Practice Problems

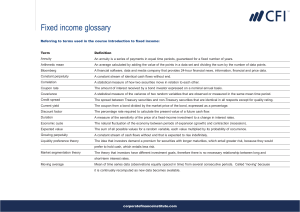

advertisement

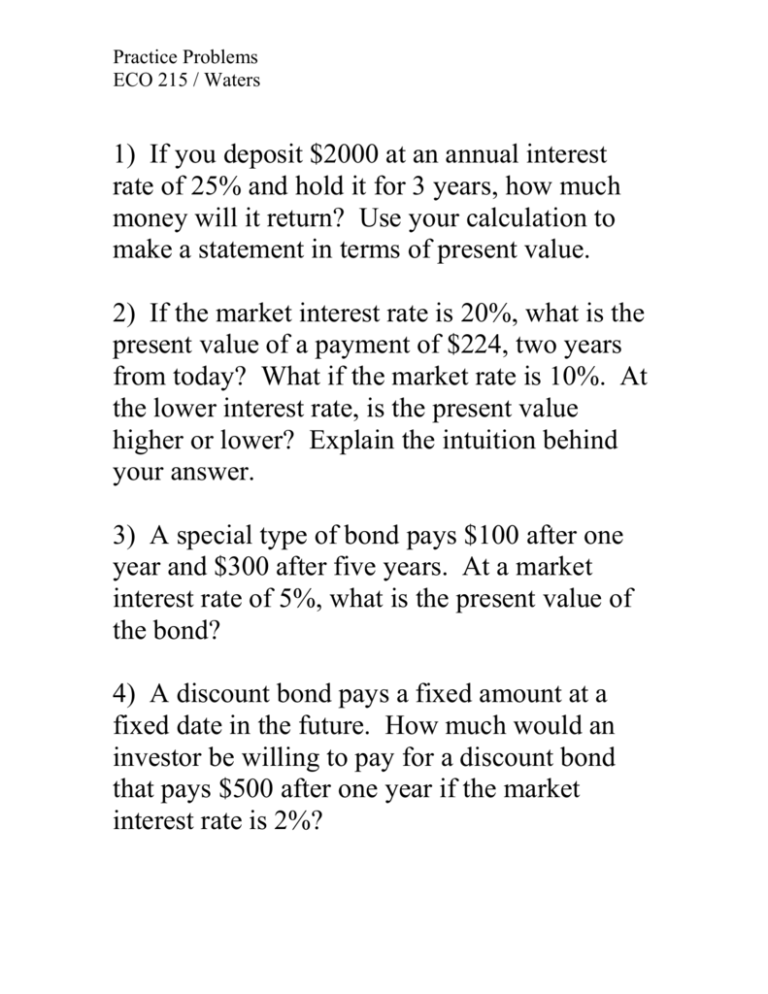

Practice Problems ECO 215 / Waters 1) If you deposit $2000 at an annual interest rate of 25% and hold it for 3 years, how much money will it return? Use your calculation to make a statement in terms of present value. 2) If the market interest rate is 20%, what is the present value of a payment of $224, two years from today? What if the market rate is 10%. At the lower interest rate, is the present value higher or lower? Explain the intuition behind your answer. 3) A special type of bond pays $100 after one year and $300 after five years. At a market interest rate of 5%, what is the present value of the bond? 4) A discount bond pays a fixed amount at a fixed date in the future. How much would an investor be willing to pay for a discount bond that pays $500 after one year if the market interest rate is 2%? 5) A coupon bond has a $1000 face value, a coupon rate of 2% and a time to maturity of two years. If the yield to maturity of the bond is 3%, what is the price? Answers: 1) $3906.25, If the interest rate is 25%, the present value of a payment of $3906.25 three years in the future is $2000. 2) At 20% PV=$155.56, at 10% PV=$185.12, At the lower rate the present value is higher. At a lower interest rate, money today is worth less, so future payments are relatively more valuable. 3) $330.30 4) $490.20 5) $980.87