GAAP

advertisement

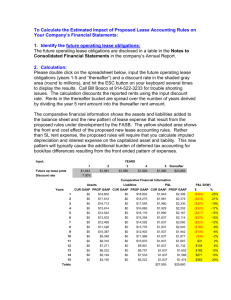

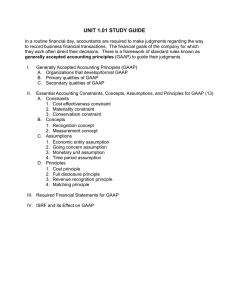

Introduction to International Financial Reporting Standards 1 GAAP Traditional Sources: AICPA – ARBs (AICPA Committee on Accounting Procedures) and ABPOs (AICPA Accounting Principles Board) FASB – Statements of Financial Accounting Standards, Financial Interpretations, Emerging Issues Task Force (EITF) Abstracts, etc. Securities and Exchange Commission (SEC) 2 Should have said sources of US GAAP • GAAP for the most part has been country specific – Differences between countries may be cosmetic or substantive • Example: In UK balance sheet presentation has traditionally been A – L = OE and also in reverse order of liquidity. These are cosmetic differences. • Again in the UK when Glaxo Wellcome plc merged with SmithKline Beecham plc to form GlaxoSmithKline they used the pooling method for the consolidation. This method combines the two companies utilizing historical costs rather than the US approach which uses fair market values and records goodwill. Pooling has not be allowed per US GAAP for decades. This is an example of substantive difference. 3 Why Rules Differ Internationally • Short answer – rules are established by governments or accounting bodies that have jurisdiction only within their respective borders. • One still might think that given the desire for orderly capital markets and efficient allocation of scarce resources the rules would end up virtually the same. 4 Factors Affecting Standards • • • • • Sources of capital Inflation Taxation Culture Legal system, code vs. common law – Code countries such as France and Germany tend to have detailed, comprehensive accounting regulations. Common law countries like the UK and US typically have accounting rules that are less detailed and require higher levels of professional judgment in their application. 5 More Factors Affecting Standards • Accidents of history – war, conquest, and colonialism (http://en.wikipedia.org/wiki/Commonwealth_of_Nations) • Business complexity 6 Other Types of Differences Between Countries • Tax-based accounting – In some countries the tax treatment for a transaction must also be used in financial reporting. Hence tax revenue considerations drive standards rather than a comprehensive body of accounting theory. • Asset revaluations – Some countries allow periodic revaluation of assets. This leads to a lack of comparability for assets and equity as compared to an entity that did not revalue. 7 Other Types of Differences Between Countries • Form over substance – – an underlying concept in US and many other countries’ accounting standards. • If a lease appears to transfer the risks and rewards of ownership its treated as a sale/purchase (capital lease). – Some countries rely on the form of the transaction only • If it is a lease it is accounted for as a (operating) lease. 8 Demand for International Accounting Standards • Prior to the 1970’s cross-country accounting differences didn’t much matter. – Most businesses and capital transactions did not cross international borders. • Multinational companies • Growth of global capital markets • Economic interdependence and the rise in multinational political organizations (EU) • Reduction of costs 9 Impediments to International Standards • Who is going to make up the rules and who is going to pay for the process? • What will the rules be like (uncertainty)? • Significant transitional costs. • How will rules be enforced? • Nationalism. – Carve outs. 10