Risk, Return, and Discount Rates

Capital Market History

and

The Risk/Return Relation

How Are Risk and Expected

Return Related?

There are two main reasons to be concerned

with this question.

(1) When conducting discounted cash flow analysis, how

should we adjust discount rates to allow for risk in the

future cash flow stream?

(2) When saving/investing, what is the tradeoff between

taking risks and our expected future wealth?

Here we concentrate on the first of these questions. We will

however develop the answer to the first question by asking

the second. They are opposite sides of the same coin.

Discounting Risky Cash Flows

How must the discount rate change in our standard

NPV calculation if the cash flows are not riskless?

– This is more easily answered from the “other side.”

What must be the expected return on a risky asset so

you are happy to own it rather than a riskless asset?

– Risk averse investors say that to hold a risky asset they

require a higher expected return than they require for

holding a riskless asset. E(rrisky) = rf + .

» Note now that we have to start to talk about expected returns

since risk is being explicitly examined.

– Since a “comparable alternative” to a risky project is

owning a risky security the discount rate must also rise.

How does the expected return on a risky asset relate to the

risk of that asset? It is easy to see that expected return

should increase with the amount risk.

Expected

Return

Risk

But, how should risk be measured?

At what rate does the line slope up? At what level does it start?

Is it even a line?

Lets look at some simple but important historical evidence.

The Future Value of an Investment

of $1 in 1926

$1 (1 r1926 ) (1 r1927 ) (1 r1999 ) $2,845.63

1000

$40.22

$15.64

10

Common Stocks

Long T-Bonds

T-Bills

0.1

1930

1940

1950

1960

1970

1980

1990

2000

Source: © Stocks, Bonds, Bills, and Inflation 2000 Yearbook™, Ibbotson Associates, Inc., Chicago (annually updates work by

Roger G. Ibbotson and Rex A. Sinquefield). All rights reserved.

Rates of Return 1926-1999

60

40

20

0

-20

Common Stocks

Long T-Bonds

T-Bills

-40

-60 26

30

35

40

45

50

55

60

65

70

75

80

85

90

95

Source: © Stocks, Bonds, Bills, and Inflation 2000 Yearbook™, Ibbotson Associates, Inc., Chicago (annually updates work by

Roger G. Ibbotson and Rex A. Sinquefield). All rights reserved.

Risk, More Formally

Many people think intuitively about risk as the possibility

of an outcome that is worse than what one expected.

Useful but limited, if things can be worse they can also be

better than expected. Risk is the possibility of an outcome

being different than expected.

– For those who hold more than one asset, is it the risk of

each asset they care about, or the total risk of their

entire portfolio?

The standard construct for thinking rigorously about risk:

– The “probability distribution.”

– A list of all possible outcomes and their probabilities.

Example: Two Probability Distributions

on Tomorrow's Share Price.

Which implies more risk?

0.6

0.5

0.4

0.3

0.2

0.1

0

0.4

0.3

0.2

0.1

0

10 12 13 14 16

10 12 13 14 16

Risk and Probability Distributions

In very simple cases, we specify the probability

distributions completely.

Most often, we use parameters of the historical

distribution to summarize important information.

The expected value, which is the center or

mean of the distribution. When we think of

returns as random this is expected return.

The variance or standard deviation, which

measure the dispersion of possible outcomes

around the mean. We noted this captures risk.

Historical Returns, 1926-1999

Series

Average

Annual Return

Standard

Deviation

Large Company Stocks

13.0%

20.3%

Small Company Stocks

17.7

33.9

Long-Term Corporate Bonds

6.1

8.7

Long-Term Government Bonds

5.6

9.2

U.S. Treasury Bills

3.8

3.2

Inflation

3.2

4.5

– 90%

Distribution

0%

+ 90%

Source: © Stocks, Bonds, Bills, and Inflation 2000 Yearbook™, Ibbotson Associates, Inc., Chicago (annually updates work by

Roger G. Ibbotson and Rex A. Sinquefield). All rights reserved.

The Risk-Return Tradeoff

18%

Small-Company Stocks

Annual Return Average

16%

14%

Large-Company Stocks

12%

10%

8%

6%

T-Bonds

4%

T-Bills

2%

0%

5%

10%

15%

20%

25%

Annual Return Standard Deviation

30%

35%

Summary

An old saying on Wall Street is “You can either

sleep well or eat well.”

More than being simply colorful the idea is to

constantly remind people that greater reward

(expected reward) comes only with exposure to

greater risk.

The “other side” of the question then suggests that

for projects with risky cash flows the appropriate

discount rate must be higher than that for a project

with risk free cash flows.

The Capital Asset Pricing Model

The Risk Return Relation Formalized

Summary

E(r) = rf + .

= amount of risk premium per unit risk.

Defined the “market portfolio” as having one unit

of risk; Var(rm) = 1 “unit of risk.”

Risk premium per unit of risk is then E(rm) – rf.

Diversification implies that an asset’s contribution

to the risk of a large portfolio is measured not by

Var(ri) or STD (ri) but Cov(ri, rm).

Standardize Cov(ri, rm) by Var(rm) (to get it as the

number of “units”) and get i as the measure of

risk of any asset i.

Then: E(ri) = rf + i (E(rm) – rf) the famous SML.

Risk and Return

When we consider only large portfolios risk and

return can be measured, as we discussed, using

expected return and standard deviation of return.

When we want to consider individual assets, risk

and return are more complex.

There are two types of risk for individual assets:

– Diversifiable/nonsystematic/idiosyncratic risk

– Nondiversifiable/systematic/market risk

Think of an asset’s risk as being the sum of two

parts: risk = M + D

Nonsystematic/diversifiable risks

Examples

– Firm discovers a gold mine beneath its property

– Lawsuits

– Technological innovations

– Labor strikes

The key is that these events are random and

unrelated across firms. For the assets in a

portfolio, some surprises are positive, some are

negative. If your portfolio is made up of a large

number of assets, across assets, the surprises offset

each other .

Systematic/Nondiversifiable risk

We know that the returns on different assets are positively

correlated with each other on average. This suggests that

economy-wide influences affect all assets.

Examples:

– Business Cycle

– Inflation Shocks

– Productivity Shocks

– Interest Rate Changes

– Major Technological Change

These are economic events that affect all assets in a similar

way. The risk associated with these events does not

disappear in well diversified portfolios as they tend to be in

the same direction for all/most firms.

Diversification

One of the most important lessons in all of finance

has to do with the power of diversification.

Part of the risk of an asset can be diversified away

without loss of expected return. A great benefit.

This also means that no compensation needs to be

provided to investors for exposing their portfolios

to this type of risk.

Which in turn implies that the risk/return relation

is a systematic risk/return relation.

Diversification Example

Suppose a large green ogre has approached

you and demanded that you enter into a bet

with him.

The terms are that you must wager $10,000

and it must be decided by the flip of a coin,

where heads he wins and tails you win.

What is your expected payoff and what is

your risk?

Example…

The expected payoff from such a bet is of

course $0 if the coin is fair.

We can calculate the standard deviation of

this “position” as $10,000, reflecting the

wide swings in value across the two

outcomes (winning and losing).

Can you suggest another approach that stays

within the rules?

Example…

If instead of wagering the whole $10,000 on one

coin flip think about wagering $1 on each of

10,000 coin flips.

The expected payoff on this version is still $0 so

you haven’t changed the expectation.

The standard deviation of this version, however, is

$100.

Why?

If we bet a penny on each of 1,000,000 coin flips?

The risk, measured by standard deviation, is $10.

Example…

The example works so well at reducing risk

because the coin flips are “independent.”

If the coins were somehow perfectly correlated we

would be right back in the first situation.

With 10,000 flips, for “flip correlations” between

zero (independence) and perfect correlation the

measure of risk lies between $100 and $10,000.

This is one way to see that the way an “asset”

contributes to the risk of a large “portfolio” is

determined by its correlation or covariance with

the other assets in the portfolio.

Portfolio Risk

Above, we characterized the risk of an asset as:

M + D.

What we have just seen is that the D part (the part that is

independent across assets) goes away in large portfolios at

no cost (no reduction in expected return).

We have also argued that M (the risk that is left after

diversification) is measured by the covariance between the

assets in the portfolio.

Once we standardize covariance to put it in terms of our

“one unit of risk” we wind up with the very famous beta

coefficient (β) for stocks.

Beta

Beta is just as we said “standardized covariance”

βi = Cov(ri, rm)/Var(rm).

Alternatively we can think of it as a sensitivity

measure.

– The beta of the “market portfolio” is 1; one unit of risk.

– When the market is unexpectedly up 5%, an asset with

a beta of ½ will, on average, have a return 2.5% above

its expected return.

– What about an asset with a beta of 2.0?

Most importantly beta measures the systematic

risk (its contribution to portfolio risk) of an asset.

Betas and Portfolios

The beta of a portfolio is the weighted average of the

component assets’ betas.

Example: You have 30% of your money in Asset X, which

has X = 1.4 and 70% of your money in Asset Y, which has

Y = 0.8.

Your portfolio beta is:

P = .30(1.4) + .70(0.8) = 0.98.

Why do we care about this feature of betas?

– It shows directly that an asset’s beta measures

the contribution that asset makes to the

systematic risk (β) of a portfolio!

Expected Returns and Portfolios

Just as with betas, the expected return on a

portfolio is a weighted average of the expected

returns on the individual assets in the portfolio.

Example: You have 30% of your money in Asset

X, which has E(rX) = 16.2% and 70% of your

money in Asset Y, which has E(rY) = 11.4.

Your portfolio expected return is:

E(rP) = .30(16.2) + .70(11.4) = 12.84.

CAPM Intuition

E[ri] = rF (risk free rate) + θ (Risk Premium)

= Appropriate Discount Rate

Risk free assets earn the risk-free rate (think of

this as a rental rate on capital).

If the asset is risky, we need to add a risk

premium.

The risk premium is simply the number of units of

systematic risk times the price per unit of

systematic risk.

The CAPM Intuition Formalized

Cov(ri , rM )

E[ri ] rF

[E[r M ] rF ]

Var(rM )

or,

E[ri ] rF i [E[rM ] rF ]

Number of units of

systematic risk ()

Market Risk Premium

or the price per unit risk

• The expression above is referred to as the “Security

Market Line” (SML).

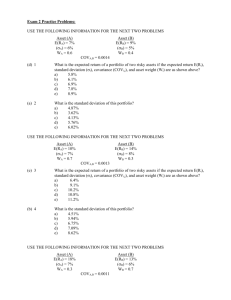

Problems

The current risk free rate is 4% and the expected

risk premium on the market portfolio is 7%.

– An asset has a beta of 1.2. What is the expected return

on this asset? Interpret the number 1.2.

– An asset has a beta of 0.6. What is the expected return

on this asset?

– If we invest ½ of our money in the first asset and ½ of

our money in the second, what is our portfolio beta and

what is its expected return?

Problem

The current risk free rate is 4% and the expected

risk premium on the market portfolio is 7%.

– You work for a software company and have been asked

to estimate the appropriate discount rate for a proposed

investment project.

– Your company’s stock has a beta of 1.3.

– The project is a proposal to begin cigarette production.

– RJR Reynolds has a beta of 0.22.

What is the appropriate discount rate and why?