Lease accounting change calculator walgreens 08

advertisement

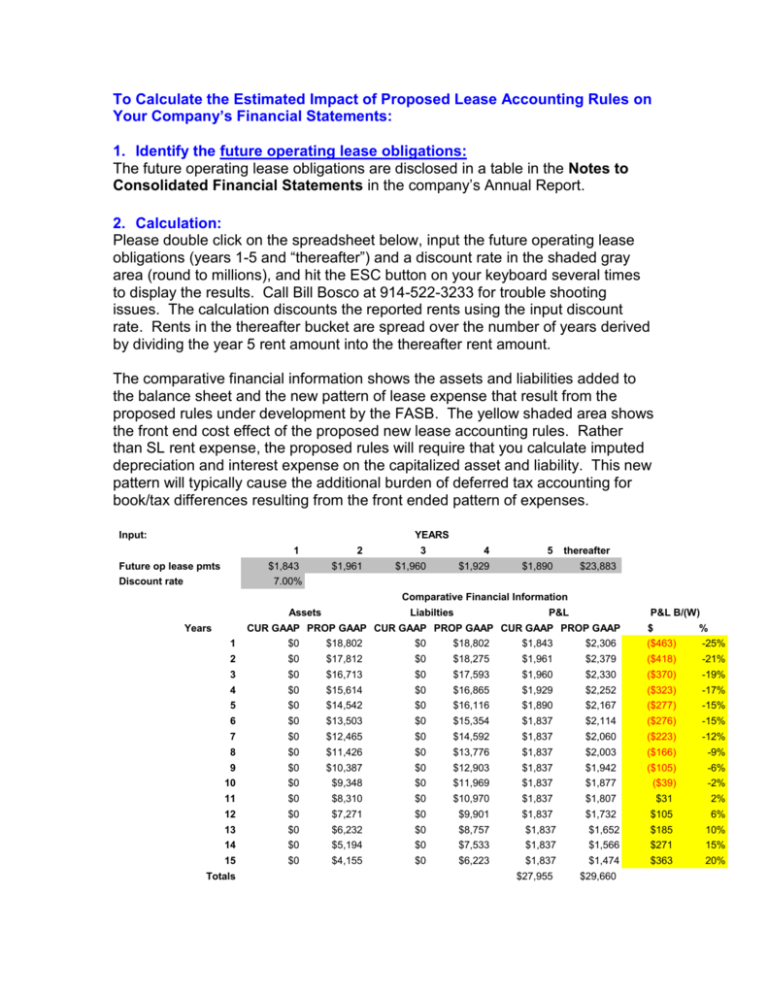

To Calculate the Estimated Impact of Proposed Lease Accounting Rules on Your Company’s Financial Statements: 1. Identify the future operating lease obligations: The future operating lease obligations are disclosed in a table in the Notes to Consolidated Financial Statements in the company’s Annual Report. 2. Calculation: Please double click on the spreadsheet below, input the future operating lease obligations (years 1-5 and “thereafter”) and a discount rate in the shaded gray area (round to millions), and hit the ESC button on your keyboard several times to display the results. Call Bill Bosco at 914-522-3233 for trouble shooting issues. The calculation discounts the reported rents using the input discount rate. Rents in the thereafter bucket are spread over the number of years derived by dividing the year 5 rent amount into the thereafter rent amount. The comparative financial information shows the assets and liabilities added to the balance sheet and the new pattern of lease expense that result from the proposed rules under development by the FASB. The yellow shaded area shows the front end cost effect of the proposed new lease accounting rules. Rather than SL rent expense, the proposed rules will require that you calculate imputed depreciation and interest expense on the capitalized asset and liability. This new pattern will typically cause the additional burden of deferred tax accounting for book/tax differences resulting from the front ended pattern of expenses. Input: YEARS Future op lease pmts Discount rate 1 2 3 4 5 $1,843 $1,961 $1,960 $1,929 $1,890 thereafter $23,883 7.00% Comparative Financial Information Assets Years Liabilties P&L P&L B/(W) CUR GAAP PROP GAAP CUR GAAP PROP GAAP CUR GAAP PROP GAAP $ % 1 $0 $18,802 $0 $18,802 $1,843 $2,306 ($463) -25% 2 $0 $17,812 $0 $18,275 $1,961 $2,379 ($418) -21% 3 $0 $16,713 $0 $17,593 $1,960 $2,330 ($370) -19% 4 $0 $15,614 $0 $16,865 $1,929 $2,252 ($323) -17% 5 $0 $14,542 $0 $16,116 $1,890 $2,167 ($277) -15% 6 $0 $13,503 $0 $15,354 $1,837 $2,114 ($276) -15% 7 $0 $12,465 $0 $14,592 $1,837 $2,060 ($223) -12% 8 $0 $11,426 $0 $13,776 $1,837 $2,003 ($166) -9% 9 $0 $10,387 $0 $12,903 $1,837 $1,942 ($105) -6% 10 $0 $9,348 $0 $11,969 $1,837 $1,877 ($39) -2% 11 $0 $8,310 $0 $10,970 $1,837 $1,807 $31 2% 12 $0 $7,271 $0 $9,901 $1,837 $1,732 $105 6% 13 $0 $6,232 $0 $8,757 $1,837 $1,652 $185 10% 14 $0 $5,194 $0 $7,533 $1,837 $1,566 $271 15% 15 $0 $4,155 $0 $6,223 $1,837 $1,474 $363 20% Totals $27,955 $29,660