31. On December 1, you borrow $210,000 to buy a house. The

advertisement

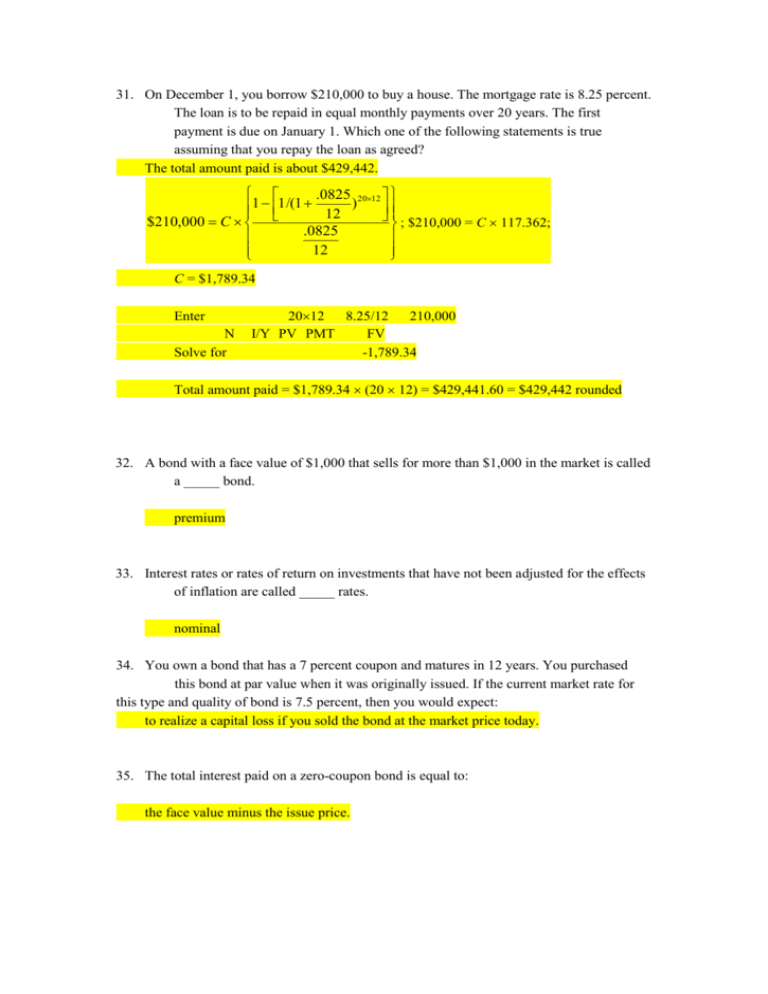

31. On December 1, you borrow $210,000 to buy a house. The mortgage rate is 8.25 percent. The loan is to be repaid in equal monthly payments over 20 years. The first payment is due on January 1. Which one of the following statements is true assuming that you repay the loan as agreed? The total amount paid is about $429,442. .0825 2012 1 1 /(1 12 ) $210,000 C ; $210,000 = C 117.362; .0825 12 C = $1,789.34 Enter N Solve for 2012 8.25/12 210,000 I/Y PV PMT FV -1,789.34 Total amount paid = $1,789.34 (20 12) = $429,441.60 = $429,442 rounded 32. A bond with a face value of $1,000 that sells for more than $1,000 in the market is called a _____ bond. premium 33. Interest rates or rates of return on investments that have not been adjusted for the effects of inflation are called _____ rates. nominal 34. You own a bond that has a 7 percent coupon and matures in 12 years. You purchased this bond at par value when it was originally issued. If the current market rate for this type and quality of bond is 7.5 percent, then you would expect: to realize a capital loss if you sold the bond at the market price today. 35. The total interest paid on a zero-coupon bond is equal to: the face value minus the issue price. 36. The bonds issued by Jensen & Son bear a 6 percent coupon, payable semiannually. The bond matures in 8 years and has a $1,000 face value. Currently, the bond sells at par. What is the yield to maturity? 6.00 percent r 1 1 /(1 )8 2 .06 $1,000 $1,000 2 $1,000 ; This can not be solved r r 2 (1 )8 2 2 2 directly, so it’s easiest to just use the calculator method to get an answer. You can then use the calculator answer as the rate in the formula just to verify that your answer is correct. Enter N Solve for 82 /2 -1,000 I/Y PV PMT FV 6 60/2 1,000 Answer is 6.00 percent 37. Mitzi’s, II. Bonds offer a 6 percent coupon at a current market price of $989. The bonds have a face value of $1,000 and a call price of $1,020. What is the current yield on these bonds? 6.07 percent Current yield = .06 $1,000 .06067 6.07 percent (rounded) $989 38. Next year’s annual dividend divided by the current stock price is called the: dividend yield. 39. A member of the New York Stock Exchange acting as a dealer in one or more securities on the exchange floor is called a: specialist. 40. Fred Flintlock wants to earn a total of 10 percent on his investments. He recently purchased shares of ABC stock at a price of $20 a share. The stock pays a $1 a year dividend. The price of ABC stock needs to _____ if Fred is to achieve his 10 percent rate of return. increase by 10 percent