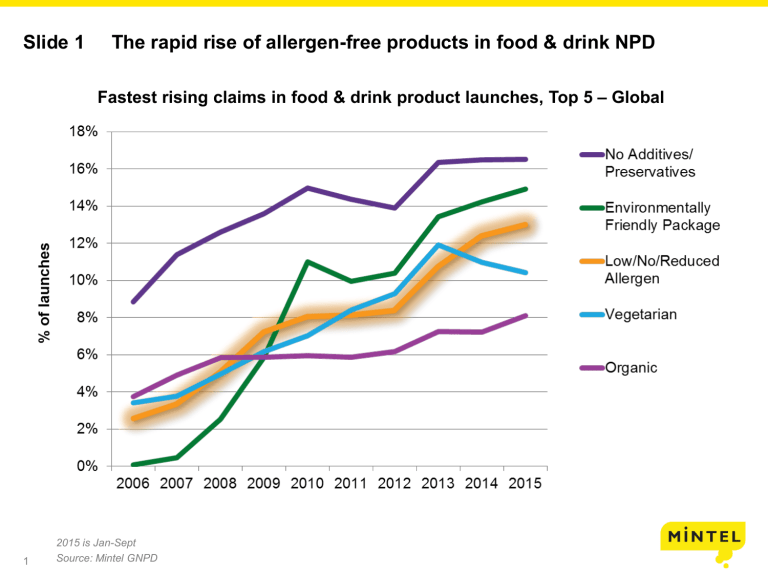

Free-from Developments and Bakery Product Innovation

advertisement

Slide 1 The rapid rise of allergen-free products in food & drink NPD Fastest rising claims in food & drink product launches, Top 5 – Global 1 2015 is Jan-Sept Source: Mintel GNPD Slide 2 Gluten-free is the driving force Gluten-free claim penetration in food & drink launches - per region Driven by legislative requirement for gluten disclosure in Brazil The most innovative regions by some distance Consistent progress, led by Spain, Germany, UK, Italy 2 2015 is Jan-Sept Source: Mintel GNPD Slide 3 US, by far the largest market for gluten-free Gluten-free food & drink $8.8 bn market value in 2014 62% value growth forecast 2014-2017 25% of adults said they eat gluten-free versions of food in June 2015, compared to 22% in June 2014 3 Source: Mintel Reports A wide range of health-related issues influence perception of gluten-free Other (than intolerance/sensitivity) reasons for eating gluten-free foods, US, June 2014 Slide 4 The UK is less dynamic (than the US), but still a fast growing market • • Total UK free from market valued at £365m in 2014, forecast to grow by 50% by 2019 Both the dairy-free and gluten-free segments continue to record impressive growth (both seeing 15% growth between 2013 and 2014) 2014: Gluten/wheat-free: £184m +15.0% on 2013 Dairy/lactose-free: £181m +15.3% on 2013 4 Excludes prescription sales Source: Mintel Reports (based on IRI/Mintel) Slide 5 Penetration of free-from food reaches 30% Three in 10 people in the UK had bought or eaten free-from food in the six months to June 2014, with gluten-free and dairy substitutes being the most commonly purchased/eaten – by 18% and 17% respectively. 5 Source: Mintel Reports Slide 6 Millennials are more influenced by new ‘free from’ lifestyles UK 16-34 year olds are 31% more likely than average to avoid red meat and/or poultry They are 40% more likely than average to avoid dairy and/or lactose They are also 40% more likely than average to avoid wheat and/or gluten 6 Source: Source:Free-from Mintel Reports Foods - UK - November 2014 Figure 1 The “Lifestylers” account for almost half of the ‘free from’ audience 39% of people live in households where somebody is avoiding specific foods/ingredients because of an allergy/intolerance or because of a lifestyle choice Of the avoiders, almost half (46%) do so “as part of a general healthy lifestyle” with the remainder having “an allergy or food tolerance” 7 Source: Mintel Reports Slide 7 UK: avoidance driven as much by healthy lifestyles than intolerance Types of food avoided, UK, June 2014 8 Source: Mintel Reports Slide 8 Healthy image, variety, naturalness and weight control benefits all appeal above personal allergy/intolerance Reasons for eating free-from foods, UK, September 2015 • 9 Source: Mintel Reports The top reason consumers don’t eat free-from foods is because they are deemed as too expensive compared to standard foods (39%), followed by the belief that they do not taste as good as standard alternatives (22%) Slide 9 Food launches by selected health/natural claim: GF vs. Non-GF Gluten-free vs. Non-Gluten-free, Europe, Oct 2012 – Sept 15 % of launches by selected claim 10 Slide 10 Riding the craze for trendy ingredients – protein, ancient grains, almond/coconut High protein claims are increasingly coming into mainstream products but free-from has already been riding the craze Wholesome Chow Organic Gluten Free Hi-Protein Pancake & Baking Mix (US) 11 Source: Mintel GNPD Enjoy Life Brownie Mix with Ancient Grain made with teff and flaxseed (US) Melro's Best Simply Oragnic Raw Coconut Brownie (France) Slide 11 Bread brands work harder to convey health • Genius adapts its bread recipes – now boasting low levels of saturated fat and high levels of fibre, as well as no artificial preservatives and additional vitamins and minerals (some lines containing omega-3 or iron) • Dr. Schär USA revamps with a new line of Artisan Baker breads, baked with ancient grains Silver Hills Gluten Free Omega Flax Bread contains high fibre omega 3 flax seeds (US) 12 Source: Mintel GNPD PureBred Bakery Multigrain Farmhouse Loaf is a gluten-free, five grain high fibre loaf with omega 3 rich seed mix (UK) Slide 12 What’s next – watch for grain-free Simple Mills Naturally GlutenFree Chocolate Muffin & Cake Almond Flour Mix (US) 13 Source: Mintel GNPD Paleonola Pumpkin Pie Grain Free Granola (US) Slide 13 Bakery remains fragmented globally • Grupo Bimbo is the biggest baking company in the world but it still claims less than a 5% share of the global baking industry according to its own estimates. This despite a very acquisitive few years for the company, including buying Canada Bread in 2014 No.1 in North America - 26% value share of bread market in the US 32% in Canada No. 1 in Latin America, e.g.: - 34% value share of bread market in Brazil 55% in Chile 56% in Colombia 85% in Mexico Also a leader in sweet bakery in those regions But elsewhere it’s more ‘patchy’: • • 14 **Market share Source: Grupo Bimbo company information / Mintel Market Sizes No.1 in Spain/Portugal and also present in the UK with New York Bakery Co. Small presence in China (c1% share) Slide 14 Grupo Bimbo - recent NPD of note • Bimbo Bakeries in the US has a range of mainstream bread brands and has been prioritising a healthier positioning for many of these. The company has had particular recent success with the Thomas’ brand, with high recent sellers including a limited edition cinnamon vanilla English muffin, and protein and fibre fortified versions Thomas' Double Protein Oatmeal English Muffins Comprise a blend of wheat and rice protein. The low fat product is free from trans fat and cholesterol, it contains 7g of protein per serving 15 Source: Mintel GNPD Healthfull Bread - available in Flax & Sunflower, Steel Cut Oats & Honey, and Nuts & Seeds variations Contains no high-fructose corn syrup or artificial colors or flavors Brownberry Natural Health Nut Bread Made with natural ingredients, including almonds/walnuts, provides 8g of wholegrain and 3g of fibre per slice Slide 15 Yamazaki Baking – recent NPD of note Yamazaki has used seasonality in many of its launches, as well as co-branding, and has also more directly targeted children through new products such as lunch pack sandwiches aimed specifically at this demographic Yamazaki Lunchpack Milk Coffee Cream Sandwich (limited edition) Features milk coffee cream designed to resemble Ucc Milk Coffee Yamazaki Lunch Pack Three Berries Chocolate Tablet & Yogurt Cream Sandwich Fiilled with a chocolate tablet with three berry syrups and yogurt cream with Disney design 16 Source: Mintel GNPD Yamazaki Wonut Strawberry Chocolate Waffle Doughnut Yamazaki has introduced numerous packaged hybrid bakery products, such as cronut variants and this ‘Wonut’ Yamazaki Ensaïmada Originally from Spain. The soft fluffy bread contains cheese and is saturated in sugar and margarine. It is common to see European specialities re-configured in the Yamazaki range and in singleportion packs Slide 16 • Aryzta – recent NPD of note On the back growth for American-style bakery products in Europe, Aryzta has launched its Otis Spunkmeyer brand into the foodservice sector in Europe with its range of cookies, donuts and muffins. It is also embarking on a US retail push for the brand in 2016 US retail push for Otis Spunkmeyer The new retail line will begin hitting shelves in early 2016 and will go beyond the cookies and muffins the company long has been known for 17 Source: Mintel GNPD In the UK, Aryzta has been focussing on the ethnic bread market recently, launching a new line of Planet Deli naan breads in the retail market Aryzta has also been expanding its Wrapped to Go range in the UK, including with the above salted caramel shortbread bar Under the Cuisine de France unit, Aryzta has also recently launched ‘Le Twist’, an almond encrusted pastry filled with crème patissiere Slide 17 Flowers Foods – recent NPD of note • Pushing naturalness/quality under Nature’s Own and Cobblestone Bread Co. brands, although more NPD can be expected from the Wonder brand following its integration into the business in 2013/2014 Has also made a big push into organic in 2015, buying Dave’s Killer Bread and Alpine Valley • Natures Own White Enriched Bread No trans fat, cholesterol, artificial preservatives, colors, flavors or HFCS. 35% less sodium and x5 the fiber of enriched white bread Flowers has this year cut the number of ingredients in Nature’s Own bread (the best-selling bread brand in the US) to 14 from 26 18 Source: Mintel GNPD Cobblestone Bread Co. Knead for Seed 12 Grain Bread Cobblestone is Flowers new brand described as “everyday artisan” bread aimed at the millennial generation with a big focus on social media and sandwich recipe idea generation “The cure for the sandwich rut” Dave's Killer Bread Sprouted Wheat Organic Bread Free from GMO, animal products, artificial preservatives, artificial ingredients, HFCS and power-packed with wholegrain nutrition. Alpine Valley Natural Whole Grain Breads Organic multi-grain bread with omega3 Slide 18 Rich Products – recent NPD of note • Rich Products has aimed to take advantage of the flatbread boom in the US with anew retail range, as well brand licensing opportunities (in its ice cream cakes) and the demand for more varied flavours in sweet bakery (via its in-store bakery range) Our Specialty is a new line of 10 retail-packaged, premium flatbread products The new items include traditional flatbread products such as original naan, original pita, wheat pita, white Sandwich Flats and multigrain Sandwich Flats, as well as garlic cheese naan, original rustic Flats, Italian herb Flats, chipotle Flats, and garlic and herb pizza crust. 19 Source: Mintel GNPD Rich's Wishes Chocolate Cake & Vanilla Ice Cream & Hello Kitty licensed Ice Cream Cake The company has a range of Happy Birthday ice cream cakes, with other licences including Oreo, Twix, Snickers, Chips Ahoy! And recently the Peanuts comic strip Rich’s Extreme (in-store bakery) Line-up of indulgent, decadent treats includes six items portioned for one to two people: Mini Chocolate Brownie Extreme, Mini Caramel Sea Salt Blondie Extreme, Mini Boston Crème, and three flavours of bar cake (Red Velvet, Triple Chocolate, and Carrot) Slide 19 Top 6 other global bread and sweet bakery innovations (last 12 months) New formats and new ingredients a feature Ferrero Nutella B-Ready Bread Wafer with a Nutella Filling (Italy) Atrian Home Crok Glas croissant-doughnut pastry (Spain) 20 Source: Mintel GNPD Woolworths Food CarbClever Cauliflower Wraps (SA) Windy City Organics Rawmio Organic Raw Chocolate Truffle Cake (US) Food for Life Sprouted for Life Gluten-Free Almond Bread (US) Dahls Coarse Coffee Bread baked with coffee and flavoured with cranberries (Sweden)