Finance Assignment: Insurance, Loans, Bonds, and Returns

advertisement

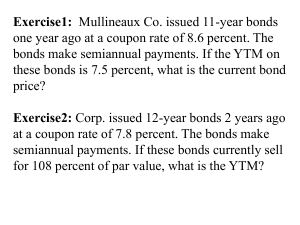

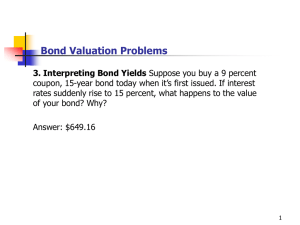

Dr. Sudhakar Raju FN 6100 Spring 2011 QUESTIONS FOR ASSIGNMENT 3 (This assignment is due at the beginning of class on Monday, Feb. 21) 1.) The Perpetual Life Insurance Company is trying to sell you an insurance policy that will pay and your heirs $5000 per year forever. a.) If the required return on this investment is 9%, how much will you pay for this policy? b.) If the policy costs $58,000 at what interest rate would this be a fair deal? 2.) Big Al’s Pawn Shop charges an interest rate of 25% per month on loans to its customers. Like all lenders, Big Al must report an APR to consumers. What rate should the shop report? What is the effective annual rate? 3.) One of your customers is delinquent on his accounts payable balance. You’ve mutually agreed to a repayment schedule of $400 per month. You will charge 1.50% per month interest on the overdue balance. If the current balance is $17,805.69, how long will it take for the account to be paid off? 4.) Maybepay Life Insurance Co. is selling a perpetuity contract that pays $1,050 monthly. The contract currently sells for $75,000. What is the monthly return on this investment vehicle? What is the APR? EAR? 5.) You receive a credit card application from Shady Banks Savings and Loan offering an introductory rate of 2.90% percent per year, compounded monthly for the first six months, increasing thereafter 15% compounded monthly. Assuming you transfer the $3,000 balance from your existing credit card and make no subsequent payments, how much interest will you owe at the end of the first year? 6.) In the 1994 NBA draft, no one was surprised when the Milwaukee Bucks took Glenn “Big Dog” Robinson with the first pick, but Robinson wanted big bucks from the Bucks: a 13-year deal worth a total of $100 million. He had to settle for about $68 million over 10 years. His contract called for $2.9 million the first year with annual raises of $870,000. So, how big a bite did Big Dog really take? Assume a 10% discount rate. 7.) You have just purchased a new warehouse. To finance the purchase, you’ve arranged for a 30-year mortgage loan for 80% of the $1,200,000 purchase price. The monthly payment on this loan will be $9,300. What is the APR on this loan? The EAR? 8.) A local finance company quotes a 13% rate on one-year loans. So, if you borrow $20,000, the interest for the year will be $2,600. Because you must repay a total of $22.600 in one year, the finance company requires you to pay $22,600/12, or $1,883.33, per month over the next 12 1 months. Is this a 13% loan? What rate would legally have to be quoted? What is the effective annual rate? 9.) You have just arranged for a $300,000 mortgage to finance the purchase of a large tract of land. The mortgage has a 9% APR, and calls for monthly payments over the next 15 years. However, the loan has a five-year balloon payment, meaning that the loan must be paid off by then. How big will the balloon payment be? 10.) Suppose you buy a 7% coupon, 20-year annual bond today when it is first issued. If interest rates suddenly rise to 15%, what, happens to the value of your bond? Why? 11.) Mustaine Enterprises has bonds on the market making annual payments, with 13 years to maturity, and selling for $850. At this price, the bonds yield 7.40 %. What is the coupon rate on Mustaine's bonds? 12.) Barely Heroes Corporation has bonds on the market with 14.50 years to maturity, a YTM of 9%, and a current price of $850. The bonds make semiannual payments. What is the coupon rate on these bonds? 13.) Lifehouse Software has 10% coupon bonds on the market with 7 years to maturity. The bonds make semiannual payments and currently sell for 104% of par. What is the current yield on Lifehouse's bonds? The YTM? The effective annual yield? 14.) BDJ Co. wants to issue new 10 year bonds for some much-needed expansion projects. The company currently has 8% coupon bonds on the market that sell for $1,095, make semiannual payments, and mature in 10 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? 15.) The YTM on a bond is the interest rate you earn on your investment if interest rates do not change. If you actually sell the bond before it matures, your realized return is known as the “holding period yield” (HPY). a.) Suppose that today you buy a 9% coupon bond making annual payments for $1,150. The bond has 10 years to maturity. What rate of return do you expect to earn on your investment? b.) Two years from now, the YTM on your bond has declined by 1% and you decide to sell. What price will your bond sell for? What is the HPY on your investment? Compare this yield to the YTM when you first bought the bond. Why are they different? 2