Personal Management MB Day 1 1Nov05

advertisement

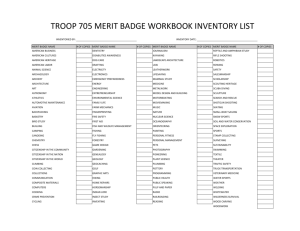

Welcome to the Personal Management Merit Badge Objective of this Presentation: To help you pass off as many of the requirements as you can during the next two weeks BSA Advancement ID#: 11 Source: Boy Scout Requirements, #33215, revised 2004 Day 1 Assignments Assignment Schedule • Day 1 1 2a-b 3a-e 4a-c 5a-c 6a-e Prepare for Day 2 1a 1b(2) 8a-b 2 Day 2 1c 2b 7a-e 8c-d 9a-e 10a-b Your Previous Assignment: Requirement 1 Do the following: • • A. Choose an item that your family might want to purchase that is considered a major expense. B. Write a plan that tells how your family would save money for the purchase identified in requirement 1a. • Discuss the plan with your family • Discuss how other family needs must be considered in this plan • Bring the plan to the Pow Wow and discuss the plan with your merit badge counselor 3 Comparison Shopping Comparison shop for the item. Who is selling it for the best price? • Call different stores. • Study ads. • Look for coupons or sales. Consider alternatives: • Could you buy it used? • Should you wait for a sale? Discuss your shopping strategy with your counselor. 4 Your Previous Assignment: Requirement 1 (continued) • C. Develop a written shopping strategy for the purchase identified in requirement 1a. Bring this shopping strategy with you to Day 2 • 1. Determine the quality of the item or service (using consumer publications or rating systems). • 2. Comparison shop for the item. • Find out where you can buy the item for the best price. (Provide prices from at least two different price sources.) Call around; study ads. Look for a sale or discount coupon. • Consider alternatives. Can you buy the item used? Should you wait for a sale? 5 Requirement #2a This assignment takes 13 weeks—start today a. Prepare a budget reflecting your expected income, expenses, and savings. • Track your actual income, expenses, and savings for 13 consecutive weeks. • You may use the forms provided in the merit badge pamphlet, devise your own, or use a computer generated version from the website. • When complete, present the results to your merit badge counselor. 6 Budgeting (continued) What is a Budget? • It’s the process of making sure your resources are being used for the things that matter most to you—your personal goals • A budget is a star to set your sights by, not a stick to beat yourself with. It’s an important tool While a budget is easy to understand, it takes discipline to follow. • It is probably the most important single factor in helping you to attain your personal goals. 7 Budgeting (continued) There are different methods to track expenditures: • Checks and credit cards • These expenditures leave a paper trail • Cash • Record expenditures in a notebook • Computer programs, i.e., Quicken, Money or spreadsheets • These are very useful, especially if tied to bank and credit card companies • Generate a monthly record of spending and income 8 Budgeting (continued) What is in a budget? • All cash inflows and outflows Income: • Money coming in, from work, savings, parents Expenses: • Two types • Fixed • These are expenses that do not change each month, i.e. non-discretionary • Variable • These are expenses that can change, i.e. discretionary 9 Budgeting: The Old Way Income Expenses Personal Goals 10 Available for Savings Budgeting: The Right Way Income Pay the Lord Pay Yourself Expenses Personal Goals 11 Other Savings The Right Way (continued) Elder L. Tom Perry affirmed this when he said: After paying your tithing of 10 percent to the Lord, you pay yourself a predetermined amount directly into savings. That leaves you a balance of your income to budget for taxes, food, clothing, shelter, transportation, etc. It is amazing to me that so many people work all of their lives for the grocer, the landlord, the power company, the automobile salesman, and the bank, and yet think so little of their own efforts that they pay themselves nothing. L. Tom Perry, “Becoming Self-Reliant,” Ensign, Nov. 1991, 64 12 Your Personal Budget Prepare a personal budget for 3 months. Put money into savings before spending it on anything else. Keep track of everything you buy. Balance your income (money you receive) with your savings and expenses (things you spend money on). See packet for budget Budget Income Month #1 Plan Actual Month #2 Plan Actual Month #3 Plan Actual Plan Total Actual Month #3 Plan Actual Plan Total Actual Mowing Lawns Chores Gifts Allowance Total Expenses Month #1 Plan Actual Savings Food CD's + movies Total Discretionary 13 Month #2 Plan Actual 2b. Report to Your Counselor • After the 3 months, share your budget with your counselor. • Explain how you determined how much you saved, what you spent money on, and what was left over. • Did you spend more or less than you budgeted? 14 Assignment 3 Discuss with your merit badge counselor FIVE of the following concepts: • A. What emotions do you feel when you receive money? • What does it make you feel like? • Does it vary, depending on how much money you receive? 15 Assignment 3 (continued) • B. How does the amount of money you have with you (in your pockets) affect your spending habits? • If you have money in your pocket, are you more likely to spend it or save it? • If you are more likely to spend it, what does this indicate about money you have in your pockets? • If you want to save money, should you keep it with you or not? 16 Assignment 3 (continued) • C. What are your thoughts when you buy something new and your thoughts about the same item three months later? Are they the same? • What is buyer's remorse? • Buyer’s remorse is when you buy a product for a certain reason, and then afterwards realize that it did not fulfill that reason • Often we buy things we think will satisfy us, and then after we have owned it for a while, realize that it did not fulfill those needs • How can you guard against buyers remorse? 17 Assignment 3 (continued) • D. How does hunger affect you when shopping for food items (snacks, groceries)? • If you are hungry, will you buy more food? • Will you buy more junk food? • If hunger affects what you purchase, should you eat well before shopping? 18 Assignment 3 (continued) • E. Share an experience of an item you have purchased after seeing or hearing advertisements for it. Did the item work as well as advertised? • What did you do when it didn’t work as advertised? • Should we take things back that don’t work? • Is that the correct thing to do? 19 Assignment 3 (continued) • F. What happens when you put money into a savings account? • Is it safe? • What does the bank do with the money? • What is the difference between interest you earn and interest you pay? 20 Assignment 3 (continued) • G. What is charitable giving? Explain its purpose and your thoughts about it. • Charitable giving is sharing the things we have received with others • God gives to us freely. We should share with others 21 Assignment 3 (continued) • H. What you can do to better manage your money? • Ideas include: • Be more careful with your spending • Plan your spending and live your plan • Live within your means • Be smart--Earn interest—don’t pay interest. 22 Requirement 4 Explain the following to your merit badge counselor: • • A. What is the difference between saving and investing? Why would you use one over the other? • Saving: to put money aside, usually in a bank account for future use • The return you earn is generally very low but certain • Investing: to invest money to make even more money in the future • The return is generally higher but uncertain Generally you save for short-term goals, and invest for long-term goals 23 Requirement 4 (continued) • B. What is return on investment? • Return on investment is the money received from investing divided by the amount of money invested. • What is risk? • Risk can be many things, but generally relates to uncertainty. The less certain a return, generally the higher the risk 24 Requirement 4 (continued) • C. What is the difference between simple interest and compound interest? How do these affected the results of your investment exercise? • Simple interest is interest on principle only. • You invest $1,000 for 1 year at 10% interest and you will have $110 at year end. • At the end of 10 years you will have $1,100 or $100 interest each year * 10 years + 1,000 principle. 25 Requirement 4 (continued) • Compound interest is interest on interest. • You invest $1,000 at 8% interest compounded monthly will earn 1,083 in 1 year • In 10 years, your investment will have increased to $2,220, nearly double the simple interest method • Compound interest is a very important part of investing 26 Requirement 5 Select five publicly traded stocks from the business section of the newspaper. Explain to your merit badge counselor the importance of the following information for each stock: • • • Current price How much the price changed from the previous day The 52-week high and the 52-week low prices 27 From the Wall Street Journal 28 Requirement 6 Pretend you have $1,000 to save, invest, and help prepare yourself for the future. Explain to your merit badge counselor the advantages or disadvantages of saving or investing in each of the following: • • • • • Common stocks Mutual funds Life insurance A certificate of deposit (CD) A savings account or U.S. savings bond 29 Requirement 6 (continued) What are common stocks? • Stocks are pieces of ownership in a listed company Advantages • Higher returns over the long-term Disadvantages • Higher risk 30 Requirement 6 (continued) What are mutual funds? • Mutual funds are portfolios of securities (stocks, bonds, or cash) managed by an investment company Advantages • Professionally run • Immediate diversification Disadvantages • No control over taxes • May not outperform benchmarks 31 Requirement 6 (continued) What is life insurance? • Life insurance is a contract that will pay money to your beneficiaries should you die Advantages • Life insurance payments are tax-free • Cash value life insurance grows tax-free Disadvantages • Cash value life insurance is very expensive • You have to die to get paid 32 Requirement 6 (continued) What are Certificates of Deposit (CDs)? • CDs are savings accounts held with a financial institution for a specific time Advantages • Returns are higher than savings accounts • Returns are guaranteed Disadvantages • Returns are lower than other instruments 33 Requirement 6 (continued) What are U.S. Savings bonds? • U.S. Savings Bonds are bonds issued by the US government Advantages • Returns are higher than general savings accounts • Returns are tax-free if used for education Disadvantages • Returns are lower than other instruments 34 Day 1 Assignments We should have completed the following assignments for Day 1: • Day 1 2a 3a-e 4a-c 5a-c 6a-e Prepare for Day 2 1a 1b 35 Day 2 1c 2b 7a-e 8a-d 9a-e 10a-b Preparation for Day 2— To do this next week Requirement 1 Do the following: • • A. Choose an item that your family might want to purchase that is considered a major expense. B. Write a plan that tells how your family would save money for the purchase identified in requirement 1a. • Discuss the plan with your family • Discuss how other family needs must be considered in this plan. • Be prepared to discuss the plan with your merit badge counselor when you return 36 Preparation for Day 2 (continued) C. Develop a written shopping strategy for the purchase identified in requirement 1a. • 1. Determine the quality of the item or service (using consumer publications or rating systems). • 2. Comparison shop for the item. • Find out where you can buy the item for the best price. (Provide prices from at least two different price sources.) Call around; study ads. Look for a sale or discount coupon. • Consider alternatives. Can you buy the item used? Should you wait for a sale? 37 Preparation for Day 2 (continued) Requirement 8 • Demonstrate to your merit badge counselor your understanding of time management by doing the following: • A. Write a "to do" list of tasks or activities, such as homework assignments, chores, and personal projects, that must be done in the coming week. List these in order of importance to you. • What is a “to do” list? • Why must you prioritize this list? 38 Preparation for Day 2 (continued) • B. Make a seven-day calendar or schedule. Put in your set activities, such as school classes, sports practices or games, jobs or chores, and/or Scout or church or club meetings, then plan when you will do all the tasks from your "to do" list between your set activities. • Why is a calendar important? • Why is planning so important? • What is meant by the statement: • “Those who fail to plan, plan to fail.” 39 Preparation for Day 2 (continued) • C. Follow the one-week schedule you planned. • Keep a daily diary or journal during each of the seven days of this week's activities, writing down when you completed each of the tasks on your "to do" list compared to when you scheduled them. • D. Review your "to do" list, one-week schedule, and diary/journal to understand when your schedule worked and when it did not work. • With your merit badge counselor, prepare to discuss what you learned from this requirement and what you might do differently the next time when you get together in two weeks. 40 Additional Information Investing Tools: the investment hourglass • It is a way of helping remember that investing is a means to help us achieve our goals—it is not an end in itself • And since our goals are based on our values, our investments should reflect those values 41 Before you Invest: The Hourglass Top 1. Have your priorities in order and are “square” with the Lord 2. Have adequate life and health insurance 3. Be out of credit card and consumer debt 4. Know your personal goals, budget, and have an investment plan If you can answer these affirmatively, you are ready to invest! 42 The Hourglass Bottom (continued) Retirement Assets Taxable Assets 4. Opportunistic: Individual Stocks and Sector Funds 3. Diversify: Broaden and Deepen your Asset Classes 2. Core: Broad Market Exposure: Core Mutual Funds 1. Basics: Emergency Fund and Food Storage 43