Working Together For A Secure and Prosperous Future.

advertisement

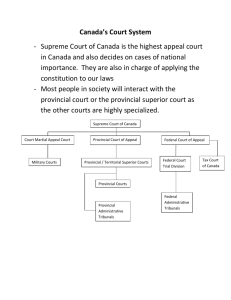

Presentation to Select Committee on Finance: KZN’s Provincial Expenditure 19 June 2015 1 Overall Provincial Budget Performance by Department 2 Provincial Own Revenue - 2014/15 Preliminary Outcome Table 1: Summary of provincial own receipts by Vote - 2014/15 R thousand 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. Office of the Premier Provincial Legislature Agriculture and Rural Development Economic Development, Tourism and Enviro. Affairs Education Provincial Treasury Health Human Settlements Community Safety & Liaison The Royal Household Co-operative Governance and Traditional Affairs Transport Social Development Public Works Arts and Culture Sport and Recreation Total Preliminary Actual Final Appropriation Over/ (Under) % collected (1) (2) (3) = (2) - (1) (4) = (1) / (2) 1 612 3 503 32 077 135 108 95 570 850 967 289 681 28 923 74 79 23 471 1 656 834 8 725 19 464 1 576 402 479 703 21 302 8 770 73 199 839 470 246 161 1 830 85 109 3 203 1 572 160 6 931 8 252 715 275 1 133 2 800 10 775 126 338 22 371 11 497 43 520 27 093 (11) (30) 20 268 84 674 1 794 11 212 861 127 336.5 498.3 150.6 1 540.6 130.6 101.4 117.7 1 580.5 87.1 72.5 732.8 105.4 125.9 235.9 220.4 146.2 3 148 066 2 783 644 364 422 113.1 3 2014/15 Preliminary Outcome • The bulk of KZN’s own revenue is derived from 4 main sources - Motor vehicle licences by Transport, Casino and Horse racing taxes and Interest, dividends and rent on land by Provincial Treasury, as well as Health patient fees by Health • The aggregated preliminary revenue collected amounted to R3.148bn compared to the Final Appropriation of R2.784bn, resulting in a substantial over-collection of R364.422m or 13.1% • The departments largely responsible for the over-collection are Economic Development, Tourism and Environmental Affairs, Transport, followed by Health, Human Settlements, Education, COGTA, Provincial Treasury, Public Works and Agriculture and Rural Development 4 Comparative Analysis Revenue Rankings No. 2008/09 2009/10 2010/11 2011/12 2012/13 2013/14 2014/15φ 1 GP 2 351 735 GP 2 631 046 GP 2 838 931 GP 3 615 798 GP 3 946 391 GP 4 349 100 GP 4 964 753 2 WC 1 935 003 WC 1 937 413 WC 2 067 680 KZN 2 482 057 KZN 2 664 702 KZN 2 573 308 KZN 3 148 066 3 KZN 1 698 357 KZN 1 857 203 KZN 2 038 599 WC 2 228 412 WC 2 301 793 WC 2 466 836 WC 2 907 833 4 EC 965 989 EC 765 529 FS 806 645 FS 865 214 EC 1 019 034 EC 1 281 188 EC 1 451 441 5 NW 626 467 FS 650 957 EC 747 565 EC 845 202 NW 866 284 NW 978 857 LIM 1 413 763 6 FS 593 187 NW 601 394 NW 724 970 NW 783 567 FS 804 556 FS 889 120 NW 892 144 7 LIM 539 803 LIM 579 314 LIM 584 674 LIM 586 572 MP 703 634 LIM 844 955 FS 888 992 8 MP 512 077 MP 503 801 MP 524 471 MP 301 481 LIM 680 632 MP 777 442 MP 862 494 9 NC 165 631 NC 181 115 NC 213 280 NC 225 676 NC 263 591 NC 283 001 NC 296 985 φ Notes: Preliminary Outcome 5 Revenue Issues KwaZulu-Natal • Transport – Migration of motor vehicles (esp. heavy trucks) to cheaper provinces – KZN’s tariffs are high hence the deliberate reduction in the inflation of MVL fees to reduce leakages to other provinces • Provincial Treasury – The slow down economic activity is directly related to gaming and betting activities • Health – Manual revenue collection system – Backlogs in submission of accounts to RAF • Economic Development, Tourism and Enviro. Affairs – Delays in the implementation of new tariffs due to delays in promulgating the KZN Liquor Licensing Act 6 Revenue - Recent Developments/Initiatives • • • Casino and Horse racing taxes, with effect from April 2014, fall under Provincial Treasury Transport and Provincial Treasury are the two largest generators of own revenue for the province Development of Revenue Enhancement Strategy for Health o • • • • • Incl. a revenue retention incentive for over-collections on patient fees Revenue forums and bi-lateral meetings with departments to share best practices Health engaged a service provider to assist with submission of accounts to the RAF All departments are now charging for Tender Document fees Closer collaborative efforts between PT and departments Closer monitoring of staff debt growth 7 Expenditure - 2014/15 Preliminary Outcome Table 2: Summary of Provincial expenditure analysis by Vote - 2014/15 R thousand 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. Office of the Premier Provincial Legislature Agriculture and Rural Development Economic Development, Tourism and Enviro. Affairs Education Provincial Treasury Health Human Settlements Community Safety and Liaison The Royal Household Co-operative Gov. & Traditional Affairs Transport Social Development Public Works Arts and Culture Sport & Recreation Total Preliminary Actual Adjusted Appropriation Virement Post Adj. Est. Final Appropriation Under/ (Over) % spent (1) (2) (3) (4) = (2) + (3) (5) = (4) - (1) (1) / (2) 686 081 458 782 2 003 549 2 909 788 39 673 330 673 998 31 298 562 3 860 536 179 238 61 837 1 502 149 9 051 941 2 485 407 1 388 623 714 918 451 203 683 775 483 590 2 131 046 3 008 455 39 594 931 708 726 31 119 465 3 858 443 179 692 61 337 1 505 395 9 050 885 2 489 760 1 391 763 730 120 455 317 - 683 775 483 590 2 131 046 3 008 455 39 594 931 708 726 31 119 465 3 858 443 179 692 61 337 1 505 395 9 050 885 2 489 760 1 391 763 730 120 455 317 (2 306) 24 808 127 497 98 667 (78 399) 34 728 (179 097) (2 093) 454 (500) 3 246 (1 056) 4 353 3 140 15 202 4 114 100.3 94.9 94.0 96.7 100.2 95.1 100.6 100.1 99.7 100.8 99.8 100.0 99.8 99.8 97.9 99.1 97 399 942 97 452 700 - 97 452 700 52 758 99.9 8 2014/15 Preliminary Outcome • • • As at the end of 14/15, the aggregated expenditure for the year amounts to R97.400bn, compared to the Final Appropriation of R97.453bn, resulting in under-spending of R52.758m or 0.1% The Final Appropriation contains all additions to the budget which were formalised in the 14/15 Adjustments Estimate, as well as the R236m additional funding for the HSDG and other provincial allocations which were formalised in the Second Adjustments Estimate, and the post-Adjustments Estimate virements undertaken thus far However, Education did not include the additional funding of R355m in their preliminary March IYM, which means that, if this is included, KZN is actually under-spent by R407.758m 9 Table 3: Summary of conditional grants by Vote - 2014/15 R thousand Agriculture and Rural Development Comprehensive Agricultural Support Programme Land Care grant EPWP Integrated Grant for Provinces Ilima/Letsema Projects grant Economic Development, Tourism and Environmental Affairs EPWP Integrated Grant for Provinces Education Education Infrastructure grant HIV and AIDS (Life-Skills Education) grant National School Nutrition Programme grant FET College Sector grant Technical Secondary Schools Recap. grant Dinaledi Schools grant EPWP Integrated Grant for Provinces OSD for Education Therapists Social Sector EPWP Incentive Grant for Provinces Health Comprehensive HIV and AIDS grant Health Facility Revitalisation grant Health Professions Training and Development grant National Tertiary Services grant National Health Insurance grant EPWP Integrated Grant for Provinces Social Sector EPWP Incentive Grant for Provinces Human Settlements Human Settlements Development grant Community Safety and Liaison Social Sector EPWP Incentive Grant for Provinces Co-operative Governance and Traditional Affairs EPWP Integrated Grant for Provinces Transport Provincial Roads Maintenance grant Public Transport Operations grant EPWP Integrated Grant for Provinces Social Development Social Sector EPWP Incentive Grant for Provinces EPWP Integrated Grant for Provinces Public Works EPWP Integrated Grant for Provinces Arts and Culture Community Library Services grant EPWP Integrated Grant for Provinces Sport and Recreation Mass Participation and Sport Development grant EPWP Integrated Grant for Provinces Social Sector EPWP Incentive Grant for Provinces Total Preliminary Actual Final Appropriation Under/ (Over) % spent (1) (2) (3) = (2) - (1) (1) / (2) 319 760 212 632 10 854 4 181 92 093 13 120 13 120 319 760 212 632 10 854 4 181 92 093 16 827 16 827 3 707 3 707 100.0 100.0 100.0 100.0 100.0 78.0 78.0 3 200 609 1 385 781 83 651 1 253 920 355 330 53 649 21 953 2 937 41 581 1 807 6 380 773 3 206 610 1 362 572 291 241 1 497 952 17 237 2 581 2 580 3 510 523 3 510 523 2 565 2 565 3 471 3 471 2 832 553 1 788 158 984 952 59 443 5 746 3 746 2 000 3 167 3 167 110 657 108 555 2 102 93 608 83 448 2 102 8 058 3 193 492 1 385 781 81 547 1 253 300 351 475 52 833 21 458 2 937 41 581 2 580 6 434 734 3 257 992 1 362 469 292 837 1 496 427 19 848 2 581 2 580 3 509 045 3 509 045 2 580 2 580 3 471 3 471 2 752 384 1 788 158 904 783 59 443 5 746 3 746 2 000 3 168 3 168 124 856 122 754 2 102 95 595 85 435 2 102 8 058 (7 117) (2 104) (620) (3 855) (816) (495) 773 53 961 51 382 (103) 1 596 (1 525) 2 611 (1 478) (1 478) 15 15 (80 169) (80 169) 1 1 14 199 14 199 1 987 1 987 - 100.2 100.0 102.6 100.0 101.1 101.5 102.3 100.0 100.0 70.0 99.2 98.4 100.0 99.5 100.1 86.8 100.0 100.0 100.0 100.0 99.4 99.4 100.0 100.0 102.9 100.0 108.9 100.0 100.0 100.0 100.0 100.0 100.0 88.6 88.4 100.0 97.9 97.7 100.0 100.0 16 476 552 16 461 658 (14 894) 10 100.1 Conditional Grants - 2014/15 Preliminary Outcome • Table 3 shows the Preliminary Actual expenditure incurred in 14/15 on national conditional grants by department and grant • It is noted that the Final Appropriation takes into account the increase of the HSDG by R236m that was tabled and formalised in the Second Adjustments Estimate (moved from Limpopo to various provinces) • The conditional grant allocation was over-spent by R14.894m, with the main contributor to this over-spending being Transport • The spending at year-end is 100.1% of the annual conditional grant budget 11 Infrastructure - 2014/15 Preliminary Outcome Table 4 Summary of Infrastructure expenditure analysis by Vote - 2014/15 R thousand 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. Office of the Premier Provincial Legislature Agriculture and Rural Development Economic Development, Tourism and Enviro Affairs Education Provincial Treasury Health Human Settlements Community Safety and Liaison The Royal Household Co-operative Governance & Trad. Affairs Transport Social Development Public Works Arts and Culture Sport and Recreation Total Preliminary Actual 23 358 6 382 209 013 540 775 2 216 919 31 665 1 654 385 184 389 10 114 55 892 6 510 012 137 005 108 631 60 864 62 392 Adjusted Appropriation 17 097 4 685 127 686 540 747 1 862 349 31 883 1 632 855 108 720 8 863 85 152 6 552 451 135 133 109 168 70 257 58 378 Virement Post Adj. Est. 11 811 796 11 345 424 115 549 (29 800) 126 - Final Appropriation 17 097 4 685 243 235 540 747 1 862 349 31 883 1 632 855 108 720 8 863 55 352 6 552 451 135 133 109 168 70 383 58 378 Under/ (Over) (6 261) (1 697) 34 222 (28) (354 570) 218 (21 530) (75 669) (1 251) (540) 42 439 (1 872) 537 9 519 (4 014) 85 875 11 431 299 (380 497) % Spent 136.6 136.2 85.9 100.0 119.0 99.3 101.3 169.6 114.1 101.0 99.4 101.4 99.5 86.5 106.9 103.3 12 2014/15 Preliminary Outcome • The table indicates actual infrastructure expenditure at 103.3% of the annual budget, showing an over-spending of R380.497m. This amount is made up of various over- and under-spending in departments, as indicated below: – Education over-spent by R354.570m. The department stopped various infrastructure projects as a result of the budget reprioritisation undertaken during the Adjustments Estimate. However, the R860m budget reprioritisation undertaken in the Adjustments Estimate to ease spending pressures against Compensation of employees included projects that were already committed and contracted. As mentioned, the department was allocated an additional R355m in the 14/15 Second Adjustments Estimate to assist with outstanding payments relating to projects which were already committed and could therefore not be easily stopped. The department did not include this amount in their budget column in the IYM. Once this additional funding is taken into account, the department will reflect minor under-spending of R430 000 – Health over-spent by R21.530m due to higher than anticipated maintenance and repair of health facilities – Human Settlements over-spent by R75.669m due to higher than anticipated spending on the maintenance and repair of housing stock 13 Fiscal Sustainability 14 Analysis of spending from 2009/10 to 2014/15 Table 5 Summary of provincial expenditure vs budget by department: 2009/10 to 2014/15 2009/10 2010/11 R thousand Actual Budget Over/ Under Actual Budget 2011/12 Over/ Under Actual Budget 2012/13 Over/ Under Actual Budget 2013/14 Over/ Under Actual Budget 2014/15 Over/ Under Actual Budget Over/ Under 1. Office of the Premier 429 103 435 718 6 615 423 807 451 361 27 554 485 600 491 105 5 505 675 821 687 539 11 718 699 086 762 405 63 319 686 081 683 775 (2 306) 2. Provincial Legislature 288 238 309 896 21 658 310 909 345 161 34 252 380 588 401 373 20 785 431 718 431 042 (676) 450 119 454 820 4 701 458 782 483 590 24 808 3. DARD 1 970 012 1 999 301 29 289 2 045 856 2 228 840 182 984 2 475 378 2 481 989 6 611 2 849 212 2 854 220 5 008 2 810 376 2 850 023 39 647 2 003 549 2 131 046 127 497 4. DEDTEA 2 425 318 2 492 401 67 083 1 631 736 1 724 798 93 062 1 534 144 1 577 558 43 414 1 685 848 1 789 685 103 837 2 515 207 2 514 971 (236) 2 909 788 3 008 455 98 667 9 616 39 673 330 39 594 931 (78 399) 5. Education 26 230 746 26 058 854 6. Provincial Treasury 7. Health 8. Human Settlements 613 902 523 449 20 349 276 18 329 163 (171 892) 28 760 756 29 570 060 (90 453) 388 936 692 500 809 304 33 799 217 33 227 001 (572 216) 35 588 285 35 672 863 84 578 37 587 146 37 596 762 303 564 119 699 94 895 390 325 510 024 (2 020 113) 20 678 687 22 120 186 1 441 499 24 791 118 24 669 096 518 340 613 235 (122 022) 27 390 532 27 290 930 577 541 653 971 (99 602) 29 531 410 29 219 210 76 430 673 998 708 726 34 728 (312 200) 31 298 562 31 119 465 (179 097) 2 492 647 2 573 713 81 066 3 089 237 3 112 556 23 319 3 042 495 3 084 991 42 496 3 377 771 3 377 820 49 3 617 002 3 648 370 31 368 3 860 536 3 858 443 (2 093) 125 272 127 638 2 366 129 186 140 744 11 558 145 239 150 139 4 900 135 892 161 334 25 442 171 922 175 847 3 925 179 238 179 692 454 9. Comm Safety & Liaison 10. The Royal Household 40 407 40 643 236 50 364 47 149 (3 215) 59 409 60 643 1 234 61 367 65 361 3 994 67 896 68 746 850 61 837 61 337 (500) 11. COGTA 1 023 420 1 093 918 70 498 1 052 179 1 061 903 9 724 1 106 349 1 155 995 49 646 1 314 550 1 316 127 1 577 1 242 496 1 246 342 3 846 1 502 149 1 505 395 3 246 12. Transport 5 164 996 5 231 798 66 802 5 958 923 5 952 652 (6 271) 6 639 855 6 628 044 (11 811) 7 650 308 7 643 794 (6 514) 8 055 187 8 046 081 (9 106) 9 051 941 9 050 885 (1 056) 13. Social Development 1 361 280 1 361 280 - 1 438 163 1 668 182 230 019 1 934 257 1 952 956 18 699 1 985 386 2 062 167 76 781 2 329 906 2 315 947 (13 959) 2 485 407 2 489 760 4 353 14. Public Works 796 169 798 625 2 456 1 114 209 1 333 583 219 374 1 182 268 1 212 970 30 702 1 133 311 1 352 388 219 077 1 270 253 1 313 731 43 478 1 388 623 1 391 763 3 140 15. Arts and Culture 259 157 267 323 8 166 349 369 364 922 15 553 369 752 369 818 66 479 744 479 857 113 698 686 691 026 (7 660) 714 918 730 120 15 202 16. Sport and Recreation 239 342 266 187 26 845 276 740 311 065 34 325 307 836 358 333 50 497 364 151 384 163 20 012 406 268 407 297 1 029 451 203 455 317 4 114 (64 952) 97 399 942 97 452 700 52 758 Total 63 809 285 61 909 907 Percentage over/ under-spent (1 899 378) 67 699 057 71 125 662 3 426 605 78 643 830 78 332 035 -3.07% 4.82% (311 795) 85 642 236 86 182 525 -0.40% 540 289 92 030 501 91 965 549 0.63% -0.07% 0.05% 2014/15 information is as per March Preliminary IYM 15 Analysis of spending from 2009/10 to 2014/15 • • • • • Cost-cutting has been in place in KZN since 2009/10 when the Provincial Recovery Plan was first implemented as the province was projecting over-expenditure of some R5.6bn in that year Since 11/12, KZN has had a less than 1% variance in terms of provincial over- or underspending Province has remained cash positive since May 2010 Figure 1 shows the provincial cash position since March 2007 and up to December 2014. It also shows the year that cost-cutting started KZN reports on its spending trends to the Provincial Executive Council on a monthly basis – Allows for immediate corrective action to be undertaken if there is projected over-expenditure • KZN also reports mid-year and close-out spending to the provincial Finance Portfolio Committee – Good team work exists in terms of oversight between Provincial Legislature and PT • Have formal bilaterals with all departments 3 times a year to look at budget and spending – Informal engagements on a nearly daily basis 16 Effectiveness of cost-cutting C o s tc u tt i n g 17 Effectiveness of cost-cutting • • • • • • As can be seen in the graph, KZN was in overdraft from about March 2008, with the overdraft reaching concerning levels from December 2008 The Provincial Recovery Plan was implemented from October 2009, and this included the implementation of a number of cost-cutting measures These cost-cutting measures are reviewed annually to see if they are still applicable or to see if they can be strengthened Cost-cutting remains in place in KZN for the foreseeable future and are viewed as elements of good governance rather than a once-off initiative to contain costs KZN turned the corner very quickly when it comes to repaying the overdraft with the province being in the black since May 2010 KZN Treasury has recently undertaken an assessment on just 4 of the spending items that were targeted for cost-cutting, and these include catering, leave gratuities and travel claims. The aggregate savings over the period under review (i.e. from 09/10 to the end of 14/15) was in the region of R2bn 18 Fiscal Position Table 6 Equitable share allocation cuts - 2013/14 MTEF 1. Census data cuts 2. Provision to buffer the impact of the 2011 Census 3. KZN's baseline reductions after buffer 4. 1%, 2% and 3% cuts 5. Total equitable share reductions 2013/14 (1 123 908) 289 915 (833 993) (170 703) (1 004 696) 2014/15 (2 387 435) 656 600 (1 730 835) (358 424) (2 089 259) 2015/16 (3 260 935) 1 224 143 (2 036 792) (554 928) (2 591 720) • This table is included as a reminder of the amounts KZN lost when the 2011 Census was used to update the ES formula and when NT imposed 1, 2 and 3% cuts to lower the expenditure ceiling • Was dealt with by cutting all departments’ budgets proportionately • This comes after all departments’ Goods and services budgets were cut by 7.5%, as part of the Provincial Recovery Plan (from 09/10) 19 Fiscal Position Table 7 KwaZulu-Natal: Revisions to the Provincial Equitable Share (PES) - 2015/16 MTEF R thousand Provincial Equitable Share (PES) Adjustments to baseline due to new data updates in PES formula (phased-in) Provision for 2011 Census impact to losing provinces Adjustments to baseline due to function shifts to the National Department of Higher Education & Training Programme 1: Administration (3.2% of CoE and 5% of that CoE to get G&S) Programme 6: Adult Basic Education and Training Programme 9: Auxiliary and Associates Services (payments to SETA -1% of function shift CoE) Programme 9: Auxiliary and Associated Services (external examinations share of 3.9%) Adjustments to baseline due to function shifts to the National Department of Health Port Health Services National Health Laboratory Services (NHLS) Reduction to the PES due to fiscal consolidation cuts Total PES for 2015/16 MTEF Variance 2015/16 MTEF vs 2014/15 MTEF 2015/16 83 347 554 (159 360) (280 136) (66 081) (187 232) (9 728) (17 095) (92 387) (20 379) (72 008) (561 725) 82 253 946 (1 093 608) 2015/16 MTEF 2016/17 87 887 479 (87 769) 321 958 (295 547) (70 120) (197 155) (10 254) (18 018) (96 885) (21 459) (75 426) (843 789) 86 885 446 (1 002 034) 2017/18 92 113 167 (271 402) (310 123) (73 482) (207 013) (10 746) (18 882) (101 663) (22 597) (79 066) – 91 429 978 (683 189) Total Revisions 263 348 200 (518 532) 321 958 (885 806) (209 683) (591 400) (30 728) (53 995) (290 935) (64 435) (226 500) (1 405 515) 260 569 370 (2 778 830) 20 Fiscal Position • Table 7 shows changes to KZN’s allocation over the 15/16 MTEF made by NT: – Phasing in of the data that informs the ES formula results in a decrease over the MTEF of R159.360m, R87.769m and R271.402m – Buffer funding was supposed to fall away in 16/17. NT has agreed to leave this for a further year due to fiscal consolidation cuts and R321.958m is given in 16/17 – Various function shifts in Education result in R280.136m, R295.547m and R310.123m being moved from the provincial to the national sphere – Various function shifts in Health result in R92.387m, R96.885m and R101.663m being moved from the provincial to the national sphere – Fiscal consolidation cuts result in KZN’s ES being cut by R561.725m in 15/16 and R843.789m in 16/17 – Unlike other years, NO ADDITIONAL funding was given by NT 21 Fiscal Position • The fiscal consolidation cuts and data updates to the ES budget reductions are, once again, quite significant for KZN • Considering that significant cuts had already been effected against all departments’ budgets in 09/10 during provincial recovery plan period, and again when the Census data cuts were implemented in 13/14, it was felt that the departments would be unable to cope with another major cut • Had to think differently in terms of funding this cut • Besides this, it was felt that, despite NT not funding any portion of the 2014 wage agreement shortfall, Education and Health should at least receive a portion of the carry-through costs of the 2014 wage agreement (funded from the provincial fiscus) • Provincial fiscus therefore provides 40% of the required amount to these 2 depts, with the balance having to be sourced from within their baselines • As NT was not funding this, the 40% also had to be sourced from within the 22 provincial budget Fiscal Position • Some tough choices had to be made, but this is a natural consequence of a period of fiscal consolidation. The following were then identified as areas where KZN sourced the required funding to cover these shortfalls: – The Strategic Cabinet Initiatives fund of R100m per annum was put on hold during this period of fiscal consolidation – The government office precinct project for which R600m had been allocated, was put on hold during this period of fiscal consolidation – KZN has continued to budget for a Contingency Reserve, with this being set at just above R1bn per annum over the 14/15 MTEF. This Contingency Reserve is now capped at R750m per annum over the 15/16 MTEF, and this released some funding to finance the budget cuts – R240m is carried forward from the 14/15 Net Financial Position to fund parts of the 15/16 MTEF equitable share reductions • This financing plan therefore meant that none of the dept’s equitable share budgets were cut and service delivery spending was protected 23 Provincial Fiscal Framework Table 8 Summary of provincial fiscal framework R thousand 1. Receipts Baseline Allocation Transfer receipts from national Equitable share Conditional grants Provincial own receipts Increase / (Decrease) in allocation Transfer receipts from national Equitable share Conditional grants Provincial own receipts Revised allocation Transfer receipts from national Equitable share (after update of formula data & fiscal consolidation cuts) Conditional grants Provincial own receipts Provincial cash resources 2. Planned spending by departments 3. Contingency Reserve 2015/16 2016/17 2017/18 103 665 526 100 671 247 83 347 554 17 323 693 2 994 279 (1 535 759) (1 536 626) (1 093 608) (443 018) 867 102 711 237 99 134 621 82 253 946 16 880 675 2 995 146 581 470 101 961 237 106 474 835 103 286 051 87 887 479 15 398 572 3 188 784 984 043 983 471 (1 002 033) 1 985 504 572 107 632 456 104 269 522 86 885 446 17 384 076 3 189 356 173 578 106 882 456 110 859 962 107 511 739 92 113 167 15 398 572 3 348 223 2 629 921 2 635 771 (683 189) 3 318 960 (5 850) 113 523 383 110 147 510 91 429 978 18 717 532 3 342 373 33 500 112 773 383 750 000 750 000 750 000 24 Provincial Fiscal Framework • Table 8 shows KZN’s fiscal framework, taking into account the baseline cuts, function shifts, changes to conditional grants, own revenue updates and the provincial cash resources used to fund various provincial priorities • Line 1 shows: – ES decreases in 15/16 by R1.094bn, R1.002bn in 16/17 and R683.189m in 17/18. This is the effect of the period of fiscal consolidation, due to the decrease in the PES, as well as various function shifts including, among others, Port Health (to NDOH), FET and AET functions (to DHET) and aspects of the NHLS costs (to NDOH) – There are a number of changes to the CG over the 15/16 MTEF, with these decreasing by R443.018m in 15/16, but increasing by R1.986bn in 16/17 and R3.319bn in 17/18 – Minor revision to provincial own receipts with an increase of R867 000 in 15/16 and R572 000 in 16/17 and a decrease of R5.850m in 17/18 – Provincial cash resources indicates the amounts the province allocated to various priorities, but with these funded through previous years’ Net Financial Position calculations • Line 2 shows that depts are planning on spending R101.961bn, R106.882bn and R112.773bn over the MTEF • Line 3 shows that KZN is budgeting for a Contingency Reserve of R750m per annum over the MTEF 25 Provincial Fiscal Framework • The Contingency Reserve is being kept for a number of reasons: – The outcome of the 2015 wage negotiations were not known when the 2015/16 MTEF was tabled. If NT does not fund any portion of this, the province will have to fund this from within its baseline – The negotiations regarding the amount that the province owes to NHLS are still ongoing. This debt could place a significant demand on the provincial fiscus – It is therefore prudent to keep a Contingency Reserve that will act as a buffer in the event that these potential cost pressures become reality 26 Provincial Fiscal Framework • As mentioned, KZN’s conditional grant allocations are also being affected by the fiscal consolidation • National Treasury indicated that all provincial conditional grants will be reduced by the same proportion, with the exception of a few grants that are linked to essential service delivery programmes or are smaller grants that fund important operational expenditure – The baselines of the Comprehensive HIV and AIDS grant and the NSNP grant were protected from the cut – The Further Education and Training (FET) Colleges grant and the Occupational Specific Dispensation (OSD) for Education Sector Therapists grant were also protected from the cut • Budgets of KZN’s departments are presented in the next slide • Despite various cuts, there is still growth in departments’ budgets 27 Provincial Budget – 2015/16 MTEF Table 9 Summary of provincial payments and estimates by vote R thousand 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. Office of the Premier Provincial Legislature Agriculture and Rural Development Economic Development, Tourism and Enviro Affairs Education Provincial Treasury Health Human Settlements Community Safety and Liaison The Royal Household (moved to OTP) Co-operative Governance and Traditional Affairs Transport Social Development Public Works Arts and Culture Sport and Recreation Total Audited Outcome 2011/12 2012/13 2013/14 524 129 697 795 721 074 380 588 431 718 460 929 1 782 966 2 109 591 2 005 528 2 226 580 2 421 869 3 311 354 32 809 703 34 556 731 37 156 042 411 205 557 733 623 448 24 791 118 27 390 533 29 531 410 3 042 495 3 377 771 3 617 002 145 239 135 892 171 922 1 106 349 1 314 550 1 242 496 6 639 855 7 650 308 8 055 187 1 934 257 1 985 386 2 329 906 1 182 268 1 133 311 1 270 253 369 752 479 744 698 686 307 836 367 751 414 968 77 654 340 84 610 682 91 610 205 Main Adjusted Revised Appropriation Appropriation Estimate 2014/15 751 370 745 112 745 112 491 186 483 590 483 590 2 133 126 2 169 946 2 169 946 2 883 969 3 013 455 3 013 455 38 918 092 39 066 103 39 092 741 878 315 708 472 667 134 30 914 196 31 119 465 30 919 465 3 600 282 3 622 443 3 622 443 181 295 179 692 179 692 1 348 076 1 486 694 1 486 694 9 060 595 9 050 885 9 050 885 2 497 952 2 489 760 2 489 760 1 369 361 1 391 763 1 392 088 705 112 730 120 730 120 456 379 455 571 455 571 96 189 306 Medium-term Estimates 2015/16 743 214 465 494 2 203 074 2 973 459 42 142 355 712 151 32 981 786 3 584 685 187 069 1 368 043 9 341 457 2 630 481 1 389 666 783 914 454 389 2016/17 746 934 480 352 2 290 677 3 080 528 44 210 091 707 768 34 741 665 3 776 080 198 470 1 436 920 9 735 659 2 767 560 1 449 782 819 399 440 571 2017/18 784 281 504 370 2 409 455 3 219 734 46 488 066 708 506 36 873 548 4 011 284 200 285 1 508 766 10 274 611 2 905 938 1 526 583 894 444 463 512 96 713 071 96 498 696 101 961 237 106 882 456 112 773 383 28 Macroeconomic Framework 29 Macroeconomic Scene Nationally • Eskom capacity constraints • Poor economic growth outlook – Lower taxes (PIT, VAT and CIT) • Recently ended mining strike in the platinum belt – Lower corporate and income taxes • SA downgraded to one level above junk status – Increased borrowing costs – Less FDI, lower employment potential • Exponential growth in COE – Crowding out of service delivery • 2011 Census data of Provincial Equitable Share 30 Population distribution in KZN Darker shaded = bigger population • • • • In 2011 when the Census was undertaken, KZN was proportionately less populous when calculated as a % of the national population. Of significance is that we did not have fewer people living in KZN, but that our proportion of the national total had dropped – resulted in cuts in our ES. Therefore have less money, but our service delivery needs have not decreased In terms of the change in the Age Cohort, there has been a significant increase in the no. of males between the ages of 2029, a smaller increase in this age cohort in females. There has also been a decline in males and females in the 0-19 age cohort, while there is growth in the 60-80+ age cohort Urbanisation continues with more than 50% of the KZN province expected to live in urban areas by 2024 The unemployment rate (expanded definition) has increased from 38.53% in Q2 of 2011, to 40.42% in Q1 of 2015 Gross Domestic Product Sector Performance Primary Industries Agriculture, forestry and fishing Mining and quarrying Secondary Industries Manufacturing Electricity, gas and water Construction Tertiary industries Wholesale & retail trade; hotels & restaurants Transport , storage and communication Finance, real estate and business services Personal services General government services GDPR at constant 2005 prices (non-seasonal adjusted annualized) GDPR at constant 2005 prices (seasonal adjusted annualized) 2014q1 -1.67 2014q2 5.09 2014q3 7.93 2014q4 2.06 2015q1 6.50 -1.97 6.72 12.21 4.49 6.47 -1.00 -0.54 -2.39 -1.37 6.58 2.20 1.99 1.11 3.57 2.36 -0.52 -1.39 -0.76 3.18 2.09 0.30 -0.16 -1.23 3.14 2.23 0.83 0.39 -0.36 3.31 1.89 0.87 0.56 0.30 2.35 1.89 1.38 0.43 1.14 0.61 0.59 2.01 2.69 2.51 2.85 2.69 2.90 2.14 2.33 2.16 2.87 1.87 3.14 1.49 3.38 1.58 3.19 1.35 2.45 1.21 1.63 2.07 1.57 2.06 1.61 1.95 2.35 1.43 1.87 1.66 1.76 Economic Performance % change Main and sub indices of Kwazulu-Natal Barometer Agriculture Index Mining Index Manufacturing Index Electricity Index Construction Index Transport Index Trade Index Government Finance, Real Estate and Business Services Index Kwa-Zulu Natal Growth Index Kwa-Zulu Natal Stress Index Kwa-Zulu Natal Barometer • • • • • • • • • • % Change on a year ago -2.8% 1.6% -0.7% -2.4% -3.4% 18.2% 2.1% 6.0% 9.6% 5.3% 4.4% 0.9% % Change on a % Change on a on 3 years month ago Quarter ago ago -0.2% -1.1% -3.3% -1.4% -1.8% 0.7% -1.4% -0.4% 2.0% -5.9% 3.1% -3.8% -5.4% -7.7% -16.9% -5.4% -7.3% 29.0% -0.5% 2.0% 8.2% -0.8% 4.8% 7.2% 1.6% 6.3% 11.3% -1.5% 0.4% 8.6% -1.2% -3.6% 7.7% -0.3% 4.2% 0.8% Growth positive short-term Government spending booms Agriculture on downward slope Mining slowing down Manufacturing declined Electricity down Construction’s outlook bleak Transport and communication does not disappoint Lower business confidence hampers Trade index growth Finance, real estate and business services boosted by property market Main and sub indices of the KwaZulu Investment Monitor % Change from a % Change on a year ago quarter ago Transport Equipment 16.3% 0.5% Buildings 3.5% 14.1% Civil Construction -0.6% 7.4% Machinery 0.4% 7.7% ICT Equipment 1.3% 6.2% Transfers 10.7% 6.1% Total Investment Index 2.7% 6.8% • • • • • • Transport equipment boosted by local projects Building investment supported by non-residential and commercial buildings Civil construction down Transfers investment surprises with double-digit growth Machinery investment looking up ICT equipment investment growth slowing down Gini coefficient KwaZulu-Natal, Total 0.68 0.66 0.64 0.62 0.60 0.58 0.56 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Summary of KZN’s economic outlook • The economic outlook for KZN is somewhat less optimistic than last year and earlier (January 2015) expectations, despite the lower oil price, which has already and will continue to put pressure on inflation which in turn will keep interest rates lower for longer • The lower oil price has also, to some degree, improved the current depressed levels of consumer confidence and has given consumers some debt breathing space • The weaker exchange rate and moderate improvement in global economic conditions should also support the KZN manufacturing and transport sectors • Unfortunately, continued electricity constraints, labour concerns, logistical bottlenecks, digital un-competitiveness and economic policy divide will hamper the growth prospects for 2015 • Provincial economic growth is therefore estimated at 1.8 per cent for 2015 compared to 2.1 per cent estimated in January 2015 Provincial Growth and Development Strategy and Plan (and Poverty Eradication Master Plan) 39 Macro Policy Focus on Eradication of Poverty firmly embedded in the National Development Plan and the 2014- 19 MTSF Working Together For A Secure and Prosperous Future. 40 Six pillars of the National Development Plan The objectives of the plan are the elimination of poverty and the reduction of inequality through: Uniting South Africans of all races and classes around a common programme to eliminate poverty and reduce inequality; Encouraging citizens to be active in their own development, in strengthening democracy and in holding their government accountable; Raising economic growth, promoting exports and making the economy more labour absorbing; Focusing on key capabilities of both people and the country with focus on skills, infrastructure, social security, strong institutions and partnerships both within the country and with key international partners; Building a capable and developmental state; and Strong leadership throughout society that work together to solve our problems Providing leadership towards achieving KZN Vision 2030. 41 14 MTSF Outcomes as implementation framework of the NDP: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Education Health MTSF 2019 Safety MTSF Employment 2014 Skilled work force Economic infrastructure Rural development Human settlements Developmental local government Environmental assets and natural resources Better South Africa Development oriented public service Social protection Transforming society and uniting the country MTSF 2024 Working Together For A Secure and Prosperous Future. 2030 Vision 42 Macro Policy Focus on Eradication of Poverty firmly embedded in the Provincial Growth and Development Strategy and Plan Working Together For A Secure and Prosperous Future. 43 NDP/ MTSF / PGDP Alignment and positioning of OSS 1 4 M T S F O U T C O M E S 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Education Health Safety Employment Skilled work force Economic infrastructure Rural development Human settlements Developmental local government Environmental assets and natural resources Better South Africa Development oriented public service Social protection Transforming society and uniting the country 1. Job creation 7 2. Human resource development P G 3. Human and community D development P G O A L S 3 0 P G D P O B 4. Strategic infrastructure J E 5. Environmental C sustainability T I 6. Policy and V governance E 7. Spatial equity S 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. Unleashing the Agricultural Sector Industrial Development through Trade, Investment & Exports Government-led job creation SMME, Entrepreneurial and Youth Development Enhance the Knowledge Economy Early Childhood Development, Primary and Secondary Education Skills alignment to Economic Growth Youth Skills Dev & Life-Long Learning Poverty Alleviation & Social Welfare Health of Communities and Citizens Sustainable Household Food Security Promote Sustainable Human Settlement Enhance Safety & Security Advance Social Capital Development of Harbours Development of Ports Development of Road & Rail Networks Development of ICT Infrastructure Improve Water Resource Management Develop Energy Production and Supply Productive Use of Land Alternative Energy Generation Manage pressures on Biodiversity Adaptation to Climate Change Policy and Strategy Co-ordination & IGR Building Government Capacity Eradicating Fraud & Corruption Participative Governance Promoting Spatial Concentration Integrated Land Man & Spatial Planning 44 Alignment of Strategic Plans WARD BASED PLANS 45 STRATEGIC GOALS 1 2 KZN PGDS STRATEGIC FRAMEWORK JOB CREATION HUMAN RESOURCE DEVELOPMENT 3 HUMAN & COMMUNITY DEVELOPMENT 7 4 STRATEGIC INFRASTRUCTURE 5 ENVIRONMENTAL SUSTAINABILITY 6 GOVERNANCE AND POLICY 7 SPATIAL EQUITY Aspire to … • Gateway • Human & Natural Resources • Safe, Healthy & Sustainable Living Environments • Healthy Educated Communities • employable people are employed • Equitable society • Basic Services • More equitable Society • World Class Infrastructure • Investors Confidence • Skilled Labour Force • Focus on People centredness. • Strong & Decisive Leadership • Foster Social Compacts Vision 2030 1. 2. 3. 4. 5. STRATEGIC OBJECTIVES Unleashing the Agricultural Sector Enhance Industrial Development through Trade, Investment & Exports Expansion of Government-led job creation programmes Promoting SMME, Entrepreneurial and Youth Development Enhance the Knowledge Economy 6. Early Childhood Development, Primary and Secondary Education 7. Skills alignment to Economic Growth 8. Youth Skills Development & Life-Long Learning 9. 10. 11. 12. 13. 14. Poverty Alleviation & Social Welfare Enhancing Health of Communities and Citizens Enhance Sustainable Household Food Security Promote Sustainable Human Settlements Enhance Safety & Security Advance Social Capital 30 15. Development of Harbours 16. Development of Ports 17. Development of Road & Rail Networks 18. Development of ICT Infrastructure 19. Improve Water Resource Management & Supply 20. Develop Energy Production and Supply 21. 22. 23. 24. Increase Productive Use of Land Advance Alternative Energy Generation Manage pressures on Biodiversity Adaptation to Climate Change 25. 26. 27. 28. Strengthen Policy and Strategy Co-ordination & IGR Building Government Capacity Eradicating Fraud & Corruption Promote Participative, Facilitative & Accountable Governance 29. Actively Promoting Spatial Concentration 30. Facilitate Integrated Land Management & Spatial Planning 46 46 Poverty Eradication Master Plan prepared through an Operation Phakisa Labs approach, adopted by the Provincial Executive Council and now ready for IMPLEMENTATION Working Together For A Secure and Prosperous Future. 47 PEMP 5 Pillars and 29 Game Changers Working Together For A Secure and Prosperous Future. 48 PGDP STRATEGIC GOALS 1 2 JOB CREATION Poverty Eradication Game Changers Aspire to … Game Changer 1 Social Protection HUMAN RESOURCE DEVELOPMENT Game Changer 2 Agriculture Deepened 3 HUMAN & COMMUNITY DEVELOPMENT STRATEGIC INFRASTRUCTURE 5 ENVIRONMENTAL SUSTAINABILITY 6 GOVERNANCE AND POLICY 7 5 7 4 SPATIAL EQUITY Game Changer 3 Enterprise Development Game Changer 4 Employment Creation Vision 2030 Game Changer 5 Skills Development 49 49 PEMP 5 Pillars and 29 Game Changers AWG 10 AWG 6 AWG 8 AWG 8 AWG 1 AWG 1 AWG 8 AWG 12 + 14 AWG 12 +14 AWG 3 AWG 1 AWG 1 AWG 1 AWG 8 AWG 6 AWG 7 AWG 1 AWG 1 AWG 8 AWG 16 AWG 2 AWG 2 AWG 15 AWG 4 AWG 2 AWG 7 AWG 7 AWG 2 Working Together For A Secure and Prosperous Future. AWG 7 50 Institutional Framework and Structure for implementing the Poverty Eradication Master Plan Working Together For A Secure and Prosperous Future. 51 The PGDP Institutional Structure PROVINCIAL EXECUTIVE COUNCIL SPCHD CLUSTER ESID CLUSTER OSS OSS OSS OSS OSS A A A A A A A A A A WWWW W WWWWW G G G G G G G G G G 1 2 3 4 5 1 1 1 1 1 2 3 4 5 6 OSS OSS OSS A A A A A WW WWW G G G G G G&A CLUSTER OSS OSS OSS A A W W G G 1 1 1 1 7 8 0 1 POVERTY ERADICATION 6 7 8 OSS JCPS CLUSTER OSS OSS OSS A W G 9 Working Together For A Secure and Prosperous Future. 52 Implementation Approach 1. TARGET: most deprived households in most deprived wards in most deprived municipalities 2. WHERE IS THIS: KZN has 3.2 million households living in conditions of extreme poverty The majority of these households live in the now identified 169 poorest wards Most of these wards are located in the 5 local municipalities ranked as the poorest in the province, namely Msinga, Umhlabuyalingana, Maphumulo, Vulamehlo and Nkandla Providing leadership towards achieving KZN Vision 2030. 53 Implementation Approach 3. TARGETED APPROACH IMPLIES THAT WE NEED TO: Focus in Phase 1 on the 5 most deprived municipalities in KZN In Phase 2, move to the five most deprived wards in each district In Phase 3, expand to all 169 poorest wards in KZN In Phase 4, deal with the rest Providing leadership towards achieving KZN Vision 2030. 54 WHAT DO WE DO WHEN WE GET THERE HH Profiling and Community profiling Provision of Comprehensive Services Monitoring & Evaluation Provision of Immediate Services Identification of individuals and households • • HH with Malnutrition cases mod/sever Income < R443 per Capita/No food/ • Departments • Municipalities • Civil Society and • Private sector • The provision of the social relief package. • Profiling forms issued with tracking register • Referral Register • Community profile for resources/pro jects/capabili ties • Development of the appropriate package • Pillar 1: Social Protection • Pillar 2:Agriculture • Pillar 3:Enterprise Development • Pillar4: Employment Creation • Pillar 5: Skills Development • Baseline • Monitoring of service delivery • Documenting of cases exiting from poverty • Cyclical challenges • HH is more resilient • Reduced vulnerability • Behaviour change has commenced • Moving towards independence • Community project sustenance through community based plans/IDP Providing leadership towards achieving KZN Vision 2030. 55 Thank You 56