Finance Competency

advertisement

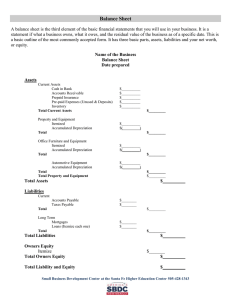

Finance Competency For CFM Exam Overview • • • • • • • Operating & Capital Budgeting General Financial Concepts Management Accounting Principles Procurement Life Cycle Costing Depreciation ROI Budgeting • A comprehensive, formal plan, expressed in quantitative terms, describing the expected operations of an organization over some future time period. • Capital Budget – Systematic process of identifying and evaluating capital investment projects to arrive at a capital expenditure budget. • Operating Budget – Set of budgets for the normal operations of a business, including all activities involved in generating operating income. Financial Concepts • Balance Sheet – Snapshot of a company’s position at a point in time – Asset = Liabilities + Owner’s equity – Liabilities and owner’s equity are 2 ways to finance assets – Assets are shown at original cost – not current value – Current assets will be used or turned into cash within one year – Current liabilities will be paid within one year – Retained earnings is not a pool of cash, but accumulated income amounts that have been reinvested in assets • Income Statement – (Profit & Loss) Measure of a company’s financial performance over a specific accounting period – Income = Revenue-Expenses – Efforts are matched to accomplishments – Cash sales and credit sales are considered revenues – Expenses occur when cash is paid, when major assets are used (depreciation) , or when material is used that was bought on credit – You can have income and be short of cash – Income should be a major source of owner’s equity • Net Present Value - NPV is an indicator of how much value an investment or project adds to the firm. • In financial theory, if there is a choice between two mutually exclusive alternatives, the one yielding the higher NPV should be selected. • Future value is the value of an asset at a specific date. It measures the nominal future sum of money that a given sum of money is "worth" at a specified time in the future assuming a certain interest rate, or more generally, rate of return; it is the present value multiplied by the accumulation function • Internal Rate of Return – IRR - is a rate of return used in capital budgeting to measure and compare the profitability of investments. It is also called the discounted cash flow rate of return. • the IRR of an investment is the discount rate at which the net present value of costs (negative cash flows) of the investment equals the net present value of the benefits (positive cash flows) of the investment. • Depreciation – decrease in the value of assets – Allocation of the cost of assets to periods in which the assets are used • Amortization – depreciation of intangible assets – Intangible assets – cannot be seen, touched, or physically measured – trade secrets, copyrights, patents, trademarks, goodwill, • Book Value = Cost – Accumulated depreciation – No relation to market value • Break-even analysis – 2 ways – Profit = Revenues – variable costs – fixed costs – Profit = Contribution – Fixed costs – Set profit to zero for break even point