money - WesFiles

advertisement

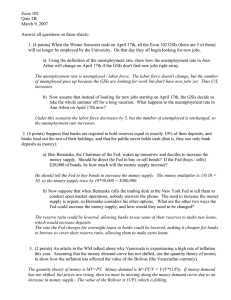

Although we commonly think of “money” as being paper bills and metal coins, these are by no means the only items that can act as “money.” Money must fulfill three functions: Medium of exchange Store of value Unit of account Problem with barter system: “Coincidence of wants.” In a barter system, both people must have exactly what the other person wants, exactly when and where it’s wanted. Medium of exchange eliminates this problem. Definition: Anything used to facilitate trade and avoid a straight barter system. Anything can serve as money so long as people are willing to accept it. US dollars are what is called fiat money: They have no intrinsic value. Rather, their value is a function of the US government saying they have value. This is true for most nations’ currencies: They are backed only by the faith and credit of the given country’s government. “This note is legal tender for all debts, public and private.” Money need not be convertible into something with intrinsic value (e.g., gold). Standard unit of measurement of the value/cost of goods, services, or assets. Analogy: you go to WeShop and pay $5 for a gallon of milk. Gallon : size :: dollar : price Take away the price units: A gallon of milk simply costs “5.” 5 what? Another example: “GM incurred losses of 700 million in the second quarter.” The dollar sign lends meaning to the phrase. Yap (island in the Pacific Ocean) uses stones ranging from 1.4 inches to 10 feet in diameter Ithaca, NY, has its own currency, the Ithaca HOUR. One Ithaca HOUR is valued at $10 Ithaca HOURs cannot be converted to US dollars Businesses that receive HOURs must spend them on local goods and services Ithaca inspired similar systems in Madison, WI, and Corvallis, OR Here is the Swedish 10-daler coin ca. 1720, which was made of copper and weighed 43 pounds (and facilitated the introduction of paper money) And last but not least, the currently available Canadian $1 million gold coin, which weighs 100kg and has a diameter of 50 cm. Needed for transactions transactions demand: Money demand in its most simple form Asset-holding motives: Precautionary demand (i.e., money people want in case of emergency or if they are worried how long they will live) Speculative demand (need for cash to take advantage of investment opportunities that may arise in the future) M1, M2 M1: Physical currency + demand deposits (i.e., checking accounts) M2: M1 + savings accounts + money market accounts + small-denomination time deposits (CDs under $100,000) A balance sheet indicates a bank’s assets and liabilities. Assets = reserves + loans Liabilities = deposits + capital (stockholders’ equity) The two sides of the balance sheet must be equal! The accounting identity was developed in the 15th century as a means for identifying accounting errors Sometimes the right side (Liabilities) is broken into liabilities (=deposits) & net worth (=equity/capital) Banks are required to keep a certain percentage of their deposits in reserve. The percentage they must keep is called the reserve ratio (rr) and is set by the Fed. Banks can choose to keep additional reserves beyond the requirement. Banks are free to lend out the rest of their deposits. These loans make their way to other banks, which in turn loan them out, and so on. Fractional banking can lead to damaging “bank runs,” such as what partially precipitated the Great Depression (remember in Mary Poppins?) This cycle shows how banks can create money. The money multiplier (mm) describes the total increase in money resulting from a $1 initial increase in reserves. mm = 1/rr So, for example, if rr = 20%, a $1 initial increase will increase the money supply in total by $5. Note that the effect of the money multiplier is diminished if individuals increase their cash holdings. Policymakers at the Fed determine the US money supply. The Fed has three tools to change Ms: Reserve ratio Discount rate (interest rate charged to banks that borrow from the Fed) Open-market operations (buying and selling bonds) When the Fed wishes to lower the money supply, it sells bonds (government securities) to the public. The money it receives from these transactions is retired (removed from circulation), so the net effect is to lower Ms. Similarly, when the Fed wants to increase the money supply, it buys bonds from the public. The money multiplier acts to further increase Ms as well. (Money multiplier also works backwards when Fed sells bonds.) Let’s bring money supply and money demand together on one graph Why is Md downward-sloping? Think of interest rate as the cost of holding money Money sitting in your wallet does not earn interest; the higher the interest rate, the more interest is foregone by holding onto money—so the opportunity cost of holding money is higher. As output (Y) increases, Md shifts/increases (more money demanded for transactions)