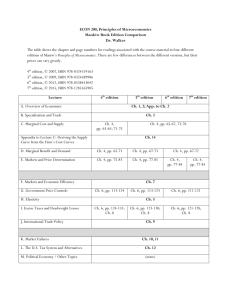

Chapter 14

advertisement

CHAPTER 14 Issues in financial reporting by multinationals Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Contents Investor relations Income smoothing Supplementary information Financial instruments Pension obligations Environmental disclosures Intellectual capital Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Investor relations Investor relations is a company department whose job it is to maintain continuing relations with financial market professionals (to respond to their questions, organize ‘roadshows’, etc.) Financial market professionals tend to become company specialists Internet brokers facilitate private investors as active market participants Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Income smoothing Income smoothing is a kind of earnings management (‘managing’ reported earnings to meet analysts’ expectations) Earnings management is stimulated by the direct link between accounting earnings and share price (P/E ratio) Income smoothing refers more specifically to the preference of reporting steadily rising profits Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Price/earnings ratio The P/E ratio reflects the degree of risk which the market considers inherent to a particular company within a particular industry Market professionals use P/E to value shares Current market price is evaluated as a function of the historic P/E * forecast earnings per share Changes in expected earnings directly affect market price of a share Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Managing earnings Management of discretionary costs R&D, staff training, advertising Temporal adjustments in cost levels Closure of loss-making divisions Changing the consolidation scope Cookie jar accounting Stash accruals in ‘cookie jars’ during good times and reach into them when needed in bad times Misuse of provision accounting Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Big bath accounting Taking a one-time loss through a major cleaning-up exercise (‘big bath’) of the balance sheet Identifying and adjusting over-valued assets and under-valued liabilities Usually explained as an exceptional one-time operation Restructuring charges make room for future profit enhancements Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Supplementary disclosures Supplementary disclosures are used as a way of dealing with events which are too difficult to measure reliably Contingencies (IAS 37) Supplementary disclosures are used as a way of informing investors on events which do not relate to the accounting period but may have an impact on future years Post-balance sheet events (IAS 10) Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Contingencies A contingency is a condition or situation, the ultimate outcome of which (gain or loss) will be confirmed only by the occurrence or nonoccurrence of uncertain future events not wholly under control of the company IAS 37 Provisions, Contingent Liabilities and Continent Assets Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Provisions A provision is a present obligation as a result of a past event, whereby It is probable that settlement of the obligation will lead to a future outflow of company resources The amount or timing of future outflow is uncertain A reliable estimate of the amount of the obligation is feasible Borderline between provisions and contingent liabilities Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts IAS 37 – Provisions, Contingent Liabilities and Contingent Assets (Extracts) Definitions 10. A contingent liability is: (a) a possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity; or (b) a present obligation that arises from past events but is not recognised because: (i) it is not probable that an outflow of resources embodying economic benefits will be required to settle the obligation; or (ii) the amount of the obligation cannot be measured with sufficient reliability. A contingent asset is a possible asset that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity. Source: IAS 37 – Provisions, Contingent Liabilities and Contingent Assets Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Figure 6.1 Decision tree - Recognising a provision Start Present obligation as a result of an obligating event No Possible obligation ? No Yes Probable outflow ? No Remote? Yes No Yes Reliable estimate ? No (rare) Yes Provide Disclose contingent liability Do nothing Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Source: IAS 37 – Provisions, Contingent Liabilities and Contingent Assets Contingent liabilities A contingent liability refers to 1. 2. A possible obligation that arises from past events, or A present obligation that is not recognized because the future expenditure is not probable or the obligation cannot be measured with sufficient reliability Requires disclosure in the notes to the accounts as it may affect the assessment of future profitability Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Onerous contracts Pending contracts in general need no special accounting treatment except if they are ‘onerous’ Onerous contracts are contracts where the expected unavoidable costs of meeting the contract are greater than the benefits expected to be received from it If a contract is onerous, the present obligation under the contract terms should be recognized as a provision Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Contingent assets Contingent assets refer to events which give rise to the possibility of an inflow of economic benefits to the company If the inflow of economic resources is probable, the material contingent gains (contingent asset) should be disclosed in the notes If the inflow of economic resources is either possible or remote, disclosure is not required Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Post-balance sheet events Events between the balance sheet date and the date the financial statements are authorized for issue with a significant bearing upon the future of the company IAS 10 Events after the Balance Sheet Date Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Types of post-balance sheet events Adjusting events are those that provide evidence of conditions that existed at the balance sheet date These shall be reflected in the financial statements by adjusting the amounts recognized Non-adjusting events are indicative of conditions that arose after the balance sheet date If material, their nature and estimated effect should be disclosed in the notes to the accounts Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts IAS 10 – Events after the Balance Sheet Date (Extract) Definitions 3. Events after the balance sheet date are those events, favourable and unfavourable, that occur between the balance sheet date and the date when the financial statements are authorised for issue. Two types of events can be identified: (a) those that provide evidence of conditions that existed at the balance sheet date (adjusting events after balance sheet date); and (b) those that are indicative of conditions that arose after the balance sheet date (non-adjusting events after the balance sheet date). Source: IAS 10 – Events after the Balance Sheet Date Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Financial instruments Financial instruments follow specific recognition and measurement rules (see chapter 18) and require extensive disclosures, especially on their risk management implications IAS 32 Financial Instruments: Disclosure and Presentation IFRS 7 Financial Instruments: Disclosures (from 2006 on) Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Pension obligations Pension obligations with regard to extra-legal pension schemes have to be recognized and properly disclosed Two main types can be discerned: defined contribution plans and defined benefit plans IAS 19 Employee Benefits specifies the accounting rules and requires extensive disclosures on pension scheme details Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Defined contribution plans Under a defined contribution plan, the company pays fixed contributions to a pension fund and has no obligation to pay further contributions if the fund does not hold sufficient plan assets to pay the pension benefits No special accounting rules apply contributions payable under the plan are recognized as an expense as the employee provides services Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Defined benefit plans Under a defined benefit plan, the company guarantees to provide to the retired employee a pension which may, for example, be a proportion of the final salary of the employee; the employee accumulates rights to a bigger and bigger portion with each year of service IAS 19 requires an estimate of the defined benefit obligation at balance sheet date and the recognition of a pension liability, net of the fair value of the funded plan assets Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Defined benefit obligation The defined benefit obligation (DBO)is estimated based on a set of actuarial assumptions which encompass demographic and financial characteristics The funding rate of the pension plan affects the defined benefit liability recognized un the balance sheet, but not the DBO DB liability = DBO minus Fair value of funded plan assets Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Pension cost The cost of providing pension benefits should be recognized in the period in which the benefit is earned, not when it is paid The pension cost is determined as the change in the defined benefit liability for the year and charged to the income statement Pension costs details are separately disclosed in the notes to the accounts Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Actuarial assumptions Actuarial assumptions relate to distant time horizons and significant uncertainties Future characteristics of current and former employees (and their dependents), mortality rates, rates of employee turnover and early retirement Discount rate, future salary levels, expected return on plan assets DB calculations are sensitive for these actuarial assumptions Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Actuarial gains and losses Changes in actuarial assumptions and unexpected changes in the fair value of plan assets result in actuarial gains and losses IAS 19 provides for a ‘corridor’ of 10% of the DBO or of the fair value of the plan assets within which the actuarial gains and losses need not be immediately recognized The corridor functions as a cushion against short-term fluctuations Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Environmental disclosures Majority of environmental disclosures (included in management commentary, a stand-alone section of the annual report or in the notes to the accounts) are voluntary and company-specific Mandatory reporting requirements dealing with environmental liabilities and contingencies Decommissioning costs as a specific topic Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Decommissioning liabilities Decommissioning liabilities arise if a company, when it purchases or constructs an asset, takes on a contractual or statutory obligation to decommission the asset or restore the asset site to certain minimum standards at the end of the asset’s life A provision is recognized as soon as the dismantling obligation exists and the provision expenses are capitalised as part of the asset’s acquisition cost Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts Intellectual capital Large parts of intellectual capital (intellectual resources/assets) fall outside the bounderies of the financial accounting model However, as intellectual capital fits into the framework of analysts’ concerns about assessing the quality of management and its resources, companies tend to discuss these issues in the voluntary sections of the annual report Use with Global Financial Accounting and Reporting ISBN 1-84480-265-5 © 2005 Peter Walton and Walter Aerts