loan-level data for cash-flow analysis. The necessities of investors for this matter, at least for the European market environment, have been overstated. It is possible to give sufficient information without descending to loan-level data. The information provided by cash-flow servicers on alternative prepayment scenarios may be a reasonable second best. Leave the issuers to decide if they open their ABS portfolios for all investors at loan-level data. 6 4. The ECB triple-A rating requirement for ABS • The triple-A requirement (2 agencies) doesn’t have a solid justification and damages the ABS market • The introduction of rating requirements in Regulation, in particular in what refers to triple-A levels, has corrupted the ultimate sense and purpose of credit rating. • Triple-A is a thin and blurred line, understood but by a few, that in the financial world separates heaven from hell. Such a line should not be used as an instrument for regulatory discrimination • Data shows that the refinement of CRA analysis in the upper part of the rating scale is no more than an illusion and the product of models that produce thin results out of gross hypothesis • The financial system is wasting resources dancing around a notion of total absence of credit risk which neither logic nor reality sustains. • Triple-A requirements benefit some, because resources are distributed in their favour, but damages all by introducing instability in the system 7 Standard & Poor’s | RatingsDirect on the Global Credit Portal | May 17, 2010 8 9 ABS S&P Default Probabilities Term AAA AA A BBB BB B CCC CC 1 0,000% 0,001% 0,006% 0,062% 0,493% 1,246% 12,595% 100,000% 2 0,003% 0,019% 0,041% 0,266% 1,939% 4,086% 21,179% 100,000% 3 0,008% 0,042% 0,088% 0,488% 3,259% 6,987% 27,086% 100,000% 4 0,021% 0,083% 0,155% 0,822% 4,490% 10,013% 32,503% 100,000% 5 0,043% 0,144% 0,269% 1,255% 5,704% 13,073% 37,767% 100,000% 6 0,073% 0,218% 0,405% 1,699% 6,942% 15,963% 40,832% 100,000% 7 0,116% 0,315% 0,576% 2,203% 8,296% 18,599% 43,803% 100,000% 10 ABS Moody's Loss Default Table Term\Ratin g Aaa Aa2 A2 Baa2 Ba2 1 0,0000% 0,0007% 0,0060% 0,0935% 0,8580% 2 0,0001% 0,0044% 0,0385% 0,2585% 3 0,0004% 0,0143% 0,1221% 4 0,0010% 0,0259% 5 0,0016% 6 7 Caa2 Ca 3,9380% 14,3000% 55,0000% 1,9085% 6,4185% 17,8750% 55,0000% 0,4565% 2,8490% 8,5525% 21,4500% 55,0000% 0,1898% 0,6600% 3,7400% 9,9715% 24,1340% 55,0000% 0,0374% 0,2569% 0,8690% 4,6255% 11,3905% 26,8125% 55,0000% 0,0022% 0,0490% 0,3207% 1,0835% 5,3735% 12,4575% 28,6000% 55,0000% 0,0029% 0,0611% 0,3905% 1,3255% 5,8850% 13,2055% 30,3875% 55,0000% 11 B2 5. The Spanish ABS information framework (1/2) • The ABS market started in Spain in 1993 and it is regulated by law • Each ABS has to be structured by means of a SPV (Fondo de Titulización (FT)) and approved for registry by the CNMV • FTs are represented and administrated by management companies (Sociedades Gestoras de Fondos de Titulización (SGFT)). • There are 7 active SGFTs, with control of all the ABS transactions issued under Spanish legislation since the origin of the market in 1993. • SGFT functions – Loan-level monthly control of loan servicer data (typically on monthly basis) – Portfolio and bond information to supervisors and market on regular basis – Track performance of SPV contracts and rating compromises. Watch for any breach of contract, act accordingly to demand responsibilities if any and take the necessary steps to substitute counterparties if required. – Responsibility to liquidate the FT in favour of investors. • Spanish ABS require rating and external audit of the portfolio 12 5. The Spanish ABS information framework (2/2) • The ABS information framework is well established In Spain and applies to all underlying portfolios without distinction of asset type. • However, as of today, loan-level information doesn’t satisfy the standards of the ECB template, in particular in what refers to debtor’s data. • The Spanish ABS market, by means of the role played by SGFTs, is well positioned relatively to other EU markets to accomplish with the ECB information requirements. • The SGFT have in their data systems all the information on a loan by loan basis of all the Spanish ABS now in the market. • The Spanish SGFT in conjunction with the official market AIAF, where all ABS are listed, are proposing the ECB to create a unified web portal for Spanish ABS, to give investors access to whatever bond and loan information is required. 13 6. Securitisation versus covered bonds (1/2) • Transferring credit risk by means of securitisation and consequently reducing capital consumption has become more difficult. • Derecognising securitised assets has been increasingly difficult even before the crisis, at least in what refers to Spanish banks due to the supervisory practices of the Bank of Spain. • Expected new regulation to align issuers and investors and disincentive originate-to-distribute strategies, by requiring some form of tranche retention by originators, will also amount to a reduction in risk transfer, and consequently make securitisation less attractive for issuers. • Rating agencies have modified their criteria giving more importance to counterparty risk and commingling risk. This increases the cost of securitisation, in particular to those issuers which do not have maximum short-term rating level. 14 6. Securitisation versus covered bonds (2/2) • The SEC amendment to Rule 17 g-5 complicates ABS rating processes and increases its costs. • Requirements of information for accounting and supervisory purposes have increased dramatically for ABS as compared to CB. • Investors penalise the complexity of pass-through structures, typical of securitisation, in relation to the simplicity of CB. • SIVs had close to 60% of the outstanding volume of European ABS. It is very unlikely that these vehicles or other similar alternative play the same role in the future to sustain the ABS market. • The lack of homogeneity of ABS, even within the same class of collateral, reduces the possibility of liquidity. • The ECB discount facility penalises securitisation given both the double triple-A requirement, the higher haircut compared to the rest of discountable bonds and the opacity of the ABS valuation criteria. 15 7. The Future of Securitisation • If securitisation has been reduced to a funding tool and no longer can be used to optimise capital, why not use covered bonds instead? • The benefit of matching cash flows within the originating bank can not be the only justification for securitisation. • The concept of secured loan, which is the covered bond concept, can be easily expanded to all types of assets. • Bank funding should concentrate in high rated bonds, with simple financial characteristics: that is, adequately secured bullet bonds. Issued in ample and potentially liquid markets, where investors are concerned by and properly informed about the cover pools, but do not require loan-level information to evaluate market risks. • Risk transfer and capital optimisation, could be left to illiquid markets, where specialised investors will demand high information quality. • This could be the future of securitisation: transfer of risk by means of illiquid transactions where funding is not the issue, and a tool for (non-banking) future flows transactions. 16 José Antonio Trujillo – Chairman and CEO: jtrujillo@imtitulizacion.com Carmen Barrenechea – General Manager: cbarrenechea@imtitulizacion.com Manuel González Escudero – General Manager: mgonzalez@imtitulizacion.com Borja Sáez - Director: bsaez@imtitulizacion.com Mónica Hengstenberg - Director: monicah@imtitulizacion.com www.imtitulizacion.com www.imcedulas.com Plaza Pablo Ruíz Picasso 1, Torre Picasso, planta 23, 28020 MADRID Tel. +34 91 432 64 88 Fax +34 91 597 21 75 17