Ch 1 Tax Benefits

advertisement

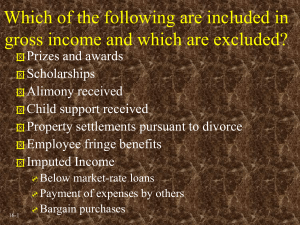

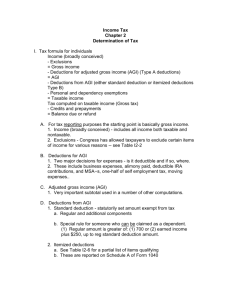

Tax Benefits Chapter 1 pp. 1-37 2015 National Income Tax Workbook™ Tax Benefits Limited by Income pp. 1-37 Many benefits in the I.R.C. are applicable only to taxpayers whose income does not exceed specific thresholds. Benefits can be obtained by tax planning to minimize income and maximize deductions. Above-the-Line Deductions and Exclusions pp. 2-12 Gross Income and Adjusted Gross Income (AGI) are defined by the I.R.C. (§ 61 and § 101140) Definition of Modified Adjusted Gross Income (MAGI) can vary depending on the benefit. Above-the-Line Deductions and Exclusions pp. 2-12 Three income-limited items factor into AGI. ▪ Deductions for contributions to IRAs ▪ Deductions for student loan interest, ▪ The exclusion for certain interest paid on US savings bonds. IRA Contributions pp. 2-7 Deductions for traditional IRA contributions may be limited if the taxpayer/spouse can participate in an employer provided retirement plan. To determine deductible amount when in the phaseout range: (End of phaseout range – MAGI) x contribution limit / Phaseout range = Deductible amount IRA Contributions pp. 2-7 Contributions to Roth IRA are not deductible, but are subject to a limit which is phased out as MAGI increases. To determine contribution limit when in the phaseout range: (End of phaseout range – MAGI) x maximum contribution / Phaseout range = Contribution limit Student Loan Interest Deductions pp. 7-9 Up to $2,500 deduction of qualified student loan interest. Not available if filing MFS, and deduction is only available to the borrower. If student loan is refinanced including additional funding used for noneducation expenses, none of the subsequent interest is considered student loan interest. US Savings Bond Interest Exclusion pp. 9-11 Interest earned on US savings bonds can be excluded provided they were used to pay qualifying educational expenses. Limited exclusion in the phaseout range is calculated by: (End of phaseout range – MAGI) x qualified savings bond interest/ Phaseout range = Exclusion US Savings Bond Interest Exclusion pp. 9-11 Planning Pointer ▪ Taxpayers may consider switching from low-rate savings bonds to a higher performing 529 plan, a tax free exchange. Comparative Case Studies pp. 11-12 Case #1: Barbara Brown ▪ IRA deduction not limited Case #2: Gloria Green ▪ Calculation of nondeductible contribution Case #3: Wilma White ▪ MAGI exceeds phaseout range Below-the-Line Deductions pp. 12-24 2015 standard deductions ▪ Single - $6,300 ▪ MFJ or QW - $12,600 ▪ HoH - $9,250 ▪ MFS - $6,300 Below-the-Line Deductions pp. 12-24 Pease rule – itemized deductions reduced by lesser of two amounts ▪ 3% of AGI in excess of thresholds to the right ▪ 80% of all affected itemized deductions Filing Status Single MFJ or QW HoH MFS AGI $258,250 $309,900 $284,050 $154,950 Personal Exemptions Deduction Phaseout Personal and dependent exemption deduction can be completely phased out if AGI is substantial. Decreases by 2% for each $2,500 over threshold amounts to the right. No deduction for AGI above phaseout region. p. 13 Filing Status Single Phaseout Phaseout Begins Ends $258,250 $380,750 MFJ or QW HoH MFS $309,900 $432,400 $284,050 $154,950 $406,550 $216,200 Personal Exemptions Deduction Phaseout Pease limitation ▪ See Example 1.6 – 1.8 p. 13 Other Itemized Deductions pp. 15-19 Medical/dental expenses can be claimed as an itemized deduction, but deduction is reduced by 10% of AGI (7.5% of AGI if over 65 during 20132016). Other Itemized Deductions pp. 15-19 Mortgage insurance through the VA or RHS are fully deductible in the year the contract is issued. FHA and private mortgage insurance must be allocated over the shorter of the term of the mortgage or 84 months. Other Itemized Deductions pp. 15-19 Example 1.9 Limited Specific Itemized Deductions ▪ Medical expenses and mortgage insurance deductions Other Itemized Deductions pp. 15-19 Charitable contribution deductions are AGI limited. ▪ Generally the limit is 50% of AGI, but can be lower depending on type of property donated. ▪ Excess carries over for 5 years. Other Itemized Deductions pp. 15-19 Losses from theft of personal use property events are reduced by $100, and then by 10% of AGI. Losses from business and income property are not subject to these reductions. Other Itemized Deductions pp. 15-19 Other expenses related to generating taxable income may be eligible itemized deductions, subject to a 2% of AGI floor. Alternative Minimum Tax pp. 19-21 I.R.C. § 55 imposes the alternative minimum tax (AMT) on both corporate and noncorporate taxpayers, which limits the use of specified benefits to reduce total tax. 2015 AMT rates are 26% for alternative minimum taxable income less than $185,400, and 28% otherwise. Comparative Case Studies pp. 23-24 Case #1: Barbara Brown ▪ Itemized deductions less than standard deduction Case #3: Wilma White ▪ Subject to Pease Limitations and PEP Refundable/Nonrefundable Credits pp. 24-37 Credits reduce taxes by the same amount for low-bracket taxpayers as for high-bracket tax payers. Many credits are limited or eliminated as a taxpayer’s income increases. Earned Income Credit pp. 24-28 The EIC is applicable to those who have income from wages, salaries, tips, union strike benefits, or long-term disability benefits received prior to minimum retirement age. Earned Income Credit pp. 24-28 The EIC increases over a range of earned income: Not Filing MFJ or MFS Qualifying Children Credit Rate (%) Income for Maximum Credit Phaseout Phaseout Maximum Rate(%) Credit None 7.65 $6,580 - $8,240 $8,240 $14,820 7.65 $503 One 34.00 $9,880 - $18,110 $18,110 $39,131 15.98 $3,359 Two or more 40.00 $13,870 - $18,110 $18,110 $44,454 21.06 $5,548 Three or more 45.00 $13,870 - $18,110 $18,110 $47,747 21.06 $6,242 Earned Income Credit pp. 24-28 The EIC increases over a range of earned income: Filing MFJ or MFS Qualifying Children Credit Rate (%) Income for Maximum Credit Phaseout Phaseout Maximum Rate(%) Credit None 7.65 $6,580 - $13,750 $8,240 $20,330 7.65 $503 One 34.00 $9,880 - $23,630 $23,630$44,651 15.98 $3,359 Two or more 40.00 $13,870 - $23,630 $23,630$49,974 21.06 $5,548 Three or more 45.00 $13,870 - $23,630 $23,630 $53,267 21.06 $6,242 Earned Income Credit pp. 24-28 Taxpayers with more than $3,400 in investment income for the year cannot claim EIC. Self-employed taxpayers with earned income in the phasein range for the EIC may be able to increase their EIC by deferring expenses from and accelerating income to that year. Taxpayers in the phaseout range of the EIC may be able to accelerate deductions and defer income to qualify for a higher EIC. Child Tax Credit pp. 28-30 Can be as much as $1000 per qualifying child. Phases out with increasing AGI, decreases by $50 for each $1000 the AGI exceeds the limits. Filing Status MFJ Phaseout Range $110,000 $129,001 Single, $75,000 HoH, or $94,001 QW MFS $55,000 $74,001 Child and Dependent Care Credit pp. 30-32 Expenses for child or dependent care while the taxpayer is working can qualify for a tax credit. Qualifying expenses are limited by earned income, and as AGI increases expenses used to calculate the percentage is reduced from 35% to 20%. Retirement Savings Contribution Credit pp. 32-33 Maximum credit is a percentage of $2,000 ($4,000 for MFJ) of qualified savings returns. Percentage is 50%, 20%, or 10%, depending on taxpayers AGI. Education Credits pp. 33-36 American Opportunity Tax Credit ▪ Extended through Dec. 31, 2017 ▪ 100% of first $2000, 25% of next $2,000, for $2,500 maximum credit, 40% of which is refundable. ▪ Phased out over a range of AGI. Education Credits pp. 33-36 Lifetime Learning Credit ▪ Taxpayers can claim 20% of the first $10,000 of qualified educational expenses. ▪ MAGI phaseouts are lower than for AOTC, $110,000 to $130,000 for MFJ, $55,000 $65,000 for all others. Case Studies pp. 36-37 Case #1: Barbara Brown ▪ AOTC and EITC refundable credit Case #2: Gloria Green ▪ AOTC credit, but ineligible for other credits Case #3: Wilma White ▪ Exceeds all credit phaseout ranges Questions? 34