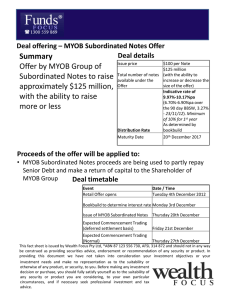

Fixed MYOB Subordinated Notes (MYBG)

advertisement

26 November 2012 Analysts MYOB Subordinated Notes (MYBG) Damien Williamson 613 9235 1958 Barry Ziegler 613 9235 1848 Authorisation John Gleeson 612 9255 7220 Risks require a double digit yield MYBG provides investors with a substantial initial yield of at least 10% fixed for the first year (90BBSW + 6.70-6.90% post year 1) to compensate for MYOB’s low interest cover and high gearing adopted by its private equity owner Bain Capital. As a leading provider of accounting, payroll and tax software to small and medium enterprises and accounting practices in Australia and New Zealand, MYOB has historically generated strong cash flow with recurring revenue representing 87% of total revenue. Fixed Interest Issue overview Issuer MYOB Issue ASX code MYBG Face value $100 Estimated offer size Bookbuild margin range $125m 6.70-6.90% Franking 0% Interest payments First interest payment Quarterly 20 Mar 2013 Minimum application Maturity While MYOB currently has adequate headroom under most of its debt covenants, the Senior Leverage Ratio covenant is most at risk. If this ratio remains constant at 4.04x, it will be breached by June 2014, as the covenant requirement tightens to 3.75x from an initial 5.60x. Assuming covenant EBITDA remains constant at $106.7m, satisfying the Dec 2015 Senior Leverage Ratio of 2.50x will require debt to reduce by $55m p.a. MYBG provides a similar structure to the Healthscope Notes (HLNG) issued in Nov 2010 and Myer Notes (Sep 2006). The private equity owners all issued ASX listed subordinated debt securities yielding at least 10%, targeting an IPO before maturity. In comparison with the Aug 2012 Crown Subordinated Notes (CWNHA) which offer a record 5.00% margin above 90 BBSW, investors are taking on considerable more risk in chasing the additional 2.00% yield. MYBG may appeal to investors with an above average risk profile who are comfortable with MYOB’s operational and financial risks. $5,000 20 Dec 2017 Figure 1: Comparative subordinated debt securities Issue Size Issue Terms EBITDA Term Conversion 5.0 years 2.5% (IPO) Interest Cover Timeline $125m Healthscope Notes $200m 3 Dec 2012 Announcement of margin 4 Dec 2012 Offer opens 4 Dec 2012 Offer closes: General 12 Dec 2012 Broker firm 19 Dec 2012 Issue date 20 Dec 2012 ASX listing (deferred settlement) 21 Dec 2012 Additional Disclosure: Bell Potter Securities Limited is acting as Comanager to the MYBG issue and will receive fees for this service. BELL POTTER SECURITIES LIMITED ACN 25 006 390 772 AFSL 243480 1.9x Fixed 11.25% 1.8x 5.5 years 2.5% (IPO) Myer Notes $255m Fixed 10.19% 1.9x 6.5 years 2.5% (IPO) 90BBSW+6.70-6.90% Lodgement of prospectus 26 Nov 2012 Bookbuild margin Fixed 10.00% year 1 Discount MYOB Notes SOURCE: COMPANY DATA, BELL POTTER Key features Subordinated to $476.6m of senior debt: MYBG ranks senior to the $550m of equity Bain has invested into MYOB. Exchangeable at a 2.5% discount to retail offer price in the event of an IPO Mandatory redemption at year 5 (20 December 2017) Early redemption (excluding IPO) will result in additional payments: 5% in year 1, 3% in year 2, and 1% in year 3. Interest is cumulative: Suspended interest payments will accrue on a daily basis and compound on a quarterly basis, plus a 2.00% per annum penalty. First $53.8m raised to repay senior debt: Any additional funds raised (net of ~$5.3m of issue costs) will be distributed as a capital return to MYOB shareholders. Risks: High debt levels with tightening covenants may result in suspension of interest payments if MYOB’s operating performance deteriorates, and increases redemption risk if MYOB is not able to refinance debt or proceed with an IPO. Refer Risk section on page 6. DISCLAIMER AND DISCLOSURES THIS REPORT MUST BE READ WITH THE DISCLAIMER AND DISCLOSURES ON PAGE 8 THAT FORM PART OF IT. Page 1 MYOB Subordinated Notes 26 November 2012 MYOB Subordinated Notes MYOB Overview Commencing operations over 20 years ago, MYOB is a leading provider of business management, accounting, payroll and tax software to nearly 1 million small & medium sized enterprises, and over 50,000 public accountants in Australia and New Zealand. MYBG is being issued by the special purpose entity MYOB Finance Australia Limited, a wholly owned subsidiary of MYOB Holdings, the parent entity of MYOB Group. Group revenue was $213m in the 12 months to 30 September 2012. New software sales accounted for 13% of revenue, while the remaining 87% represented recurring revenues from the sale of transactional, training and consulting services (11% of group revenue), additional software licenses and subscription (38%) and maintenance contracts to existing clients (38%). MYOB operates four business segments: • Business Division - MYOB’s largest division providing accounting software products to small and medium sized businesses. Approximately 15% of divisional revenue is generated from new software sales, with 84% recurring from software support services and automatic software upgrades. • Accountants Division - Provides accounting practice management software solutions. Approximately 96% of revenue is recurring from maintenance fees. • Enterprise Division - Enterprise Resource Planning solutions to companies with between 20-199 employees in Australia and New Zealand. Software products are based around financial & business management systems and payroll & human resource administration systems. • Website Division - Provides web hosting, website construction and domain registration services for small businesses with under 20 employees. Figure 2: MYOB Divisions SOURCE: COMPANY Page 2 MYOB Subordinated Notes 26 November 2012 MYOB Subordinated Notes Operating performance MYOB’s historical revenues and EBITDA have been relatively stable with a constant track record of growth. Cash flow has also been sound with a respectable cash conversion of EBITDA. This earnings profile has enable the private equity owners to aggressively gear the balance sheet. Figure 3: Operating performance 12 months ending Dec 2009 Dec 2010 Dec 2011 Sep 2012 $m $m $m $m Business Division 94.5 109.7 111.8 116.2 Accountants Division 63.2 66 70.7 73.3 Enterprise Division 12.6 15.2 16.1 17.5 Websites Division 4.8 4.8 4.9 4.8 Revenue Other Total Revenue EBITDA (adjusted) 0 0.8 0.8 0.9 175.1 196.5 204.3 212.7 65.2 81.9 91.6 98.5 Senior debt (pro forma) 40.7 MYBG (pro forma on $125m issue) 12.5 Net Interest Expense 53.2 Interest Cover Operating Cash Flow (excl non-recurring items) 1.85x 53.6 87.2 85.8 86.1 Net Interest Paid 53.2 Net Operating Cash Flow after Interest 32.9 Tax 0.0 Dividends 0.0 Net Cash Flow Before Financing Cash flow conversion (operating cash flow / EBITDA) 32.9 82.2% 106.5% 93.7% 87.4% SOURCE: COMPANY Page 3 MYOB Subordinated Notes 26 November 2012 MYOB Subordinated Notes Debt covenants: 15% EBITDA decline for covenant breach Investors need to be aware that a 15% decline in EBITDA will result in a breach of the Interest Cover Ratio, while a 28% decline in EBITDA will result in a breach of the Senior Leverage Ratio. If an event of default occurs as a result of a covenant breach, interest payments could be suspended. As interest is cumulative, suspended interest payments will accrue on a daily basis and compound on a quarterly basis. In addition a 2.00% per annum penalty will apply. Figure 4: Debt covenant overview Current Senior covenant covenant Covenant Interest Covenant Debt & Covenant headroom suspension headroom distribution headroom restriction $m $m 92.9 63.7 53.2 53.2 7.5 7.5 7.5 60.7 60.7 60.7 Cashflow Cover Ratio 1.53x 1.05x 1.10x Senior Debt 431.5 431.5 Covenant cashflow available to service debt Senior + subordinated debt interest Senior debt repayments Debt Service Obligations Covenant EBITDA (adjusted) 106.7 77.1 Senior Leverage Ratio 4.04x 5.60x Covenant EBITDA (adjusted) 106.7 90.4 53.2 53.2 2.01x 1.70x Senior + subordinated debt interest Interest Cover Ratio $m -31% 66.8 $m -28% 53.2 -28% -15% Senior Debt 431.5 MYOB Notes 125.0 125.0 Gross Debt 556.5 556.5 Covenant EBITDA (adjusted) 106.7 101.2 Total Net Leverage Ratio 5.22x 5.50x EBITDA Adjustments to Covenant Ratios Pro Forma EBITDA 98.5 2.3 One off costs: Product development / marketing 5.0 Covenant EBITDA (adjusted) Change in net working capital Capital expenditure -5% $m Bain Management Fee Other 431.5 0.9 106.7 -0.9 -11.5 Change in non-operating provisions -1.4 Covenant cashflow available to service debt 92.9 SOURCE: COM PANY DATA, BELL POTTER Page 4 MYOB Subordinated Notes 26 November 2012 MYOB Subordinated Notes Tightening covenant requirements After factoring in the scheduled principal repayments required under the $212m debt Facility A, the Senior Leverage Ratio appears the most at risk of a covenant breach. If we assume EBITDA remains constant at $106.7m, extra debt repayments will be required to satisfy the covenant from March 2015, peaking at an extra $34m in December 2015. If senior debt reduces in line with the Facility A repayment schedule, EBITDA will need to increase from $106.7m to $120.3m by December 2015. Factoring in the scheduled debt reductions to the interest expense, EBITDA would need to be $2.2m higher in March 2016 to satisfy the Interest Cover covenant. Figure 5: Senior Leverage and Interest Cover covenant sensitivities Senior Debt Facility A Senior Debt Outstanding EBITDA Senior (constant) Leverage Leverage Repayments $m $m $m Dec 2012 5.60x 14.0 417.5 106.7 Mar 2013 5.50x 417.5 106.7 3.91x Jun 2013 5.00x 15.0 402.5 106.7 3.77x Sep 2013 4.60x 402.5 106.7 3.77x Dec 2013 4.40x 387.0 106.7 Mar 2014 4.25x 387.0 Jun 2014 3.75x Sep 2014 3.50x Dec 2014 3.25x Mar 2015 3.15x Jun 2015 3.00x Sep 2015 2.75x Dec 2015 2.50x Mar 2016 2.50x Jun 2016 2.50x Sep 2016 2.50x Senior Debt EBITDA Headroom Headroom Interest EBITDA Cover (constant) Interest Interest EBITDA Cover Headroom $m $m $m $m 180.0 32.1 1.70x 106.7 53.2 2.01x 16.3 169.4 30.8 1.60x 106.7 53.2 2.01x 21.6 131.0 26.2 1.60x 106.7 53.2 2.01x 21.6 88.3 19.2 1.60x 106.7 51.0 2.09x 25.0 3.63x 82.5 18.7 1.60x 106.7 50.3 2.12x 26.2 106.7 3.63x 66.5 15.6 1.70x 106.7 49.6 2.15x 22.4 367.1 106.7 3.44x 33.0 8.8 1.80x 106.7 48.8 2.19x 18.9 367.1 106.7 3.44x 6.3 1.8 1.90x 106.7 47.9 2.23x 15.6 345.0 106.7 3.23x 1.8 0.5 2.00x 106.7 47.0 2.27x 12.8 345.0 106.7 3.23x -8.9 -2.8 2.10x 106.7 46.0 2.32x 10.2 322.9 106.7 3.03x -2.8 -0.9 2.20x 106.7 44.9 2.37x 7.9 322.9 106.7 3.03x -29.5 -10.7 2.30x 106.7 43.9 2.43x 5.8 300.8 106.7 2.82x -34.1 -13.6 2.40x 106.7 42.9 2.49x 3.9 300.8 106.7 2.82x -34.1 -13.6 2.50x 106.7 41.8 2.55x 2.2 26.5 274.3 106.7 2.57x -7.5 -3.0 2.50x 106.7 40.7 2.62x 5.0 27.4 246.9 106.7 2.31x 19.9 7.9 2.50x 106.7 38.9 2.74x 9.5 15.5 19.9 22.1 22.1 22.1 SOURCE: COMPANY DATA, BELL POTTER 3.91x $m Capital position Gearing on MYOB’s balance sheet is quite high at 100%. MYBG ranks behind $476.6m of senior debt, although in event of a wind up, it appears unlikely that MYBG will receive any material consideration, only ranking ahead of $563.9m of equity, which includes $1,209m of intangibles assets and goodwill. Figure 6: Balance sheet As at 30 September 2012 (pro forma) Cash Property, plant, equipment Intangibles Other Total Assets $m 38.1 5.6 1,209.2 31.8 1,284.7 Senior Debt 476.6 MYOB Notes 125.0 Other Liabilities 119.2 Total Liabilities 720.8 Total Equity 563.9 Net Debt / Equity 100% SOURCE: COMPANY DATA, BELL POTTER Page 5 MYOB Subordinated Notes 26 November 2012 MYOB Subordinated Notes Investment risks MYBG risks are outline on page 83 of the prospectus. Key security risks include: • Subordinated to $528m of senior debt facilities. In event of a wind up, it appears unlikely that MYBG will receive any material consideration, only ranking ahead of $563.9m of equity, which includes $1,209m of intangibles assets and goodwill (94% of total assets). • Limited free cash flow to meet interest payments, capex and scheduled debt Facility A principal repayments. • Meeting debt covenants - MYOB requires a combination of increased EBITDA and continued reduction of debt to ensure all debt covenants are continuously satisfied. Loss of market share, aggressive competitor pricing and failure to develop new products (limited capex funding) could result in a decline in earnings and cash flow. Failure to meet debt covenants could result in interest payments being suspended. • Refinancing risk - MYOB has a series of existing debt facilities that will require refinancing on 30 Sep 2016. There is a risk that these facilities may not be able to refinanced or the refinance terms may not be attractive. • IPO risk - Failure to achieve exit via IPO increases MYBG redemption risk at maturity on 20 Dec 2017. • Adverse movement in credit spreads as a result of a tightening in the availability and cost of credit, as well as a deterioration in MYOB’s financial and operating performance. • New issues may offer more attractive issue terms and margins, placing downward pressure on the security price. • Poor accounting disclosure - MYBG investors require quarterly reporting of where MYOB is trading relative to its requirements under its four key covenants. There is no guarantee this information will be disclosed on a timely manner, if at all. Accurate calculation of these ratios may also prove difficult given adjustments required to EBITDA. If MYOB’s financial position deteriorates and places covenants at risks, it may take some time for investors to become aware. Page 6 MYOB Subordinated Notes 26 November 2012 MYOB Subordinated Notes Other investment risks Key Business Risks of MYOB include: • Increasing competition - In providing business software and services, MYOB operates in a highly competitive and rapidly evolving area. New products offered by competitors could be superior and more cost effective. In addition, one competitor (Xero) has MYOB’s founder and former CEO Craig Winkler as a director. • A material deterioration in the Australian and New Zealand economies could lead to a reduction in the number of small to medium sized enterprises and a reduction in demand for MYOB products and services. • Accountants may no longer recommend MYOB software to clients. • Cloud Computing - MYOB’s investment in Cloud Computing may not achieve the projected level of demand and market acceptance. • Security and storage - Failure to protect client data stored or transmitted by MYOB could lead to significant legal action, damage to the company’s reputation and potential loss of significant customers. Additional investment risk: ASIC “Be wary of the risks” warning: Money Smart website The ASIC publication should be used as guidance which may be relevant to your consideration of MYBG – namely, information for retail investors who are considering investing in hybrid securities. Copies of the ASIC Guidance can be obtained from ASIC’s website at: www.moneysmart.gov.au/investing/complex-investments/hybrid-securities-and-notes Basically, hybrid securities (including subordinated notes and convertible preference shares) may be from well-known companies but they are very different from 'normal' corporate bonds. Some hybrid securities make investors take on 'equity-like' risks. Some also have terms and conditions that allow the issuer to exit the deal or suspend interest payments when they choose. Some are very long-term investments (for example, more than 20 years). Hybrid securities may be unsuitable for you if you need steady returns or capital security typically from a bank term deposit style of investment. Page 7 MYOB Subordinated Notes 26 November 2012 Research Team Fixed Income Bell Potter Securities Limited ACN 25 006 390 772 Level 38, Aurora Place 88 Phillip Street, Sydney 2000 Telephone +61 2 9255 7200 www.bellpotter.com.au Staff Member Title/Sector Phone @bellpotter.com.au John Gleeson Research Manager 612 9255 7220 jgleeson Sam Haddad Emerging Growth 612 8224 2819 shaddad John O’Shea Emerging Growth 613 9235 1633 joshea Jonathan Snape Emerging Growth 613 9235 1601 jsnape Bryson Calwell Emerging Growth Associate 613 9235 1896 bcalwell Sam Byrnes Emerging Growth Associate 612 8224 2886 sbyrnes Stuart Roberts Healthcare/Biotech 612 8224 2871 sroberts Tanushree Jain Healthcare/Biotech Associate 612 8224 2849 tnjain TS Lim Banks/Regionals 612 8224 2810 tslim Lafitani Sotiriou Diversified 613 9235 1668 lsotiriou Stuart Howe Bulks & Copper 613 9235 1782 showe Fred Truong Bulks & Copper 613 9235 1629 ftruong Trent Allen Emerging Growth 612 8224 2868 tcallen Johan Hedstrom Energy 612 8224 2859 jhedstrom Stephen Thomas Gold & Nickel 618 9326 7647 sthomas Quantitative & System 612 8224 2833 jtai Damien Williamson Fixed Income 613 9235 1958 dwilliamson Barry Ziegler Fixed Income 613 9235 1848 bziegler Industrials Financials Resources Quantitative Janice Tai Fixed Income The following may affect your legal rights. Important Disclaimer: This document is a private communication to clients and is not intended for public circulation or for the use of any third party, without the prior approval of Bell Potter Securities Limited. In the USA and the UK this research is only for institutional investors. It is not for release, publication or distribution in whole or in part to any persons in the two specified countries. This is general investment advice only and does not constitute personal advice to any person. Because this document has been prepared without consideration of any specific client’s financial situation, particular needs and investment objectives (‘relevant personal circumstances’), a Bell Potter Securities Limited investment adviser (or the financial services licensee, or the representative of such licensee, who has provided you with this report by arraignment with Bell Potter Securities Limited) should be made aware of your relevant personal circumstances and consulted before any investment decision is made on the basis of this document. While this document is based on information from sources which are considered reliable, Bell Potter Securities Limited has not verified independently the information contained in the document and Bell Potter Securities Limited and its directors, employees and consultants do not represent, warrant or guarantee, expressly or impliedly, that the information contained in this document is complete or accurate. Nor does Bell Potter Securities Limited accept any responsibility for updating any advice, views opinions, or recommendations contained in this document or for correcting any error or omission which may become apparent after the document has been issued. Except insofar as liability under any statute cannot be excluded. Bell Potter Securities Limited and its directors, employees and consultants do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this document or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this document or any other person. Disclosure of interest: Bell Potter Securities Limited, its employees, consultants and its associates within the meaning of Chapter 7 of the Corporations Law may receive commissions, underwriting and management fees from transactions involving securities referred to in this document (which its representatives may directly share) and may from time to time hold interests in the securities referred to in this document. Additional disclosure: Bell Potter Securities Limited is acting as Co-manager to the MYBG issue and will receive fees for this service. Page 8