Practice test 3 answers

advertisement

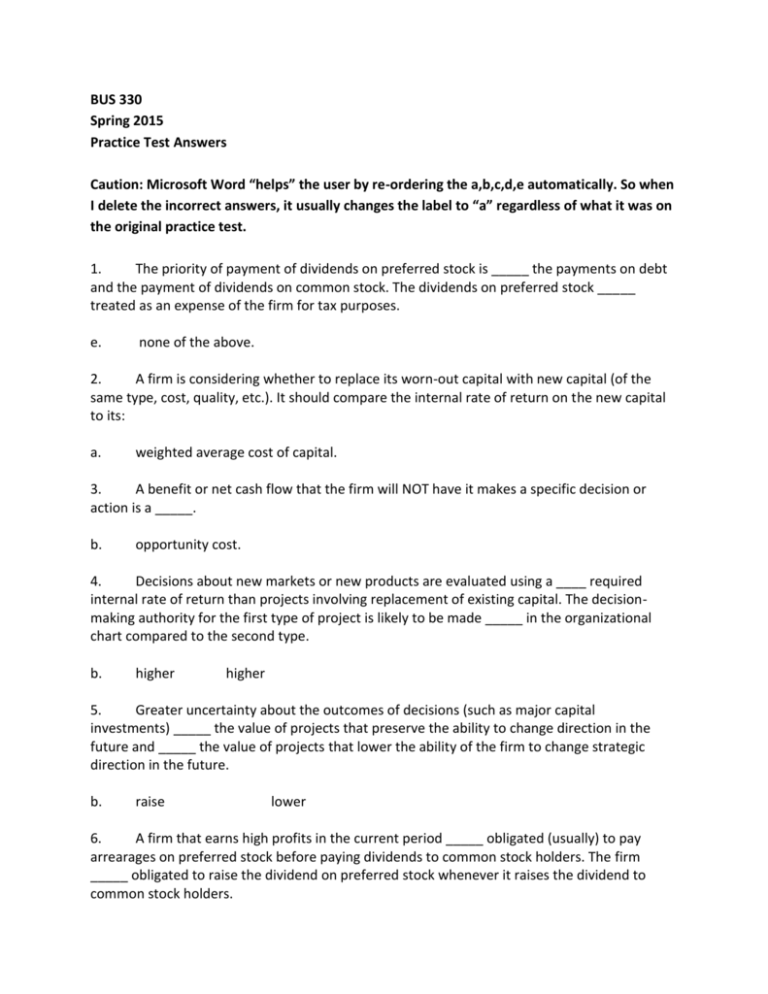

BUS 330 Spring 2015 Practice Test Answers Caution: Microsoft Word “helps” the user by re-ordering the a,b,c,d,e automatically. So when I delete the incorrect answers, it usually changes the label to “a” regardless of what it was on the original practice test. 1. The priority of payment of dividends on preferred stock is _____ the payments on debt and the payment of dividends on common stock. The dividends on preferred stock _____ treated as an expense of the firm for tax purposes. e. none of the above. 2. A firm is considering whether to replace its worn-out capital with new capital (of the same type, cost, quality, etc.). It should compare the internal rate of return on the new capital to its: a. weighted average cost of capital. 3. A benefit or net cash flow that the firm will NOT have it makes a specific decision or action is a _____. b. opportunity cost. 4. Decisions about new markets or new products are evaluated using a ____ required internal rate of return than projects involving replacement of existing capital. The decisionmaking authority for the first type of project is likely to be made _____ in the organizational chart compared to the second type. b. higher higher 5. Greater uncertainty about the outcomes of decisions (such as major capital investments) _____ the value of projects that preserve the ability to change direction in the future and _____ the value of projects that lower the ability of the firm to change strategic direction in the future. b. raise lower 6. A firm that earns high profits in the current period _____ obligated (usually) to pay arrearages on preferred stock before paying dividends to common stock holders. The firm _____ obligated to raise the dividend on preferred stock whenever it raises the dividend to common stock holders. c. is is not 7. In a perfect world (without taxes or lawyers) a firm’s weighted-average-cost-of-capital would _____ as the debt-to-total-assets ratio rises. a. none of the above. 8. Suppose that we live in an imperfect world populated with lawyers who make bankruptcy inefficient and expensive, but that there are no taxes. Suppose also that the probability of bankruptcy is zero until the debt ratio reaches 30%, and then rises above zero if the debt ratio is 30% or more. For this firm, the graph showing the firm’s debt ratio on the horizontal (x) axis and the cost of capital on the vertical (y) axis would be: a. flat until the debt ratio reaches 30%, then increasing. 9. Suppose McDonald’s wishes to diversify out of hamburgers and move into the commercial aircraft business. It is considering purchasing Boeing, Inc. Boeing is financed entirely by equity, has stable earnings, and a price-to-earnings ratio of 10, meaning that the shareholders of Boeing require a 10% return on their shares. The acquisition would double the total amount of McDonald’s assets. McDonald’s current balance sheet shows 50% debt (interest rate of 5%) and 50% equity (required return on equity of 9%). When McDonald’s management evaluates the expected cash flows from the Boeing acquisition to compute the net present value of the acquisition, the discount rate is should use is: a. 10% 0.4 0.35 0.3 0.25 0.2 0.15 0.1 0.05 0 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 10. The graph above shows the required return on debt (the bottom line, starting at 2%) and required return on equity (the top line, starting at 8%) of a firm operating in a perfect world. If the debt/assets ratio rises above 0.3, the possibility of bankruptcy begins to increase the required return on debt. If the firm had a debt-to-asset ratio of 0.5, then the weighted average cost of capital would be: a. 8% 11. The debt-to-assets ratio that maximizes the firm’s expected earnings per share is ___ the level that maximizes shareholder wealth and is ____ the level that minimizes the firm’s weighted-average-cost-of-capital. a. higher than higher than 12. Company X has a “beta” of 6. Company X’s capital structure is 2/3 debt and 1/3 equity. The business risk of company X would result in a beta of _____, and the financial leverage causes the value of beta resulting from the business risk to _____. a. 2 13. triple A firm’s operating break-even occurs where (using the same abbreviations as the text): a. EBIT = 0 14. Suppose the world is almost perfect, because no taxes distort firm or investor decisions. However bankruptcy costs reduce both payments to creditors and returns to shareholders. Suppose the firm’s risk of bankruptcy is zero until the debt-to-asset ratio reaches 50%. On a graph showing the required return on the vertical (Y) axis and the debt ratio on the horizontal (X) axis, the slope of line (moving left to right) showing the firm’s weighted-average-cost-ofcapital will be _____ until the debt ratio reaches 50%. For debt ratios above 50% the slope of the line is _____. a. zero positive 15. Suppose there are no transactions costs associated with bankruptcy (no lawyers), but the tax code allows the firm to deduct interest payments before computing taxable income, but dividend payments are made after taxes. Suppose the firm’s risk of bankruptcy is zero until the debt-to-asset ratio reaches 50%. On a graph showing the required return on the vertical (Y) axis and the debt ratio on the horizontal (X) axis, the slope of line (moving left to right) showing the firm’s weighted-average-cost-of-capital will be _____ until the debt ratio reaches 50%. For debt ratios above 50% the slope of the line is _____. a. Negative negative 16. Suppose firm managers have inside information about the firm’s intrinsic value, unknown to the general investing public. If managers act on behalf of existing shareholders, and managers know that the firm’s intrinsic value is significantly greater than the current market price of the shares, they should: a. Finance the firm’s capital expenditures by issuing debt. 17. In a perfect world, which of the following have no effect on the firm’s weightedaverage-cost-of-capital? (1) (2) (3) (4) Increasing the firm’s dividend payout ratio Issuing a special dividend to shareholders Using the firm’s cash flow to make a stock re-purchase. Carrying out a stock split. a. (1), (2), (3), and (4) are all true. 18. In the context of corporate finance, the acronym “DRIP” stands for: a. Dividend Re-Investment Plan 19. If a firm has net cash flow available to distribute to the firm’s owners, no attractive investment opportunities that it has not already funded, and is interested in the most taxefficient method of distributing the cash to owners, it should: a. Re-purchase the company’s stock. 20. A stock re-purchase announcement is often viewed as a _____ signal by investors who assume the announcement indicates that management believes that: a. Positive the stock’s current market price is less than its intrinsic value. Part II. Suppose Wal-Mart is considering expanding into Bulgaria. The company has identified a location for its first store, and considering the prospective profitability. Assume Wal-Mart’s WACC is 10%. The company won’t know whether its business model will work well in Bulgaria until it opens its first store. If the sales from the first store are “STRONG”, then the store will generate (starting in year 1 if the decision to build the store is made in year 0) a discounted cash flow of 22. If the sales from the first store are “WEAK”, then the store will generate (starting in year 1 if the decision to build the store is made in year 0) a discounted cash flow of 11. The cost of building the first store is 16. 1. If Wal-Mart believes there is a 50% chance of sales being STRONG and a 50% chance of sales being WEAK, what is the expected NPV of the project? NPV = -16 + (1/1.1)*[(0.5)*11 + (0.5)*22] = -1 2. Suppose Wal-Mart has 3 other locations in Bulgaria that it thinks are suitable for stores. Each of the others will also cost 16. If the first store turns out to be STRONG, then each of the other 3 has an 80% chance of being STRONG and a 20% chance of being WEAK. If the first store is WEAK, then each of the others has an 80% chance of being WEAK and a 20% chance of being STRONG. If Wal-Mart is considering building a “test store” (the first one) and then deciding whether to build the remaining 3. What is the expected NPV of the “build-a-test-store-and-then-decide-what-to-do” project? If test store is STRONG, then the NPV of building the remaining 3 stores is: V = -48 + 3*(1/1.1)*[(0.2)*11 + (0.8)*22] = 6 If test store is WEAK, then the NPV of building the remaining 3 stores is: V = -48 + 3*(1/1.1)*[(0.8)*11 + (0.2)*22] = -12 If Wal-Mart chooses not to build the remaining 3 stores, the NPV of the do-nothing project is 0. Wal-Mart will choose the maximum of NPV(build), NPV(don’t build). When the first store is STRONG, the choice will be to build. When the first store is WEAK, the choice will be “don’t build”. Adding this to the decision to build the first store produces: NPV = -16 + (1/1.1)[(0.5)*(11 + 0) + (0.5)*(22 + 6)] = 1.73 3. If Wal-Mart has 4 stores in Bulgaria, then it can also build a local distribution center to supply the 4 stores. The distribution center will cost 5, but open after one year and produce a NPV of 11 once it opens. What is the expected NPV of the “build-a-test-store-and-then-decide-whether-to-buildthe-other-3-stores-and-distribution-center” project? The distribution center will only be built if the other 3 stores are built. Assuming that there are 4 stores to serve, the distribution center has a NPVDC = -5 + (1/1.1)*11 = 5. NPV = -16 + (1/1.1)[(0.5)*(11 + 0 + 0) + (0.5)*(22 + 6 + NPVDC)] = 4 4. Suppose an aggressive manager at Wal-Mart (probably a former JMC major) wants to build all 4 stores plus the distribution center immediately. What is the option value of “waiting to see how the first store does before deciding what else to do”? The answer to question 3 is the NPV of the project if taken step-by-step. If done all at once, the NPV will be: NPVJMC = - (4*16) – 5 + (1/1.1) * 11 + 4*(1/1.1)*[0.5*11 + 0.5*22] = 1 Therefore the value of the option to see how the first store does before deciding is the difference between the expected NPV of 4 in the previous question and the expected NPV of 1. Therefore the option is worth 3. 5. What is the option value of adding the distribution center to the project of “building one store and then deciding whether to build the remaining 3 stores”? There is a 50% chance the first store will be WEAK. The NPV of building the remaining 3 stores is -12 – which means they won’t be built at all. This also means the distribution center won’t be built. There is a 50% chance the first store will be STRONG, which means the other stores will be built and also that the distribution center will be built. The distribution center project has a NPV of 5 as long as there are 4 stores. There is a 50% chance this will happen. Therefore the distribution center option adds 2.5 to the expected NPV of the overall project.