Financial Statement Analysis

advertisement

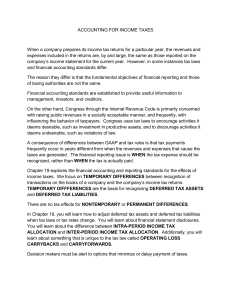

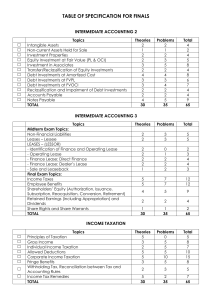

Key Topics Covered in the comprehensive exam for Financial Statement Analysis To pass the exam it is important that students review the reading material and the lecture material which were provided in the lectures. In addition to this please go through the questions and the solutions which were provided to the students. The exam is for four hours and consists of 4 questions. Each question has a number of sub questions. A few topics to focus on are outlined below. • Introduction to International Financial Reporting Standards: Importance of International reporting standards and key differences between IFRS and US GAAP. • Liabilities, On and Off Balance Sheet: Leasing (Pay particular attention to the calculation of lease payments, the implications of different type of leases and the proposed changes to lease accounting). • Transactions and operations in foreign currencies (Pay particular attention to the preparation of financial statements using the two methods discussed in the lectures as well as the implication of using the different methods for financial analysis purposes). • Taxation in financial statements (Pay particular attention to the calculation of deferred tax as well as the meaning of deferred tax). • Revenue Recognition (Pay particular attention to the definition of revenue, measurement of revenue, recognition of revenue and disclosure requirements of IAS18; Included in this area is revenue and expense manipulation by management and management incentives to manipulate earnings). • Inter Corporate Investments: (Pay particular attention to Analyse intercorporate investments by accounting method, Defining four different methods: Cost or Market (“fair value”), Equity, Consolidation, Proportionate Consolidation, Analyse acquisition accounting (“business combinations”)).