Unit 4- Financial Sector

Sam Simon

At the base of the pyramid on the $1 bill

you will find “****” in Roman Numerals

On the $100 bill, the clock tower of

Independence Hall in Philadelphia is

shown with the time set at 4:10.

According to the US Bureau of Engraving

and Printing, “there are no records

explaining why that particular time was

chosen”

The elm tree on back of the $20 bill near

the White House represents a real tree

in this same location. However, the tree

is no longer on the White House grounds

because it succumbed to rain-softened

ground in 2006

Most people save $2 bills, thinking they

are rare and therefore valuable; they're

actually worth... $2

97% of all paper money contains

traces of cocaine

Barter

• Inefficient

• Prevents economic growth

• Double coincidence of wants

Types of Money

Commodity money- money itself serves a

purpose (i.e. tulip bulbs, salt, tobacco)

Commodity-Backed money- money’s value is

backed by a commodity (gold, silver)

*Fiat money- value based solely on acceptance

of value and government backing

Functions of Money

• Medium of Exchange

• Unit of Account (Standard of Value)

• Store of Value

Time Value of Money

Money and Interest Rates

• PV=FV/(1+r)n

• FV = PV X (1+r)n

13% interest rate

I give you $100 today

I give you $100 on March 10, 2016

*No calculators on the AP exam, so…

Money Supply

Measures based on Liquidity

• Monetary Base =

• M0 =

• M1=

• M2=

The Banking System

– Three important features of the fractional reserve

banking system:

• Bank profitability

• Banks discretion over the money supply

• Exposure to bank runs

The Banking System

• Principles of Bank Management: Profits versus

Safety

– Greater risk – greater potential profit.

– How much risk to take??

– How’s that worked out?

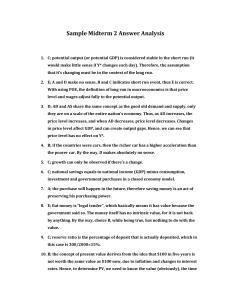

FIGURE 28-1 Bank Failures in the United

States, 1915-2000

2,200

FDIC established

1,800

1,600

1,400

1,200

1,000

800

Number of Bank Failures

Number of Bank Failures

2,000

200

160

120

80

40

0

1935

1945

1955

1965

1975

1985

'95 '00

600

400

Great Depression begins

200

0

1915 1920 1925 1930 1935 1940 1945 1950 1955 1960 1965 1970 1975 1980 1985 1990

Year

'95

'00

Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

The Banking System

• Bank Regulation

– Deposit Insurance

• The Federal Deposit Insurance Corporation insures

people’s deposits at banks.

– Bank Supervision

• Ensures banks take only sensible, defensible risks

• Controls the money supply

– Reserve Requirements

• Helps control the money supply

Multiplier Effect

• Simple Deposit Multiplier = 1 /Reserve Requirement

• RR = 10%

• Multiplier =

Money Supply Expansion

• Expansion = Multiplier X Excess Reserves

• For each calculate expansion for a $1000

deposit.

How Bankers Keep Books

Banks keep balance sheets

Assets = liabilities + net worth (Equity)

Assets include:

Reserves

Loans

Liabilities include:

Deposits owed to customers.

Money Market

Money Market

• Q of money is fixed at any given point in time

• MS = M1

Money Market

• i = nominal interest rate

• Money Market graphs short term interest rates

Money Market

• Nominal Interest rate is the Federal Funds Rate

• FFR = rate banks charge each other for

overnight loans

Money Market

• MD= Q of money demanded at various interest

rates

• Q of money demanded = amount of wealth held as

money over other assets

Money Market

• What is the opportunity cost of holding money?

Money Market

• Money v. Bonds

Money Market

• Change in “i“ causes movement along the curve

Money Market

• Increase in RGDP and Price Level will shift MD to

the right

Fed Tools

• Open Market Operations- buy/sell bonds

• Discount Rate- rate Fed charges banks

• Reserve Requirement/Required Reserve Ratio

What should the Fed do?

• During a recessionary period? List 3

• During an inflationary period? List 3

What should the Fed do?

• During a recessionary period?

– Expansionary Monetary Policy

• During an expansionary period?

– Contractionary Monetary Policy

Agenda

• FRQ Review

– Bond Basics

– Bond prices

• Balance Sheets

– Intro and Practice

• HW- Real v. Nominal Article

• Test- Friday???? Or Monday

Just what is a bond?

•

•

•

•

•

•

•

•

Issued by a government or business to raise $

Bond purchaser is the lender

Purchaser receives regular interest payments

Interest rate is called coupon rate

Purchaser is paid the principle at maturity

Longer the term, higher the interest

Bonds can be traded before maturity

Privately issued bonds have higher coupon

rates- more risk

• US government bonds have “zero” risk

Agenda

• Balance Sheet FRQs

• Money Demand Dissected

• Equation of Exchange Intro

• Sides Game

Stock v. Bonds

• Stock = owner

• Bond = lender

– Riskier company = higher coupon rate

Trading Existing Bonds

• If interest rates go up?

• If interest rates go down?

How Bankers Keep Books

Banks keep balance sheets

Assets = liabilities + net worth (Equity)

Assets include:

Reserves

Loans

Liabilities include:

Deposits owed to customers.

Balance Sheets- Important Points

1. Deposits and withdraws do not INITIALLY change M1

2. Required Reserves only apply to demand (checkable) deposits

Demand for Money

• Transaction Demand- function?

• Asset Demand- function?

Demand for Money

• Financial Assets- stocks, bonds, loans, deposits

• Asset Demand- inverse relationship to interest rates

Monetarism

• Money Supply is chief determinant of

economic growth

• MV = PQ

MV = PQ

• Equation of exchange

•

•

•

•

M= money supply

V= velocity of money

P= price level

Q= quantity of goods and services produced

MV = PQ

• Equation of exchange

• V = constant

• Increase in M should outpace increase in Q

• Otherwise- “Too much money chasing too few

goods”

MV = PQ

• Otherwise- “Too much money chasing too few

goods”

Sides Game

Investment Demand

Investment Demand

• Investment leads to capital formation

• This changes future capital stock

• This influences growth rate

Investment Demand

• Some Determinants

– Expectations

– Capacity Utilization

– Cost of Capital Goods

– Tax Credits