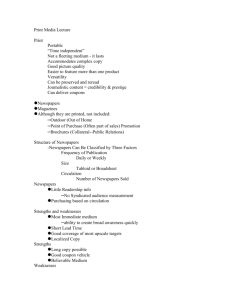

4 Year Category Trend by Quarter

advertisement

Report 75.0 - 1st Quarter Release Johannesburg 14 May 2014 General Local Developments: Media Inflation Watch Up-date 2013 Media Inflation Watch revealed Radio as the most aggressive platform from a rate perspective; up 11.54% yoy. With declining circulation, however, and an absence of support / research from the key players in print, the published inflation data must be raising value concerns. AMPS / JIC’s and the rest! With the latest AMPS hot into the market, many marketers and perhaps publishers have perhaps taken their collective eye off the future of what will become of AMPS in its new “establishment” survey role. PAMS has still to be agreed, it’s content decided and funding issues remain the elephant in the room. What is clear is that the TV broadcasters are now driving the process and even siblings such as radio appear now to be an afterthought. Print has a powerful story to tell as proven over the passing of Nelson Mandela and recently demonstrated via Millward Brown’s independent research. Print research going forward must demonstrate the value of print and not just the quantum. Value is determined by return on investment and not just the rates charged.. Finally, in respect of the research, we should remember that digital is the new print ink, and not a competitor. The future for print in Africa will be a combination of both written delivery methods. International Developments: Print “Only” readership holding its own in the USA • A new analysis (Feb 2014) of the most recent newspaper audience reports suggests a surprising split in reading habits. Digital audience continues to grow. Mobile audience is growing quickly. Mobile-only audience, though much smaller, has grown to 7 million. • Yet more than half of newspaper audience — 54 percent still read their local paper’s news report only in print. • The daily circulation gains (+3%) however were entirely driven by digital gains at the largest newspapers. • Sunday gains also reflected the heavy use of “Sunday Select” products — packets of inserts to non-subscribers — by larger papers. Rule Amendments effective 1st January 2014: PDF Replica Editions: • Paid Circulation – circulation is counted when payment is received. • Bulk sales – The publisher must prove distribution in terms of a list provided by the purchaser – limited to 10% of total paid circulation. • Free bulk distribution is excluded. Membership Statistics: 31 December 2013 Magazines Admissions Removals - 524 218 184 102 20 366 28 13 29 55 5 236 - 7 526 2 -4 Consumer 220 2 -4 Business to Business 184 - - Custom 102 - - Free Magazines 20 - - Newspapers 361 10 Daily 27 1 Weekly 15 Weekend 27 Local 57 Hybrid 5 1 Free Newspapers 230 6 Advertising Brochures Total ABC Members 7 894 -5 - - -2 2 - - -2 12 31 March 2014 -1 -9 897 Sector size ranked by circulation– Quarter 1 2014: POSITION 1 2 3 4 5 6 7 8 9 10 11 SECTOR Custom Magazines Free Newspapers Consumer Magazines Weekend Newspapers Daily Newspapers B2B Magazines Advertising Brochures Weekly Newspapers Free Magazines Local Newspapers Hybrid Newspapers TOTAL CIRCULATION 11 787 596 6 596 237 5 888 456 2 086 611 1 622 041 1 159 427 934 869 621 750 527 859 432 771 23 136 31 680 753 NUMBER OF PUBLICATIONS 102 236 218 29 28 184 7 13 20 55 5 AVERAGE 115 565 27 950 27 011 71 952 57 930 6 301 133 553 47 827 26 393 7 869 4 627 897 35 319 Overall Economic Perspective Comment: Real GDP at market prices increased by 1.9% in 2013. The main increase was in Finance, Real Estate & Business. Retail sales grew by 2.2% year on year in February 2014.The main increase was in Textiles, Clothing, Footwear and Leather. 4 Year Total Newspaper Circulation Trend by Quarter: 10,800,000 10,700,000 Total newspaper circulation 10,600,000 10,500,000 10,400,000 10,300,000 10,200,000 10,100,000 Comment: Total Newspaper circulation increased by 20,000 compared to the previous quarter. 4 Year Category Trend by Quarter: Daily Newspapers Comment: • • Circulation has declined annually by 4.5% since 2010, equivalent to 304,000 copies. However, Q1 remained static, compared to Q4. 4 Year Trend Analysis by Language Daily Newspapers Comment: English titles have declined by 4.7% annually (232, 000 copies) over the period. Afrikaans titles have declined by 6.5% annually (87,000 copies) over the period. Vernacular titles have increased by 3.5% (15,000 copies) over the period. 4 Year Trend Analysis: Coastal vs Inland Daily Newspapers Comment: Inland circulation declined annually by 4.7% (208,000 copies) over the period. Coastal circulation declined annually by 4.% (96,000 copies) over the period. Q1 increased by 20,000 copies compared to Q4. Titles Showing Largest Growth Daily Newspapers Publication Name No TOTAL Corresponding Variance - Previous Variance CIRCULATION Previous Prior Year Quarter Previous Period Quarter 1 Daily Dispatch 30,199 28,879 4,57% 25,521 18,33% 2 Isolezwe 119,846 116,186 3,15% 107,119 11,88% Titles Showing Largest Decline Daily Newspapers Publication Name No TOTAL Corresponding Variance - Previous Variance CIRCULATION Previous Period Prior Year Quarter Previous Quarter Citizen, The 1 (Daily) 57,385 63,854 -10,13% 58,735 -2,30% 2 Cape Argus 30,319 33,247 -8,81% 30,204 0,38% 3 Son (Daily) 84,87 92,213 -7,96% 86,837 -2,27% New Members / Removals Daily Newspapers New Member Title Zambia Daily Mail 4 Year Category Trend by Quarter: Weekly Newspapers Comment: • • Weekly newspapers reflect an erratic performance. Q1, however, declined by 2.5% (13,000 copies) compared to Q4. Titles Showing Largest Growth Weekly Newspapers Publication No Name 1 Soccer Laduma TOTAL Corresponding Variance CIRCULATION Previous Period Prior Year 317,013 289,654 9,45% Variance Previous Previous Quarter Quarter 307,275 3,17% Titles Showing Largest Decline Weekly Newspapers Publication No Name 1 Motorsport World Corresponding TOTAL Previous Variance CIRCULATION Period Prior Year Variance Previous Previous Quarter Quarter 4,997 6,143 -18,66% 8,227 -39,26% 2 Ilanga 100,853 117,115 -13,89% 95,994 5,06% 3 Mail & Guardian 44,266 45,279 -2,24% 51,551 -14,13% New Members / Removals Weekly Newspapers Removal Title Auto week The Zimbabwean 4 Year Category Trend by Quarter: Weekend Newspapers Comment: Circulation has declined annually by 5% (485,000 copies) over the period. Q1, however, only declined by 1.8% (34,000 copies) compared to Q4. 4 Year Trend Analysis by Language: Weekend Newspapers Comment: English titles have declined annually by 5.5% (367,000 copies) over the period. Afrikaans titles have declined annually by 8% (193,000 copies) over the period. Vernacular titles have grown annually by 11.6% (76,000 copies) over the period. Titles Showing Largest Growth Weekend Newspapers Corresponding Variance TOTAL Previous Variance - Previous Previous Prior Year Quarter Quarter No Publication Name CIRCULATION Period 1 Saturday Dispatch 22,109 20,450 8,11% 20,679 6,92% Titles Showing Largest Decline Weekend Newspapers Variance TOTAL Corresponding Variance - Previous Previous No Publication Name CIRCULATION Previous Period Prior Year Quarter Quarter 1 Rapport 2 Beeld, Saturday Volksblad – 3 Saturday 4 Ilanga Langesonto Pretoria News 5 Saturday Son op Sondag (formerly Sondag 6 Son) 177,016 210,675 -15,98% 187,288 -5,48% 55,26 65,645 -15,82% 58,411 -5,39% 17,913 20,234 -11,47% 18,286 -2,04% 55,224 61,918 -10,81% 56,074 -1,52% 10,177 11,382 -10,59% 10,126 0,50% 50,186 55,885 -10,20% 54,625 -8,13% New Members / Removals Weekend Newspapers New Member Title Saturday Mail Sunday Mail 4 Year Category Trend by Quarter: Local Newspapers Comment: Local Newspapers have declined by 2.8% (63,000 copies) over the period. Q1 increased by 11,000 copies compared to Q4. Titles Showing Largest Growth Local Newspapers No Publication Name Variance TOTAL Corresponding Variance - Previous Previous CIRCULATION Previous Period Prior Year Quarter Quarter 1 Review Midweek 2,976 2,311 28,78% 2,738 8,69% 2 Capricorn Voice Lowvelder, The / Laevelder, Die ( 3 Tuesday) 5,975 5,186 15,21% 5,693 4,95% 14,697 13,258 10,85% 13,686 7,39% Titles Showing Largest Decline Local Newspapers No Publication Name Corresponding Variance TOTAL Previous Variance - Previous Previous CIRCULATION Period Prior Year Quarter Quarter 1 The Mail 12,673 16,834 -24,72% 12,637 0,28% 2 Standerton Advertiser 3,052 3,563 -14,34% 3,199 -4,60% 3 Rustenburg Herald 22,397 25,606 -12,53% 21,874 2,39% New Members / Removals Local Newspapers Removal Title Letaba Herald Palaborwa Herald 4 Year Category Trend by Quarter: Hybrid Newspapers Comment: Circulation shows a dramatic decline as a result of The Times moving to Daily Newspapers in Q4. Q1 remained static compared to Q4. New Members / Removals Hybrid Newspapers New Member Title The Zimbabwean Removal Title Free State Times 4 Year Category Trend by Quarter: Free Newspapers Total Circulation 8,000,000 Total Circulation 7,000,000 6,000,000 5,000,000 4,000,000 3,000,000 Q1 Q2 Q3 2010 Q4 Q1 Q2 Q3 2011 Q4 Q1 Q2 Q3 2012 Q4 Q1 Q2 Q3 2013 Q4 Q1 2014 Comment: Distribution has increased annually by 7.1% (1,513,000 copies) over the period. Q1 increased by 53,000 copies compared to Q4. New Members / Removals Free Newspapers New Members Title Bash Lifestyle Ermelo Insig/Insight Highlands Panorama News Rise n Shine - Capricorn, Mopane, Vhembe Rise n Shine - Waterburg Secunda & Betal Insig Titles Showing Largest Growth Free Newspapers Publication Name No 1 2 Northern Eyethu Midvaal Ster Kalahari Buletin (Formerly Kuruman 3 Bulletin) TOTAL Corresponding Variance Previous Variance CIRCULATION Previous - Prior Quarter Previous Period Year Quarter 21360 6002 255,88% 21402 -0,20% 15540 9034 72,02% 15069 3,13% 27832 19867 40,09% 27834 -0,01% Titles Showing Largest Decline Free Newspapers No Publication Name 1 2 Makhado Review Veereniging Ster Rekord 3 Central/Sentraal 4 Express TOTAL Corresponding Variance CIRCULATION Previous - Prior Period Year Previous Variance Quarter Previous Quarter 924 5800 -84,07% 472 95,76% 16806 23709 -29,12% 17631 -4,68% 18391 22540 -18,41% 18391 0,00% 43928 53733 -18,25% 47205 -6,94% 4 Year Magazine Circulation by Quarter Comment: Total magazines increased by 0.5% (97,000 copies) over the previous quarter. Consumer magazines decreased by 0.4% (24,000 copies) over the previous quarter. 4 Year Category Trend by Quarter: Consumer Magazines Comment: Circulation declined annually by 1.7% (468,000 copies) over the period, although the decline has slowed in Q1 compared to the previous 6 quarters. New Members / Removals Consumer Magazines New Members Title The 12th Player The Bass Angler Removals Title FHM PC Format Real Magazine Tight Lines Titles Showing Largest Growth Consumer Magazines Publication No Name Kuier Combo 1 (Annual) SA Career Focus 2 (Six monthly) 3 4 Super Bike Real Brides TOTAL Corresponding Variance - Previous Variance CIRCULATION Previous Prior Year Quarter Previous Period Quarter 105 511 23 077 357,21% 4 835 2 412 100,46% 9722 6172 57,52% 6432 51,15% 2192 1507 45,45% 1723 27,22% Titles Showing Largest Decline Consumer Magazines Publication No Name Tech-Smart 1 Magazine TOTAL Corresponding Variance - Previous Variance CIRCULATION Previous Prior Year Quarter Previous Period Quarter 14767 74304 -80,13% 14784 -0,11% 2 HQ Pony 3782 9909 -61,83% 3729 1,42% 3 Today's Child 10069 24016 -58,07% 10034 0,35% 4 Year Category Trend by Quarter: Consumer Magazines - Home Comment: Circulation has remained static over the period, Q1, however, increased by 20,000 copies compared to Q4.. 4 Year Category Trend by Quarter: Consumer Magazines - Sport and Hobby Comment: Circulation declined annually by 3.3% (66,000 copies) over the period. Q1 remained static compared to Q4. 4 Year Category Trend by Quarter: Consumer Magazines - Travel Comment: Circulation increased annually by 22.7% (259,000 copies) over the period, fluctuating considerably as a result of biennial reporting titles. Q1 increased by 19,000 copies compared to Q4. 4 Year Category Trend by Quarter: Consumer Magazines – Woman’s General Comment: Circulation declined by 3.4% annually (237,000 copies) over the period. Q1 decreased by 48,000 copies compared to Q4, mainly the result of a discontinued title. 4 Year Category Trend by Quarter: Business to Business Magazines Comment: Circulation has remained static over the period. Titles Showing Largest Growth Business to Business Magazines No Publication Name Business Brief (Six 1 monthly) TOTAL Corresponding Variance - Previous Variance CIRCULATION Previous Prior Year Quarter Previous Period Quarter 31 270 19 216 62,73% MIMS Guide to OTC 2 Products (Annual) 2 857 1 778 60,69% 3 Poultry Focus Africa 4352 2927 48,68% 4254 2,30% Titles Showing Largest Decline Business to Business Magazines No Publication Name TOTAL Corresponding Variance - Previous Variance CIRCULATION Previous Prior Year Quarter Previous Period Quarter 1 RISKsa 2004 6602 -69,65% 7399 -72,92% My Office (formerly 2 Shop-SA) 3969 7970 -50,20% 3987 -0,45% Business In Durban 3 (Annual) 8770 14561 -39,77% Modern Medicine 4 Magazine 3912 5986 -34,65% 4021 -2,71% 4 Year Category Trend by Quarter: B2B Magazines – Hospitality, Catering and Tourism Comment: Circulation declined annually by 13% (62,000 copies) over the period, although has remained fairly static over the last year. 4 Year Category Trend by Quarter: Custom Magazines Comment: Circulation increased annually by 2% (918,000 copies) over the period. Q1 increased by 204,000 copies compared to Q4. Titles Showing Largest Growth Custom Magazines TOTAL Corresponding Variance - Previous Variance CIRCULATION Previous Prior Year Quarter Previous Period Quarter No Publication Name TAXtalk (Six 10 082 2 028 1 monthly) 397,14% 2 TFG Escapes 59 080 27 656 113,62% 3 Mercedes (Annual) 31 355 15 840 97,95% 4 TFG Man 61 562 32 349 90,31% 57 346 3,02% 56829 8,33% Titles Showing Largest Decline Custom Magazines Publication Name No TOTAL Corresponding Variance - Previous Variance CIRCULATION Previous Prior Year Quarter Previous Period Quarter Strategic Marketing Magazine (Six 1 monthly) 5 145 16 763 -69,31% Q-One Student 2 Diary (Annual) 54 054 103 060 -47,55% The SA Journal of Epidemoilogy & Infection (SAJEI) 3 (Annual) 1 069 1 922 -44,38% 4 Year Category Trend by Quarter: Custom Magazines – Entertainment Comment: Circulation increased annually by 5.7% (513,000 copies) over the period. However, Q1 increased by 9% (221,000 copies) compared to Q4. 4 Year Category Trend by Quarter: Custom Magazines – Retail Comment: Circulation increased annually by 1% (263,000 copies) over the period. Q1 remained static compared to Q4. 4 Year Category Trend by Quarter: Free Magazines Comment: Circulation declined annually by 16.9% over the period. Q1 decreased by 10% (60,000 copies) compared to Q4. Observations: • With the elections behind us we should remember that circulation remains “democracy in print”; perhaps the most accurate expression of public support” available for publisher and advertiser scrutiny and decision making. • The results that you have seen this morning should be scrutinized and the implications understood fully by all stakeholders. Within each segment there are winners as well as titles where there is room for improvement. • Decisions and negotiations going forward should be based on such objective performance results. • Press: - Daily Newspaper performance remains promising as results show consistency with Q4 2013. It is interesting to point out that inland circulations dropped unexpectedly. However Daily Dispatch jumped 18% and Isolezwe was up 11% on Q4 2013. - Weeklies, The slide continues down a further 2.5% on 2013 Q4. - Weekend titles dropped only 1.8% albeit Afrikaans titles faired worse than their English or vernacular counterparts. - The Local and free newspapers category grew over the period with strong growth in particular from the Review Midweek. Magazines: - The overall performance of the magazine category suggest stability. This is not true. There were more closures than new entrants. This combination obscures the results. - Specific highlights include: - The travel category jumped 19 000 copies since Q4 2013. - Discontinued titles in the Woman’s General category resulted in the category reflecting a decline. - In the Business 2 Business segment, the circulation declined marginally. That said, Business Brief jumped 62% year on year which is a remarkable performance given its target market. - Custom magazines continue to grow, up 204 000 copies compared to Q4 2013. Growth was as expected industry specific. Taxi Talk jumped 394%, while retail titles remained fairly static. - Free magazines declined 10% on 2013 Q4 In summary newspapers continue to perform relatively better than magazines, which given the prophets of a digital apocalypse seems counter intuitive. What remains clear is that relevant content remains king…irrespective of the channel. Thank you. Your ABC - Transparency you can see -