Accounting 5

advertisement

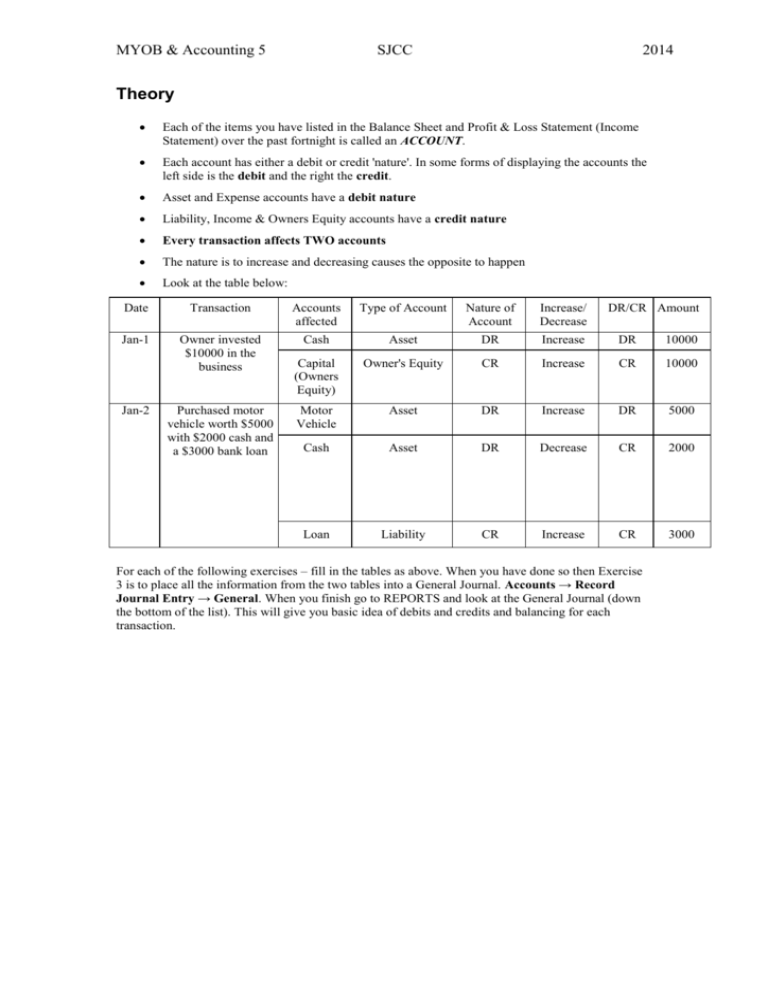

MYOB & Accounting 5 SJCC 2014 Theory Each of the items you have listed in the Balance Sheet and Profit & Loss Statement (Income Statement) over the past fortnight is called an ACCOUNT. Each account has either a debit or credit 'nature'. In some forms of displaying the accounts the left side is the debit and the right the credit. Asset and Expense accounts have a debit nature Liability, Income & Owners Equity accounts have a credit nature Every transaction affects TWO accounts The nature is to increase and decreasing causes the opposite to happen Look at the table below: Date Transaction Accounts affected Type of Account Nature of Account Increase/ Decrease Jan-1 Owner invested $10000 in the business Cash Asset DR Increase DR 10000 Capital (Owners Equity) Owner's Equity CR Increase CR 10000 Motor Vehicle Asset DR Increase DR 5000 Cash Asset DR Decrease CR 2000 Loan Liability CR Increase CR 3000 Jan-2 Purchased motor vehicle worth $5000 with $2000 cash and a $3000 bank loan DR/CR Amount For each of the following exercises – fill in the tables as above. When you have done so then Exercise 3 is to place all the information from the two tables into a General Journal. Accounts → Record Journal Entry → General. When you finish go to REPORTS and look at the General Journal (down the bottom of the list). This will give you basic idea of debits and credits and balancing for each transaction. MYOB & Accounting 5 SJCC 2014 Exercise 1 – complete the following for Jamie – owner of an art gallery (try to aim for 10 minutes maximum) Date Transaction Feb-1 Jaimie invested $30000 into the business Feb-2 Paid $150000 to purchase building Feb-8 Purchased $1700 of stock (on credit) Feb-13 Paid $900 off Accounts Payable Feb-16 Purchased land work $180000 with a bank loan Feb-19 Paid $3400 in salaries and $280 for electricity Feb-24 Jamie withdrew $200 cash Accounts affected Type of Account Nature of Account Increase/ Decrease DR/CR Amount MYOB & Accounting 5 SJCC Exercise 2 – complete the following for Melissa – try to aim for 15 minutes Date Transaction Mar1 Owner invested $100000 into the business Mar5 Paid rent for the store $5000 Accounts affected Type of Account Nature of Increase/ DR/CR Amount Account Decrease Mar- Purchased $23000 8 stock on credit Mar- Purchased Furniture 12 & Fittings for the store $37000 Mar- Collected Rental fee 15 Income for the week $6070 cash MarPaid $1000 to 22 Accounts Payable Mar- Collected Rental 22 Fee Income for the week $13500 cash Mar25 Owner withdrew $500 from the business Mar- Paid $1600 wages 27 Create a General Journal to reflect the above in MYOB 2014