Financial Management for Entrepreneurs

advertisement

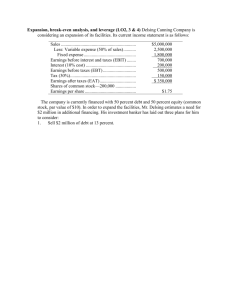

Principles of Managerial Finance 9th Edition Chapter 12 Leverage & Capital Structure Learning Objectives • Discuss the role of breakeven analysis, how to determine the operating breakeven point, and the effect of changing costs on the breakeven point. • Understand operating, financial, and total leverage and the relationship among them. • Describe the basic types of capital, external assessment of capital structure, capital structure of non-U.S. firms, and capital structure theory. Learning Objectives • Explain the optimal capital structure using a graphic view of the firm’s cost of capital functions and a modified form of zero-growth valuation model. • Discuss the graphic presentation, risk considerations, and basic shortcomings of EBIT-EPS approach to capital structure. • Review the return and risk of alternative capital structures and their linkage to market value, and other important capital structure considerations. Leverage Sales revenue和 EBIT之間的關係 Sales revenue和 EPS之間的關係 EBIT和EPS 之間的關係 Breakeven Analysis • Breakeven (cost-volume-profit) Analysis is used to: – determine the level of operations necessary to cover all operating costs, and – evaluate the profitability associated with various levels of sales. • The firm’s operating breakeven point (OBP) is the level of sales necessary to cover all operating expenses. • At the OBP, operating profit (EBIT) is equal to zero. Breakeven Analysis • To calculate the OBP, cost of goods sold and operating expenses must be categorized as fixed or variable. • Variable costs vary directly with the level of sales and are a function of volume, not time. • Examples would include direct labor and shipping. • Fixed costs are a function of time and do not vary with sales volume. • Examples would include rent and fixed overhead. Breakeven Analysis Algebraic Approach • Using the following variables, the operating portion of a firm’s income statement may be recast as follows: P = Q = FC = VC = sales price per unit sales quantity in units fixed operating costs per period variable operating costs per unit EBIT = (P x Q) - FC - (VC x Q) • Letting EBIT = 0 and solving for Q, we get: Breakeven Analysis Algebraic Approach • Using the following variables, the operating portion of a firm’s income statement may be recast as follows: P = Q = FC = VC = sales price per unit sales quantity in units fixed operating costs per period variable operating costs per unit Q = FC P - VC Breakeven Analysis Algebraic Approach Breakeven Analysis Algebraic Approach • Example: Omnibus Posters has fixed operating costs of $2,500, a sales price of $10/poster, and variable costs of $5/poster. Find the OBP. Q = $2,500 = 500 posters $10 - $5 • This implies that if Omnibus sells exactly 500 posters, its revenues will just equal its costs (EBIT = $0). Breakeven Analysis Algebraic Approach • We can check to verify that this is the case by substituting as follows: EBIT = (P x Q) - FC - (VC x Q) EBIT = ($10 x 500) - $2,500 - ($5 x 500) EBIT = $5,000 - $2,500 - $2,500 = $0 Breakeven Analysis Graphic Approach EBIT at Various Levels of Quantity Sold Quantity Total Total Total Total Sold Revenue Costs FC VC 0 0 2,500 2,500 0 500 5,000 5,000 2,500 2,500 0 1,000 10,000 7,500 2,500 5,000 2,500 1,500 15,000 10,000 2,500 7,500 5,000 2,000 20,000 12,500 2,500 10,000 7,500 2,500 25,000 15,000 2,500 12,500 10,000 3,000 30,000 17,500 2,500 15,000 12,500 EBIT (2,500) Breakeven Analysis Total Revenue Total Costs Total FC 14,000 revenue/costs ($) 12,000 EBIT>0 10,000 8,000 6,000 Operating breakeven point 4,000 2,000 EBIT<0 - 500 1,000 sales (posters) 1,500 2,000 Operating & Financial Leverage Operating & Financial Leverage Effects of Leverage on the Income Statement Net Sales Scenario 1 Scenario 2 Scenario 3 10% Sales Sales Rem ain 10% Sales Decrease Unchanged Increase $ 630,000 $ 700,000 $ 770,000 Less: Variable Costs (60% of Sales) 378,000 420,000 462,000 200,000 200,000 200,000 EBIT 52,000 80,000 108,000 Less: Interest Expense 20,000 20,000 20,000 EBT 32,000 60,000 88,000 9,600 18,000 26,400 Less: Fixed Costs Less: Taxes (30%) Net Incom e $ 22,400 $ 42,000 $ 61,600 Operating & Financial Leverage Degree of Operating Leverage • operating leverage=the potential use of fixed operating costs to magnify the effects of changes in sales on the firm’s EBIT • The degree of operating leverage (DOL) measures the sensitivity of changes in EBIT to changes in Sales. • A company’s DOL can be calculated in two different ways: One calculation will give you a point estimate, the other will yield an interval estimate of DOL. • Only companies that use fixed costs in the production process will experience operating leverage. Operating & Financial Leverage Degree of Operating Leverage Effects of Operating Leverage on the Income Statement Scenario 1 Scenario 2 Sales Decrease Sales Rem ain 10.0% Net Sales $ 630,000 Scenario 3 Sales Increase Unchanged $ 700,000 10.0% $ 770,000 Less: Variable Costs (60% of Sales) Less: Fixed Costs EBIT 378,000 420,000 462,000 200,000 200,000 200,000 52,000 80,000 108,000 Ebit Decreases Ebit Increases 35.0% 35.0% Operating & Financial Leverage Degree of Operating Leverage DOL愈大表示operating risk愈大,DOL>1表示有operating leverage Interval Estimate of DOL DOL = % Change in EBIT = 35% % Change in Sales 10% = 3.50 Because of the presence of fixed costs in the firm’s production process, a 10% increase in Sales will result in a 35% increase in EBIT. Note that in the absence of operating leverage (if Fixed Costs were zero), the DOL would equal 1 and a 10% increase in Sales would result in a 10% increase in EBIT. Operating & Financial Leverage Degree of Operating Leverage Point Estimate of DOL 當FC相對於VC愈大時,DOL也愈大,例如:公司決定增加sales的salary ,減少sales commission DOL = Sales - VC Sales - VC - FC = 700 - 420 700 - 420 - 200 = 3.50 Care must be taken when using the point estimate because the DOL will be different at different levels of sales. For Example, if sales increase to 770, DOL will decline as follows: DOL = Sales - VC Sales - VC - FC = 770 - 462 770 - 462 - 200 = 2.08 Operating & Financial Leverage Degree of Financial Leverage • Financial leverage=potential use of fixed financial costs to magnify the effects of changes in EBIT on the firm’s EPS • The degree of financial leverage (DFL) measures the sensitivity of changes in EPS to changes in EBIT. • Like the DOL, DFL can be calculated in two different ways: One calculation will give you a point estimate, the other will yield an interval estimate of DFL. • Only companies that use debt or other forms of fixed cost financing (like preferred stock) will experience financial leverage. *兩種fixed financing costs: interest expense與preferred stock dividend Operating & Financial Leverage Degree of Financial Leverage Effects of Financial Leverage on the Income Statement Scenario 1 Scenario 2 Scenario 3 EBIT Dcrease Sales Rem ain EBIT Increase 35.00% Unchanged 35.00% EBIT 52,000 80,000 108,000 Less: Interest Expense 20,000 20,000 20,000 EBT 32,000 60,000 88,000 9,600 18,000 26,400 Less: Taxes (30%) Net Incom e $ 22,400 $ 42,000 $ 61,600 EPS (42,000 shares) $ 0.53 $ 1.00 $ 1.47 EPS Decreases 46.67% EPS Increases 46.67% 注意:若有特別股存在,則這裡要再減去特別股股利 Operating & Financial Leverage Degree of Financial Leverage Interval Estimate of DFL DFL = % Change in EPS = 46.67% = 1.33 % Change in EBIT 35.00% In this case, the DFL is greater than 1 which indicates the presence of debt financing. In general, the greater the DFL, the greater the financial leverage and the greater the financial risk. Operating & Financial Leverage Degree of Financial Leverage Point Estimate of DFL DFL = EBIT = 80 EBIT - Interest 80 - 20 = 1.33 DFL = EBIT = 108 = 1.23 EBIT - Interest 108 - 20 In this case, we can see that the DFL is related to the expected level of EBIT. However, the DFL declines if the firm performs better than expected. Note also, however, that the DFL will rise if the firm performs worse than expected. 若有preferred stock,則公式為 DFL EBIT EBIT Interest PD 1 Operating & Financial Leverage Degree of Total Leverage Effects of Combined Leverage on the Income Statement Net Sales $ Scenario 1 Scenario 2 Scenario 3 10% Sales Sales Rem ain 10% Sales Decrease Unchanged Increase 630,000 $ 700,000 $ 770,000 Less: Variable Costs (60% of Sales) 378,000 420,000 462,000 200,000 200,000 200,000 EBIT 52,000 80,000 108,000 Less: Interest Expense 20,000 20,000 20,000 EBT 32,000 60,000 88,000 9,600 18,000 26,400 Less: Fixed Costs Less: Taxes (30%) Net Incom e $ 22,400 $ 42,000 $ 61,600 EPS (42,000 shares) $ 0.53 $ 1.00 $ 1.47 EPS Decreases 46.67% EPS Increases 46.67% Operating & Financial Leverage Degree of Total Leverage Interval Estimate of DTL DTL = % Change in EPS = % Change in Sales 46.7% 10% = 4.67 In this case, the DTL is greater than 1 which indicates the presence of both fixed operating and fixed financing costs. In general, the greater the DTL, the greater the financial leverage and the greater the operating leverage. Operating & Financial Leverage Degree of Total Leverage Point Estimate of DTL DTL = DOL x DFL = Q x (P - VC) x Q x (P-VC) - FC DTL = EBIT = EBIT – I - [PD/(1-t)] 700 – 420 = Q x (P-VC) EBIT- I - [PD/(1-t)] 4.67 700 - 420 - 200 - 20 - 0 At our base level of sales of 700, the point estimate gives us the same result we obtained using the interval estimate. Operating & Financial Leverage Degree of Total Leverage The relationship between the DTL, DOL, and DFL is illustrated in the following equation: DTL = DOL x DFL Applying this to our example at a sales level of $770, we get: DTL = 3.50 x 1.33 = 4.6 Which is the same result we obtained using either the point or interval estimates at that sales level. The Firm’s Capital Structure • Capital structure is one of the most complex areas of financial decision making due to its interrelationship with other financial decision variables. • Poor capital structure decisions can result in a high cost of capital, thereby lowering project NPVs and making them more unacceptable. • Effective decisions can lower the cost of capital, resulting in higher NPVs and more acceptable projects, thereby increasing the value of the firm. Types of Capital Internal Assessment of Capital Structure High business risk industry tends to maintain a lower financial risk Lower business risk industry tends to have a higher financial risk Capital Structure of Non-U.S. Firms • In recent years, researchers have focused attention not only on the capital structures of U.S. firms, but on the capital structures of foreign firms as well. • In general, non-U.S. companies have much higher degrees of indebtedness than their U.S. counterparts. • In most European and Pacific Rim countries, large commercial banks are more actively involved in the financing of corporate activity than has been true in the U.S. Capital Structure of Non-U.S. Firms • Furthermore, banks in these countries are permitted to make large equity investments in non-financial corporations -- a practice forbidden in the U.S. • However, similarities also exist between U.S. firms and their foreign counterparts. • For example, the same industry patterns of capital structure tend to be found around the world. • In addition, the capital structures of U.S.-based MNCs tend to be similar to those of foreign-based MNCs. Capital Structure Theory MM [ Modigliani and Miller(1958)]: capital structure irrelevancy • According to finance theory, firms possess a target capital structure that will minimize its cost of capital. • Unfortunately, theory can not yet provide financial mangers with a specific methodology to help them determine what their firm’s optimal capital structure might be. • Theoretically, however, a firm’s optimal capital structure will just balance the benefits of debt financing against its costs. Capital Structure Theory • The major benefit of debt financing is the tax shield provided by the federal government regarding interest payments. • The costs of debt financing result from – the increased probability of bankruptcy caused by debt obligations, – the agency costs resulting from lenders monitoring the firm’s actions, and – the costs associated with the firm’s managers having more information about the firm’s prospects than do investors (asymmetric information). Capital Structure Theory Tax Benefits NI ( EBIT Int )(1 ) EBIT EBIT Int Int 每年的 tax savings為Int • Allowing companies to deduct interest payments when computing taxable income lowers the amount of corporate taxes. • This in turn increases firm cash flows and makes more cash available to investors. • In essence, the government is subsidizing the cost of debt financing relative to equity financing. Capital Structure Theory Probability of Bankruptcy • The probability that debt obligations will lead to bankruptcy depends on the level of a company’s business risk and financial risk. • Business risk is the risk to the firm of being unable to cover operating costs. • In general, the higher the firm’s fixed costs relative to variable costs, the greater the firm’s (1) operating leverage and business risk. (2) (3) • Business risk is also affected by revenue and cost stability. Capital Structure Theory Probability of Bankruptcy • The firm’s capital structure - the mix between debt versus equity - directly impacts financial leverage. • Financial leverage measures the extent to which a firm employs fixed cost financing sources such as debt and preferred stock. • The greater a firm’s financial leverage, the greater will be its financial risk - the risk of being unable to meet its fixed interest and preferred stock dividends. Capital Structure Theory Agency Costs Imposed by Lenders • When a firm borrows funds by issuing debt, the interest rate charged by lenders is based on the lender’s assessment of the risk of the firm’s investments. • After obtaining the loan, the firm (stockholders/managers) could use the funds to invest in riskier assets. • If these high risk investments pay off, the stockholders benefit but the firm’s bondholders are locked in and are unable to share in this success. Capital Structure Theory Agency Costs Imposed by Lenders • To avoid this, lenders impose various monitoring costs on the firm. • Examples of these monitoring costs would include: – raising the rate on future debt issues, – denying future loan requests, – imposing restrictive bond provisions. Capital Structure Theory Pecking order • (1)Retained earnings • (2)Debt • (3)Equity Note: Agency Costs Imposed by Stockholders • As firms issue more stock, the ownership becomes more diffused and therefore separated from management. • Manager has incentives to consume more perks and work less. • This will hurt the stockholders. • To avoid this, stockholders impose various monitoring costs on the firm. • Examples of these monitoring costs would include: – establishing a more efficient director board, e.g., outside director – pressure from the SEC and CPA to closely monitor the management, – asking for more cash dividends. Capital Structure Theory Asymmetric Information • Asymmetric information results when managers of a firm have more information about operations and future prospects than do investors. • Asymmetric information can impact the firm’s capital structure as follows: Suppose management has identified an extremely lucrative investment opportunity and needs to raise capital. Based on this opportunity, management believes its stock is undervalued since the investors have no information about the investment. Capital Structure Theory Asymmetric Information • Asymmetric information results when managers of a firm have more information about operations and future prospects than do investors. • Asymmetric information can impact the firm’s capital structure as follows: In this case, management will raise the funds using debt since they believe/know the stock is undervalued (underpriced) given this information. In this case, the use of debt is viewed as a positive signal to investors regarding the firm’s prospects. Capital Structure Theory Asymmetric Information • Asymmetric information results when managers of a firm have more information about operations and future prospects than do investors. • Asymmetric information can impact the firm’s capital structure as follows: On the other hand, if the outlook for the firm is poor, management will issue equity instead since they believe/know that the price of the firm’s stock is overvalued (overpriced). Issuing equity is therefore generally thought of as a “negative” signal. The Optimal Capital Structure So What is the Optimal Capital Structure? • In general, it is believed that the market value of a company is maximized when the cost of capital (the firm’s discount rate) is minimized. • The value of the firm can be defined algebraically as follows: V = EBIT (1 - t) ka 假設zero growth model ka為WACC The Optimal Capital Structure So What is the Optimal Capital Structure? • 股東每年所享有之現金流量 ( EBIT Int )(1 ) Dep C.E. NWC PR PR=本期攤還之本金 Dep=折舊費用 C.E.=資本支出=今年的機器廠房等固定資產比去年增加的部份 NWC=淨營運資金之改變 • 假設不成長,則Dep=CE,且NWC=0 ∴上式=EBIT(1-)-Int(1- )-PR 至於債權人每年所享有之現金流量=Int(1- )+PR,所以整個公司 每年的現金流量= EBIT(1-) • It can be described graphically as shown on the following two slides. The Optimal Capital Structure Kd比ke低是因為tax shield以及求償權 當D/A=0時,WACC=ke。隨著(D/A) 時kd所佔的比重也愈來愈大 ,但因為kd<ke,所以wacc一開始會下降 Cost (%) Graphically Ke Cost of equity WACC =ka Ke Why 先下降再上升? D D k d (1 ) ke A A Kd 為稅後的cost of debt Kd 0 Target Capital Structure TD/TA (%) The Optimal Capital Structure Firm Value ($) Graphically V = EBIT (1 - t) ka V($) 0 Target Capital Structure TD/TA (%) The Optimal Capital Structure • An example of how this might work using actual numbers is demonstrated below: Cost of Capital & Firm Value for Alternative Capital Structures Source of Capital Capital Structure 1 Capital Structure 2 Capital Structure 3 Debt 25% 40% 70% Equity 75% 60% 30% WACC 10% 8% 13% Expected Future Annual Cash Flows $ Firm Value $ 20 $ 20 $ 20 200 $ 250 $ 160 The Optimal Capital Structure WACC & Firm Value WACC (%) Firm Value ($) 13% $300 12% $250 11% $200 10% $150 9% $100 8% 7% $50 6% $25% 40% 70% Total Debt/Total Assets WACC Value Debt Ratios for Selected Industries Debt Ratios for Selected Industries (1994-1995) Debt TIE Manufacturing: Ratio Ratio Books 65% Computers Steel Debt TIE Retailing: Ratio Ratio 3.8 Autos 78% 2.9 58% 3.0 Restaurants 68% 2.9 59% 3.7 Shoes 60% 3.5 Wholesaling: Services: Furniture 66% 2.9 Accounting 52% 6.6 Groceries 68% 2.6 Advertising 77% 4.9 Hardw are 60% 3.1 Physicians 70% 2.7 EPS-EBIT Approach to Capital Structure • The EPS-EBIT approach to capital structure involves selecting the capital structure that maximizes EPS over the expected range of EBIT. • Using this approach, the emphasis is on maximizing the owners returns (EPS). • A major shortcoming of this approach is the fact that earnings are only one of the determinants of shareholder wealth maximization. • This method does not explicitly consider the impact of risk. EPS-EBIT Approach to Capital Structure Example The capital structure of JGS, a soft drink manufacturer is shown in the table below. Currently, JGS uses only equity in its capital structure. Thus the current debt ratio is 0.00%. Assume JGS is in the 40% tax bracket. JGS Current Capital Structure Long-term debt $ - Common stock (25,000 shares @ $20) $ 500,000 Total Capital (assets) $ 500,000 EPS-EBIT Approach to Capital Structure EPS-EBIT coordinates for JSG’s current capital structure can be found by assuming two EBIT values and calculating the associated EPS as follows: EBIT $ 100,000 Interest $ EBT $ 100,000 $ 200,000 T $ 40,000 $ 80,000 NI $ 60,000 $ 120,000 EPS $ 2.40 $ 4.80 - $ $ 200,000 - This can be plotted on an EPS-EBIT plane as follows: EPS-EBIT Approach to Capital Structure JSG's Zero Leverage Financing Plan $6.00 EPS ($) $5.00 $4.80 $4.00 $3.00 $2.00 $2.40 $1.00 $$100,000 $200,000 EBIT ($) EPS-EBIT Approach to Capital Structure JSG is considering altering its capital structure while maintaining its original $500,000 capital base as shown in the table below: JSG's Alternative Current and Alternative Capital Structures Debt Ratio Total Assets Debt - Equity Int. Rate (%) Annual Int. ($) No. of Shares 0% $ 500,000 $ $ 500,000 0.0% $ - 25,000 30% $ 500,000 $ 150,000 $ 350,000 10.0% $ 15,000 17,500 60% $ 500,000 $ 300,000 $ 200,000 16.5% $ 49,500 10,000 We can use this information to calculate the EPSEBIT coordinates as shown on the following slide: EPS-EBIT Approach to Capital Structure Capital Structure 30% Debt Ratio EBIT $ 100,000 60% Debt Ratio $ 200,000 $ 100,000 $ 200,000 Interest $ 15,000 $ 15,000 $ 49,500 $ EBT $ 85,000 $ 185,000 $ 50,500 $ 150,500 T $ 34,000 $ 74,000 $ 20,200 $ 60,200 NI $ 51,000 $ 111,000 $ 30,300 $ 90,300 EPS $ 2.91 $ $ 3.03 $ 9.03 6.34 49,500 This may be shown graphically as shown on the following slide: EPS-EBIT Approach to Capital Structure 多少的EBIT會使得EPS=0? EPS-EBIT Analysis 令EPS=0,所以(EBIT-Int)(1-)=0 ∴EBIT=Int EPS (0% Debt) EPS (30% Debt) EPS($) $10.00 $8.00 EPS (60% Debt) 若目標為EPS maximization,則當EBIT在不同的區間時,公 司會prefer不同的debt ratio $6.00 $4.00 $2.00 $0.00 ($2.00) $- $100,000 $200,000 ($4.00) EPS極大化並不是個好目標,因為並未考慮risk! 如debt ratio 愈大,FBP就愈大,同時利息保障倍數(EBIT/INT) 就愈小,DFL(上圖之斜率)就愈大,所以Financial risk愈高 EBIT($) Basic Shortcoming of EPS-EBIT Analysis • Although EPS maximization is generally good for the firm’s shareholders, the basic shortcoming of this method is that it does not necessary maximize shareholder wealth because it fails to consider risk. • If shareholders did not require risk premiums (additional return) as the firm increased its use of debt, a strategy focusing on EPS maximization would work. • Unfortunately, this is not the case. Choosing the Optimal Capital Structure • The following discussion will attempt to create a framework for making capital budgeting decisions that maximizes shareholder wealth -- i.e., considers both risk and return. • Perhaps the best way to demonstrate this is through the following example: Assume that JSG is attempting to choose the best of several alternative capital structures -- specifically, debt ratios of 0, 10, 20, 30, 40, 50, and 60 percent. Furthermore, for each of these capital structures, the firm has estimated EPS, the CV of EPS, and required return Choosing the Optimal Capital Structure If we assume that all earnings are paid out as dividends, we can use the zero growth valuation model [P0 = EPS/ks] to estimate share value as follows: Estim ated Share Value Resulting from Alternative Capital Structures for JSG Com pany 類似第10章RADR的方式 Debt Expected Estim ated Estim ated Estim ated Ratio EPS CV of EPS Requ. Return Share Price 0% $ 2.40 0.71 11.5% $ 20.87 10% $ 2.55 0.74 11.7% $ 21.79 20% $ 2.72 0.78 12.1% $ 22.48 30% $ 2.91 0.83 12.5% $ 23.28 40% $ 3.12 0.91 14.0% $ 22.29 50% $ 3.18 1.07 16.5% $ 19.27 60% $ 3.03 1.40 19.0% $ 15.95 Choosing the Optimal Capital Structure 另一個方法為使用Hamada Formula equity D 1 (1 ) unlevered,再放入CAPM E 1.先以OLS迴歸估出某公司股票之Beta值,並找出其D/E 2.利用上式估出βunlevered 3.再次利用上式找出在不同D/E時的βequity 4.代入CAPM求出ks E(ri)=rf+ βi [E(rm)-rf Choosing the Optimal Capital Structure Estimated Stock Price at Various Capital Structures Expected EPS Estim ated Share Price EPS ($) Stock Price ($) $3.40 $24.00 $3.20 $22.00 $20.00 $3.00 $18.00 $2.80 $16.00 $2.60 $14.00 $2.40 $12.00 $2.20 $10.00 0% 10% 20% 30% 40% Debt Ratio (%) 50% 60% 70% Other Influences on Capital Structure Choice Flexibility Maintaining financial flexibility simply means that a company would like to give itself slack in terms of being able to raise additional capital to support working capital requirements if desirable investment opportunities arise. As a result, most firms try to ensure that they have excess borrowing capacity available by keeping debt levels at manageable levels. Other Influences on Capital Structure Choice Timing The sale of securities by most firms depend not only on the investment opportunities available but also on the the cost of capital at a particular point in time. 利率高:發股票 利率低:舉債 Successful companies usually try to forecast and take advantage of changing market conditions to lower their overall cost of raising funds. Other Influences on Capital Structure Choice Corporate Control Many firms avoid the issuance of new equity because it may cause existing controlling shareholders to lose their ability to influence the direction of the company. As a result, most companies are reluctant to issue new shares of stock and instead issue debt when additional funds are needed. Other Influences on Capital Structure Choice Maturity Matching Many firms also try to match the maturity of their source of financing with the maturity of the assets they are using the funds to finance. As a result, the capital structure of a firm is determined in part by the types of investments it makes. Other Influences on Capital Structure Choice Management’s Attitude Toward Risk 這些factors都會影響management決定要舉多少債? Management’s perception about the risk of using debt versus equity to finance assets will also determine the nature of a company’s capital structure. External risk assessment:債權人及信用評等機構對公司的信用風險評估 Contractual obligation: 如債權保護條款 Business risk