A Step by Step Approach to Preparing Financial

Reports and Processing Journal Entries

[manual and using MYOB Accounting Plus v17]

Copyright Notice:

Copyright ©2008 Marian Brown. All rights reserved.

No part of this material may be reproduced or copied in any form or by any means (graphic,

electronic or mechanical, including photocopying or by information retrieval systems) without

permission in writing from Marian Brown.

Written by:

Marian Brown Dip T [Commerce], MICB

Cert IV Workplace Training and Assessment, Cert IV in Financial Services [Bookkeeping]

MYOB Certified Consultant for 13 years

MYOB Accredited Author, MYOB Publisher, MYOB Accredited Trainer

MBS Training Services Pty Ltd

sales@mbsts.com.au

www.mbsts.com.au

Publishers:

Software Publications Pty Ltd [ABN 75078026150]

Head Office – Sydney

Unit 10, 171 Gibbes Street

Chatswood NSW 2067

Phone:

Web address:

ISBN

1 800 146 542

www.softwarepublications.com.au

1-74123-877-3

Printed September 2008

This book is dedicated to my Year 10 commercial teacher, Delmai Winnett who taught me my bookkeeping basics and

encouraged me to further my accounting studies.

© Copyright Marian Brown 2008

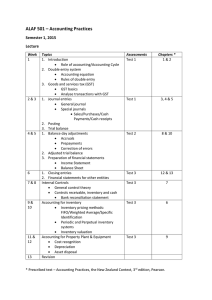

A STEP BY STEP APPROACH TO PREPARING FINANCIAL REPORTS [manual and MYOB] – Table of Contents

Copyright/Trademark Information:

MYOB®, MYOB AccountEdge®, MYOB Accounting™, MYOB Accounting Plus™, MYOB

BusinessBasics™, MYOB FirstEdge®, MYOB M-Powered®, MYOB M-Powered Services™, MYOB MPowered Bank Statements™, MYOB M-Powered Invoices™, MYOB M-Powered MoneyController™,

MYOB M-Powered Payments™, MYOB ODBC Direct™, MYOB PowerPay®, MYOB Premier® and

MYOB Premier Enterprise® are registered trademarks or trademarks of MYOB Technology Pty Ltd and

their use is prohibited without prior consent. Ceedata, Solution 6 MAS and Xlon are registered trademarks

or trademarks of Solution 6 Holdings Limited, a member of the MYOB group.

Bpay® is a registered trademark of Bpay Pty Ltd, ABN 69 079 137 518.

MasterCard® is a registered trademark of MasterCard International Inc.

Microsoft, Access, Excel, Internet Explorer, Office, Outlook, Smart Tags, Windows and Word are

registered trademarks or trademarks of Microsoft Corporation in the United States or other countries.

VISA® is a registered trademark of Visa International Service Association.

Other products mentioned may be service marks, trademarks or registered trademarks of their respective

owners.

Screen captures from MYOB Accounting Plus v18 reproduced with permission.

Limitations of Liability:

This material is designed to provide basic information on how to use MYOB Accounting/Accounting Plus

v18. Because business circumstances can vary greatly, the material is not designed to provide specific GST

or business advice for particular circumstances. Also, because aspects of the GST are complex and detailed,

the material is not designed to comprehensively cover all aspects of the GST. Further, the laws

implementing GST and rulings and decisions under those laws may change.

Before you rely on this material for any important matter for your business, you should make your own

enquiries about whether the material is relevant and still current, and whether it deals accurately and

completely with that particular matter; and as appropriate, seek your own professional advice relevant to

that particular matter.

This information is for the general information of MYOB clients and is not to be taken as a substitute for

specific advice. Consequently Marian Brown will accept no responsibility to any person who acts on

information herein without consultation with Marian Brown.

The information in this book is relevant to MYOB Accounting Plus v18. Earlier or later versions of MYOB

software could change the instructions in this workbook.

Table of Contents

A STEP BY STEP APPROACH TO PREPARING FINANCIAL REPORTS [manual and MYOB] © Copyright Marian Brown 2008

⌦Unit 4:

Process Journal

Entries

[manually and using MYOB Accounting Plus]

In this Unit you will learn how to process journal entries for the following:

Depreciation

Disposal of an asset

Prepaid Income

Prepaid Expenses

Accrued Income

Accrued Expenses

Stock Adjustments

Bad and Doubtful Debts

This unit covers the following performance criteria in BSBADM408A:

2.1

Depreciation of non-current assets and disposal of fixed assets are recorded in

accordance with organisational policy and procedures.

2.2

Expense and revenue accounts are adjusted for prepayments and accruals in

accordance with organisational policy and procedures and accounting requirements.

2.3

Bad and doubtful debts are recorded in accordance with organisational policy and

procedures and accounting requirements.

2.4

Ledger accounts are adjusted for inventories, if required, and transferred to final

accounts in accordance with organisational policy and procedures and accounting

requirements.

© Copyright Marian Brown 2008 A STEP BY STEP APPROACH TO PREPARING FINANCIAL REPORTS [manual and MYOB]

Process Journal Entries– Unit 4

49

This unit also covers the following performance criteria in FNSICACC306B.

1.1

1.2

2.1

3.1

4.1

4.2

4.4.

5.1

5.2

6.1

6.2

50

Supporting documentation is examined to establish accuracy and completeness

Supporting documentation is examined to ensure authorisation by appropriate level

Journal is accurate, complete and prepared within company timelines

Journal is authorised in accordance with company policy and procedures.

Data is entered into system accurately and in accordance with company input

standards.

Transaction is correctly allocated to system and account.

Data entry is undertaken in accordance with relevant health and safety requirements.

Where appropriate, processing report is examined for accuracy and reconciled in

accordance with relevant company policy and procedures, accounting principles and

practices.

Entries requiring alteration are identified and adjusting entries processed accurately

in accordance with company policy and procedures.

Documentation is filed promptly and in accordance with company policy and

procedures, industry and legislative requirements.

Filed documentation is easily accessible and traceable.

Unit 4 – Process Journal Entries

A STEP BY STEP APPROACH TO PREPARING FINANCIAL REPORTS [manual and MYOB] © Copyright Marian Brown 2008

Brocks Tyreworld Policies and Procedures

(i)

Read the Policies and Procedures of Brocks Tyreworld in Unit 2.

(ii)

What procedures must be followed when entering journal entries?

......................................................................................................................................................

......................................................................................................................................................

......................................................................................................................................................

......................................................................................................................................................

......................................................................................................................................................

Analysing and Interpreting reports

The Depreciation Schedule for 2009 created in the previous unit looked like this.

You will now use this document, approved by Angus to process journal entries in the books

of Brocks Tyreworld.

You may need to refer to your double-entry accounting rules in your “Maintain Financial

Records” text.

(i)

What is the annual amount of Office Equipment depreciation to be written off? ……….

(ii)

What is the annual amount of Motor Vehicle depreciation to be written off? ………….

(iii) What is the annual amount of Low-Value Pool depreciation to be written off? ………...

© Copyright Marian Brown 2008 A STEP BY STEP APPROACH TO PREPARING FINANCIAL REPORTS [manual and MYOB]

Process Journal Entries– Unit 4

51

Creating Journals for Depreciation

Task 1:

Account for depreciation on Office Equipment – $3,298.63.

Your journal entry will look like this.

GENERAL JOURNAL

Date

June

30

Particulars

Ref

Depreciation

Debit

Credit

3,298.63

[Increase in Expenses]

Accumulated Depreciation – Office Equipment

3,298.63

[Decrease in Assets]

[Annual depreciation using diminishing value method]

Task 2:

Account for depreciation on Motor Vehicles – refer to Schedule.

Enter the above transaction in the journal below using the example above as a

guide.

You may need to refer to the Chart of Accounts on page 8.

GENERAL JOURNAL

Date

June

Particulars

Ref

Debit

Credit

30

Task 3:

Account for depreciation on Low-Value Pool - refer to Schedule

Enter the above transaction in the journal below using the example above as a

guide.

You may need to refer to the Chart of Accounts on page 8.

GENERAL JOURNAL

Date

June

Particulars

Ref

Debit

Credit

30

Solutions can be found on page 63.

52

Unit 4 – Process Journal Entries

A STEP BY STEP APPROACH TO PREPARING FINANCIAL REPORTS [manual and MYOB] © Copyright Marian Brown 2008

Creating Journals for Disposal of Asset

The completed Toyota Ute Asset Card [after disposal] looked like this.

ASSET: TOYOTA UTE

Asset No.:

M010

Purchase date:

30/6/08

Class/Category:

Motor Vehicles

Purchased from:

Black Toyota

Deprec. Cost:

$35,000.00

New/second-hand:

NEW

Location:

N/A

Effective life:

8

Rego Number

00 OEQ

Depreciation method:

Straight-Line

Date

Cost

Details

GST

30/6/08

Purchase

30/6/09

Depreciation

$35,000

Depreciation

Accumulated

Depreciation

Written-down

Value

$0

$0

$35,000.00

$4,375.00

$4,375.00

$30,625.00

$3,500

Date of disposal:

30/6/09

Disposal price:

$27,500.00 inc GST

Authorised by:

Angus Brock

Gain/{Loss} on disposal:

Loss $5,625.00

You will record the above disposal like this. [Explanation is in italics.]

You are required to complete the journal by completing the “?” fields.

[Remember to refer to the Chart of Accounts on page 8 for appropriate accounts.]

30 June 2009 – Sold Toyota Ute for $27,500.00 including GST to T White. Paid by bank transfer.

GENERAL JOURNAL

Date

June

30

Particulars

Ref

Debit

Bank

[Amount actually received and banked.]

Accumulated Depreciation – Motor Vehicles

[Depreciation amount already written off]

Loss on Sale

[Amount calculated in Unit 3]

Credit

27,500.00

?

?

Motor Vehicle [at Cost]

35,000.00

[The cost price of the car which is now being

disposed of.]

GST Collected

2,500.00

[Amount of GST= 1/11th of $27,500.]

[Sale of Toyota Ute 00 0EQ to T White]

[Totals to check the double-entry is accurate.]

$?

$?

Solution can be found on page 63.

© Copyright Marian Brown 2008 A STEP BY STEP APPROACH TO PREPARING FINANCIAL REPORTS [manual and MYOB]

Process Journal Entries– Unit 4

53

Creating Journals for Disposal of Asset

The completed Canon Photocopier Asset Card [after disposal] looked like this.

ASSET: CANON PHOTOCOPIER

Asset No.:

P312

Purchase date:

30/6/08

Class/Category:

Office Equipment

Purchased from:

Printer Supplies

Deprec. Cost:

$8,000.00

New/second-hand:

NEW

Location:

Print Room

Effective life:

5

Serial Number

DNRX547892

Depreciation method:

Diminishing Value

Date

Cost

Details

GST

30/6/08

Purchase

30/6/09

Depreciation

$8,000.00

Depreciation

Accumulated

Depreciation

Written-down

Value

$0

$0

$8,000.00

$3,200.00

$3,200.00

$4,800.00

$800

Date of disposal:

30/6/09

Disposal price:

$5,500.00 inc GST

Authorised by:

Angus Brock

Gain/Loss on disposal:

Gain $200.00

Record the above figures in the General Journal below.

[Remember to refer to the Chart of Accounts on page 8 for appropriate accounts.]

30 June 2009 – Sold Canon Photocopies for $5,500.00 inc GST to Local School. Paid by bank transfer.

GENERAL JOURNAL

Date

Particulars

Ref

Debit

Credit

Solution can be found on page 63.

54

Unit 4 – Process Journal Entries

A STEP BY STEP APPROACH TO PREPARING FINANCIAL REPORTS [manual and MYOB] © Copyright Marian Brown 2008

Creating Journals for Balance Day Adjustments

The Trial Balance of Brocks Tyreworld on 30 June 2009 is printed on Page 21.

However there are a number of other transactions that have happened in the business and

need to be accounted for to report an accurate picture of the business for the 2009 financial

year.

You will now account for these transactions.

Prepaid Expenses

Task 1:

Advertising costs [$495.00 inc GST ie $450.00 ex GST] were paid for 12

months – August to July. The business needs to account for 1/12th of the amount

[$37.50] which is paid for the next financial year to report the correct amount

for the 2009 financial year.

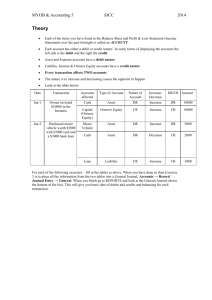

The Advertising Account looks like this in the General Ledger.

610 ADVERTISING

Date

Particulars

Ref

31//7/08

Cash Payments

CPJ

Debit

Credit

450.00

Balance

Dr/Cr

450.00

Dr

However $37.50 needs to the deducted so that the account looks like this.

610 ADVERTISING

Date

Particulars

Ref

31/7/08

Cash Payments

CPJ

30/6/09

Prepaid Expenses

Debit

Credit

450.00

37.50

Balance

Dr/Cr

450.00

Dr

412.20

Dr

Therefore the following journal entry must be created.

[Complete the ? fields from the information above.]

GENERAL JOURNAL

Date

June

30

Particulars

Ref

Debit

Prepaid Expenses [see Chart of Accounts]

[increase an asset]

Advertising

[decrease an expense]

Credit

37.50

?

{Account for advertising paid for July]

Solution can be found on page 63.

© Copyright Marian Brown 2008 A STEP BY STEP APPROACH TO PREPARING FINANCIAL REPORTS [manual and MYOB]

Process Journal Entries– Unit 4

55

Creating Journals for Balance Day Adjustments

Prepaid Income

Task 2:

$1,000 [ex GST] has been paid and recorded in Sales for work not yet done. The

business wishes to report the exact sales amount.

The Sales Account looks like this in the General Ledger.

410 SALES [tyres, accessories]

Date

Particulars

Ref

31/7/08

Accounts Receivable

Cash Receipts

Debit

Credit

Balance

Dr/Cr

SJ

15,200.00

15,200.00

Cr

CRJ

1,900.00

17,100.00

Cr

However $1,000.00 needs to the deducted so that the account looks like this. [There is

no GST issue in this entry.]

410 SALES [tyres, accessories]

Date

Particulars

Ref

31/7/08

Accounts Receivable

Cash Receipts

30/6/09

Prepaid Income

Credit

Balance

Dr/Cr

SJ

15,200.00

15,200.00

Cr

CRJ

1,900.00

17,100.00

Cr

16,100.00

Cr

GJ

Debit

1,000.00

Therefore the following journal entry must be created.

[Complete the ? fields from the information above.]

GENERAL JOURNAL

Date

June

30

Particulars

?

[decrease income]

Prepaid Income [see Chart of Accounts]

[increase a liability]

Ref

Debit

Credit

?

1,000.00

{?

Solution can be found on page 63.

56

Unit 4 – Process Journal Entries

A STEP BY STEP APPROACH TO PREPARING FINANCIAL REPORTS [manual and MYOB] © Copyright Marian Brown 2008