Document

advertisement

Chapter 14

Determinants

of the Money Supply

Introduction

In Ch 13, we developed a simple model of multiple

deposit creation which showed that the Central Bank

can influence MONEY SUPPLY through monetary

base. This is by using OMOs and discount loans.

However, the model assumes unrealistically that:

1) the public holds no cash (C) and;

2) banks hold no excess reserves (ER).

THE MONEY SUPPLY MODEL AND THE

MONEY MULTIPLIER

We now develop a more realistic money supply

model that allows for the fact that the public does

hold cash balances and banks can hold excess

reserves.

We link the monetary base, which the central bank

can better control, to the money supply (M for M1),

using the money multiplier (m).

Money Multiplier (m)

It is a ratio that shows how much the money supply

changes for a given change in the monetary base.

M= m x MB

(1)

Because the multiplier is larger than one, the monetary

base is called “high powered money”, meaning that a

change in monetary base (MB) by 1% leads to a

change in money supply (M) by more than 1%.

Deriving the Money Multiplier

Here we account for the possibility that depositors hold

some cash (outside the banking system) and banks hold

excess reserves. These two decisions affect the money

multiplier (m).

We assume that holdings of currency (C) and excess

reserves (ER) grow proportionally with checkable

deposits (D), which means that the following ratios are

constants:

{C/D} = currency ratio, {ER/D} = excess reserve ratio

Next, we derive a formula showing how these ratios

plus the required reserve ratio affect m.

Total reserves equal the sum of required reserves (RR)

and excess reserves (ER):

R = RR + ER

We know that RR equals checking deposits multiplied

by the reserve requirement ratio, thus R equals:

R = ( RRR x D ) + ER

But MB equals to C plus R, thus it can be rewritten

using the above equation as follows:

MB = R + C = ( RRR x D ) + ER + C

This equation shows the amount of MB needed to

support the existing amounts of checkable deposits,

currency and excess reserves.

To derive a formula for m in terms of the currency and

excess reserve ratios, we rewrite the above equation

specifying

C as {C / D} X D and ER as {ER / D} X D, as follows:

MB = ( RRR x D ) + ({ER / D} X D) + ({C / D} X D)

= ( RRR + {ER / D} + {C / D}) X D

Next, divide both sides of the equation by the term inside the

parentheses to get an expression linking checkable deposits

(D) to the monetary base (MB):

D = [1 / (RRR + {ER / D} + {C / D})] X MB……... (2)

Using the definition of money supply as currency plus

checkable deposits (M = D + C) and specifying C as {C / D}

X D,

M = D + ({C / D} X D)

= (1 + {C/D}) X D

Substituting equation (2) for D in the above equation,

we have

M = [(1+{C/D}) / (RRR + {ER / D} + {C / D})] X MB (3)

Equation (3) is a detailed form of equation (1)

(M = m x MB), to get an expression for m, we have to

divide both sides of equation (3) by MB:

m = [(1+ {C/D}) / (RRR + {ER / D} + {C / D})] (4)

Clearly, m depends on: {C/D} set by depositors,

{ER/D} set by banks, and (RRR) set by the central bank.

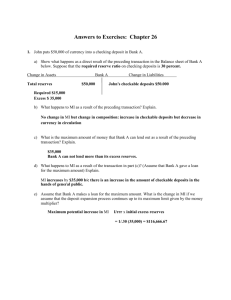

Example

Given: RRR = 10%, ER = $0.8 billion, C = $400 billion

, D = $800 billion, ………………Calculate m?

We can calculate the currency and excess reserve ratios:

C/D =

/

=

ER/D =

/

=

The money multiplier is calculated as follows:

m=

Given -----------------M= m(MB)

The multiplier shows that an increase in MB by( $ 1)

leads to an increase in money supply by $____.

The value of (m) is much smaller than 10, which was

expected from the model in chapter 13. There are two

reasons for the low value found here:

First, we allow for the possibility that the public hold

currency proportional to their holdings of deposits.

Second, banks are also allowed to hold excess reserves

proportional to the value of deposits.

Factors that Determine the Money Multiplier

1. Changes in RRR

If RRR increases, more required reserves are needed

proportional to the level of checkable deposits.

This reduces the bank’s ability to lend, so loans will

decline and as a result (new) deposits decline too.

Finally, money supply has to decline.

But since money supply has declined while MB didn’t

change, this means that (m) must have declined

{M=m (MB)}.

In other words, if RRR is higher, less multiple expansion

of checkable deposits occur which means that (m) must

fall.

Example

If RRR increases from 10% to 15%.

m=

Result:

The money supply and the money multiplier are

_________ related to the required reserve ratio.

2. Changes in {C/D}

An increase in {C/D} means that depositors are

converting some of their checkable deposits into

currency.

As it was shown in chapter 13, checkable deposits

undergo multiple expansion while currency does not.

Therefore, an increase in currency results in a decline in

the level of multiple expansion and (m) too.

Example

If {C/D} rises from 0.5 to 0.75.

m=

Result:

The money multiplier and the money supply are

_________ related to the currency ratio.

3. Changes in {ER/D}

When banks increase their holdings of excess reserves,

this means that for the same level of MB, banks will

reduce their loans, causing a decline the level of

checkable deposits and a decline in the money supply.

As a result, m must fall.

Example

If {ER/D} rises from 0.001 to 0.005.

m =

Result:

The money multiplier and the money supply are

__________related to the excess reserve ratio.

SUMMARY

VARIABLE

MB

RRR

C/D

ER/D

CHANGE

Increase

Increase

Increase

Increase

REPSONSE IN MS

________

________

________

________