1313P7

advertisement

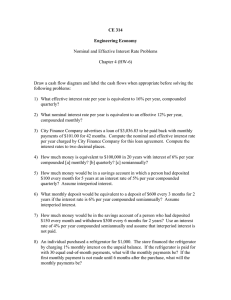

Math 1313 Popper 7 Which formula would you use for each of the following problems? B. 𝐹 = 𝑃(1 + 𝑖)𝑛 C. 𝑃 = 𝐹(1 + 𝑖)−𝑛 A. 𝐼 = 𝑃𝑟𝑡 1. How much simple interest will be earned on an $800 deposit in an account that earns 2.3% simple interest per year over a period of 5 months? 2. Kyrie borrowed $3,000 from her parents to buy some furniture. Her parents will charge her 3.25% simple interest per year. Her parents want the loan repaid in 1.5 years. How much will Kyrie owe her parents in 1.5 years? 3. In a certain town child daycare rates have been rising at the rate of 7% per year compounded annually. If 2 years ago the rate per week was $150, how much would you expect to pay today for one week of daycare? 4. A large corporation has invested $1 million in certificate of deposits (CD). The CDs pay 8% per year compounded semiannually. How much will the CDs be worth in 8 years? 5. Jerry would like to purchase a new car in 4 years. He deposits $3,500 in an account that pays 7% per year compounded monthly. How much will he have towards the purchase of the car in 4 years? Identify the type of problem. A) Sinking Funds OR B) Amortization 6. Wang plans to retire in 38 years and would like for his Individual Retirement Account (IRA) to have $1 million by then. If the IRA pays 8% per year compounded semiannually, what must his semiannual payment be to achieve his goal? 7. A recently married couple is buying a condo. The original cost is $475,733.76. They make a 25% down payment and finance the rest with a lending company. Their financing is for 25 years at 5.75% per year compounded monthly. Find their monthly payment. 8. New Body, a gym, bought new exercise equipment on credit. The purchase price was $10,438.88. They secure the loan with a financing company that charges 6.25% per year compounded quarterly for 6 years. How much are their quarterly payments? 9. Clean and Press, a cleaners, anticipates they will need $15,000 in 4 years to replace some machines. Their credit union pays 7.5% per year compounded quarterly. How much should they invest in this account quarterly to have the desired funds in 4 years? 10. Sweet Goodies, a bakery, bought new appliances and equipment for $23,468.99. They made a $7,000 down payment and financed the rest with a lending company. The lending company charges 7% per year compounded monthly for 3 years. Find their monthly payment.

![Practice Quiz Compound Interest [with answers]](http://s3.studylib.net/store/data/008331665_1-e5f9ad7c540d78db3115f167e25be91a-300x300.png)

![Practice Quiz 6: on Chapter 13 Solutions [1] (13.1 #9) The](http://s3.studylib.net/store/data/008331662_1-d5cef485f999c0b1a8223141bb824d90-300x300.png)