Unit 3 Powerpoint

What Makes Money . . . Money?

Money has three basic functions

as a medium of exchange, a standard of value, a store of value

Money also has six main characteristics

acceptability scarcity portability durability divisibility

uniformity

Commodity money was used for thousands of years before the creation of banks.

Banknotes replaced commodity money and were eventually replaced by fiat money.

What Makes Money . . . Money?

The money supply is made up of these assets:

currency

checkable deposits

traveler’s checks

Credit cards and debit cards can be used to make

purchases, but they are not part of the money supply.

How Does the Banking System

Work?

Saving is any form of putting money aside for later use.

Banks are financial institutions that provide two main services:

receiving deposits from savers making loans to borrowers

Banks charge interest on the loan principal. They profit by charging more interest on loans than they pay on deposits.

Banks are required to keep a fraction of deposits in reserve and can make loans with the rest.

The Federal Reserve System regulates and manages the nation’s banks.

How Is Saving Important to the

Economy—And to You?

Saving helps the economy grow by supplying the funds that financial institutions lend out for business investment.

Putting money aside today can help one reach future goals, weather hard times, and fund retirement.

Retirement is often funded by three sources of money:

Social Security

company retirement plans

personal savings

How Do Americans Invest Their

Savings?

Investing involves using money that has been saved to

earn more money, usually through compounding.

Investment options have different risks and returns.

Government bonds: low risk, low rate of return

Corporate bonds: higher risk and rate of return than government bonds

Stocks: historically high rate of return, with high risk

Mutual funds: diversification keeps risk lower than with

individual stocks or bonds, with a relatively high rate of return

Asset allocation involves dividing the assets in one’s portfolio among different types of investments.

What Does It Take to Start a New

Business?

Entrepreneurs play a critical role in the economy because they start businesses to meet consumer demand, create jobs, and spur economic growth.

Running a business can bring great rewards, such as personal satisfaction and being one’s own boss.

Entrepreneurs also face challenges, such as the risk of failure.

What Kinds of Businesses Are Best

Organized as Sole Proprietorships?

A sole proprietorship is a business owned and managed by

one person. The owner makes the profits and is responsible for the debts.

Advantages:

ease of start-up and closing few restrictions

full decision-making power profits individual taxation

Disadvantages:

unlimited liability,

limited growth potential limited life.

What Kinds of Businesses Are

Organized as Partnerships?

In a partnership, two or more owners own and operate a

business together. In most cases, they share the profits and the liability.

Advantages:

ease of start-up few restrictions shared decision-making power specialization by partners individual taxation increased growth potential

Disadvantages:

unlimited liability for some partners conflict between partners keeping continuity if a partner leaves

Why Are Large Businesses

Organized as Corporations?

A corporation is a business owned by shareholders who have limited liability in

the firm’s debts. It is a legal entity that can conduct business affairs in its name.

Advantages:

limited liability greater growth potential

professional management long life

Disadvantages:

complexity of start-up loss of owner control

greater government regulation tax on profits at the corporate

shareholder levels

A multinational corporation operates in more than one country. It offers such advantages as access to global markets and diversification of operations.

What Purposes Are Served by Franchises,

Cooperatives, and Nonprofit Organizations?

In a business franchise, a parent company (franchiser)

grants to an independent business owner (franchisee) the exclusive right to use its trade name and sell its products in a designated location.

A cooperative is a business that is owned and operated

by a group of individuals for their shared benefit.

Examples include credit unions and agricultural co-ops.

A nonprofit organization functions mostly like a

business, though it does not operate to make a profit. It is established to support a particular private or public goal.

What Rights and Responsibilities Do Businesses

Have in a Free Enterprise System?

In a free enterprise system, businesses have many of the rights individuals have, such as freedom of speech.

They also have legal obligations, such as paying taxes.

Business ethics are the notions of right and wrong that guide the decisions and actions of a company and its employees.

Studies show that consumers reward good corporate conduct and respond unfavorably to unethical behavior.

What Trends Are Shaping Today’s

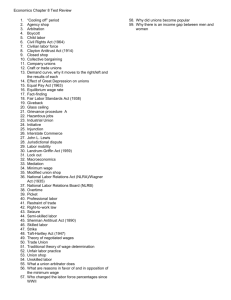

Labor Market?

In recent decades, an influx of women and minorities has resulted in a larger and more diverse labor force.

Labor force consists of those people age 16 and over who have jobs or who are actively looking for work.

The labor force does not include; unpaid workers (homemakers, volunteers) active members of the military, or prison inmates.

Job growth has shifted from manufacturing to the service sector.

Training and technology have increased worker productivity

Knowledge workers—people like financial experts who develop or apply information in the workplace—have become increasingly important.

Other trends changing the labor market include

Outsourcing (the practice of using outside contractors instead of staff), temping, and telecommuting.

Globalization has impacted the U.S. labor force by offshoring some

jobs to other countries, inshoring some jobs to the United States, and increasing global competition.

What Determines How Much

Workers Earn?

Wage rates reflect various factors, but mainly depend on the skill level of workers and the value of what workers produce. Much like the equilibrium price of goods and services, an equilibrium wage results when labor

demand and labor supply come into balance.

Other factors that influence wages include:

minimum wage laws working conditions location cost of living fringe benefits such as health insurance (increases the overall coast to employers)

Foreign competition

A difference in wages earned by various groups in society, called the wage gap, exists for a variety of reasons.

Nondiscrimination laws and affirmative action programs have attempted to decrease wage discrimination and reduce this gap by increasing the presence of historically underrepresented groups.

How Can You Increase Your

Human Capital?

People should develop their human capital throughout their lifetimes. They can start this process by identifying their abilities, interests, and aspirations.

Obtaining a good education is an important step in building human capital, as is securing necessary certification or licensing.

Through work experience and on-the-job training, people can gain vital skills and knowledge that can be applied in future employment.

Some methods of developing human capital are not easily quantifiable but are still very important. These include:

having high personal standards

exhibiting a strong work ethic building a network of friends and colleagues

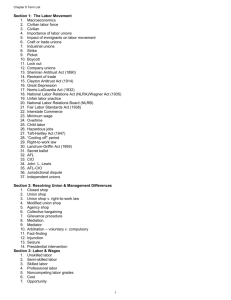

What Role Do Unions Play in the

Labor Market?

Historically, unions have helped workers defend their rights and improve their pay and working conditions.

Often this is achieved through collective bargaining in which workers, represented by their union, negotiate their conditions of employment with their employers. Collective bargaining was most supported through New Deal Legislation in the 1930’s.

A decline in manufacturing jobs and right-to-work laws that

make it illegal to require union membership have led to a decrease in union membership since the 1970s.

However, unions still help many workers achieve concrete gains in the workplace.

Although men and women are equal, women tend to earn less than men due to their careers being interrupted for families.