Chapter 17

advertisement

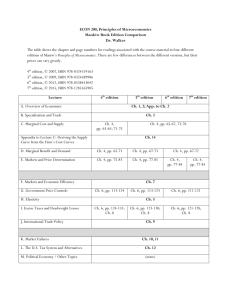

CHAPTER 17 Financial statement analysis II Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Contents Introduction – Framing of financial statement analysis Quality of earnings Analytical techniques Strategic ratio analysis Z scores Shareholder value Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Framing of financial statement analysis Accounting numbers are not the only input into the assessment of a company’s prospects Figure 17.1 provides an overview of relevant framing factors Increasing use of investor briefings by companies Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fig. 17.1 Rating pyramid Sovereign macro-economic analysis Industry sector analysis Regulatory environment (national and global) Competitive trends in sector Market position Quantitative analysis financial statements past performance future projections Qualitative analysis management strategic direction financial flexibility Rating Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Quality of earnings Is profit (and profit growth) sustainable? What is the impact of short term conditions ? What is the impact of ‘creative’ accounting changes ? Changes in accounting policies Changes in accounting estimates Changes in consolidation scope Changes in interest % Exceptional sale of assets or business segments Other extraordinary operations Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Quality of earnings (cont.) Some analysts will compare, in a longitudinal fashion, operating profit to net operating cash flow to identify and analyse the effect of ‘accruals’- games on operating earnings. Quality of operating earnings = Net operating cash flow Net operating profit Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Discontinuing operations A discontinuing operation is a clearly distinguishable component of a group’s business, that (a) Is disposed of or terminated pursuant to a single plan (b) Represents a separate major line of business or geographical area of operations, and (c) Can be distinguished operationally and for financial reporting purposes. Requires major additional disclosures Income statement / Cash Flow Statement / Notes Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts IFRS 5 - Presentation of Discontinued Operations in the Income Statement (Extract) XYZ GROUP - INCOME STATEMENT FOR THE YEAR ENDED 31 DECEMBER 20-2 (illustrating the classification of expenses by function) (in thousands of currency units) Continuing operations 20-2 Revenue X Cost of sales (X) Gross profit X Other income X Distribution costs (X) Administrative expenses (X) Other expenses (X) Finance costs (X) Share of profit of associates X Profit before tax X Income tax expense (X) Profit for the period from continuing operations X 20-1 X (X) X X (X) (X) (X) (X) X X (X) X continues Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts IFRS 5 - Presentation of Discontinued Operations in the Income Statement (Extract) – cont. Discontinued operations Profit for the period from discontinued operations1 X X Profit for the period X X X X X X X X Attributable to: Equity holders of the parent Minority interest 1 The required analysis would be given in the notes Source: IFRS 5 – Non-current assets held for sale and discontinued operations, Guidance on implementing Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Analytical techniques Common accounting base Common size Ebitda Objectives of analysis Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Common accounting base Adapt financial statement data for differences in accounting rules among companies, e.g. Accounting for R&D costs Depreciation rules Goodwill treatment Revaluation of fixed assets Set up comparable pro-forma statements for cross-sectional analysis Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Common size Common size financial statements Resize components of balance sheet as a % of total assets Express components of income statement as a % of sales They allow a straightforward internal or structural analysis of a company’s financial position and performance Useful for comparisons in time and in space Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Ebitda ‘Earnings before interest, taxation, depreciation and amortization’ Proxy for net operating cash flow Cleans operating result for non-cash costs and non-cash revenues Robust measure for comparison of performance in time and space Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Objectives of analysis Investors and creditors as predominant users of financial statements Broadly, both investor and creditor will use the same indicators, but the relative importance of specific indicators will be different and will be contingent on the type of investor (and creditor) decisions to be made Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Strategic ratio analysis Sustainable growth ROI decomposition Financial leverage Operational gearing Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Recap ratio analysis Understand accounting principles Develop a consistent analysis framework Constraints of an historical perspective Garbage in, garbage out Take into account trends and industry comparisons Take into account worldwide variations in accounting rules Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Strategic analysis Elements of strategic analysis: Phase in life cycle of company and products Nature of market • Difficult entry <> large margins • Easy entry <> margins usually very low Nature of products • Niche products (low volume, high price) • Bulk (high volume, low margins) …. Develop (combinations of) ratios which will give insights to a company’s strategic positioning Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Sustainable growth Look at growth of key items of financial statements Trend analysis Differentiate organic and acquired growth Sustainable growth = ROE x (1 – Dividend payout ratio) Dividend payout = Dividend / Earnings attributable to shareholders = indicator of internally generated growth potential if the company’s profitability, dividend payout and level of debt financing are kept constant Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Growth analysis Periodic growth of sales as point of departure Link with profit growth ? Differentiate between organic and acquired growth Identify regional or geographic location of growth Differentiate growth potential by business segment Impact on cash flow ? Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts ROI decomposition There is a conventional relationship between management performance ratios which links return on investment, profit margin and asset turnover as follows: Profit margin * Asset turnover = ROI If we apply this reasoning to the ROA (return on assets) ratio, we arrive at the following algebraic equality: Profit before interest Sales * Sales Total assets = Profit before interest Total assets Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts ROI decomposition (2) Assume: ROA decreases over a number of periods Cause? Asset turnover, Profit margin or both ? Assume: Asset turnover drops => Cause? Sales, assets or both? Potential causes: (1) (2) Due to competition, sales decrease and one is not able to adjust inventory levels accordingly Recent investments in IT were necessary to support current competitive position Assume: Profit margin decreases => Cause ? Increasing operating expenses, decreasing market share, decreasing sales prices, … Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Financial leverage Taking the analysis one step further, the return on equity can be analytically linked to the return on assets ratio with the introduction the concept of financial leverage. ROA * Financial leverage = ROE Starting with the ROA (return on assets) ratio, we arrive at the following algebraic equality: Profit before interest Total assets * Total assets Equity = Profit before interest Equity Alternatively, we can start from the original ROE definition and get the following: Net profit for the period * Total assets Total assets = Equity Net profit for the period Equity Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Final leverage coefficient A related, but somewhat different, concept is the financial leverage coefficient ratio, defined as ROE divided by ROA: Financial leverage coefficient = ROE% / ROA% Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Table 17.1 Financial leverage effect at different debt/equity ratios Total assets = 1,000 ROA = 10% After-tax cost of debt = 7% Debt /Equity Profit before interest Cost of debt Net profit ROE Financial leverage coefficient 100% 150% 300% 100 100 100 35 42 52.5 65 58 47.5 13% 14.5% 19% 13%/10% = 1.30 1.45 1.90 Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts The DuPont model Combining ROI decomposition and financial leverage brings us to the following overall model (also called the DuPont model): ROE = Net profit margin * Asset turnover * Financial leverage or: Net profit for the period = Equity Net profit for the period Sales Sales * Total assets * Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Total assets Equity Operational gearing Volatility of profit as a function of changes in sales (taking into account the cost structure) Operational gearing is the % change in profit as sales changes 1% Based on the traditional difference between fixed and variable costs Operational gearing = (Sales – variable costs) / EBT or (Earnings before tax + fixed costs) / EBT Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fig. 17.2 Operational gearing Value Sales Costs = Fixed + Variable Costs Break-even Volume Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fig. 17.2 Operational gearing (cont.) Value Sales Costs = Fixed + Variable Costs Break-even Volume Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fig. 17.2 Operational gearing (cont.) Value Sales Costs = Fixed + Variable Costs Break-even Volume Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Different cost structures Sales Fixed costs Variable costs PbT Operational gearing Co. A 100 20 70 10 3:1 Co.B 100 70 20 10 8:1 If sales increase by 10%, profit before tax of company A increases by 30% and profit of company B by 80% A decrease in sales will have a more dramatic effect in company B Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Operational gearing indicators Operational gearing = (Sales – variable costs) / EBT (Earnings before tax + fixed costs) / EBT Proxy in external analysis: LT assets / Total assets LT assets / Current assets Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Investigate link between ratios and cash flows Cash from operations Changes in working capital Days credit given and net working capital Investment outflows ROCE, profit margins and growth Capital intensity, age assets and depreciation regime Free cash flow Should be positive if company in stable position Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Z-scores Failure prediction models: ratios are used as input for more sophisticated models, taking into account the simultaneous impact of several factors How measured ? 2 samples with mutual matching of which one with failed companies - data consist of financial ratios relative to years before failure => ratios which discriminate best between two groups are used as input for failure prediction models Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Shareholder value Focus on present (discounted) value of forecast earnings Time value of money and present value calculations Forecast cash flows Discount rate Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Present value The essence of present value is that a rational person will prefer to have a receipt sooner rather than later because the money can be used to generate more money. For example, if a company has a choice of receiving $1,000 now or $1,000 in a year’s time, it would prefer to have the cash now because it could be invested and earn a return. If the money was put into risk free securities where it could earn 15 per cent, then $1,000 now would be worth $1,150 in a year’s time. Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Present value (cont.) Extending that, the $1,000 to be received after a year is worth $1,000/1.15 (or $870) today, because $870 invested today at 15 per cent would yield $1,000 in a year’s time. Similarly, $1,000 to be received in two years’ time is worth $1,000/(1.15*1.15) = $756 at present (i.e. compound interest at 15 per cent for two years would be $244). Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts