Fair value

advertisement

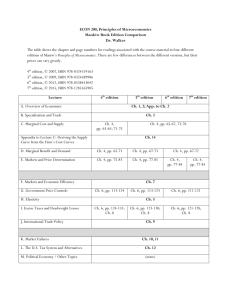

CHAPTER 18 Accounting values and reporting Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Contents Accounting values Measurement focus Expanding the boundaries of the accounting model Fair value measurement The IASB’s mixed-attribute model Comprehensive income Efficient market hypothesis Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Accounting values Different value perspectives 1) 2) 3) Entry and exit values are market values Entry value Exit value Value in use Market buying price and market selling price of an item Value in use is an entity-specific value Specific to the company that uses the item Incorporates management intentions Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Value in use Value in use is the incremental firm value from continuing use of the item Estimate the future net cash flows expected to arise from the continuing use and ultimate disposal of the item and discount these to present value More subjective and unique to the item Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Values in the accounting model Entry values are basic to the historical cost model (initial measurement) Replacement cost as a (potential) revised entry cost for subsequent measurement Exit values are used both as a control and as a measurement base for subsequent measurement Net realizable value Fair value remeasurement Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Values in the accounting model (cont.) Value in use is used as a control measure only Threshold value to arrive at an estimate of the recoverable amount of an asset IAS 36 Impairment of Assets Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Deprival value Deprival value rests on a comparison of a current entry value (replacement cost) and the recoverable amount Value to the business - what the loss to the business would be if it were obliged to forfeit the asset in question Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fig. 18.1 Deprival value Replacement cost Deprival value = lower of Higher of Net realizable value or Value in use Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Measurement focus The income statement articulates with the balance sheet: the values in both statements are not derived independently of each other Balance sheet focus: measure balance sheet values independently on different dates and the changes will determine profit or loss of the intervening period Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Measurement focus (cont.) Income statement focus: measure income with the balance sheet representing unabsorbed costs (assets) and anticipated expenditure (current liabilities) and financing The IASB’s view tends to a mixed focus Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Expanding the boundaries of the accounting model Standard setters tend to give more emphasis on representing the current economic status of the company’s assets and liabilities in addition to its completed transactions Drive towards earlier recognition of (changes in) assets and liabilities than takes place under the completed transaction approach General issue of recognising changes in economic value Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Executory contracts Executory contracts are binding contracts where the company has entered into an agreement but fulfilment of the terms has not been completed Steps to bring executory contracts within the boundaries of the financial accounting model Treatment of onerous contracts (IAS 37) Recognising assets and liabilities from executory contracts that are financial instruments (IAS 39) Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fair value measurement Fair value is the amount for which an asset could be exchanged or a liability settled between knowledgeable, willing parties in an arm’s length transaction Fair value has been introduced in IFRS as A means of putting a value on an incomplete transaction A measurement attribute for subsequent measurement in a number of significant standards Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fair value measurement Fair value is a market-based measurement and as such not affected by factors specific to a particular company If available, an observable market price in an active market is the best evidence of fair value But what if a) there is more than one market price, b) the market is illiquid, c) there are no recent prices, and d) there is no market for the specific item to be measured ? Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fair value measurement hierarchy Need for a formal hierarchy which recognizes different market circumstances in how a fair value is derived Bottom layer = fair value entirely derived using a model and company data with no market inputs Reliability concerns Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts The IASB’s mixed-attribute model In IFRS, fair value accounting has come to complement historical cost accounting in several domains Main fair value requirements: IFRS 3 Business Combinations IAS 36 Impairment of Assets IAS 37 Provisions, Contingent Liabilities and Contingent Assets IAS 39 Financial Instruments: Recognition and Measurement IAS 40 Investment Property IAS 41 Agriculture Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Financial instruments Financial instruments include cash, receivables, payables, equity and debt instruments as well as derivatives and some commodity contracts IAS 39 Financial Instruments: Recognition and Measurement establishes principles for recognizing and measuring financial instruments Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Derivative financial instruments Derivatives are defined as financial instruments exhibiting three characteristics: 1. 2. 3. Their value changes in response to a change in some market-related underlying variable It requires no or relatively small initial investment It is settled at a future date The potentially significant future cash flow consequences of these risky contracts bring them within the scope of the definition of assets and liabilities with fair value as the most relevant measurement attribute Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Four categories of financial instrument (IAS 39) A financial asset or liability at fair value through profit or loss (includes financial instruments held with a view to short-term profit taking and derivatives) Held-to-maturity investments and liabilities Loans and receivables Available-for-sale assets Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts IAS 39 measurement rules The four different categories of financial instruments (financial assets and financial liabilities) are measured and reported (treatment of fair value changes) differently after initial recognition Fair value option: a company has the option to designate a qualified financial instrument on initial recognition as one to be measured at fair value with fair value changes in profit or loss Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fig. 18.2 IAS 39 – Measurement bases of financial assets Measurement of financial assets General: Fair value Specific: Amortised cost (historical cost) Exception: Hedge Accounting Loans and receivables Held-to-maturity investments If no reliable fair value estimate determinable Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fig. 18.3 IAS 39 – Measurement bases of financial liabilities Measurement of financial liabilities General: Amortised cost (historical cost) Held for trading liabilities (including derivatives) Specific: Fair value Exception: Hedge Accounting Those designated using the fair value option Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Hedge accounting Hedge accounting rules apply if a financial instrument (usually a derivative) qualifys as an effective hedging instrument Hedge accounting will try to match any gain or loss that arises due to movements in the hedged item (the result of the hedged risk) with corresponding (but opposite) movements in the hedging instrument Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fig. 18.4 IAS 39 – Accounting for changes in fair value of financial instruments Remeasurement gains or losses on financial instruments (Changes in fair value) Held for trading (including derivatives) Fair value option Available-for-sale Profit or loss of period in which fair value changes occur Directly in equity (through Statement of Changes in Equity) Special treatment Hedge Accounting Recycling of cumulative gain or loss to profit or loss on disposal or impairment Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts IAS 40 Investment property IAS 40 covers tangible fixed assets of property which are held as an investment for the purpose of earning rental or for capital appreciation Choice between an historical cost model and a fair value model (with changes recognized in the income statement) Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts IAS 41 Agriculture IAS 41 covers valuation of biological assets and agricultural produce at the point of harvest Required measurement at fair value less estimated point-of-sale costs from initial recognition up to the point of harvest, with changes in fair value to be include in profit or loss Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Comprehensive income Comprehensive income encompasses all recognized changes in assets and liabilities from transactions or other events except those related to transactions with shareholders in their capacity as owners Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Comprehensive income (cont.) It includes net income (as traditionally defined) and other comprehensive income Other comprehensive income (OCI) is the result of remeasurements that are accounted for directly in equity Recycling of other comprehensive income at transaction completion needed? Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fig. 18.5 Comprehensive income Changes in equity Transactions with shareholders • Share issue • Dividends • Retirement of shares … Share capital Share premium Transactions with others than shareholders Net profit or loss Other comprehensive income recycling Retained profit Reserves Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Accumulated OCI Extended measurement of income income Traditional transaction-based (historical cost realized) profit + economic gains and losses (remeasurements) = Comprehensive income Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Efficient market hypothesis A strongly efficient financial market is one where the price of a security compounds all public information about the security In such a context taking the market price without research would be an efficient way to invest Challenges the benefits of financial statement analysis Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts