Department of Economics - International University of Grand

advertisement

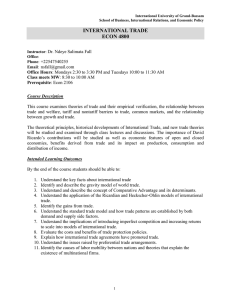

International University of Grand-Bassam School of Business, International Relations, and Economic Policy International Finance ECON 4810 Instructor: Dr. Ndeye Salimata Fall Office: Room 212 Phone: +225 47 54 02 55 Email: fall.s@iugb.org/ nsfall@gmail.com Office Hours: Mondays 2:30 to 3:30 PM and Tuesdays 10:00 to 11:30 AM Class meets WF: 10:00 to 11:30 AM Prerequisite: Econ 2105 Course Description: A study of the foreign exchange market, the balance of payments, exchange rate systems with particular emphasis on the current international monetary system, the international macroeconomic model, and policies for internal and external balance. This course is intended to provide a familiarization with international financial markets and the basic forces that affect financial decision making in the multinational firm. The course provides a background for performing in jobs created by international investment, banking, and multinational business activity. Understanding the implications of international financial news as reported, for instance, in The Wall Street Journal will be emphasized. We will study international financial problems in a global environment. Intended Learning Outcomes By the end of the course students should be able to: 1. 2. 3. 4. 5. 6. Understand the key facts about international finance. Understand the basic market forces of foreign exchange markets. Define balance of payments and identify elements. Describe forwards, futures and options. Understand how to evaluate and measure risk. Be able to apply international finance theories to evaluate current events. Text/other Material: International Money and Finance by Michael Melvin, 7th edition, Addison Wesley. International University of Grand-Bassam School of Business, International Relations, and Economic Policy EXAMS AND GRADING POLICY Grade Distribution Midterm Quizzes Group Paper Homework Attendance Final Exam 25% 15% 15% 10% 5% 30% Grade Scale Letter Grade A+ A AB+ B BC+ C CD F Numeric Grade 96 – 100 93 – 95 90 – 92 87 – 89 83 – 86 80 – 82 77 – 79 73 – 76 70 – 72 60 – 69 <60 GPA Quality Points 4.3 4.0 3.7 3.3 3.0 2.7 2.3 2.0 1.7 1.0 0.0 Exams There will be two exams – a midterm exam and a final exam. The exams are cumulative. No make-up exams are provided except for documented health or business reasons arranged with the instructor in advance if at all possible. No extra-credit projects are available under any circumstances. Quizzes Quizzes are tentatively scheduled in the course outline. If the schedule is changed, it will be announced at least one class prior to the quiz date. The format of quizzes will vary depending on the subject matter to be tested and will test chapter material covered following the previous quiz. There are no make ups for quizzes (you will receive 0) for any reason. However, out of the four quizzes the grade for the worst quiz will be dropped (your course grade will be calculated using the three best ones). Homework There will be various assignments aiming at testing your understanding of the concepts covered in class. International University of Grand-Bassam School of Business, International Relations, and Economic Policy Group Term Paper A group project is due in the 13th week of the course. Each group will be composed of 4 students. Each group should choose one specific issue to research and write about. The paper should be approximately 10 pages in length and should include a well written introduction, provide a literature review and expert assessment of the issue and provide a conclusion related to the issue chosen. This paper is worth 15 percent of your total grade. A topic and broad outline are due in the 4th week of class. You will receive approval for your topic or be requested to change topic or focus by Week 5. In week 14, each group will make a 30 minute presentation. Attendance Policy and Participation In-class participation is highly appreciated. Good participation means regular attendance, frequent involvement and positive contributions in class discussions. Each student’s classroom participation will be assessed based on: The student is to be ready for each class by performing all assigned readings. Not performing the assigned readings will negatively affect your in-class participation grade. Students are required to attend each and every class session on a timely basis. Missing a class will negatively affect your in-class participation grade. If you are more than 15 minutes late or leave class for more than 5 minutes, you will be marked absent. Policy on Academic Honesty All students are responsible for knowing and adhering to academic honesty. Any incidents of academic dishonesty (i.e. cheating on a test, plagiarizing, etc.) will result in an automatic “F” for the course. Disruptive Student Conduct in the Classroom or Other learning Environment All forms of disruptive behavior should be avoided. Disruptive student behavior includes, but is not limited to, verbal or physical threats, repeated obscenities, unreasonable interference with class discussion, making/receiving personal phone calls or pagers during class, leaving and entering class frequently in the absence of notice to instructor of illness or other extenuating circumstances, and persisting in disruptive personal conversation with other class members. Please ensure that all potentially noise-making equipment (cellular phones, pagers, laptop computers, etc) are turned off during lectures. Furthermore, be sure to get to class on time. Entering class during the lecture is disruptive to the instructor as well as to the students. International University of Grand-Bassam School of Business, International Relations, and Economic Policy Tentative Course Schedule/Outline Date Textbook Reading Topic Week 1 Chapter 1 Foreign Exchange Market Week 2 Chapter 2 Balance of Payments Week 3 Chapter 3 International Monetary Arrangements Week 4 Forwards, Futures, Options Week 5 Chapter 4 TOPIC AND OUTLINE OF PAPER DUE Chapters 4 and 5 Week 6 Chapter 6 Forwards, Futures, Options Exchange Rates and Interest Rates Foreign Exchange Risk Week 7 Week 10 MIDTERM ASSESSMENT Chapter 7 Chapter 7 (cont.) Chapter 8 Chapter 8 (cont) Chapter 9 Chapter 9 International Investment International Investment Prices and Exchange Rates Prices and Exchange Rates Balance of Trade Determinants Balance of Trade Determinants Week 11 Chapter 10 Exchange Rate Determinants Week 12 Chapter 11 Import-Export Finance Week 13 Chapter 13 International Money Market Week 14 Chapter 12 Catch up PRESENTATION OF GROUP PAPERS FINAL EXAM Open Economy Macroeconomics Week 8 Week 9 Week 15 Notes 1. If you require special accommodations for exams (e.g., "time and a half"), you must provide documentation and make arrangements with me PRIOR to the exam dates. 2. Incompletes will only be given to students who are passing the course, and even then, only in very special circumstances. In the case where an incomplete is awarded, it must be removed by the end of the next term that the student is enrolled (and within two terms regardless of whether or not the student is enrolled) or it will automatically turn into an F. 3. Students who withdraw after the midpoint of each term will not be eligible for a "W" except in cases of hardship. 4. All instructors must, on a date after the mid-point of the course (to be set by the Provost) give a WF to all those students who are on their rolls, but no longer taking the class and report the last day the student attended or turned in an assignment. If you plan to drop the class, do let me know. 5. This course syllabus provides a general plan for the course; deviations may be necessary.