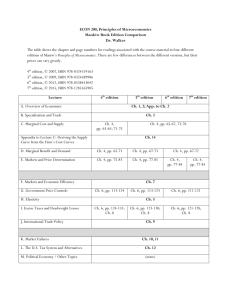

Chapter 13

advertisement

CHAPTER 13 Foreign operations Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Contents Stock exchange requirements Segment reporting Foreign currency transactions and foreign operations Primary translation – reporting foreign currency transactions in the functional currency Secondary translation – translating individual foreign currency financial statements in a group’s presentation currency Alternative accounting methods for secondary translation Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Stock exchange requirements Stock exchange listing as a strategic issue Credibility Public awareness Financing flexibility IFRS accepted by most stock exchanges IFRS not yet fully accepted in the US SEC requires reconciliation statement on net income and shareholders’ equity IFRS/US GAAP convergence program (“Norwalk Agreement”) Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Segment reporting Business and geographical segments may vary significantly in terms of rate of profitability, risks and growth oppportunities Segment reporting reflects a disaggregation of financial statement data by line of business and/or geographical area. IAS 14 Segment Reporting Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Reportable segments Primary reporting format: the company has to identify the dominant source and nature of the risks and returns (business or geographical segments) Analysis will concentrate on the primary format, with nonetheless some limited information on the other segmentation view Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Reportable segments (cont.) A segment is identified as a reportable segment if a majority of its revenue is earned from sales to external customers and a 10% threshold of total revenue, total results or total assets is satisfied Reportable segments should account for at least 75% of total consolidated revenue Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Segment information content Segment information elements: Segment Segment Segment Segment Top-down approach: elements of consolidated financial statements are systematically disaggregated into segment disclosures revenue expense assets liabilities Directly attributable elements and the relevant portion that can be allocated on a reasonable basis to the segment Some awkward links with consolidation procedures Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Foreign currency effects Foreign currency issues affect two different areas 1. 2. Translation of foreign currency transactions and related individual assets and liabilities which are denominated other than in the reporting currency (primary translation) Translation of the financial statements of foreign subsidiaries for inclusion in group financial statements (secondary translation) IAS 21 The Effects of Changes in Foreign Exchange Rates Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fig. 13.1 Primary and secondary translation Business transactions, assets and liabilities denominated in functional currency Business transactions, assets and liabilities,denominated in other currency than FC Primary Translation Individual financial statements in functional currency Secondary Translation Individual financial statements in (group) presentation currency Consolidation Consolidated financial statements in (group) presentation currency Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Functional currency The functional currency concept is central in the translation requirements Functional currency is defined as “the currency of the primary economic environment in which the entity operates” (IAS 21, par.8) It is determined separately for each individual entity within a group and may require considerable professional judgement Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Foreign currency transactions Foreign currency transactions are business transactions that are denominated or require settlement in a currency other than the functional currency of the company On initial recognition, the foreign currency transaction will be recorded in the functional currency by applying the spot exchange rate between the functional currency and the foreign currency at the date of the transaction But which rate to use for subsequent measurement? Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Illustration – Primary translation (table 13.1) UK company (reporting in £) borrows $5m on 1.1.X1, to be repaid on 31.12.X5 Balance sheet date Exchange rate £= Loan £ equivalent 1.1.X1 $1.60 3.125m 31.12.X1 $1.55 3.226m 31.12.X2 $1.40 3.571m 31.12.X3 $1.25 4.000m 31.12.X4 $1.30 3.846m 31.12.X5 $1.40 3.571m How should the loan be accounted for after initial recognition? Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Illustration – Primary translation (cont.) Historical exchange rate or closing rate for subsequent measurement of the loan? 1. Maintain historical rate £3.125m (historical equivalent), stable through time Exchange rate changes have no impact on balance-sheet value No recognition of value increase of the loan OR 2. Convert at closing rate £3.226 (on 31.12.X1), variable through time Exchange rate changes have impact on balance sheet value Recognition of value changes of the loan Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Primary translation – subsequent measurement The accounting treatment (IAS 21) of foreign currency balance sheet items depends on the type of asset acquired or liability incurred Monetary items are translated using the exchange rate at balance sheet date Cash, receivables, payables, loans outstanding etc Non-monetary items are translated using the historical rate of exchange that was in effect at the time the item was acquired or incurred Inventory, equipment, land etc Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Primary translation – subsequent measurement (cont.) Exchange differences arising on translating monetary items at rates different from those at which they were translated on initial recognition or in previous balance sheets shall be recognized in the income statement of the period in which they arise Identical accounting treatment for (unrealised) exchange gains or losses Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Hedging foreign currency transactions UK company (reporting in £) orders a machine tool for €10,000 in FRance (1£=€1) to be delivered in six months’ time Risk: exchange rate € might increase leading to an increase in the acquisition cost of the machine in £ (determined at delivery date) Action: buy €10,000 in advance at order date (to be delivered after 6 months) Result: machine acquisition cost in £ can be fixed at order date IAS 21: On recognition of transaction (at delivery date) the acquisition cost of the machine is converted at the forward exchange rate and not at the spot rate on the moment of delivery Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Secondary translation Secondary translation refers to the process of translating individual foreign currency financial statements in a group’s presentation currency A logical solution might be to translate all the transactions of the foreign subsidiary as though they had been carried by the parent company (see table 13.2) A translation difference (gain or loss) will have to be added to keep the translated balance sheet balancing Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Table 13.2 Consolidation exchange rates Balance sheet item Assets Fixed assets Receivables Inventory Cash Financing Equity Share capital Retained profit Creditors Long-term debt Rate Rate at time of acquisition Rate at balance sheet date (best estimate of likely proceeds) Rate at time of acquisition Rate at balance sheet date Rate at time of subscription Rate ruling at successive balance sheet dates when each slice of retained profit was added to the balance sheet Rate at balance sheet date (best estimate of likely payments) Rate at balance sheet date Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Illustration - Secondary translation Historical or closing rate? Foreign subsidiary (local currency = LC) 1/2/20X1 – Purchase tangible fixed asset for 1m LC Rate 1/2/20X1 – 1 LC = 10 EUR => Acquisition cost of fixed asset in €= €10m 31/12/20X1 – Full consolidation of subsidiary Closing rate – 1 LC = 7 EUR => Translated at closing rate = €7m What will the fixed asset value be in the group accounts? Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Illustration - Secondary translation Historical or closing rate? (cont.) 1. Maintain historical rate 2. €10m, stable through time Exchange rate changes have no impact on balance sheet No recognition of value decrease Use of different exchange rates in balance sheet Use of closing rate €7m, variable through time Exchange rate changes have impact on balance sheet Recognition of value increases and decreases One (unique) translation rate Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Secondary translation models 1. Which translation rate for which element of financial statements? 2. Closing rate, historical rate, average rate How are the translation differences treated? Use of different translation rates always leads to translation differences which have to be accounted for one way or another Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Table 13.3 Exchange rates – temporal method Balance sheet component Fixed assets Depreciation Exchange rate Historical Historical Current assets Inventory Monetary assets Current liabilities Long-term liabilities Historical Current Current Current Equity Share capital Retained earnings Historical Historical /Average Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Temporal method Time perspective of measurement attribute will determine the exchange rate Rates: Items at historical cost => Historical rate Items at current prices/nominal value => Closing rate Earnings => Historical rate / Average rate Translation differences are recognized in the income statement Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Net investment method Net asset value of the subsidiary is considered to be the item to which the exchange rate risk pertains Rates: Closing rate (except for equity) Equity: historical rate Average rate for income statement Translation differences are taken directly in equity under a separate heading Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Worked example on translation methods European Trading Co.plc = British parent (reporting in £) Invests on 1/1/20X1 CHF 3M in Swiss subsidiary Swiss subsidiary locally loans CHF 2M and buys factory for CHF 5M Subsidiary reports CHF 500,000 as profit for 20X1 Evolution exchange rate £ / CHF: Rate on 1/1/20X1 : £ 1 = CHF 4 Rate on 31/12/20X1: £ 1 = CHF 3 Average rate during 20X1: £ 1 = CHF 3,5 Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Worked example – temporal method 1 Jan 20X1 CHF' 000 Fixed assets less Depreciation Net current assets Inventory Monetary assets Current liabilities 31 Dec 20X1 CHF'000 5,000 5,000 -250 __ __ 500 750 -500 __ __ __ Long-term liabilities Total net assets Financed by equity Share capital Retained earnings Total equity 5,000 -2,000 3,000 3,000 __ 3,000 Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts 750 5,500 -2,000 3,500 3,000 500 3,500 Worked example – temporal method 1 Jan 20X1 £’000 Fixed assets less Depreciation Net current assets Inventory* Monetary assets Current liabilities Long-term liabilities Total net assets Equity Share capital Retained earnings*** Translation adjustment** Total equity 31 Dec 20X1 £’000 1,250 — Rate used £= 1,250.00 -62.5 4 4 — 142.86 3.5 — — 250 -166.67 3 3 — 1,250 -500 750 226.19 1,413.69 -666.67 747.02 750 — — 750 750.00 142.85 -145.83 747.02 * 3 4 3.5 This rate is assumed: the temporal method requires use of the actual rate at the time the inventory was acquired, for simplicity the example assumes that inventory was acquired uniformly throughout the year. ** Under the temporal method the translation adjustment is charged against net income and is only shown separately in this example in order to highlight its existence. ***Again to simplify, the depreciation cost in retained earnings is translated at the average rate and not at the historical rate. Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Worked example - closing rate method Fixed assets less Depreciation Net current assets Inventory Monetary assets Current liabilities 1 Jan 20x1 £' 000 31 Dec 20x1 £' 000 1,250 1,667.67 -83.33 __ __ 166.67 __ 250.00 -166.67 __ __ Long-term liabilities Total net assets Equity Share capital (initial) (Translation diff.) Retained earnings Total equity 1,250 -500 750 750 __ __ 750 Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts 250.00 1,833.34 -666.67 1,1667.67 750.00 273.82 142.85 1,166.67 Worked example – comparing methods Fixed assets less Depreciation Net current assets Inventory Monetary assets Current liabilities Long-term liability Total net assets Equity Share capital Translation adjustment Retained earnings Total equity Temporal 31 Dec 20X1 £’000 Net investment 31 Dec 20X1 £’000 1,250.00 -62.50 1,666.67 -83.33 142.86 250 -166.67 166.67 250 -166.67 226.19 1,413.69 -666.67 747.02 250.00 1,833.34 -666.67 1,166.67 750.00 750.00 -145.84 142.86 747.02 273.82 142.85 1,166.67 Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Worked example – effect of translation differences CHF accounts Temporal method Net investment method Growth in equity Opening equity Percentage growth in year 500 3,000 16.67 % -2.98 750 -0.40 % 416.67 750 55.56 % Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Worked example – temporal method 1 Jan 20X1 / CHF Fixed assets 31 Dec 20X1 / CHF 5,000 Rate OB £= (250) 4.00 (62.50) Inventory 500 3.50 142.86 Monetary assets 750 3.00 250.00 Current liabilities (500) 3.00 (166.67) 3.00 (666.67) Totals (2,000) (2,000) 3,000 3,500 3,000 3,000 4.00 1,250 31 Dec 20X1 /£ 1,250.00 LT liabilities 4.00 Rate CB £= 4.00 Less depreciation 5,000 1 Jan 20X1 /£ (500) 750 747.02 Financed by equity Share capital Retained earnings 4.00 750 500 Transl. adjustment Totals 3,000 3,500 750 Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts 4.00 750.00 3.50 142.86 P&L (145.84) 747.02 Worked example – net investment method 1 Jan 20X1 / CHF Fixed assets 31 Dec 20X1 / CHF 5,000 Rate OB £= (250) 3.00 (83.33) Inventory 500 3.00 166.67 Monetary assets 750 3.00 250.00 Current liabilities (500) 3.00 (166.67) 3.00 (666.67) Totals (2,000) (2,000) 3,000 3,500 3,000 3,000 4.00 1,250 31 Dec 20X1 /£ 1,667.67 LT liabilities 4.00 Rate CB £= 3.00 Less depreciation 5,000 1 Jan 20X1 /£ (500) 750 1,166.67 Financed by equity Share capital Retained earnings 4.00 750 500 Transl. adjustment Totals 3,000 3,500 750 Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts 4.00 750.00 3.50 142.85 Balance sheet 273.82 1,166.67 Worked example – comparison of methods Rate CB £= Temporal method 31 Dec 20X1 / ‘000£ Rate CB £= Net investment method 31 Dec 20X1 / ‘000£ Fixed assets 4.00 1,250.00 3.00 1,667.67 Less depreciation 4.00 (62.50) 3.00 (83.33) Inventory 3.50 142.86 3.00 166.67 Monetary assets 3.00 250.00 3.00 250.00 Current liabilities 3.00 (166.67) 3.00 (166.67) LT liabilities Totals 3.00 (666.67) 3.00 (666.67) 747.02 1,166.67 Financed by equity Share capital 4.00 750.00 4.00 750.00 Retained earnings 3.50 142.86 3.50 142.85 Transl. adjustment P&L (145.84) Balance sheet 273.82 Totals 747.02 Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts 1,166.67 Functional currency and type of foreign operation IAS 21 sets the functional currency of a foreign subsidiary which is heavily integrated with the operations of the parent and for which the temporal method is more appropriate, equal to the functional currency of the parent IAS 21 only refers to the closing rate method as the method to be used whan translating foreign currency financial statements to the presentation currency of the group The translation difference (under the net investment method) is treated as a direct adjustment to equity Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts