CE 314 Engineering Economy Nominal and Effective Interest Rate Problems

advertisement

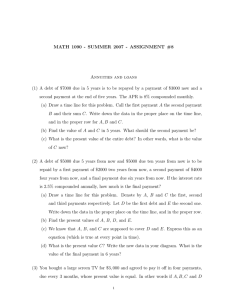

CE 314 Engineering Economy Nominal and Effective Interest Rate Problems Chapter 4 (HW-6) Draw a cash flow diagram and label the cash flows when appropriate before solving the following problems: 1) What effective interest rate per year is equivalent to 16% per year, compounded quarterly? 2) What nominal interest rate per year is equivalent to an effective 12% per year, compounded monthly? 3) City Finance Company advertises a loan of $3,036.83 to be paid back with monthly payments of $101.00 for 42 months. Compute the nominal and effective interest rate per year charged by City Finance Company for this loan agreement. Compute the interest rates to two decimal places. 4) How much money is equivalent to $100,000 in 20 years with interest of 6% per year compounded [a] monthly? [b] quarterly? [c] semiannually? 5) How much money would be in a savings account in which a person had deposited $100 every month for 5 years at an interest rate of 5% per year compounded quarterly? Assume interperiod interest. 6) What monthly deposit would be equivalent to a deposit of $600 every 3 months for 2 years if the interest rate is 6% per year compounded semiannually? Assume interperiod interest. 7) How much money would be in the savings account of a person who had deposited $150 every month and withdrawn $300 every 6 months for 2 years? Use an interest rate of 4% per year compounded semiannually and assume that interperiod interest is not paid. 8) An individual purchased a refrigerator for $1,000. The store financed the refrigerator by charging 1% monthly interest on the unpaid balance. If the refrigerator is paid for with 30 equal end-of-month payments, what will the monthly payments be? If the first monthly payment is not made until 6 months after the purchase, what will the monthly payments be?