Exam 1 Review Notes - Department of Agricultural Economics

advertisement

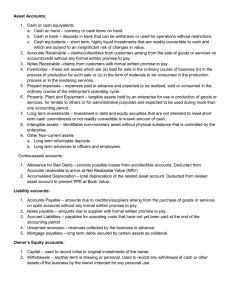

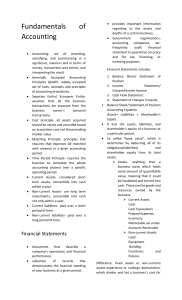

Final Exam Review Notes Chapter 1 I. Introduction Structure of Production Agriculture Trend toward fewer but larger farms Contributing Factors: 1. Labor-saving technology 2. Good employment opportunities outside of agriculture 3. Farmers and ranchers aspiring to standards of living comparable to non-farm families 4. Some technologies available only to large size farms 5. Specialization Information Technology More information More reliable and easier to use Financial Management More competition for capital (will require better financial reporting and planning) Less emphasis on resource ownership (more emphasis on resource use rights) Human Resources More like other industries Consumers Dictate Products Vertical coordination Niche markets Environmental and health concerns Chapter 2 A. What is management? B. Goals or objectives Some common goals C. Functions of Management 1. Planning-Steps in the process 2. Implementation 3. Control Management Information and Asset Value 1. Valuing Assets a. Market value b. Cost c. Lower of cost or market d. Farm production cost e. Cost less depreciation 2. Depreciation a. Purposes of depreciation b. Terminology c. Methods for calculating depreciation II. Tools of Financial and Business Analysis Chapter 5 A. Balance Sheet and It’s Analysis 1. Definition 2. Balance Sheet Categories a. Asset b. Liability c. Net Worth (owner’s equity) N.W.=A-L 3. Classification of Assets and Liabilities a. Current assets b. Non-current assets c. Current liabilities d. Non-current liabilities 4. Net Worth a. Amount of wealth remaining if all assets are sold and liabilities paid b. Will change if: c. Will not change when: 5. Balance Sheet Analysis a. Purpose b. Liquidity c. Solvency 6. Measures of Liquidity a. Current ratio b. Working capital 7. Measures of Solvency a. Debt/Asset ratio b. Equity/Asset ratio c. Percent equity 8. Cost or market basis balance sheet? Chapter 6 B. Income Statement and It’s Analysis 1. Definition 2. Categories of revenue 3. Categories of expenses a. Cash expenses b. Non-cash expenses c. Expenses may also be classified as fixed or variable 4. Cash Vs. Accrual accounting 5. Income Statement Analysis a. Net farm income b. Rate of return on assets c. Rate of return on equity d. Operating profit margin ratio e. Return to labor and management f. Return to labor g. Return to management h. Changes in Owners Equity Chapters 7 & 8 Production levels and input and output combinations 1. The production function-TPP, APP, MPP, MVP, MIC, MR, MC, and the profit maximization decision rules 2. Least cost combinations-substitution and price ratios 3. Enterprise combinations-supplementary, complementary, and competitive enterprises Chapter 9 Cost concepts 1. Opportunity cost 2. Short & long run 3. Fixed and variable components 4. Average fixed & variable costs - long run average cost 5. Decision rules regarding how much to produce Chapter 10 Enterprise Budgeting 1. What an enterprise budget is and purposes for which it may be used? 2. Parts and structure 3. Know how to do break-even analysis from an enterprise budget. 4. Know how to use budgets to estimate maximum land rents, and “returns to ---” and “returns over ---”. Chapter 11 Partial budgeting 1. What it is and purposes for which it is used? 2. Components, organization, and structure? 3. Be able to develop one for a simple problem. Chapter 13 Cash Flow Budgeting 1. What it is? 2. What is it used for? 3. Structure? Chapter 14 Forms of Business Organization A. Major forms of business organization For each know something about the following: 1. Organization and characteristics 2. Advantages 3. Disadvantages Chapter 15 Managing Risk and Uncertainty 1. Sources of risk and uncertainty production - technical, marketing - price, financial, legal, and personal 2. Risk bearing ability and attitude 3. Forming expectations Most likely; averages-simple, weighted 4. Measuring variability Range, variance, standard deviation, coefficient of variation, cumulative distribution function 5. Decision making under risk Decision tree, payoff matrix, decision rules 6. Tools for managing risk Production, market, financial risk Chapter 17 Investment Analysis 1. Know the definitions, uses, and how to determine or calculate: Present value, net present value, internal rate of return, discount rate, financial feasibility, economic feasibility. 2. Know the role of time value, inflation, and risk in determining an appropriate discount rate. Chapter 19 Capital and the Use of Credit 1. What is capital and what are it’s sources? 2. What is credit? 3. Know what the cost of capital is? 4. Know how to decide how much capital to use? 5. Know what leverage is and how it is measured? 6. Know definition/description/advantages/disadvantages for types of loans by length, use, security, and repayment plan. 7. Know definition/description/advantages/disadvantages for sources of loan funds. Chapter 20 Land -- Control and Use Know the advantages and disadvantages of ownership, cash leasing, and share leasing.