Cash Flow Statements

advertisement

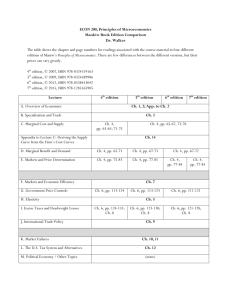

CHAPTER 10 Cash flow statements Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Contents Introduction – The cash flow statement Usefulness of cash flow information Cash flow cycles Format and structure of the cash flow statement Cash flow from operating activities Cash flows from investing and financing activities Direct and indirect method for operating cash flows Constructing a cash flow statement Disposal of fixed assets Presentational differences Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Cash flow statement A cash flow statement presents information about the cash flows associated with the company’s main operations and those associated with its investing and financing activities of the period A cash flow statement functions in conjunction with both the income statement (performance dimension) and the balance sheet (financial position) IAS 7 Cash Flow Statements Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Usefulness of cash flow information Ability to generate adequate cash flows is a significant performance dimension Cash flow information clarifies the dynamics of short-term liquidity and long-term solvency Cash flow information is an essential input for economic decision models Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Cash flow versus profit Cash flow and profit are different economic phenomena But linked through the mechanisms of accrual accounting! Cash flows are factual details of incoming and outgoing flows of cash, while the balance sheet and income statement emanate from professional judgement and are not a direct projection of objective economic data Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Liquidity/solvency and cash flows Liquidity - Solvency - Relates to “nearness to cash” of the structure of assets Determined by capacity to convert current assets into cash Relates to future availability of cash in order to settle financial liabilities on due date Determined by timing and uncertainty of expected future cash payments and cash receipts Liquidity and solvency ratios are determined on static financial position data, while cash flows reflect changes in financial position Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Relationship with BS and IS Income statement BS at start Cash flow BS at end A cash flow statement reflects both “profit related” and “non-profit related” activities (investing and financing) with an impact on available cash over the period covered in the income statement Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Related questions 1. 2. 3. 4. 5. From which sources did the company raise cash last year? How was this cash used? Were the normal operating activities capable of satisfying its need for cash during the year? If not, is the shortage of cash compensated by new borrowings, issuing new share capital or by selling fixed assets? Is a surplus of cash used for repayment of debt, for investments or for distribution of dividends? Why has the balance of cash available decreased, knowing that the company’s operations have been profitable? Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Cash conversion cycles Cash flows through the company continuously in a series of short-term and long-term conversion cycles The ST - cash conversion cycle (operating cycle) relates to the main business operations = OPERATING ACTIVITIES Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Cash conversion cycles (cont.) The LT- cash conversion cycles relate to the acquisition, renewal and disposal of intangible and tangible infrastructure and the long-term sourcing of funds Productive capacity acquired for cash and subsequently consumed during several SToperating cycles Acquisition and disposal of infrastructure = INVESTING ACTIVITIES External sourcing of funds = FINANCING ACTIVITIES Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fig. 10.1 Long-term and short-term cash flow cycles Main operations Inventory Procurement Work in Progress Sales Current payables Inventory Current receivables Payments Cash and cash equivalents Receipts Investing/ Productive infrastructure External financing Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Format and structure of the cash flow statement Cash flows from operating activities + Cash flows from investing activities + Cash flows from financing activities Net change in cash during period + Beginning cash balance Ending cash balance Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Cash flows from operating activities Operating activities are primarily the revenue-generating activities of a company “Operating cash flow” is conceptually most near to “net profit” Main differences: 1. 2. 3. Non-cash expenses and non-cash revenues (f.i. depreciation expense) Non-operating items (f.i. gain on disposal of tangible fixed assets) Timing differences between net profit and underlying cash flow (f.i. changes in the level of inventories, receivables, creditors, etc.) Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Operating cash flows: Examples Receipts from sale of goods and rendering of services (cashing in of receivables included) Receipts from taxes on sales and VAT Receipts from royalties, fees, commissions,… Payments to suppliers (payment of creditors included) Payments to employees Payments of taxes, VAT, fines, … Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Operating cash flows – Direct versus indirect method 2 methods for identifying and presenting the operating cash flow: Direct method: engenders the presentation of the most important categories of gross operating cash inflows and cash outflows Indirect method: net operating cash flow is determined by adjusting the (net) profit figure for the 3 types of differences Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Direct method - Example Cash receipts from customers 30,150 Cash paid to suppliers and employees (27,600) Cash generated from main operations 2,550 Income taxes paid (1170) Net cash flow from operating activities 1,380 Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Indirect method - Example Net profit before tax Adjustments for: Depreciation Investment income 3,350 490 (100) 3,740 Working capital changes: Increase in trade and other receivables (500) Decrease in inventories 1,050 Decrease in trade payables Cash generated from main operations Income taxes paid Net cash flow from operating activities Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts (1,740) 2,550 (1170) 1,380 Cash flow proxy Net profit or loss after tax Add back: Depreciation charge for the year Provisions created in year Deduct: Provisions released in year ‘Cash flow proxy’ xxxxxxxxxxxxxx xxxxxxxxxxxxxxx xxxxxxxxxxxxxxx (xxxxxxxxxxxxxx) xxxxxxxxxxxxxx Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Cash flow proxy (bis) Net profit or loss after tax xxxxxxxxxxxx Add back: Depreciation for the year Provisions created in year Deduct: Provisions released xxxxxx xxx (xxxx) Gain on asset disposal (xxxxx) Net change in non-cash working capital (xxxxx) ‘Cash flow proxy’ xxxxxxxxxxxx Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Cash flows from investing activities Investing activities relate to the acquisition and disposal of long-term tangible and intangible assets and other investments Cash flows from investing activities are an indication of the expansion or downsizing of operating capacity Examples: Payments for newly acquired equipment Receipts from the disposal of a building Payments for new investments Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Cash flows from financing activities Financing activities relate to changes in the size and composition of contributed capital and financial debt of the company Examples: Receipts from issuing new shares or bonds Receipts from new bank loan Payments for buy-back of shares Repayments of loans Payments of interest and dividend Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Constructing a cash flow statement 1. 2. 3. Determine the net change in cash Compare beginning and ending balance Identify all transactions of the period leading to a change in cash Direct: analyze movements in the accounts of cash (equivalents) transaction by transaction Indirect: explain net change of cash by analyzing all other accounts, knowing that each transaction with an impact on cash also affects a non-cash account Use the information (of step 1 and 2) to construct a cash flow statement according to the formal rules Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Applying step 2 Information for operating cash flow is primarily derived from balances in the IS, while information for the two other principal categories comes from the Balance Sheet (and details in the Notes) Movements in the accounts indicate a change in financial position and further examination is needed to determine if they had a cash impact Check if balances have been impacted by “accrualbased adjustments” or other “non-cash activities” Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Fig. 10.2 Classifying balance sheet movements as inflows or outflows of cash Assets Equity/liabilities Increase Outflow Inflow Decrease Inflow Outflow Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Illustration - Constructing a CFS (1) Assets Fixed assets (at cost) Acc. depreciation Inventories Trade receivables Cash Financing Equity Share capital Reserves X2 profit Liabilities Trade payables LT debt X2 X1 ∆ 980 -350 180 115 92 1017 740 -265 171 98 110 854 240 85 9 17 18 600 90 50 600 90 __ __ 50 50 62 215 1017 59 105 854 3 110 3 110 266 Outflow Inflow 240 85 9 17 18 __ 266 Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Illustration - Constructing a CFS (2) Operating activities Net profit after tax Add back depreciation Changes in non-cash working capital Net cash flow from operations (A) Investing activities Purchase of fixed assets (B) Financing activities New LT debt (C) Net change in cash (A+B+C) Cash balances At beginning of year At balance sheet date Difference Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts 50 85 135 –23 112 –240 110 –18 110 92 –18 Disposal of fixed assets - Example Disposal of equipment: - Acquisition cost 275 Accum. depreciation - 200 Net carrying value = 115 Sale at 135 Result (gain) on disposal = 135 - 115= 20 Incoming cash flow = 135, composed of a decrease in net carrying value of equipment in the BS (115) and gain on disposal in the IS (20) Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Disposal of fixed assets Net profit after tax xxxxxxxxxxxx Add back: Depreciation xxxxxx Provisions created xxxxxx Loss on disposal of assets xxxxxx Deduct: Provisions released xxxxxx Gain on asset disposal xxxxxx +/- Change in non-cash working capital xxxxxx Net cash flow from operating activities xxxxxxxxxxxx Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Incoming cash flows Cash + Other assets = Liabilities + Owners’equity (1) + (2) + (3) + + + Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Outgoing cash flows Cash + Other assets = Liabilities + Owners’equity (1) - (2) - (3) - + - Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Presentational choices Interest paid can be classified under either operating or financing activities Interest and dividends received can be included in either operating or investing cash flows Starting from net profit or operating profit under the indirect method (with implications for the adjustments to be made) Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts IAS 7 - Direct Method (Extract) 20X2 Cash flows from operating activities Cash receipts from customers Cash paid to suppliers and employees Cash generated from operations Interest paid Income taxes paid 30,150 (27,600) 2,550 (270) (900) Net cash from operating activities Cash flows from investing activities Acquisition of subsidiary X, net of cash acquired Purchase of property, plant and equipment Proceeds from sale of equipment Interest received Dividends received 1,380 (550) (350) 20 200 200 (480) Net cash used in investing activities Cash flows from financing activities Proceeds from issue of share capital Proceeds from long-term borrowings Payment of finance lease liabilities Dividends paid* Net cash used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period * This could also be shown as an operating cash flow. 250 250 (90) (1,200) (790) 110 120 230 Source: IAS 7 – Cash Flow Statements, Appendices Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts IAS 7 - Direct Method (Extract) 20X2 Cash flows from operating activities Cash receipts from customers Cash paid to suppliers and employees Cash generated from operations Interest paid Income taxes paid 30,150 (27,600) 2,550 (270) (900) Net cash from operating activities Cash flows from investing activities Acquisition of subsidiary X, net of cash acquired Purchase of property, plant and equipment Proceeds from sale of equipment Interest received Dividends received 1,380 (550) (350) 20 200 200 (480) Net cash used in investing activities Source: IAS 7 – Cash Flow Statements, Appendices Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts IAS 7 - Direct Method (Extract- cont.) Cash flows from financing activities Proceeds from issue of share capital Proceeds from long-term borrowings Payment of finance lease liabilities Dividends paid* 250 250 (90) (1,200) (790) Net cash used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period 110 120 230 * This could also be shown as an operating cash flow. Source: IAS 7 – Cash Flow Statements, Appendices Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts IAS 7 - Indirect Method (Extract) 20X2 Cash flows from operating activities Profit before taxation Adjustments for: Depreciation Foreign exchange loss Investment income Interest expense Increase in trade and other receivables Decrease in inventories Decrease in trade payables Cash generated from operations Interest paid Income taxes paid 3,350 450 40 (500) 400 3,740 (500) 1,050 (1,740) 2,550 (270) (900) Net cash from operating activities Cash flows from investing activities Acquisition of subsidiary X net of cash acquired Purchase of property, plant and equipment Proceeds from sale of equipment Interest received Dividends received 1,380 (550) (350) 20 200 200 Net cash used in investing activities Cash flows from financing activities Proceeds from issue of share capital Proceeds from long-term borrowings Payment of finance lease liabilities Dividends paid* Net cash used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period * This could also be shown as an operating cash flow. (480) 250 250 (90) (1,200) (790) 110 120 230 Source: IAS 7 – Cash Flow Statements, Appendices Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts IAS 7 - Indirect Method (Extract) 20X2 Cash flows from operating activities Profit before taxation Adjustments for: Depreciation Foreign exchange loss Investment income Interest expense Increase in trade and other receivables Decrease in inventories Decrease in trade payables Cash generated from operations Interest paid Income taxes paid Net cash from operating activities 3,350 450 40 (500) 400 3,740 (500) 1,050 (1,740) 2,550 (270) (900) 1,380 Source: IAS 7 – Cash Flow Statements, Appendices Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts IAS 7 - Indirect Method (Extract – cont.) 20X2 Cash flows from investing activities Acquisition of subsidiary X net of cash acquired Purchase of property, plant and equipment Proceeds from sale of equipment Interest received Dividends received (550) (350) 20 200 200 (480) Net cash used in investing activities Cash flows from financing activities Proceeds from issue of share capital Proceeds from long-term borrowings Payment of finance lease liabilities Dividends paid* 250 250 (90) (1,200) (790) Net cash used in financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period 110 120 230 * This could also be shown as an operating cash flow. Source: IAS 7 – Cash Flow Statements, Appendices Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts