Annual Accounting and

Auditing Update

11 December 2015

Disclaimer

►

The views expressed by panelists are not necessarily

those of Ernst & Young LLP.

►

These slides are for educational purposes only and are

not intended, and should not be relied upon, as

accounting advice.

Page 2

11 December 2015

Annual Accounting and Auditing Update

Agenda

►

ASC 606 – New Revenue Recognition Standard

►

FASB Developments - Leases

►

Restatement Themes

Page 3

11 December 2015

Annual Accounting and Auditing Update

Introduction to today’s speakers

Drew Nagus

EY - Financial Accounting Advisory

Services

Page 4

11 December 2015

Annual Accounting and Auditing Update

Matt Schuler

Raytheon

Where are we now?

►

►

►

The new standard was issued on 28 May 2014, and a number of questions

have arisen in transition.

The Financial Accounting Standards Board (FASB)/International Accounting

Standards Board (IASB) Joint Transition Resource Group for Revenue

Recognition (TRG) and American Institute of Certified Public Accountants

(AICPA) industry task forces are actively discussing issues submitted to them.

Some of the issues discussed by the TRG have resulted in FASB and IASB

activity:

►

►

►

►

►

►

May 2015 – FASB issued an Exposure Draft (ED) on licenses and performance

obligations

August 2015 – FASB issued an ED covering principal versus agent assessments

September 2015 – FASB issued an ED covering certain transition issues, noncash

consideration, sales taxes, and collectibility

The IASB issued a single ED covering its proposed amendments

The complexity of implementing the new standard should not be

underestimated.

Many companies are appropriately accelerating implementation efforts.

Page 5

11 December 2015

Annual Accounting and Auditing Update

Effective date deferral

►

The FASB issued Accounting Standards Update (ASU)

2015-14 on 13 August 2015, which finalized the one-year

deferral for the new revenue standard:

►

►

►

It will be effective in 2018 for calendar-year public companies.

Early adoption will be allowed – using original effective dates

(annual periods beginning after 15 December 2016).

The IASB has approved a one-year deferral for IFRS 15:

►

►

Page 6

Companies will be required to adopt it in 2018.

Early adoption will continue to be allowed.

11 December 2015

Annual Accounting and Auditing Update

Journey to implement the new standard

Before

adoption

You have a choice in transition methods

Reporting

10-K, 10-Q

Footnotes

2015 and prior

2016

2017

Legacy GAAP

Legacy GAAP

Legacy GAAP

2018

(year of adoption)

2019 and

beyond

SAB 74 disclosures

(including transition method and impact)

Full retrospective

Joint Transition Resource Group and industry groups

Reporting

10-K, 10-Q

New GAAP

New GAAP

New GAAP

New GAAP

ASC 250

Footnotes

Expanded

Expanded

Cumulative catch-up adjustment at January 1, 2016

Modified retrospective

After

adoption

Which will you

choose?

After

adoption

Presented in 2018 financial statements

Reporting

10-K, 10-Q

Presented in 2018 financial statements

Legacy GAAP

Legacy GAAP

New GAAP

Legacy GAAP

Footnotes

Expanded

Cumulative catch-up adjustment at January 1, 2018

Page 7

11 December 2015

Annual Accounting and Auditing Update

New GAAP

Expanded

Revenue recognition

Summary of the model

Core principle: Recognize revenue to depict the transfer of promised

goods or services to customers in an amount that reflects the

consideration to which the entity expects to be entitled in exchange for

those goods or services.

Step 1:

Identify the contract(s) with a customer

Step 2:

Identify the performance obligations in the contract

Step 3:

Determine the transaction price

Step 4:

Allocate the transaction price to the performance obligations

Step 5:

Recognize revenue when (or as) each performance obligation is satisfied

Page 8

11 December 2015

Annual Accounting and Auditing Update

What makes this complex?

Contracts

Performance

obligations

Transaction price

Allocation

Strict criteria to be a

contract

Identifying promised

goods and services

May not equal

“contractual” price

Estimating standalone

selling prices

Identifying the

customer

Determining

performance

obligations (i.e., distinct

goods and services)

Variable consideration,

incl. bonuses, returns,

concessions, discounts

Exceptions for

allocating variable

consideration and

discounts

Contract modifications

Options granting a

material right

Identify explicit and

implicit contract terms

Established business

practices

Assessing collectibility

Service-type and

assurance-type

warranties

Transfer of control:

point in time or

over time

Measuring progress

over time

Constraint on variable

consideration

Consignment

arrangements

Significant financing

component

Customer acceptance

Noncash consideration

Repurchase provisions

Payments to customers

Licenses

Principal versus agent

Combining contracts

Subsequent changes in

transaction price

Page 9

Recognition timing

11 December 2015

Annual Accounting and Auditing Update

Revenue recognition

Step 1: Identify the contract(s) with a customer

►

Contract defined as an agreement between two or more

parties that creates enforceable rights and obligations

►

►

►

Arrangement must meet these criteria to be within scope

of standard:

►

►

►

►

►

Can be written, oral or implied

Does not exist if both parties have not performed and can cancel

without penalty

Parties have approved the contract and are committed to perform

Each party’s rights and payment terms can be identified

Contract has commercial substance

Collection is probable

Contracts entered into at the same time with the same

customer should be combined if certain criteria are met

Page 10

11 December 2015

Annual Accounting and Auditing Update

Revenue recognition

Step 2: Identify the performance obligations

►

A performance obligation is a promise (explicit or implicit)

to transfer to a customer either:

►

►

►

►

►

A distinct good or service

A series of distinct goods or services that are substantially the

same and have the same pattern of transfer

Performance obligations are identified at contract

inception and determined based on contractual terms,

customary business practice

Proposed new guidance will allow entity to disregard

promises that are deemed to be immaterial to a contract

Proposed new guidance on shipping and handling

Page 11

11 December 2015

Annual Accounting and Auditing Update

Revenue recognition

Step 2: Identify the performance obligations (cont.)

►

A good or service is distinct if the following criteria are met:

►

►

►

►

►

It is capable of being distinct

It is distinct within the context of the contract

Principal vs. agent considerations

Incidental obligations or marketing incentives may be

performance obligations (e.g., “free” maintenance provided

by auto manufacturers)

Does not include activities to satisfy an obligation (e.g.,

setup activities) unless a good or service is transferred

Page 12

11 December 2015

Annual Accounting and Auditing Update

Revenue recognition

Step 3: Determine the transaction price

►

►

Transaction price is defined as the amount of

consideration to which an entity expects to be entitled in

exchange for transferring promised goods or services to a

customer

Transaction price includes the effects of the following:

►

►

►

Variable consideration (including application of the constraint)

Significant financing component

Consideration paid or payable to a customer

►

►

Page 13

TRG discussions regarding interaction of variable consideration and

“later of” guidance

Noncash consideration

11 December 2015

Annual Accounting and Auditing Update

Revenue recognition

Step 3: Determine the transaction price (cont.)

►

►

Variable consideration is estimated using an “expected

value” or a “most likely amount” approach

An entity is required to evaluate whether to “constrain”

amounts of variable consideration included in the

transaction price

►

Page 14

Amounts are included in the transaction price only if it is “probable”

a significant revenue reversal will not occur when uncertainties are

resolved

11 December 2015

Annual Accounting and Auditing Update

Revenue recognition

Step 4: Allocate the transaction price

►

Transaction price is generally allocated to each separate

performance obligation on a relative standalone selling

price basis

►

►

When a standalone selling price is not observable, an

entity is required to estimate it

►

►

►

►

Model provides two possible exceptions relating to the allocation of

variable consideration and discounts, if certain criteria are met

Maximize the use of observable inputs

Apply estimation methods consistently in similar circumstances

Standard describes three estimation methods, but others are permitted

(and a combination of estimation methods is allowed)

Standalone selling prices used to perform the initial

allocation should not be updated after contract inception

Page 15

11 December 2015

Annual Accounting and Auditing Update

Revenue recognition

Step 5: Recognize revenue

►

►

Revenue recognized upon satisfaction of a performance obligation by

transferring control of a good or service to a customer

Control transfers over time if one of three criteria is met, otherwise

control transfers at a point in time

►

►

►

►

Customer simultaneously receives and consumes the benefits as the entity

performs

Entity’s performance creates or enhances an asset that the customer controls as

the asset is created or enhanced

Entity’s performance doesn’t create an asset with an alternative use to the entity,

and the entity has an enforceable right to payment for performance to date

The following indicators should be considered when determining the

point in time that control transfers:

►

►

►

►

►

Page 16

The entity has a present right to payment for the asset

The customer has legal title to the asset

The customer has physical possession of the asset

The customer has the risk and rewards of ownership of the asset

The entity has evidence of the customer’s acceptance of the asset

11 December 2015

Annual Accounting and Auditing Update

Other aspects of the model

Incremental costs of obtaining a contract

Incremental costs of obtaining a contract would be capitalized if they

are expected to be recovered

►

►

►

Incremental costs are costs that would not have been incurred if the

contract had not been obtained

Practical expedient to allow immediate expense recognition, if the asset’s

amortization period is one year or less

Assets are amortized over the period in which the related goods or

services are transferred and subject to impairment

►

►

If costs are determined to relate to more than one contract (e.g., expected

contract renewals), amortization should consider both current and

anticipated contracts

What’s changing?

►

Current US GAAP allows an option to either immediately expense or

capitalize costs of obtaining a contract

Page 17

11 December 2015

Annual Accounting and Auditing Update

Other aspects of the model

Costs to fulfill a contract

►

►

Other applicable literature is considered first

Costs of fulfilling a contract that cannot be capitalized under another

standard would be capitalized if they meet all of the following criteria:

►

►

►

►

►

Relate directly to a contract

Generate or enhance resources that will be used to satisfy performance

obligations in the future

Are expected to be recovered

Costs of fulfilling a contract that are capitalized would be amortized

consistent with the pattern of transfer of the related good or service

and would be subject to impairment

“Abnormal costs” not considered in the price of the contract would be

expensed as incurred

Page 18

11 December 2015

Annual Accounting and Auditing Update

Revenue recognition

Disclosure

Excerpt from Accounting Standards Codification

Example 41 —Disaggregation of Revenue —Quantitative Disclosure

Consumer

Products

Segments

Primary Geographical Markets

North America

Europe

Asia

$

$

Major Goods/ Service Lines

Office Supplies

Appliances

Clothing

Motorcycles

Automobiles

Solar panels

Power plant

$

$

990

300

700

1,990

600

990

400

–

–

–

–

1,990

Transportation

$

$

2,250

750

260

3,260

$

–

–

–

500

2,760

–

–

3,260

Energy

$

Total

$

$

5,250

1,000

–

6,250

8,490

2,050

960

$ 11,500

$

–

–

–

–

–

1,000

5,250

6,250

600

990

400

500

2,760

1,000

5,250

$ 11,500

1,000

5,250

6,250

$

Timing of Revenue Recognition

Goods transferred at a point in time

Services transferred over time

$

$

Page 19

11 December 2015

1,990

–

1,990

$

$

3,260

–

3,260

Annual Accounting and Auditing Update

$

$

6,250

5,250

$ 11,500

Revenue recognition

Disclosure (cont.)

Excerpt from Accounting Standards Codification

Example 42 —Disclosure of the Transaction Price Allocated to the Remaining Performance Obligations

20X8

Revenue expected to be recognized

on this contract as of December 31, 20X7

(a)

(b)

$1,575 (a)

20X9

$788 (b)

Total

$2,363

Transaction price = $3,150 ($100 x 24 months + $750 variable consideration) recognized evenly over 24

months at $1,575 per year

$1,575 2 = $788 (that is, for 6 months of the year)

• On June 30, 20X7, an entity enters into two-year noncancellable

contract.

• The customer pays fixed consideration of $100 per month and a onetime variable consideration payment ranging from $0 - $1,000 (that is,

a performance bonus).

• The entity estimates that it will be entitled to $750 of the variable

consideration.

Page 20

11 December 2015

Annual Accounting and Auditing Update

What are we learning?

Key observations and lessons learned from diagnostics

►

►

►

►

►

►

►

Understanding the standard’s complexity is necessary for adequate planning

Leveraging a top down strategic scoping approach may reduce the number of

detailed contract reviews required

The process of identifying revenue streams should include consideration of

multiple different categories to disaggregate a company’s business

Surveying can be challenging and time consuming, but may save time in the

long run

Working closely with local management, operations and legal when reviewing

contracts is essential for a comprehensive understanding of the revenue

streams

Templates for gap analysis and contract reviews should include information

beyond the technical accounting details

Extrapolating the impacts of changes in revenue recognition patterns of one

or more individual contracts across a larger revenue stream population can

be time consuming and may require significant estimates and data inputs

Page 21

11 December 2015

Annual Accounting and Auditing Update

Program overview

Business processes and system enablement – critical path

2015

2016

Accounting

policy

Transition

and

disclosures

Accounting and reporting

PMO

governance

and change

management

Diagnostic

Business processes,

control environment and

data capture

2018

2017

Solution development

Governance

objective and plan

2019 and beyond

Implementation

Sustain

Program governance structure, ongoing management, budget and resource management, dependency analysis, risk management

Communication structure, approach, routine work sessions with stakeholders

Revenue stream

identification and

scoping

Awareness, education and change management

Individual contract

selection and review

Preliminary accounting

policy decision

Expanded contract review to support

changes and lack thereof

Training and implement new policy

Finalize

new policy

Accounting and disclosure

gap analysis

Transition method

evaluation

Analyze accounting differences

and potential financial impacts

Transition method selection

Evaluate enhanced disclosure

requirements and data to support

Follow TRG, FASB and IASB activities, AICPA and peer group implementation developments

Understand and assess current

transaction processing by revenue stream

Develop systems and

business processes

requirements

Design systems and

processes enhancements

Implement systems and

processes enhancements

Design and implement I/C changes

Go live in future state environment

Test and remediate I/C changes

Sustain I/C environment

Full retrospective -- interim processing environment, including

cumulative adjustment and “look-back” transaction processing

Transition contract and data approach, consideration and capture until future state environment is live

Modified retrospective -- interim processing environment,

including cumulative adjustment

Maintain legacy processing environment

for modified retrospective disclosures

Tax

Identify new or different temporary differences

Document, train and execute new tax policies and procedures

Identify tax method changes and finalize new policy

File method changes and adjust transfer pricing

Other

Other considerations – I/C prices,

transfer pricing and indirect taxes

Assess and implement changes to customer contracting process, legal terms or business practices, finance planning and analysis, and investor relations

Timely discussion of key implementation considerations with external audit team

* Dates assume early adoption not elected

Page 22

11 December 2015

Annual Accounting and Auditing Update

Critical path

Sample full vs. modified retrospective timelines

Full retrospective sample timeline

2015

J

F

M

A

M

J

J

2016

A

S

O

N

D

J

F

M

A

M

J

2017

J

A

S

O

N

D

J

F

M

A

M

J

J

2018*

A

S

O

N

D

Go-live

Accounting

Diagnostic

(3 months)

System

Design**

enablement (3 months)

evaluation

(1 month)

Implementation

(6 months)

Testing

(6 months)

Parallel accounting

and audit

(6 months)

Data conversion

cumulative catch-up

and reprocessing

transaction activity

from January 2016 to

April 2017 (5 months)

Dual

reporting for

2016 and

2017

Turn off old

GAAP

Start year-end

close

Record cumulative

effect adjustment

Modified retrospective sample timeline

2015

J

F

M

A

M

J

J

2016

A

S

O

N

D

J

Accounting

Diagnostic

(3 months)

F

M

A

System

enablement

evaluation

(1 month)

M

J

J

Design**

(3 months)

2017

A

S

O

N

D

Implementation

(6 months)

J

F

M

A

M

J

Testing

(6 months)

J

2018*

A

S

O

N

D

Dual

reporting for

footnote

disclosure

Go-live

Data

conversion

and cumulative Start yearend close

catch-up

(5 months)

Record cumulative

effect adjustment

*Timelines assume a January 2018 effective date

**Includes solution approach for revenue forecasting

Page 23

11 December 2015

Phase timeline

Annual Accounting and Auditing Update

Typical system blackout dates

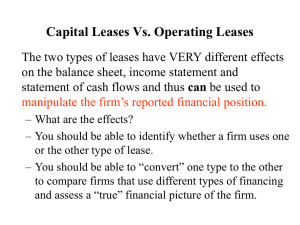

FASB developments - Leases

Page 24

11 December 2015

Annual Accounting and Auditing Update

Leases

Overview

Q3 2010

Exposure

draft (ED)

►

2014–Q2 2015

Redeliberations

on second ED

Q4 2015

Final standard

The FASB and the IASB have substantially completed redeliberations

on the new leases standards

►

►

2011–2013

Redeliberations

and second ED

Key remaining item – effective date

Key changes to today’s US GAAP guidance include:

►

►

►

►

►

Lessees would recognize assets and liabilities for most leases

New presentation and disclosure requirements for lessees

Real estate-specific guidance would be eliminated

Leases would be classified using a principle similar to IAS 17, Leases

Only costs that would not have been incurred if a lease had not been

executed would qualify as initial direct costs

Final standards are not likely to be effective before 1 January 2018

Page 25

11 December 2015

Annual Accounting and Auditing Update

Leases

Definition of a lease

►

A contract is a lease if it both:

►

Depends on the use of an identified asset (explicitly or implicitly)

►

►

Conveys the right to control the use of an identified asset – that is, the

customer has the right to (both):

►

►

►

No identified asset if the supplier has a substantive substitution right

Direct the use of the identified asset

Obtain substantially all of the potential economic benefits from directing the use

Non-lease components of a contract would be accounted for

separately under other applicable GAAP

►

Page 26

Subject to practical expedient for lessees

11 December 2015

Annual Accounting and Auditing Update

Leases

Lease classification

►

Lessees and lessors would classify leases using a classification

principle similar to IAS 17, Leases

►

►

►

►

Lessees would classify most leases as either:

►

►

►

►

Similar to US GAAP but without bright lines

Today’s real estate-specific guidance would be eliminated

Today’s additional lessor classification criteria would be changed

Type A – similar to today’s capital leases

Type B – similar to today’s operating leases

Optional exemption for short-term leases

Lessors would classify all leases as either:

►

►

Page 27

Type A – similar to today’s sales-type or direct financing leases

Type B – similar to today’s operating leases

11 December 2015

Annual Accounting and Auditing Update

Leases

Lessee accounting

Type A lease

.

Type B lease

Initial recognition

and measurement

Initially measure the right-of-use (ROU) asset and lease liability at present value of

lease payments. Initial measurement of the ROU asset also includes the lessee’s

initial direct costs and prepayments made to the lessor less lease incentives

received from the lessor.

Subsequent

measurement –

Accrete the lease liability based on the

interest method using discount rate

determined at lease commencement*

and reduce the lease liability by the

payments made

lease liability

Subsequent

measurement –

Measure the lease liability at the present

value of remaining lease payments

using discount rate determined at lease

commencement

ROU asset

Amortize the ROU asset, generally on a Measure ROU asset at amount of lease

straight-line basis over shorter of lease liability and adjust for cumulative prepaid

term or useful life of ROU asset

or accrued rents (i.e., non-straight-line

rent payments), any lease incentives

received and lessee initial direct costs

Income statement

effect

►

►

Generally “front-loaded” expense

Separate interest and amortization

* As long as a reassessment and a change in the discount rate has not been triggered.

Page 28

11 December 2015

Annual Accounting and Auditing Update

►

►

Generally straight-line expense

Single line of lease or rent expense

Leases

Lessor accounting

►

►

Many aspects of today’s lessor accounting would remain the same

Type A leases – similar to today’s sales-type or direct financing leases

►

►

Selling profit (if any) would be deferred if lease does not transfer control of

underlying asset to lessee (and collection of lease payments is probable)

Lessors can recognize profit for Type A leases that meet all of the

following:

►

►

►

►

Selling profit is included (fair value is greater than carrying value)

Control of the underlying asset is transferred to the lessee

Collectibility of lease payments is probable

►

If collectibilty is not probable: defer income recognition (similar to ASC 606)

Type B leases – similar to today’s operating leases

Page 29

11 December 2015

Annual Accounting and Auditing Update

Restatement themes

Page 30

11 December 2015

Annual Accounting and Auditing Update

Learning objectives

►

Determine whether the accounting topics that most

commonly gave rise to restatements in recent years could

require action on your part

Page 31

11 December 2015

Annual Accounting and Auditing Update

Restatement themes

Top three topics – 2014

%

Top three topics – 2013

%

Income taxes

17

Income taxes

15

Revenue recognition

13

Revenue recognition

10

Statement of cash flows

10

Statement of cash flows

►

►

6

Accounting for income taxes, revenue recognition and statement of

cash flows continue to be leading causes of annual restatements

Correct identified errors as soon as practicable to avoid restatement

due to an accumulation of individually immaterial errors

Page 32

11 December 2015

Annual Accounting and Auditing Update

Restatement themes

General observations

►

►

Restatements in 2014 not concentrated by issue

General observations

►

►

►

►

Identify and account for key contractual terms

Focus on changes in business and effects on estimates on a timely basis

Track tax basis of assets and liabilities beyond rollforward of basis

differences

Consider implications on internal controls

Page 33

11 December 2015

Annual Accounting and Auditing Update

EY | Assurance | Tax | Transactions | Advisory

About EY

EY is a global leader in assurance, tax, transaction and advisory

services. The insights and quality services we deliver help build trust

and confidence in the capital markets and in economies the world

over. We develop outstanding leaders who team to deliver on our

promises to all of our stakeholders. In so doing, we play a critical role

in building a better working world for our people, for our clients and

for our communities.

EY refers to the global organization, and may refer to one

or more, of the member firms of Ernst & Young Global Limited, each

of which is a separate legal entity. Ernst & Young

Global Limited, a UK company limited by guarantee, does not

provide services to clients. For more information about our

organization, please visit ey.com.

Ernst & Young LLP is a client-serving member firm of

Ernst & Young Global Limited operating in the US.

© 2015 Ernst & Young LLP.

All Rights Reserved.

1507-1590082

ED None.

This material has been prepared for general informational purposes

only and is not intended to be relied upon as accounting, tax or other

professional advice. Please refer to your advisors for specific advice.

ey.com