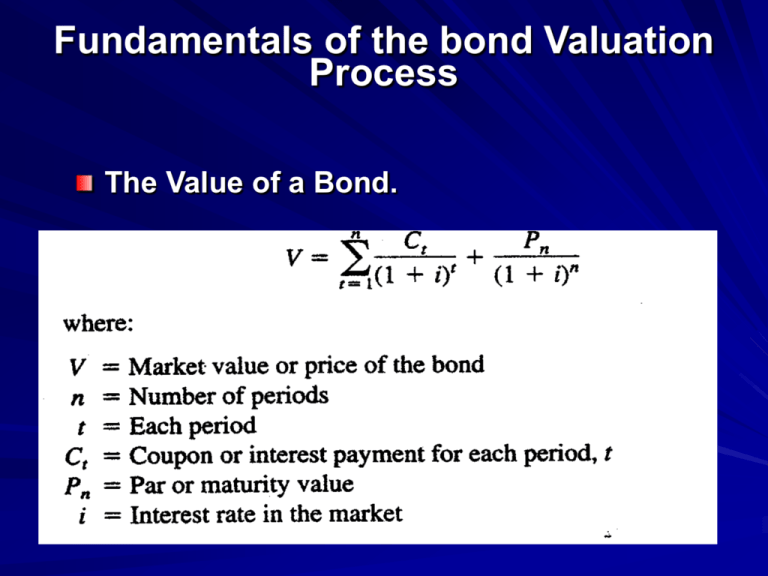

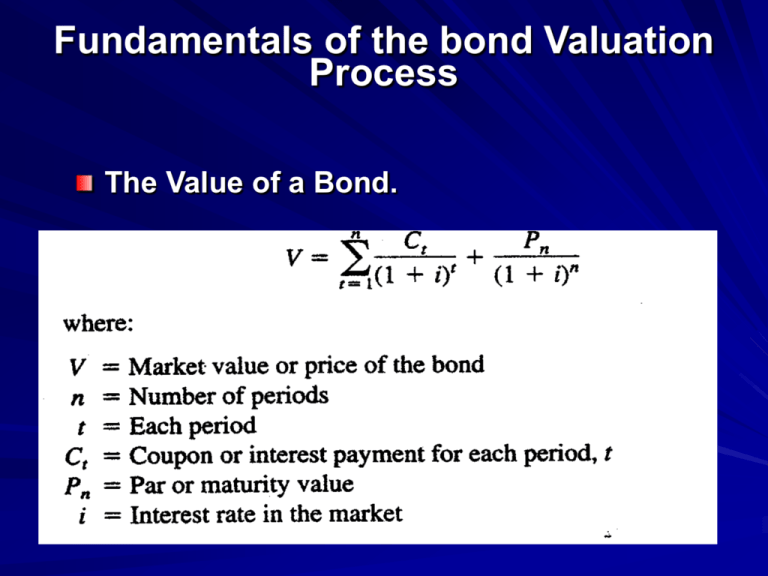

Fundamentals of the bond Valuation

Process

The Value of a Bond.

Computing Bond Yields

Yield Measure

Purpose

Nominal Yield

Measures the coupon rate

Current yield

Measures current income rate

Promised yield to

maturity

Promised yield to

call

Measures expected rate of return for bond held

to maturity

Measures expected rate of return for bond held

to first call date

Measures expected rate of return for a bond

likely to be sold prior to maturity. It considers

specified reinvestment assumptions and an

estimated sales price. It can also measure the

actual rate of return on a bond during some past

period of time.

Realized (horizon)

yield

Rates of Return

Approximate Promised Yield

APY = C + (Par – Market Price)/ NMaruity

.60 ( Market Price) + .4 (Par)

Yield to Call:

AYC = C + (Call Price – Market Price)/ NCall

.60 ( Market Price) + .4 (Call Price)

Approximate Realized Yield

ARY = C + (Realized Price – Market Price)/ NRealize

.60 ( Market Price) + .4 (Realize Price)

Corporate Bond Quotes

Cur

Bonds

Yld Vol Close

ATT 81/8 22 7.7 52 1053/8

Net

Chg

+ 1/4

52 of these bonds traded that day

Issued by AT&T

8.125% coupon rate; matures in 2022

Current yield = coupon/market price = 7.7%

The closing price was 105 3/8% of par which was up 1/4

from the prior day

Term Structure of Interest Rates

The relationship between maturity and

interest rates. It is also known as the Yield

Curve.

Expectations Hypothesis suggests that the

long-term rate is an average of the

expectations of the future short-term rates

over the applicable time horizon.

Reinforced by borrower/lender strategies.

Figure 12-1 Term Structure of Interest

Rates

Yield

Yield

Normal

a

b

Maturity

Maturity

Yield

Yield

c

Maturity

d Maturity

The Movement of Interest Rates

(cont.)

Liquidity Preference Theory states that the

shape of the yield curve is upward sloping.

Investors will pay a higher price for short-term

securities because they are more easily turned

into cash without the risk of large price changes.

Investors demand higher returns from longerterm securities.

The Movement of Interest Rates

(cont.)

Market Segmentation Theory focuses on

the demand side of the market.

– Banks tend to prefer Short Term liquid

securities to match the nature of their

deposits.

– Life insurance companies invest in Long-Term

bonds to match their Long-Term obligations.

Yield to

Maturity

Bond Value table

Coupon Rate 12 percent

Number of Years

10

20

30

8%

127.18%

139.59%

145.25%

10

112.46

117.16

118.93

12

100.00

100.00

100.00

14

89.41

86.55

85.96

Source: Reprinted by permission from the Thorndike Encyclopedia of Banking and financial tables, 1981. Copyright

©1981, Warren, Gorham and Lamont Inc. 210 South Street, boston MA. All rights reserved.

Investment Strategy: InterestRate Considerations

Bond Pricing Rules

– 1. Bond prices and interest rates are

inversely related.

– 2. Prices of long-term bonds are more

sensitive to a change in yields to maturity

than short-term bonds.

– 3. Bond price sensitivity increases at a

decreasing rate as maturity increases.

Investment Strategy: Interest-Rate

Considerations (cont.)

– 4. Bond prices are more sensitive to a decline in

market YTM than to a rise in YTM.

– 5. Prices of low-coupon bonds are more sensitive to

a change in YTM than high coupon bonds.

– 6. Bond prices are more sensitive when YTM is low

than when YTM is high.

– 7. Margin trading magnifies profits and losses of

bond investments by a factor of 1/(margin

requirement).

What Determines the

Price Volatility for Bonds

Five observed behaviors

1. Bond prices move inversely to bond yields (interest rates)

2. For a given change in yields, longer maturity bonds post

larger price changes, thus bond price volatility is directly

related to maturity

3. Price volatility increases at a diminishing rate as term to

maturity increases

4. Price movements resulting from equal absolute increases or

decreases in yield are not symmetrical

5. Higher coupon issues show smaller percentage price

fluctuation for a given change in yield, thus bond price

volatility is inversely related to coupon

What Determines the

Price Volatility for Bonds

The maturity effect

The coupon effect

The yield level effect

Some trading strategies

The Duration Measure

Since price volatility of a bond varies

inversely with its coupon and directly with

its term to maturity, it is necessary to

determine the best combination of these

two variables to achieve your objective

A composite measure considering both

coupon and maturity would be beneficial

The Duration Measure

n

Ct (t )

t

t 1 (1 i )

D n

Ct

t

t 1 (1 i )

n

t PV (C )

t

t 1

price

Developed by Frederick R. Macaulay, 1938

Where:

t = time period in which the coupon or principal payment occurs

Ct = interest or principal payment that occurs in period t

i = yield to maturity on the bond

Characteristics of Duration

Duration of a bond with coupons is always less than

its term to maturity because duration gives weight to

these interim payments

– A zero-coupon bond’s duration equals its

maturity

There is an inverse relation between duration and

coupon

There is a positive relation between term to maturity

and duration, but duration increases at a decreasing

rate with maturity

There is an inverse relation between YTM and

duration

Sinking funds and call provisions can have a

dramatic effect on a bond’s duration

Modified Duration and Bond Price

Volatility

An adjusted measure of duration can be

used to approximate the price volatility of a

bond

Macaulay duration

modified duration

YTM

1

Where:

m

m = number of payments a year

YTM = nominal YTM

Duration and Bond Price Volatility

Bond price movements will vary proportionally with

modified duration for small changes in yields

An estimate of the percentage change in bond prices

equals the change in yield time modified duration

P

100 Dmod i

P

Where:

P = change in price for the bond

P = beginning price for the bond

Dmod = the modified duration of the bond

i = yield change in basis points divided by 100

Trading Strategies Using Duration

Longest-duration security provides the maximum

price variation

If you expect a decline in interest rates, increase

the average duration of your bond portfolio to

experience maximum price volatility

If you expect an increase in interest rates, reduce

the average duration to minimize your price

decline

Note that the duration of your portfolio is the

market-value-weighted average of the duration of

the individual bonds in the portfolio

Matched-Funding Techniques

Immunization Strategies

– A portfolio manager (after client consultation)

may decide that the optimal strategy is to

immunize the portfolio from interest rate

changes

– The immunization techniques attempt to

derive a specified rate of return during a given

investment horizon regardless of what

happens to market interest rates

Immunization Strategies

Components of Interest Rate Risk

– Price Risk

– Coupon Reinvestment Risk

Classical Immunization

Immunization is neither a simple nor a

passive strategy

An immunized portfolio requires frequent

rebalancing because the modified duration

of the portfolio always should be equal to

the remaining time horizon (except in the

case of the zero-coupon bond)

Classical Immunization

Duration characteristics

– Duration declines more slowly than term to

maturity, assuming no change in market

interest rates

– Duration changes with a change in market

interest rates

– There is not always a parallel shift of the yield

curve

– Bonds with a specific duration may not be

available at an acceptable price